Global Agrochemicals Additives Market Size is valued at USD 1.8 Billion in 2024 and is predicted to reach USD 2.8 Billion by 2034 at an 4.4% CAGR during the forecast period of 2025-2034.

Key Industry Insights & Findings from the Report:

Pesticides and fertilizers used in agriculture, sometimes known as agrochemicals, are used to manage weeds and insects, ward off disease, and boost plant growth. Agrochemicals aid in managing the microorganisms and agricultural ecosystems in the farming region. Fertilizers, pesticides, herbicides, insecticides, and fungicides are a few examples of agrochemicals. The product's capacity to stop the loss of essential nutrients like phosphorus, sulfur, potassium and nitrogen is anticipated to boost growth over the projection period. Additionally, it is used to prevent caking and corrosion during fertilizer transportation and storage.

The expansion of the agrochemical additives market is anticipated to be constrained during the projected period by consumers' growing aversion to chemical additives and preference for biopesticides.

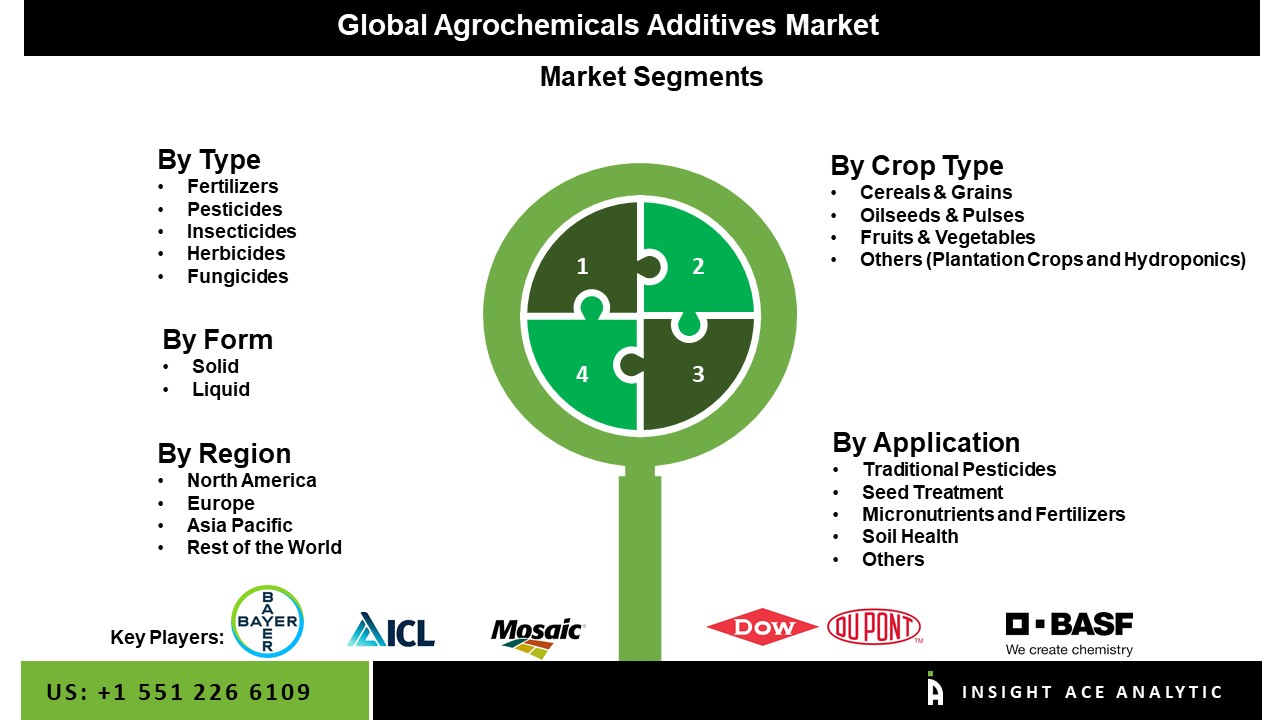

The agrochemical additives market is segmented into form, crop type, and application. Based on type, the market is divided into fertilizers, pesticides, insecticides, herbicides, and fungicides. Based on form, the market is divided into solid and liquid. Based on crop type, the market is further divided into cereals & grains, oilseeds & pulses, fruits & vegetables, and others (plantation crops and hydroponics). The market is segmented based on application: traditional pesticides, seed treatment, micronutrients and fertilizers, soil health, and others.

The fertilizer segment is anticipated to dominate the market in terms of type throughout the forecast period. Additive sales are anticipated to grow significantly throughout the forecast period due to the significant number of fertilizers produced. The need for food and agricultural products will likely increase due to population expansion, which will fuel the use of fertilizers in the agriculture sector. Government subsidies on some fertilizers are expected to help the fertilizers segment to remain a significant end-use in the market. As a result, it is projected that the need for biopesticides will rise in the years to come.

The crop segment dominates the agrochemical additives market over the forecast period. The majority of agrochemicals are used on cereals and grains because crops like rice may have lower yields and less readily available nutrients due to nutrient deficiencies in the soil. Critical minerals are added to fertilizers to boost rice crop output and grain nutrient content, which is anticipated to propel the demand for agrochemical additives. The United Nations, Food and Agriculture Organization predicts that cereal crop production will increase shortly.

Asia Pacific nations lead the market. This is because agriculture is a standard industry in emerging nations, together with the fact that countries with little amounts of available land must utilize agricultural additives to boost yield per acre. In these nations, the government supports most agrochemical additions through policies and programs for farmers. Agrochemical Additives increase a nation's productivity while assisting customers in becoming self-sufficient. Producing crops sold and exported is strongly promoted because of their higher price-attracting properties. The same producers of these crops also receive more significant incentives, such as cheaper fertilizers, seeds, and loan rates. The agricultural industry accounts for a small portion of North America's gross domestic product, and the continent has historically produced enough food for its population. Therefore, its geographic share is insignificant. However, because they are the centre of invention, these nations quickly adapt to new developments.

Agrochemicals Additives Market Report Scope

| Report Attribute | Specifications |

| Market size value in 2024 | USD 1.8 Billion |

| Revenue forecast in 2034 | USD 2.8 Billion |

| Growth rate CAGR | CAGR of 4.4% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn,, Volume in Thousand Tons and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, Form, Crop Type, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Aceto Corporation, AkzoNobel N.V., BASF SE, Bayer AG, BTC Europe GmbH, Clariant, Croda International, DowDuPont, DuSolo Fertilizers, Evonik Nutrition and Care GmbH, FMC Corporation , Harcros Chemicals, Heringer, Israel Chemicals Limited (ICL), Jordan Abyad Fertilizers and Chemicals Company, and list of other prominent players |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Agrochemicals Additives Market By Type-

Agrochemicals Additives Market By Form-

Agrochemicals Additives Market By Crop type-

Agrochemicals Additives Market By Application-

Agrochemicals Additives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.