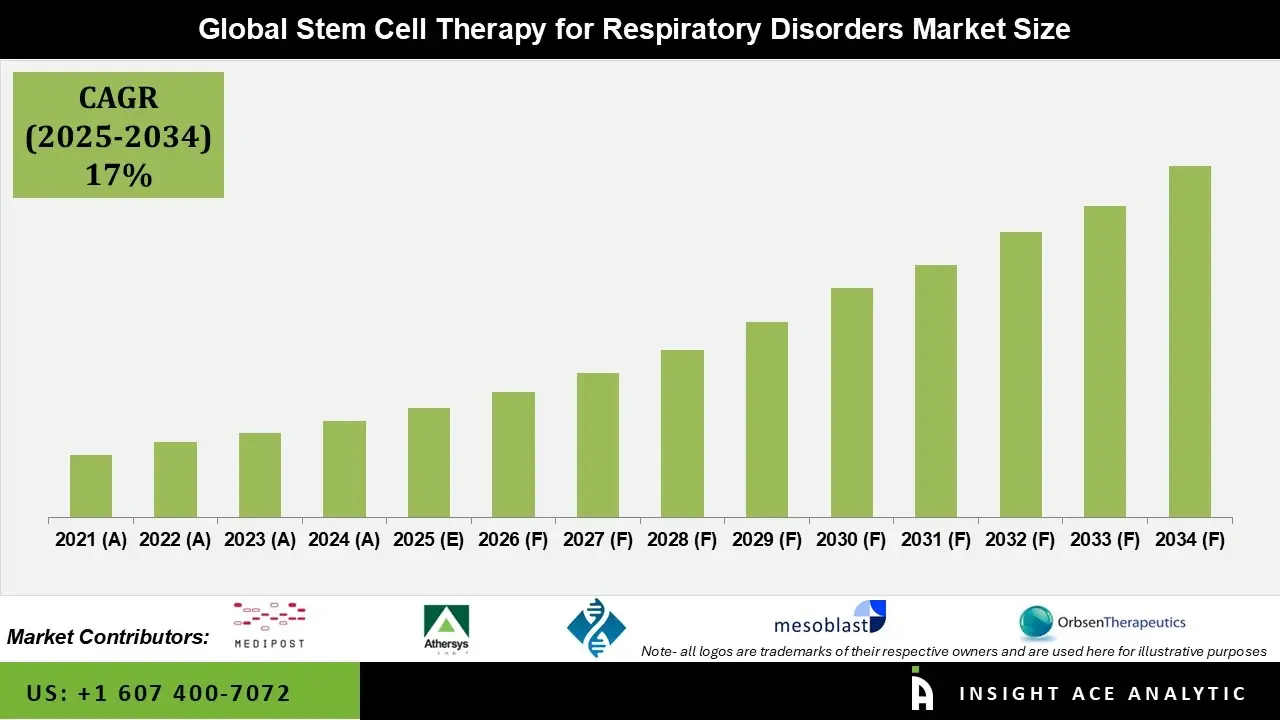

Global Stem Cell Therapy for Respiratory Disorders Market Size is estimated to grow with a 17% CAGR during the forecast period for 2025 to 2034.

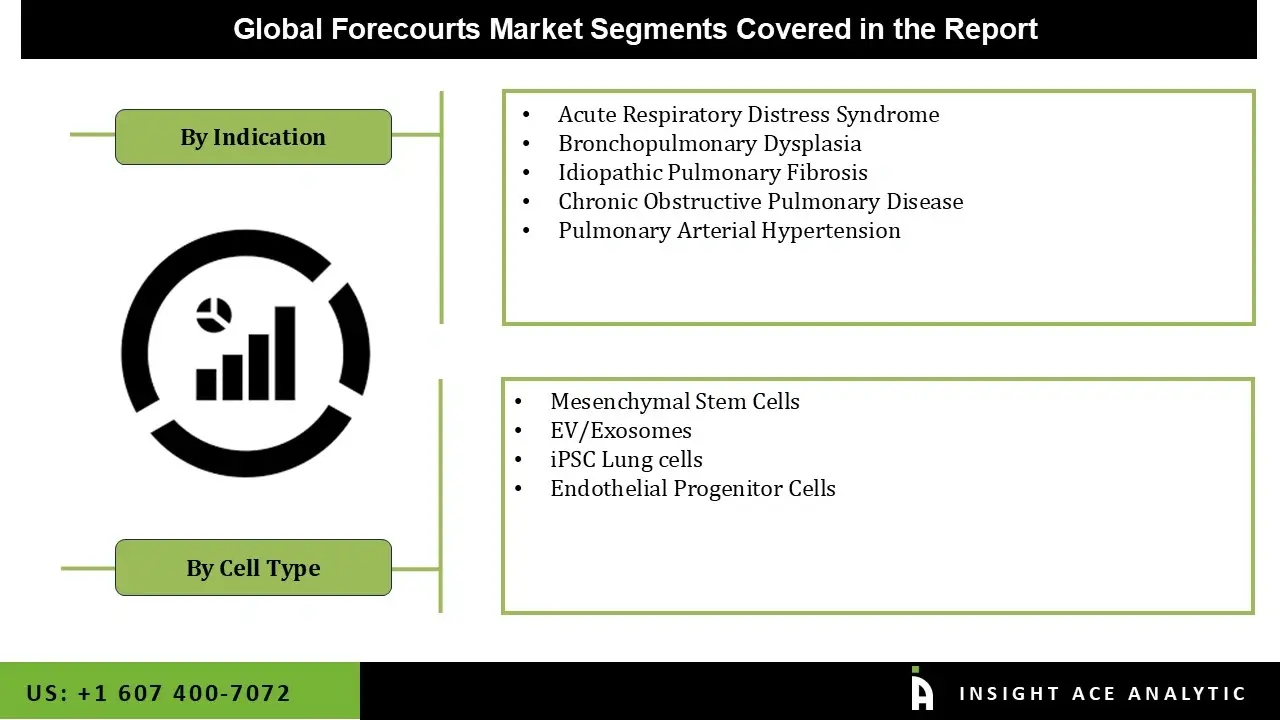

Stem Cell Therapy for Respiratory Disorders Market Size, Share & Trends Analysis Distribution By Indications (Acute Respiratory Distress Syndrome, Bronchopulmonary Dysplasia, Idiopathic Pulmonary Fibrosis, Chronic Obstructive Pulmonary Disease, Pulmonary Arterial Hypertension), Cell Type (Mesenchymal Stem Cells, EV/Exosomes, iPSC Lung cells, Endothelial Progenitor Cells) and Segment Forecasts, 2025 to 2034

Stem cell therapy for respiratory disorders is an advanced regenerative treatment that uses mesenchymal stem cells (MSCs) from bone marrow, adipose tissue, or umbilical cord to repair damaged lungs and reduce chronic inflammation in conditions such as COPD, idiopathic pulmonary fibrosis(IPF), asthma, acute respiratory distress syndrome (ARDS), and post-COVID lung injury.

Instead of only easing symptoms, these therapies act mainly through paracrine effects—releasing anti-inflammatory cytokines, growth factors, and extracellular vesicles—to promote tissue repair, decrease fibrosis, and improve breathing capacity. As of late 2025, the field remains investigational, with more than 100 active clinical trials worldwide, but no routine regulatory approvals yet exist specifically for lung diseases.

The field is advancing due to the growing burden of chronic respiratory diseases, persistent lung damage after viral infections, and increasing research funding from governments and biotech companies. Early clinical trials show meaningful improvements in lung function (10–30% increase in forced vital capacity) and quality of life, particularly in COPD and IPF patients. Major challenges include high treatment costs, strict regulatory requirements, and inconsistent results in advanced-stage disease.

Current trends focus on safer cell-free extracellular vesicles, inhaled or nebulized delivery methods, and gene-edited stem cells with stronger anti-fibrotic effects. These innovations, along with growing experience in pediatric applications and combination therapies, are paving the way for potential first approvals by 2030. With continued progress, stem cell-based treatments could shift from experimental options to standard care for currently incurable lung conditions.

• Mesoblast

• Athersys

• Medipost

• Orbsen

• Direct Biologics

• Others

The stem cell therapy for respiratory disorders market is segmented into indications and cell type. By indications, the market is segmented into acute respiratory distress syndrome, bronchopulmonary dysplasia, idiopathic pulmonary fibrosis,chronic obstructive pulmonary disease pulmonary arterial hypertension). The cell type segment comprises mesenchymal stem cells, EV/exosomes, iPSC Lung cells, endothelial progenitor cells.

In 2025, COPD held the major market share among indications due to its high global prevalence, affecting over 545 million people and ranking as the third leading cause of death worldwide, with limited curative options beyond symptom management. The condition's chronic inflammatory nature and progressive lung damage make it ideal for mesenchymal stem cell (MSC) therapies, which modulate immune responses and promote tissue repair, as evidenced by phase II trials showing 10–30% improvements in forced vital capacity (FVC) and reduced exacerbations.

Researchers and biotech firms are prioritizing COPD applications to address unmet needs in aging populations and pollution-exposed regions, with over 40 active clinical trials focused on intravenous or nebulized MSC delivery. This emphasis not only accelerates regulatory progress but also fosters collaborations for scalable production, enhancing patient access and positioning COPD as the dominant revenue generator in the respiratory stem cell therapy landscape.

In 2025, MSCs commanded the largest market share across cell types, accounting for over 70% of ongoing trials due to their well-established safety profile, immunomodulatory properties, and paracrine effects that reduce inflammation without direct lung cell differentiation. Mesenchymal stem cells (MSCs), derived from bone marrow, adipose tissue, or umbilical cord, have shown efficacy in phase I/II trials for acute respiratory distress syndrome (ARDS) and idiopathic pulmonary fibrosis (IPF), with intravenous infusions enhancing oxygenation and arresting fibrosis progression in up to 50% of subjects.

Their allogeneic compatibility and low immunogenicity enable off-the-shelf use, attracting investments from biopharma leaders like Mesoblast and Athersys, who are advancing toward phase III. This dominance stems from regulatory familiarity—stemming from approvals in related indications like graft-versus-host disease—and the cells' versatility in combination therapies, solidifying MSCs as the primary revenue driver while paving the way for broader adoption in refractory Respiratory conditions.

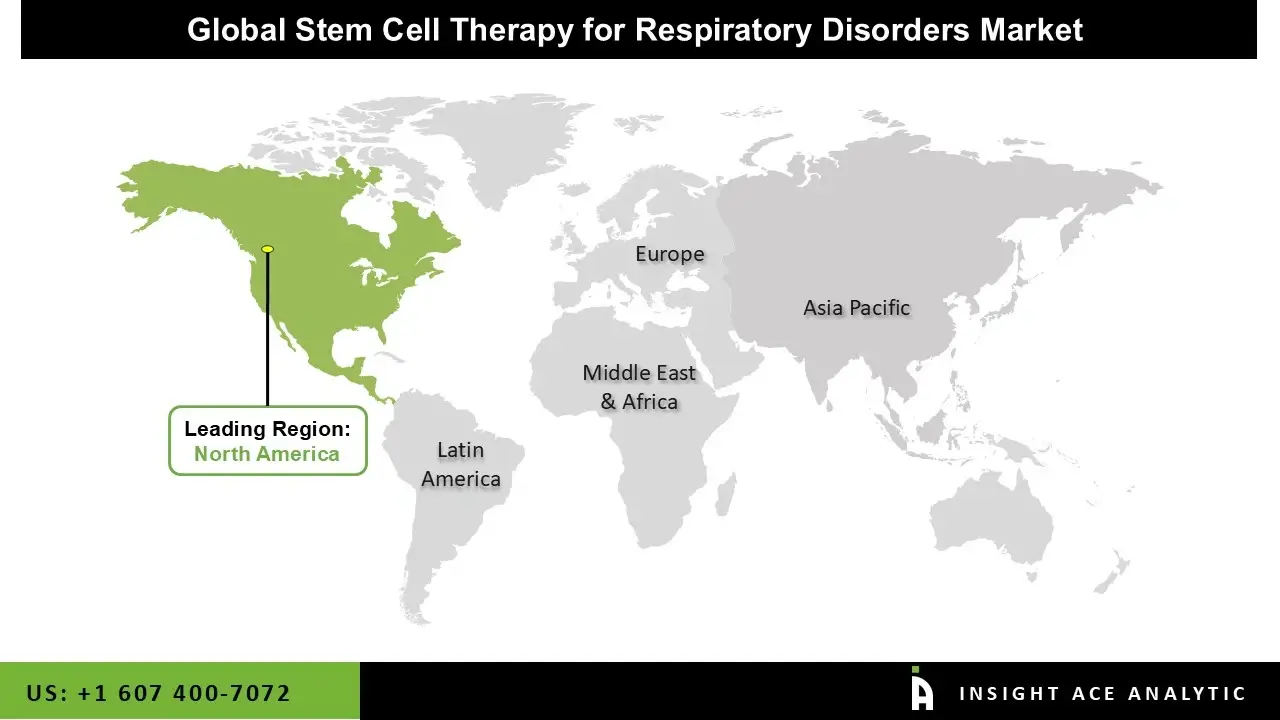

North America is the clear leader in stem cell therapy for respiratory disorders in 2025. The United States runs the most clinical trials, has the best research centers (like Mayo Clinic and UCLA), and receives strong government funding from NIH and CIRM. Big biotech companies such as Mesoblast and Athersys are based here, and the FDA offers fast-track programs that speed up development. High disease rates, good payment systems for new treatments, and top-quality manufacturing facilities make North America the top region for both innovation and revenue.

Asia-Pacific is growing the fastest. China now has the second-highest number of trials, backed by quick government approvals and large state funding. South Korea and Japan already sell some stem cell products and are expanding into lung diseases. India offers low-cost trials with many patients, while Australia helps global companies run studies. Lower costs, fast regulations, and strong government support mean this region is catching up quickly and will likely challenge North America in the next 5–7 years.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 17% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Indication and cell type, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Mesoblast, Athersys, Medipost, Orbsen, Direct Biologics, Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Acute Respiratory Distress Syndrome

• Bronchopulmonary Dysplasia

• Idiopathic Pulmonary Fibrosis

• Chronic Obstructive Pulmonary Disease

• Pulmonary Arterial Hypertension

• Mesenchymal Stem Cells

• EV/Exosomes

• iPSC Lung cells

• Endothelial Progenitor Cells

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.