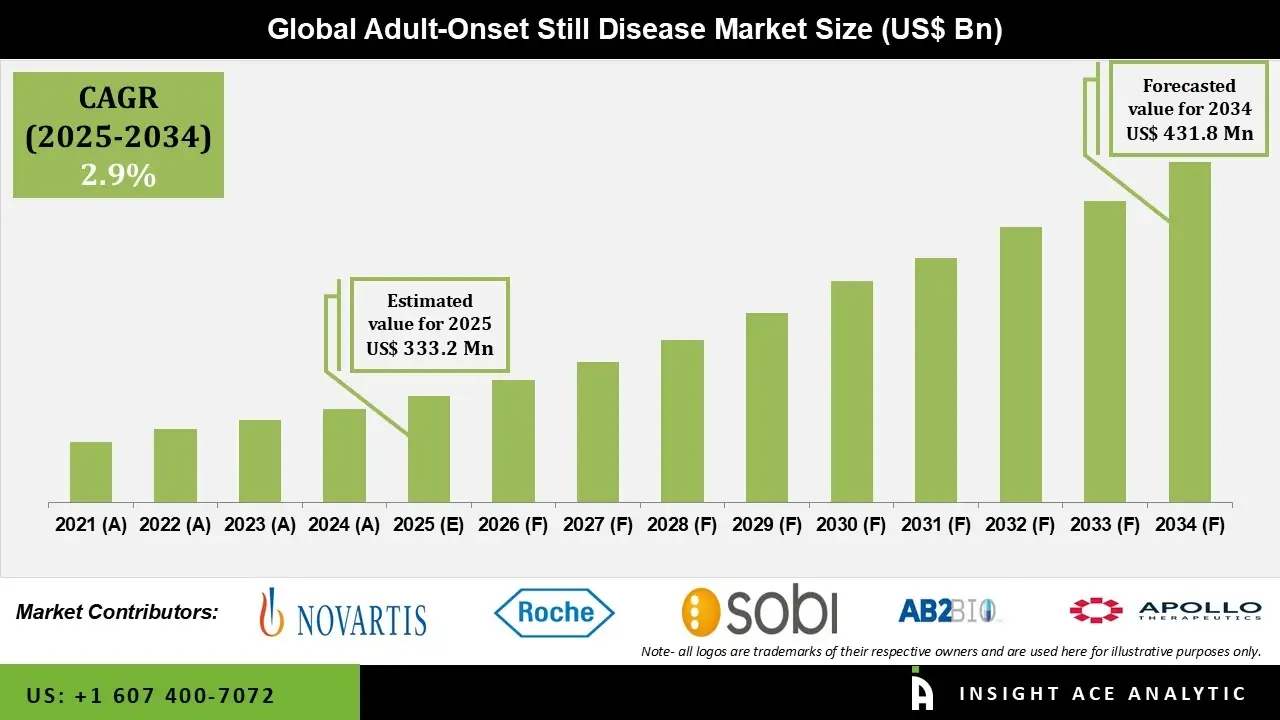

Adult Onset Still Disease Market Size is valued at USD 333.2 Mn in 2025 and is predicted to reach USD 431.8 Mn by the year 2034 at a 2.9% CAGR during the forecast period for 2025 to 2034.

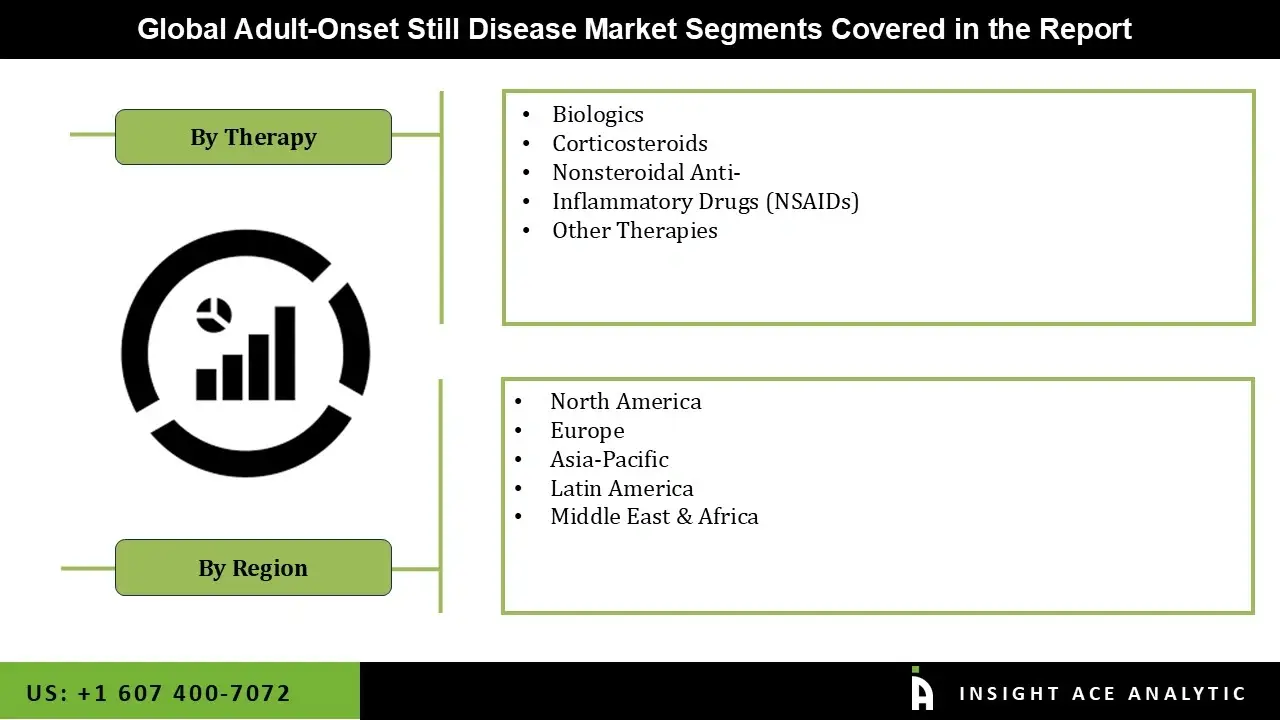

Adult Onset Still Disease Market Size, Share & Trends Analysis Distribution by Therapy (NSAIDs, Biologics, Corticosteroids, and Other), and Segment Forecasts, 2025 to 2034

Adult-Onset Still Disease (AOSD) is an uncommon, systemic autoinflammatory disorder that typically affects young and middle-aged people. It is distinguished by high spiking fevers, inflammatory arthritis, and a unique salmon-colored rash. It manifests clinically as a variety of symptoms, such as a high fever, a characteristic rash, persistent joint pain, and systemic symptoms like lymphadenopathy, splenomegaly, hepatomegaly, and sore throat. In those who are genetically predisposed, illnesses or environmental factors may cause AOSD. The course of AOSD can be monophasic, intermittent, or chronic, and some patients experience life-threatening consequences, such as macrophage activation syndrome or persistent destructive arthritis. The adult-onset still disease market is mostly being driven by rising rates of bacterial or viral infections that result in aberrant antibody responses to a dangerous antigen.

The adult-onset still disease market is growing due to an increase in autoimmune illnesses, which cause the body's healthy tissues and cells to be attacked by an overreactive immune system. Moreover, the widespread acceptance of various effective treatments, such as nonsteroidal anti-inflammatory drugs and steroids, to reduce inflammation, regulate symptoms, and improve quality of life among patients, is serving as another factor for the adult-onset still disease market growth. Additionally, the growing use of targeted biologic therapies that target the disease's underlying inflammatory pathways such as IL-1 and IL-6 inhibitors, which together account for a significant portion of current treatment modalities is expected to drive steady growth in the market for adult-onset still disease.

Additionally, the construction of hospital and specialist clinic infrastructure, particularly in emerging nations, increased access to specialty treatment, and rising healthcare spending all contribute to the overall growth of the adult-onset still disease market. In addition, the market expansion is being driven by increased clinical trial activity for uncommon and orphan illnesses as well as ongoing research and development efforts focused on novel immunomodulatory drugs. However, the rarity and diagnostic complexity of AOSD provide a considerable market barrier, resulting in underdiagnosis and treatment delays. This restricts the ability to identify patients, which in turn limits the possibility for the adult-onset still disease market expansion. Despite these limitations, the emergence of biologic medicines and advancements in diagnostics has created an opportunity for the global adult-onset still disease market to expand.

• Apollo Therapeutics

• Novartis AG

• AB2 Bio Ltd

• F. Hoffmann-La Roche Ltd

• Swedish Orphan Biovitrum AB

• AO Generium

The personalized biologic therapies, which use sophisticated biomarkers and genetic profiling to customize IL-1 and IL-6 inhibitors like anakinra, canakinumab, and tocilizumab to specific patient profiles, are becoming more prevalent in the adult-onset still disease market. By focusing on particular inflammatory pathways according to ferritin levels, cytokine profiles, and hereditary predispositions, this strategy maximizes dosage, reduces side effects, and increases remission rates. Furthermore, the increase is consistent with the growing need for precision treatment in autoimmune illnesses, improving outcomes for adult-onset still disease populations. Therefore, the increasing use of personalized biologic therapies, bolstered by biomarkers and AI diagnostics, is revolutionizing the treatment of adult-onset still disease, improving efficacy, and aligning with precision medicine trends to drive market expansion.

The adult-onset still disease market is severely hampered by the high cost of biologics and delayed diagnosis, which limits market potential and necessitates focused measures to increase access. The access is restricted in low- and middle-income countries due to the high cost of biologics, such as tocilizumab and anakinra, which frequently exceed $50,000 yearly. Furthermore, the inadequate rheumatology knowledge and biomarker testing lead to delayed diagnosis, further limiting the adult-onset still disease market expansion over the forecast period. Consistent availability is further hampered by supply chain problems with temperature-sensitive biologics. The affordability is addressed through initiatives like public-private partnerships, but scalability is still constrained, which hinders the adult-onset still disease market expansion.

The biologics category held the largest share in the adult-onset still disease market in 2024 because tailored cytokine blocking, which more closely aligns with the biology of AOSD, is gradually replacing broad, non-specific immunosuppression (NSAIDs, corticosteroids, traditional DMARDs). Since inflammatory mediators like IL-1 and IL-6 play a major role in AOSD, biologics that block these pathways are frequently utilized when steroids are insufficient or when doctors want steroid-sparing control to minimize long-term consequences. Moreover, the increased use of specialized rheumatology care, earlier diagnosis and better illness detection, and growing comfort with biologic prescribing as a result of better treatment pathways and practical experience all contribute to growth.

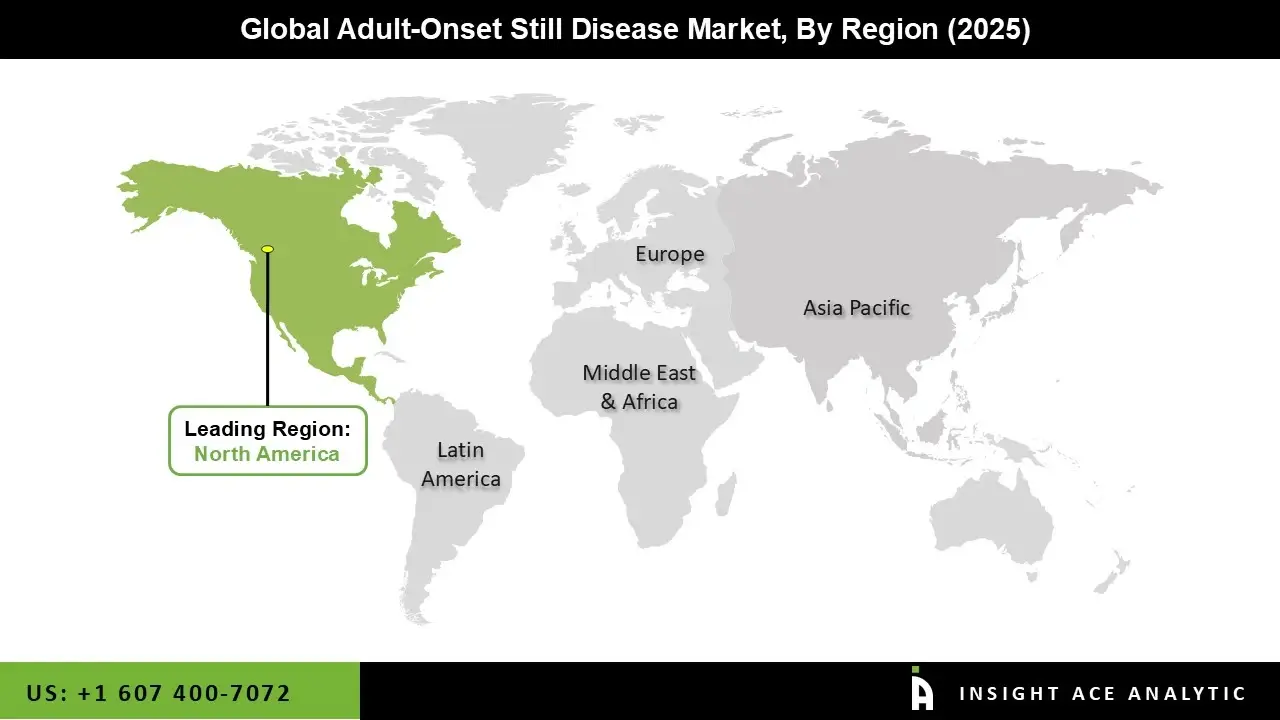

The adult-onset still disease market was dominated by the North America region in 2024, driven by a mix of factors connected to the healthcare system, technology, and clinical practice. Improved diagnosis rates have resulted from healthcare professionals' increased awareness of uncommon inflammatory and autoinflammatory disorders, especially with the increased use of sophisticated laboratory tests and imaging methods.

Additionally, the treatment uptake has increased as a result of the growing use of biologic medicines like interleukin-1 and interleukin-6 inhibitors, which have greatly improved disease management outcomes. The patients' access to pricey biologics and cutting-edge treatments is further supported by the United States and Canada's robust healthcare systems, substantial healthcare spending, and advantageous reimbursement regulations.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 333.2 Mn |

| Revenue forecast in 2034 | USD 431.8 Mn |

| Growth Rate CAGR | CAGR of 2.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Therapy and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Apollo Therapeutics, Novartis AG, AB2 Bio Ltd, F. Hoffmann-La Roche Ltd, Swedish Orphan Biovitrum AB, and AO Generium |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Adult-Onset Still Disease Market by Therapy

• NSAIDs

• Biologics

• Corticosteroids

• Other

Adult-Onset Still Disease Market- By Region

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.