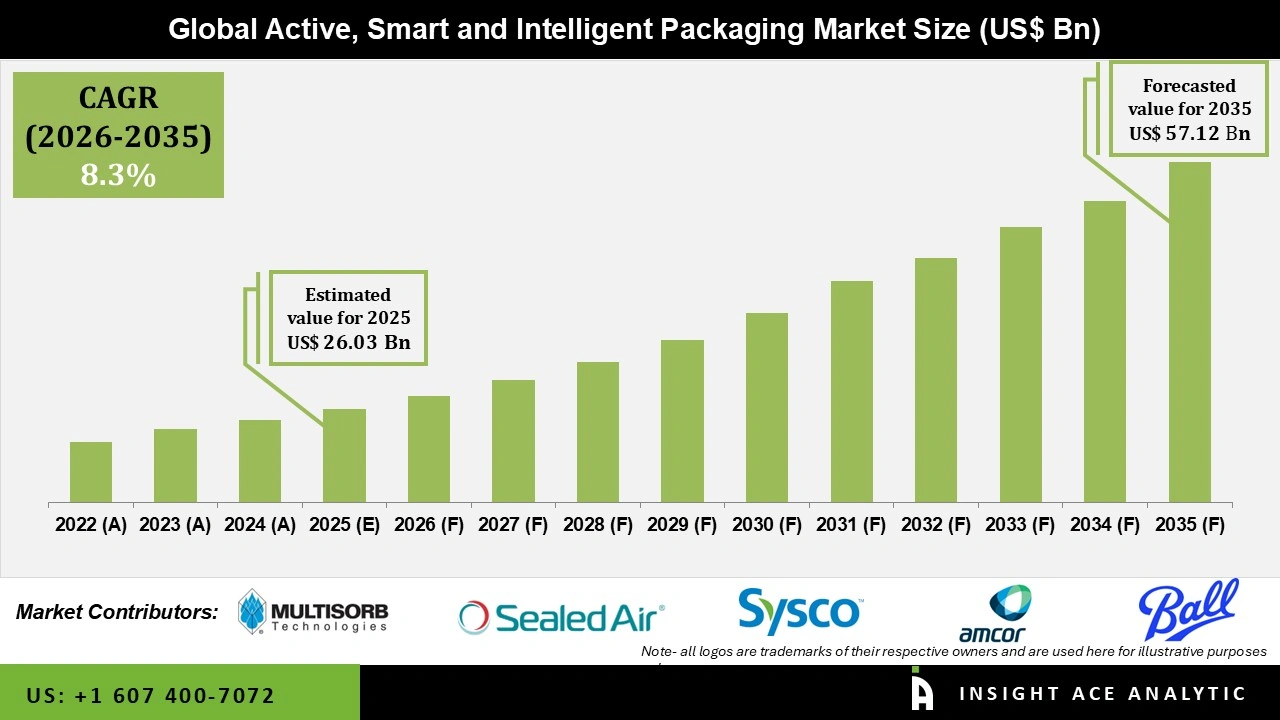

Global Active, Smart and Intelligent Packaging Market Size is valued at USD 26.03 Billion in 2025 and is predicted to reach USD 57.12 Billion by the year 2035 at an 8.3% CAGR during the forecast period for 2026 to 2035.

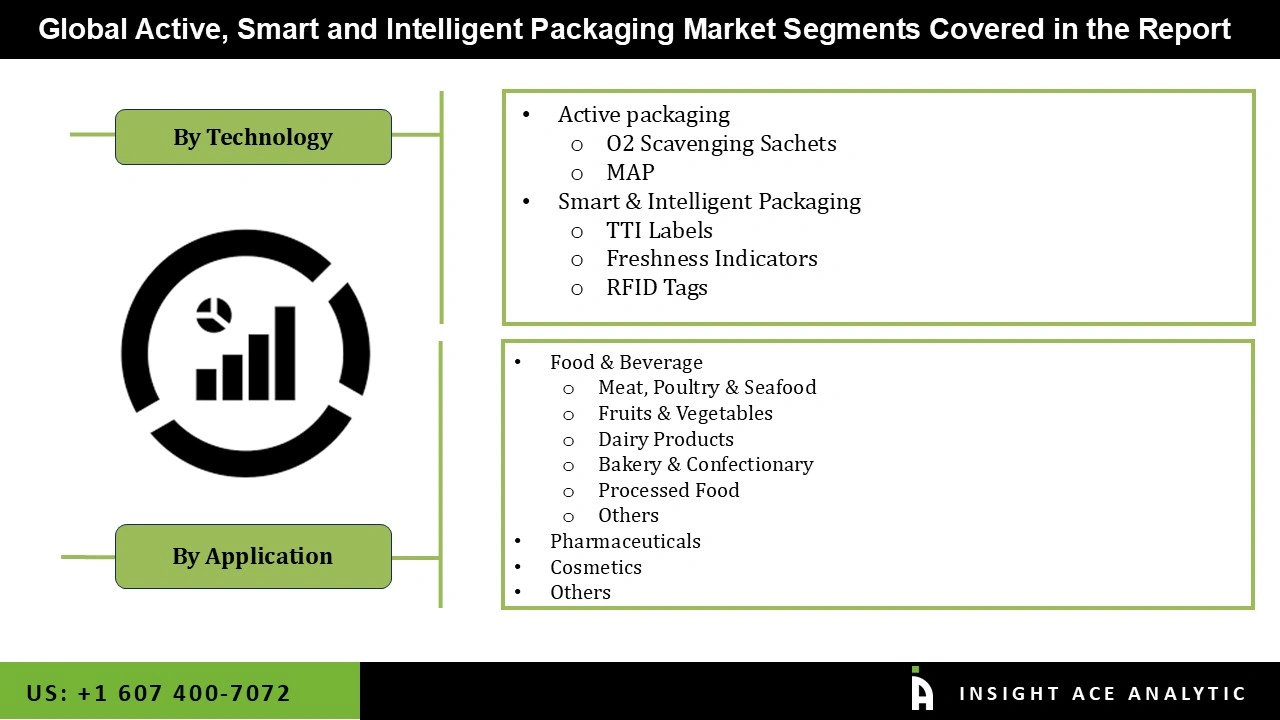

Active, Smart and Intelligent Packaging Market Size, Share & Trends Analysis Report By Packaging Type (Active, Smart, and Intelligent Packaging), Application (Food & Beverage, Pharmaceuticals, Cosmetics, Others), By Region and Segment Forecasts 2026 to 2035.

Key Industry Insights & Findings from the report:

Smart packaging refers to systems with embedded sensor technology used with foods, pharmaceuticals, and many other products. The changing lifestyle of customers because of quick urbanization and expanded utilization of individual personal items with advanced integrated innovation drive the active, smart and intelligent packaging market growth.

Moreover, undiscovered geographical markets offering gigantic open doors for the market players are relied upon to fuel the worldwide packaging market industry. Besides, Increasing demand for sustainable packaging solutions is anticipated to be a major challenge for active, smart and intelligent packaging companies over the forecast period. The developments in the printing processes in various industries have also been drivers for this market.

Additionally, active, smart and intelligent packaging results from rising consumer awareness about the composition of products and increased demand for packaged goods. Smart packaging utilizes technology and sensors to keep the product fresh and also allows manufacturers and consumers to track the product while in transit for delivery.

However, the high costs of active, smart and intelligent packaging are anticipated to be a major restraining factor for the market potential during the forecast period. Smart packaging companies are expected to invest in researching and developing more affordable active, smart and intelligent packaging solutions to boost their revenue potential over the forecast period.

The active, smart and intelligent packaging market is segmented based on product and application. Based on product, the market is segmented as active packaging, Smart & Intelligent Packaging technology. By application, the market is segmented into seafood, meat and poultry, soup, dairy products, confectionaries and fruits and vegetables.

The intelligent packaging category is expected to hold a major share of the global Active, Smart and Intelligent Packaging market in 2021. Within the packaging industry, intelligent packaging is the most recent technology. With a huge potential to increase speed and convenience, this technology is expanding faster in the food industry. Intelligent packaging can immediately measure the quality of the product within and report on the state of the product's outer packaging. By binding antibodies to a thermoplastic attaching surface, which can provide users a false sense of security, biosensors for pathogen or toxin detection, a significant concern in foodstuff and intelligent packaging, are assisting in this.

The food & beverages segment is projected to grow rapidly in the global Active, Smart and Intelligent Packaging market. Due to its strength, flexibility, and compact size, active, smart and intelligent packaging is expected to be used more frequently in the food & beverages sector, which will help the sector flourish. It is predicted that the segment will develop as more emphasis is placed on safeguarding and maintaining the quality of packaged goods from the point of creation till the point of consumption, especially in countries such as the US, Germany, the UK, China, and India.

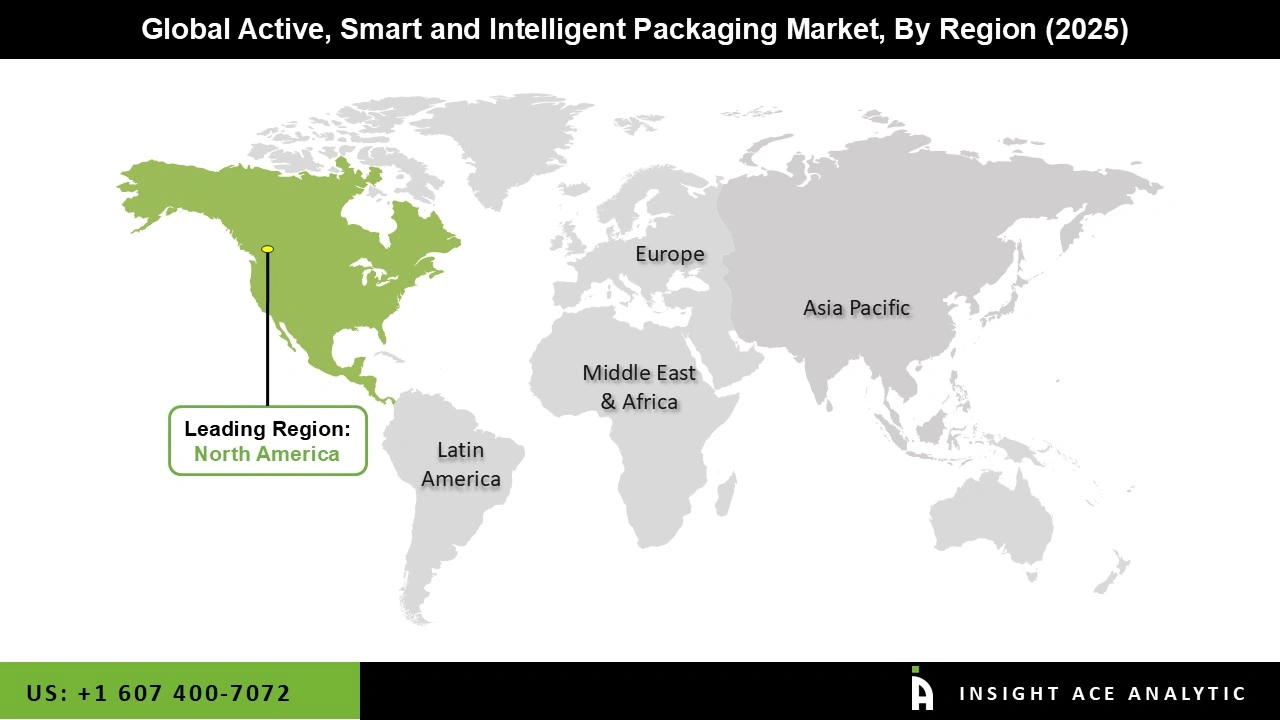

The North American active, smart and intelligent packaging market is expected to register the highest market share in revenue soon. The growing need for packaged and frozen foods, rising worries about food safety, and shifting demographics brought on by urbanization are all reasons that have helped North America take the lead in the global active, smart and intelligent packaging industry.

The main factors driving the largest share in the country are the rising use of proactive and intelligent packaging due to increasing urbanization and the growing consumer worries about food safety as a result of food safety incidents. Due to the manufacturer's shock-absorbing qualities make it perfect for storing and transporting products, including electronic systems, consumer items, wineries, and pharmaceutical & healthcare products. It is frequently used in packing applications. Other characteristics of polyurethane, like barrier properties and thermal insulation, aid in preserving the safety of perishable goods like seafood, vegetables, and fruits. These elements all influence the packaging end-use segment's need for it.

In addition, Asia Pacific is a region projected to grow at a rapid rate in the global Active, Smart and Intelligent Packaging market due to growing concerns about the environment, rapid industrialization, government initiatives, and increasing funding in various industries. Other factors driving consumption in Asia Pacific active, smart and intelligent packaging market include customers' urbanization and lifestyle changes in developing nations like China, India, and Thailand.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 26.03 Billion |

| Revenue forecast in 2035 | USD 57.12 Billion |

| Growth rate CAGR | CAGR of 8.3% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product Type, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Multisorb Technologies (US), Sealed Air Corporation (US), Ball Corporation(US); Amcor limited (Australia), Timestrip PLC (UK), Sysco Corporation (U.S), Paksense Incorporated (US) Eastman Chemical Company, and M&G USA Corporation |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.