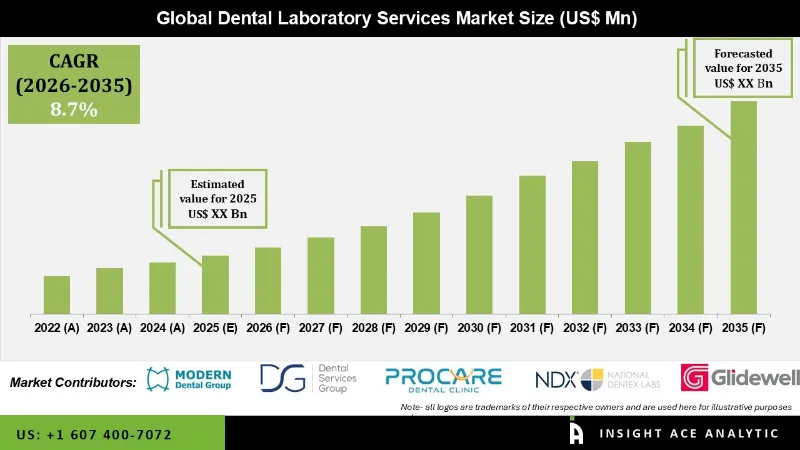

Dental Laboratory Services Market is predicted to grow with a 8.7% CAGR during the forecast period for 2026 to 2035.

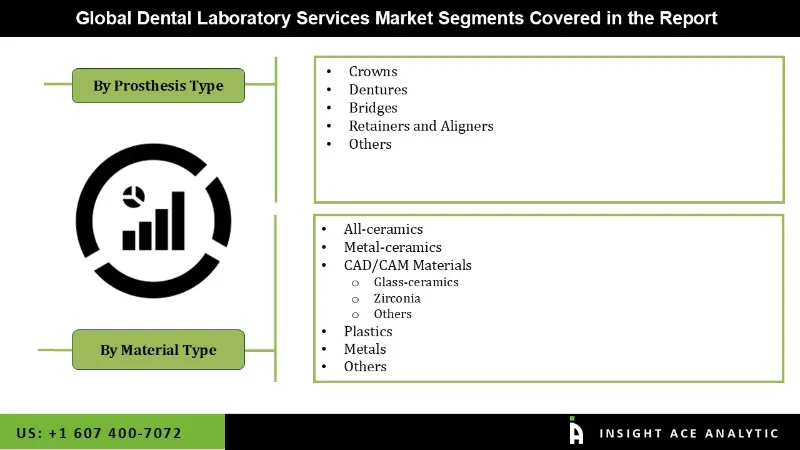

Dental Laboratory Services Market Size, Share & Trends Analysis Report By Prosthesis Type (Crowns, Bridges, Dentures, Aligners), Material Type (All-Ceramics, Zirconia, Metal), By Region, And By Segment Forecasts, 2026 to 2035

Dental Laboratory Services Market Key Takeaways:

|

Dental laboratory services are specialized facilities that produce and customize dental appliances, including orthodontic and prosthetic devices, to fulfill the unique needs of patients as directed by dentists and other dental specialists. Because they create a vast array of dental products and restorations, such as crowns, bridges, dentures, braces, retainers, and more, these labs are essential to the healthcare industry. The increasing frequency of different dental issues in both developed and developing nations is expected to drive the expansion in the global market for dental laboratory services.

Furthermore, the market is expanding due to the rapid expansion of the senior population and the rise in the prevalence of edentulism. Additionally, the two main variables influencing the trends of the dental laboratory service market during the projected period are the growth in dental tourism and the outsourcing of some manufacturing tasks to dental laboratories. Furthermore, increasing disposable income, particularly in developing countries, is anticipated to increase spending on new technologies and healthcare sectors, which is also significantly driving the expansion of the global market for dental laboratory services. However, the market expansion for dental laboratory services is anticipated to be hindered by the high cost of dental equipment and supplies. Moreover, the market for dental laboratory services is anticipated to face challenges due to the survival of small firms and new entrants.

Some of the key players in the Dental Laboratory Services Market are:

The Dental Laboratory Services market is segmented based on prosthesis type and material type. Based on prosthesis type, the market is segmented into crowns, dentures, bridges, retainers and aligners, others. By Material Type, the market is segmented into all-ceramics, metal-ceramics, CAD/CAM materials (glass-ceramics, zirconia, others), plastics, metals, and others.

The crowns category is expected to hold a major global market share in 2021 because restorative dentistry uses them extensively. Crowns are specialized caps that are used to restore the size, shape, strength, and look of a tooth that has been injured or decaying. They are extremely adaptable and can be made from a variety of materials, including zirconia, metal, porcelain-fused-to-metal (PFM), or all-ceramic, to meet the demands and preferences of diverse patients. The rising demand for cosmetic dentistry and patient knowledge of the advantages of dental prostheses further supports crowns' dominance.

In 2021, the dental laboratories services market was headed by the metal ceramics segment. This is due to their extensive record of dependability, toughness, and adaptability in restorative dentistry. The strength of metal and the beauty of porcelain are combined in metal-ceramic restorations, which usually have a metal alloy foundation covered in layers of dental porcelain. Because of this combination, metal ceramics can be used for a variety of dental prostheses, such as crowns, bridges, and restorations supported by implants.

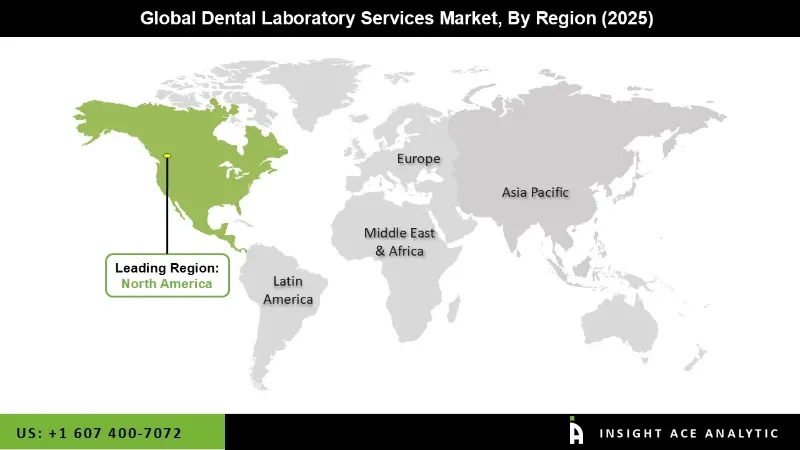

The North American Dental Laboratory Services market is expected to register the highest market share in revenue in the near future due to the region's relatively higher levels of health spending, the robust presence of advanced medical infrastructure, and supportive government initiatives. With the extensive use of cutting-edge dental technologies like CAD/CAM systems and 3D printing, which promote accuracy and efficiency in lab operations, North America is also at the forefront of technical innovation.

In addition, Asia Pacific is projected to grow rapidly in the global Dental Laboratory Services market because of the region's aging population, growing disposable income, and increased knowledge of oral healthcare. Dental lab-fabricated equipment, restorations, and prostheses are becoming more and more necessary as a result of this rising demand. Dental laboratory operations are becoming more efficient and innovative due to the growing use of digital dentistry solutions and improvements in dental technology, especially in nations like China, South Korea, and Japan.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Prosthesis Type, Material Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Modern Dental Group, National Dentex Labs, Glidewell Laboratories, Dental Services Group, Proceram Dental Laboratory, European Dental Group (EDG), ALS Dental, Corus Dental, Colosseum Dental Group, and Liberty Dental Group |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Dental Laboratory Services Market-

Dental Laboratory Services Market By Prosthesis Type-

Dental Laboratory Services Market By Material Type-

Dental Laboratory Services Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.