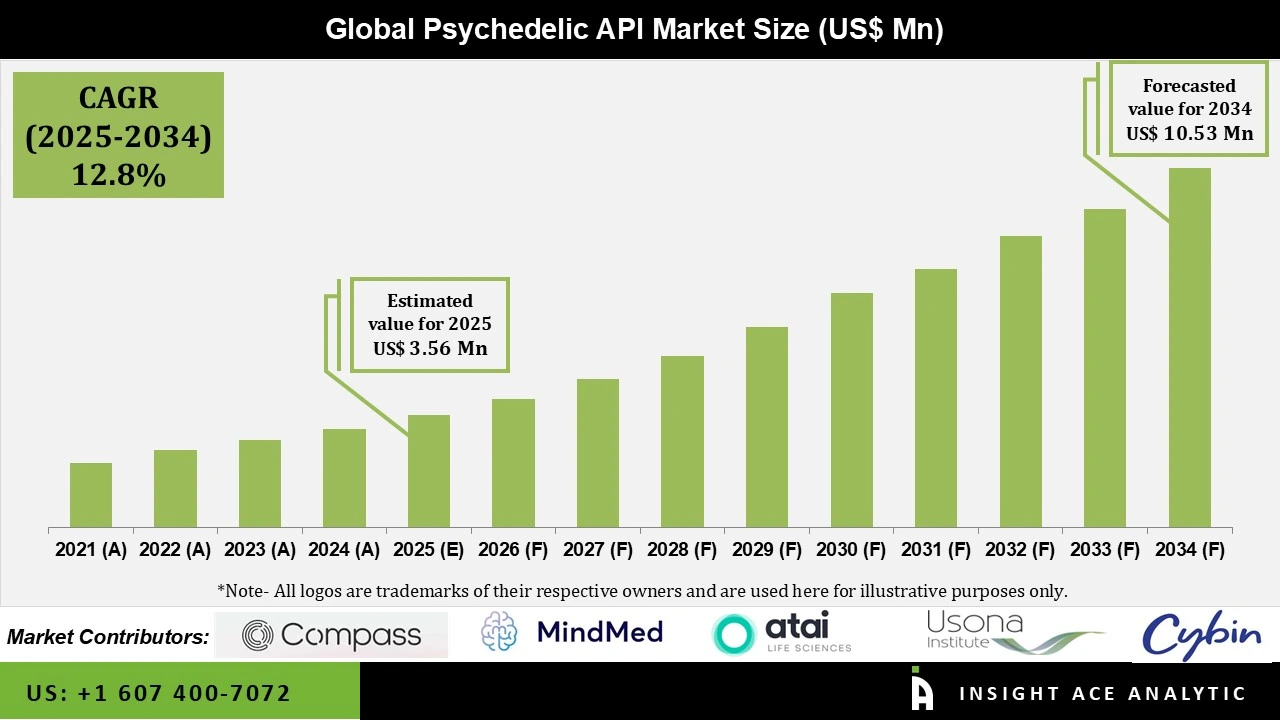

Global Psychedelic API Market Size is valued at US$ 3.5 Bn in 2025 and is predicted to reach US$ 10.5 Bn by the year 2034 at an 12.8% CAGR during the forecast period for 2025 to 2034.

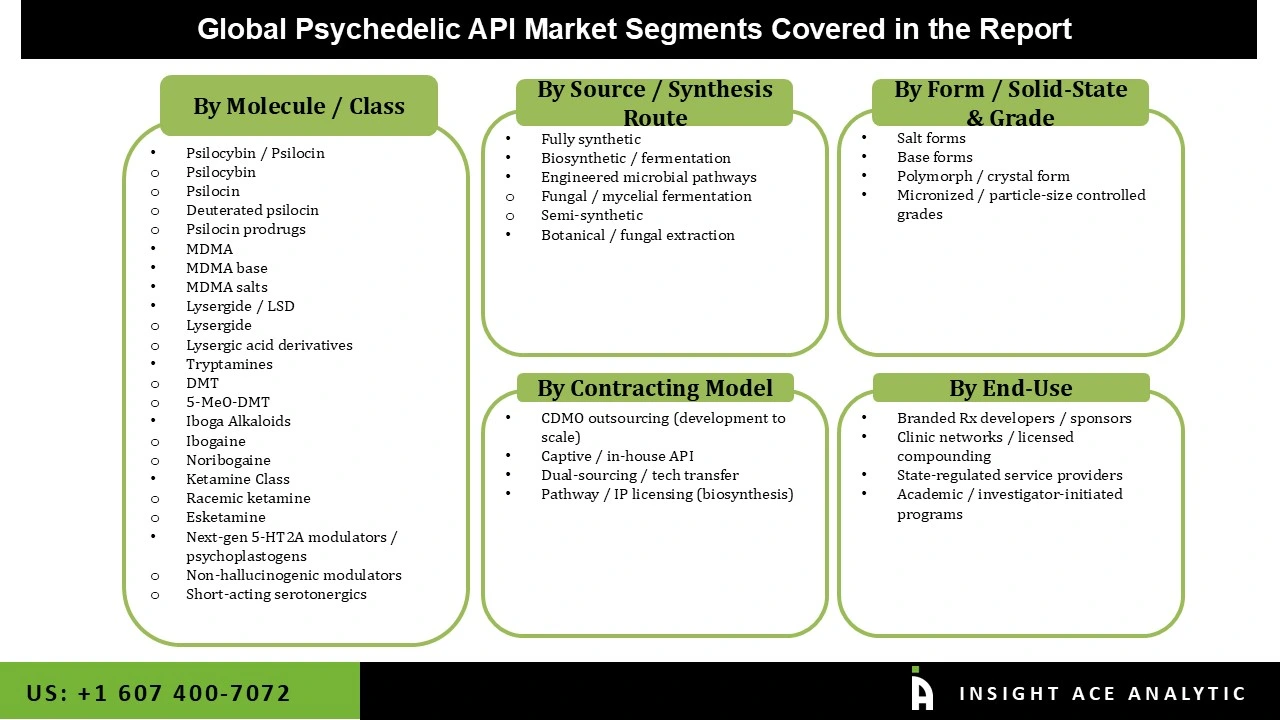

Psychedelic API Market Size, Share & Trends Analysis Distribution By Molecule / Class (Psilocybin / Psilocin, MDMA, MDMA Base, MDMA Salts, Lysergide / LSD, Tryptamines, Iboga Alkaloids, Ketamine Class, Next-Gen 5-HT2A Modulators / Psychoplastogens), By Source / Synthesis Route (Fully Synthetic, Biosynthetic / Fermentation, Engineered Microbial Pathways, And Botanical / Fungal Extraction), By Form / Solid-State & Grade (Salt Forms, Base Forms, Polymorph / Crystal Form, Micronized / Particle-Size Controlled Grades), By Contracting Model, By End Use, and Segment Forecasts, 2025 to 2034.

Psychedelic APIs are mostly utilized as crucial components in the creation of contemporary treatments for mental health issues like anxiety disorders, PTSD, addiction, and depression. They are used by pharmaceutical companies to develop controlled formulations for clinical trials, where the goal is to improve cases that are resistant to therapy. Additionally, they are used in neurobiology research to comprehend cognitive flexibility and consciousness.

These APIs are crucial in developing safer, standardized, and scientifically supported medical treatments as interest in psychedelic-assisted therapy increases. Researchers employ these active ingredients to study their effects on mood, memory, and emotional processing circuits in the brain. The global market for psychedelic API is expanding due to ,more clinical studies demonstrate positive outcomes for treating disorders including severe depression, PTSD, and addiction that don't react well to conventional psychiatric medications.

The rising need for more effective treatments for mental-health disorders, especially depression, PTSD, and addiction is another element propelling the psychedelic API market. The psychedelic API market is expanding because rising public awareness and desire for alternative mental health treatments. The WHO Over 1 billion individuals worldwide suffer from mental, neurological, or drug use illnesses; in 2023, 15% of the global population is predicted to have had a mental disorder. However, strict regulations because many psychedelic compounds are still categorized as prohibited substances, which takes time for research and authorization are some of the obstacles impeding the growth of the psychedelic API sector. Over the course of the forecast period, opportunities for the Psychedelic API market will be created by increasing investments in clinical infrastructure and local active pharmaceutical ingredient (API) synthesis capabilities.

Which are the Leading Players in Psychedelic API Market?

The psychedelic API market is segmented by molecule / class, source / synthesis route, form / solid-state & grade, contracting model, and end use. By molecule / class, the market is segmented into psilocybin / psilocin, MDMA, MDMA base, MDMA salts, lysergide / LSD, tryptamines, Iboga alkaloids (ibogaine, noribogaine), ketamine class, next-gen 5-ht2a modulators / psychoplastogens. Psilocybin / psilocin is further classified into psilocybin, psilocin, deuterated psilocin, and psilocin prodrugs. Lysergide / LSD is categorized into lysergide and lysergic acid derivatives. Tryptamines is sub-segmented into DMT and 5-meo-dmt. Iboga alkaloids is classified into ibogaine and noribogaine. Ketamine class is categorized into racemic ketamine and esketamine, whereas Next-Gen 5-ht2a modulators / psychoplastoge in classified into non-hallucinogenic modulators and short-acting serotonergics. By source / synthesis route, the market is segmented into fully synthetic, biosynthetic / fermentation, engineered microbial pathways and botanical / fungal extraction. Engineered microbial pathways is further classified into fungal / mycelial fermentation and semi-synthetic. By form / solid-state & grade, the market is segmented into salt forms, base forms, polymorph / crystal form, and micronized / particle-size controlled grades. By contracting model, the market is segmented into CDMO outsourcing (development to scale), captive / in-house API, dual-sourcing / tech transfer, and pathway / IP licensing (biosynthesis). By end use, the market is segmented into branded Rx developers / sponsors, clinic networks / licensed compounding, state-regulated service providers, and academic / investigator-initiated programs.

The ketamine segment led the psychedelic API market in 2024. This convergence is because of strong regulatory support and therapeutic acceptance. In order to facilitate the approval of the esketamine class, the FDA has expedited the creation of commercial infrastructure. The sector growth is being fulfilled by the FDA's current authorization of ketamine for treatment-resistant depression. Demand is driven by the widespread usage of ketamine in the treatment of anxiety disorders, depression, and PTSD. Rapid-acting antidepressant qualities, robust manufacturing infrastructure, and broad clinical acceptance characterize this class.

Salt forms represent the largest and fastest-growing segment, driven by increasing novel therapeutic designations and rising clinical trial activity. These forms offer enhanced stability, improved bioavailability, and greater efficiency in manufacturing processes. By optimizing key physicochemical properties, salt forms help create pharmaceutical products that are more suitable for both clinical development and commercial-scale production. For drug manufacturers, they ensure that synthetic APIs remain consistently pure, high quality, and easily scalable, making them a preferred choice across a wide range of pharmaceutical applications.

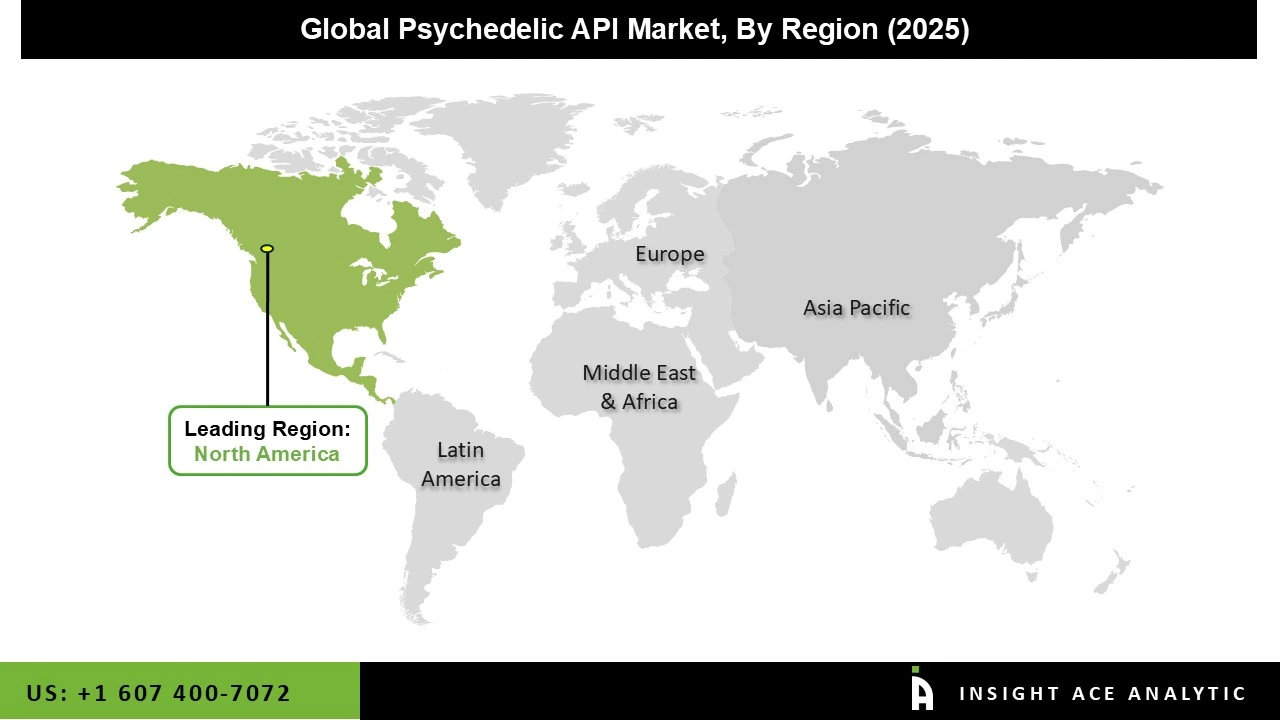

North America dominated the psychedelic API market in 2024. The United States is at the forefront of this expansion. This is due to the The region leads in clinical research, government-approved trials, and investment in mental-health innovations are attributed to this. High-quality APIs are in constant demand due to the active development of psychedelic-based medicines by universities, biotech companies, and pharmaceutical companies.North America's dominance is further reinforced by robust funding, cutting-edge labs, and growing interest in alternative therapies.

Rising prevalence of addiction, stress disorders, and depression is becoming more and more common in the Asia-Pacific area, the psychedelic API market is expanding at the strongest and fastest rate in this region. Additionally, number of nations that are progressively opening doors to innovation in mental health and enhancing their research capacities. The region has a robust production capability for high-purity APIs because to rising investment in biotech manufacturing. The market is expanding quickly as more businesses enter the market as local awareness grows and rules gradually change.

Psychedelic API Market by Molecule / Class

· Psilocybin / Psilocin

o Psilocybin

o Psilocin

o Deuterated psilocin

o Psilocin prodrugs

· MDMA

· MDMA base

· MDMA salts

· Lysergide / LSD

o Lysergide

o Lysergic acid derivatives

· Tryptamines

o DMT

o 5-MeO-DMT

· Iboga Alkaloids

o Ibogaine

o Noribogaine

· Ketamine Class

o Racemic ketamine

o Esketamine

· Next-gen 5-HT2A modulators / psychoplastogens

o Non-hallucinogenic modulators

o Short-acting serotonergics

Psychedelic API Market by Source / Synthesis Route

· Fully synthetic

· Biosynthetic / fermentation

· Engineered microbial pathways

o Fungal / mycelial fermentation

o Semi-synthetic

· Botanical / fungal extraction

Psychedelic API Market by Form / Solid-State & Grade

· Salt forms

· Base forms

· Polymorph / crystal form

· Micronized / particle-size controlled grades

Psychedelic API Market by Contracting Model

· CDMO outsourcing (development to scale)

· Captive / in-house API

· Dual-sourcing / tech transfer

· Pathway / IP licensing (biosynthesis)

Psychedelic API Market by End Use

· Branded Rx developers / sponsors

· Clinic networks / licensed compounding

· State-regulated service providers

· Academic / investigator-initiated programs

Psychedelic API Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.