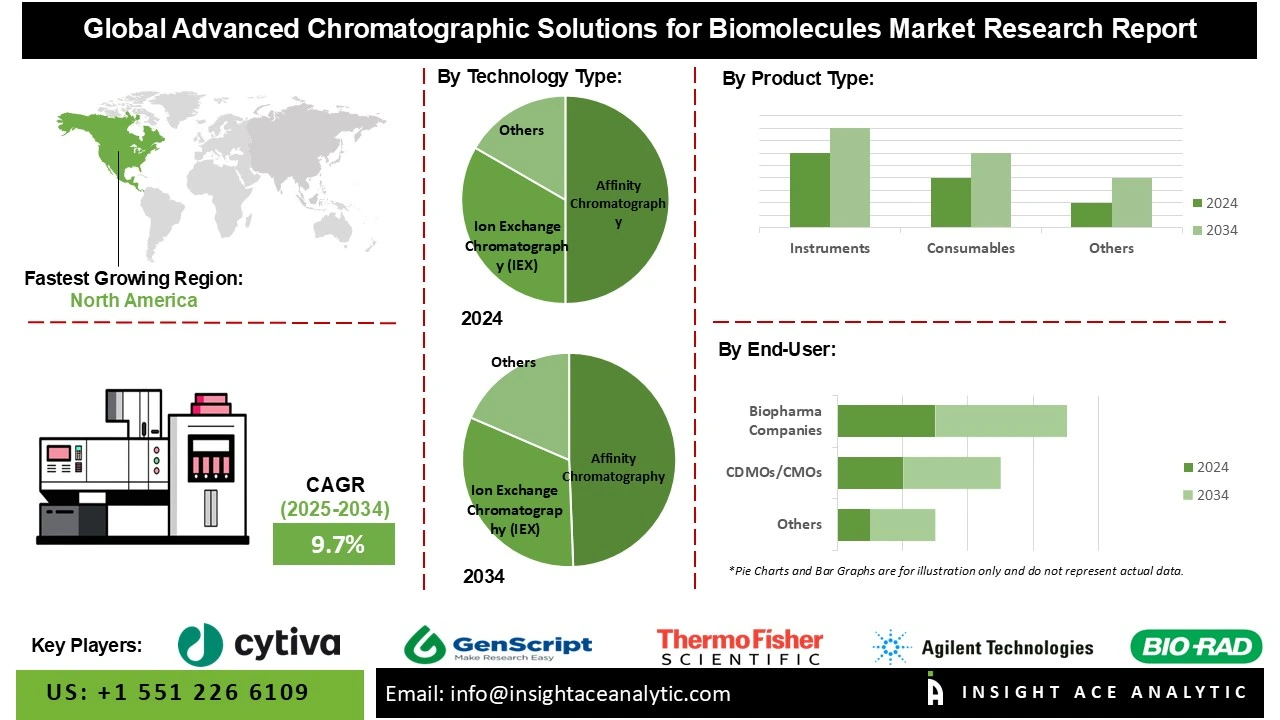

Global Advanced Chromatographic Solutions for Biomolecules Market Size is predicted to expand at a 9.7% CAGR during the forecast period for 2025 to 2034.

Advanced Chromatographic Solutions for Biomolecules Market Share & Trends Analysis Report, By Technology Type (Affinity Chromatography, Ion Exchange Chromatography (IEX), Mixed-Mode Chromatography, Size Exclusion Chromatography (SEC), Hydrophobic Interaction Chromatography (HIC), Membrane Chromatography, Monolithic Chromatography, Continuous Chromatography), By Product Type (Instruments, Consumables, Software & Services), By Application, By End-User By Region, and Segment Forecasts, 2025 to 2034

Advanced chromatographic solutions refer to sophisticated techniques and technologies used for the separation, purification, and analysis of complex biomolecules, including proteins, peptides, nucleic acids, viral vectors, and monoclonal antibodies. These solutions play a critical role in biopharmaceutical manufacturing, diagnostics, and research by enabling high-resolution separation, scalability, and product purity. At its core, chromatography is a method used to separate components in a mixture based on differences in their physical or chemical properties, such as size, charge, hydrophobicity, or affinity.

In biomolecule applications, this often includes liquid chromatography (LC), such as affinity chromatography, ion exchange chromatography (IEX), hydrophobic interaction chromatography (HIC), size-exclusion chromatography (SEC), and reverse-phase chromatography (RPC).

Recent advancements have led to the emergence of monolith columns, membrane chromatography, multi-modal resins, and continuous chromatography systems. These innovations offer faster throughput, reduced solvent usage, higher binding capacities, and better performance with viscous or large biomolecules critical for modern biologics such as mRNA, viral vectors, and exosomes. The industry is also experiencing a push towards automation, digital monitoring, and AI-based process optimization, aligning with the broader bioprocessing trend of smart manufacturing. Integrated solutions with process analytical technology (PAT) and single-use systems are now common, enabling real-time monitoring and faster development cycles.

The growth of biologics and biosimilars, expansion of cell and gene therapies, and the increasing complexity of therapeutic molecules are driving demand for more advanced chromatographic solutions. Regulatory emphasis on product quality and consistency further supports the need for reliable, scalable purification platforms.

Some of the major key players in the advanced chromatographic solutions for biomolecules market are:

· Cytiva (Danaher)

· Thermo Fisher Scientific

· Merck Millipore (MilliporeSigma)

· Sartorius

· Agilent Technologies

· Waters Corporation

· Bio-Rad Laboratories

· Tosoh Bioscience

· Repligen

· Pall Corporation (Danaher)

· BIA Separations (Sartorius)

· Purolite Life Sciences

· GenScript Biotech

· YMC Chromatography

· Sepragen

· ChromaCon (Sartorius)

· Novasep (Sartorius)

· GoSilico (Sartorius)

· Unchained Labs

· Avantor

· PerkinElmer

· Shimadzu

· Knauer Wissenschaftliche Geräte

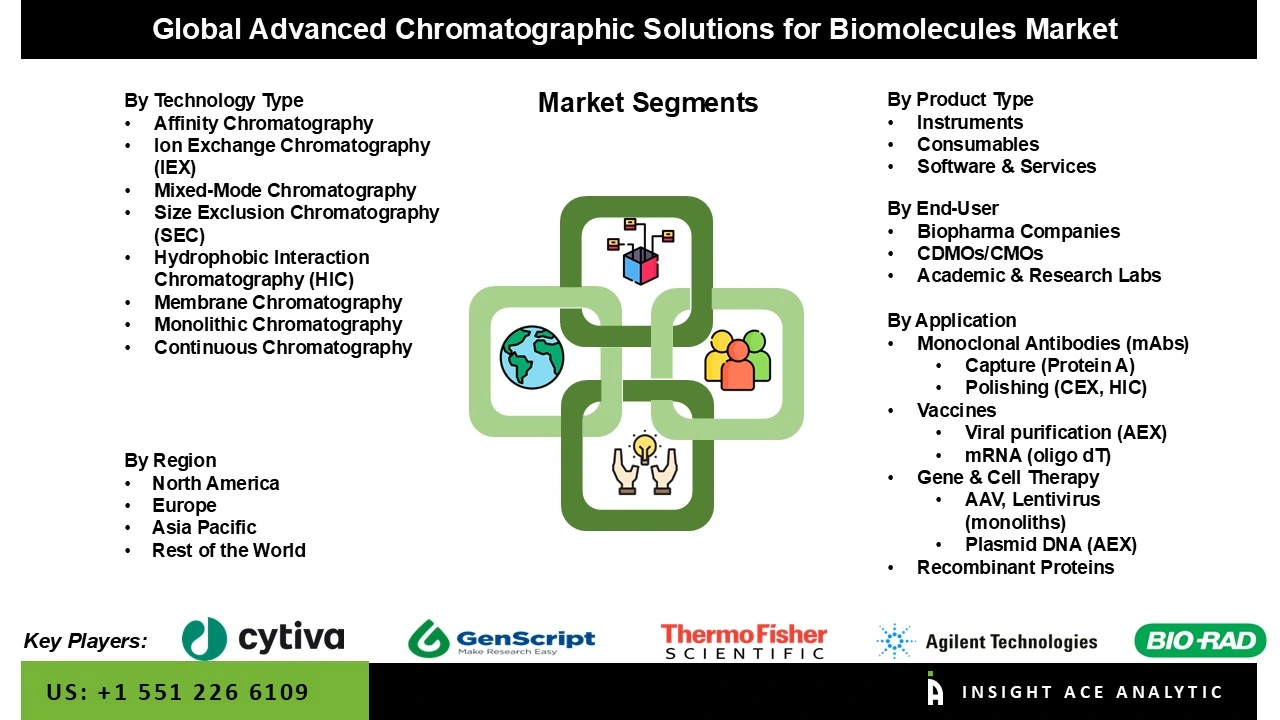

The advanced chromatographic solutions for biomolecules market is segmented into technology type, product type, application, and end-user. Based on technology type, the market is segmented into affinity chromatography, ion exchange chromatography (IEX), mixed-mode chromatography, size exclusion chromatography (SEC), hydrophobic interaction chromatography (HIC), membrane chromatography, monolithic chromatography, and continuous chromatography. Based on the product type, the market is divided into instruments, consumables, software & services. Based on the application, the market is divided into monoclonal antibodies (mAbs), vaccines, gene & cell therapy, and recombinant proteins. Based on the end-user, the market is divided into biopharma companies, CDMOS/CMOS, academic & research labs

The affinity chromatography segment holds the largest share of the advanced chromatographic solutions market, driven by its exceptional selectivity and binding specificity for target biomolecules. This technique is critical in the purification of monoclonal antibodies, recombinant proteins, and viral vectors particularly in downstream bioprocessing of biologics and gene therapies. Affinity ligands such as Protein A and custom-engineered peptides enable high yield and purity in a single step, significantly reducing processing time and cost.

Consumables such as columns, resins, membranes, filters, and buffers are crucial components in chromatography workflows and require regular replacement, unlike equipment that are long-term investments. Chromatographic resins and affinity media, notably expensive Protein A resins, are heavily used in large-scale bioprocessing, particularly in the production of biologics such monoclonal antibodies and vaccines, which are consumed in enormous amounts. Continuous purchase across research and production contexts is supported by the broad range of consumables, which include various formats and chemistries for ion exchange, hydrophobic interaction, and affinity purification. Purification consumables are a crucial and leading market segment in the advanced chromatographic solutions industry, and their demand is further fueled by the global expansion of the biopharma and biosimilars market.

North America holds the largest market share in the advanced chromatographic solutions for biomolecules market due to a combination of robust biopharmaceutical infrastructure, advanced R&D capabilities, and high adoption of cutting-edge purification technologies. The region is home to many leading biopharma companies, CDMOs, and research institutes that rely heavily on chromatographic systems for the development and manufacturing of complex biologics, including monoclonal antibodies, cell and gene therapies, mRNA-based drugs, and vaccines.

The U.S. in particular drives regional dominance, supported by strong regulatory frameworks from the FDA that emphasize stringent product quality and process control, thereby increasing the demand for precision purification solutions like affinity, ion exchange, and size-exclusion chromatography. Moreover, the presence of established technology providers and chromatography innovators such as Bio-Rad, Thermo Fisher Scientific, and Waters Corporation further enhances market maturity and access to advanced tools.

Ongoing investments in life science research, significant funding for biologics and biosimilars development, and a rapidly expanding pipeline of next-generation therapeutics also contribute to market growth. Additionally, North America leads in the adoption of digital bioprocessing, including AI-driven chromatography optimization and integrated PAT systems, positioning the region at the forefront of innovation in biomolecule purification.

· In June 2025, Ecolab Life Sciences, declared the launch of a cutting-edge new resin designed to reduce costs and improve efficiency across the antibody production process. With a 50-micron bead size, PuroliteTM AP+50 is an affinity chromatography resin that offers the highest dynamic binding capacity of the AP resin platform together with exceptional durability for the capture of monoclonal antibodies. Additionally, it makes use of Ecolab's patented Jetted resin bead manufacturing technology, a cutting-edge method that allows for faster lead times and lot-to-lot uniformity. It is the most recent addition to Ecolab's extensive Purolite Resin affinity toolkit, which aids in the resolution of challenging purification issues for biopharmaceutical firms as well as Contract Development and Manufacturing Organizations.

· In Feb 2024, Cytiva, introduced Cytiva Protein Select™ resin is an affinity chromatography resin that uses the self-cleaving Cytiva™ Protein Select™ tag to purify recombinant proteins. When applied to research, this method streamlines the purification of tagged proteins and standardizes purification for any protein lacking an affinity binding partner in process development and subsequent stages.

Global Advanced Chromatographic Solutions for Biomolecules Market - By Technology Type

· Affinity Chromatography

· Ion Exchange Chromatography (IEX)

· Mixed-Mode Chromatography

· Size Exclusion Chromatography (SEC)

· Hydrophobic Interaction Chromatography (HIC)

· Membrane Chromatography

· Monolithic Chromatography

· Continuous Chromatography

Global Advanced Chromatographic Solutions for Biomolecules Market – By Product Type

· Instruments

· Consumables

· Software & Services

Global Advanced Chromatographic Solutions for Biomolecules Market – By Application

· Monoclonal Antibodies (mAbs)

o Capture (Protein A)

o Polishing (CEX, HIC)

· Vaccines

o Viral purification (AEX)

o mRNA (oligo dT)

· Gene & Cell Therapy

o AAV, Lentivirus (monoliths)

o Plasmid DNA (AEX)

· Recombinant Proteins

Global Advanced Chromatographic Solutions for Biomolecules Market – By End-User

· Biopharma Companies

· CDMOs/CMOs

· Academic & Research Labs

Global Advanced Chromatographic Solutions for Biomolecules Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.