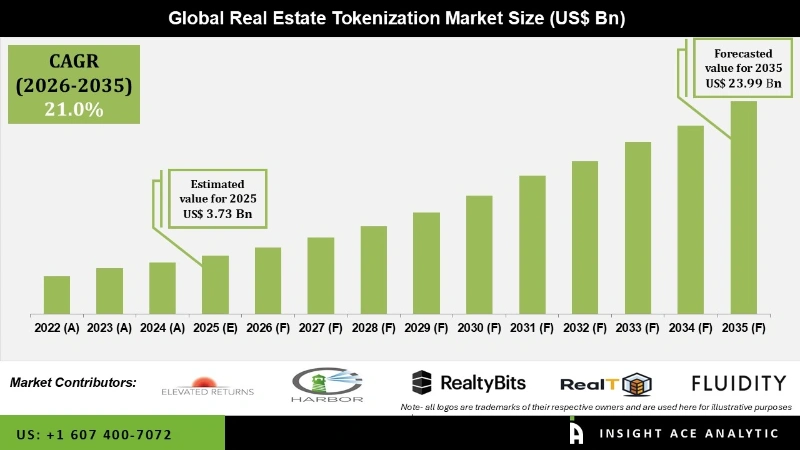

The Real Estate Tokenization Market Size was valued at USD 3.73 Bn in 2025 and is predicted to reach USD 23.99 Bn by 2035 at a 21.0% CAGR during the forecast period for 2026 to 2035.

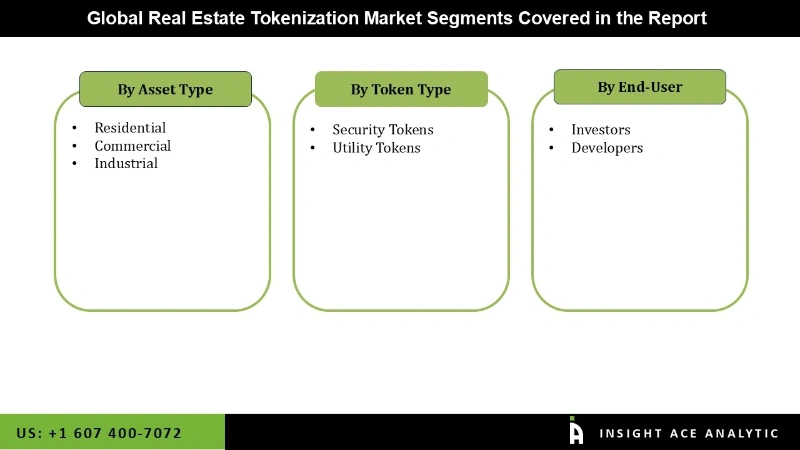

Real Estate Tokenization Market Size, Share & Trends Analysis Report, By Asset Type (Residential, Commercial, Industrial), By Token Type (Security Tokens, Utility Tokens), By End-User (Investors, Developers, By Region, Forecasts, 2026 to 2035.

Real estate tokenization means turning owning rights in a portion of real estate into digital tokens that can be used on a blockchain. The real estate tokenization market is growing because tokenization strategies are being actively explored and implemented by technology companies and real estate enterprises, driving the market's growth and development. Additionally, the immutable ledger that blockchain technology provides promotes transparency and decreases the likelihood of fraud, thereby providing investors with transaction records that are trustworthy and safe. Tokenization makes it possible to have fractional ownership, enabling more investors to capitalize on real estate opportunities with lower initial investment needs. Additionally, real estate tokenization solutions are developed in collaboration with blockchain platforms, legal advisers, developers, and companies in the industry. These solutions are secure and compliant and increase market liquidity, accessibility, and investment opportunities for all types of investors. The ongoing development of novel and improved real estate tokenization propels market expansion.

However, the real estate tokenization industry is expected to slow down market growth due to the lack of clarity about regulations, difficulties with technology, investors' lack of knowledge, and insufficient infrastructure. Moreover, the increased demand for liquidity, the spotlight on digital solutions, and the necessity for investors to seek out varied, robust assets through creative investment avenues, COVID-19, hastened the real estate tokenization market. Furthermore, the demand for real estate tokenization is expected to rise due to offering new investment opportunities based on blockchain technology to attract various investors and facilitate portfolio diversification.

The real estate tokenization market is segmented based on asset type, token type, and end-user. By asset type, the market is divided into residential, commercial, and industrial. By token type, it is divided into security tokens and utility tokens. By end-users, it is divided into investors and developers.

The commercial segment is expected to hold a significant global market share in 2023 due to its substantial asset worth and the possibility of producing reliable revenue sources. Institutional and individual investors alike are drawn to commercial assets, like office spaces and retail malls, because of their diversification and stability. Real estate tokenization makes commercial real estate more accessible and attractive to a broader spectrum of investors by offering fractional ownership, more transparency, and liquidity, which is growing the worldwide market.

The investor segment is expected to grow rapidly in the real estate tokenization market owing to the growing demand for easily accessible and diverse investment options. By facilitating fractional ownership through tokenization, investors can take part in highly valuable real estate with less capital outlay. The market is experiencing growth as more individuals and institutions explore tokenized real estate, drawn by the increased liquidity and transparency of blockchain technology. This, in turn, attracts investors looking for more flexible and secure investment possibilitiesFF.

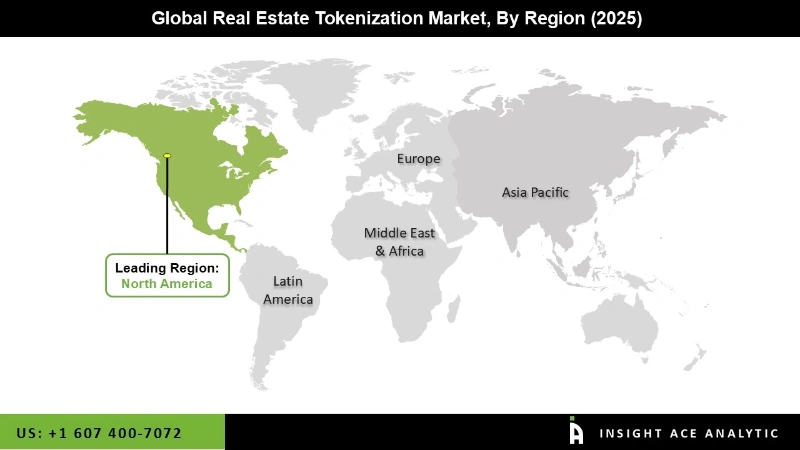

The North American real estate tokenization market is expected to register the highest market share in revenue in the near future because of the growing desire for creative financial solutions in the real estate investment market, the widespread use of blockchain technology, enabling regulatory frameworks, and a robust investor base. In addition, the Asia-Pacific region is expected to grow quickly in the global real estate tokenization market because the area is seeing fast urbanization, more technology usage, more real estate investments, and government measures that are encouraging the growth of blockchain and digital assets, which is growing the market demand in this area.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.73 Bn |

| Revenue Forecast In 2035 | USD 23.99 Bn |

| Growth Rate CAGR | CAGR of 21.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Asset Type, By Token Type, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Elevated Returns, Harbor, RealtyBits, RealT, Fluidity, AssetBlock, Realty Mogul, Templum, Smartlands, Brickblock, RealBlocks, Slice, SolidBlock, ShareRing, BrickMark, and Others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Real Estate Tokenization Market- By Asset Type

Real Estate Tokenization Market- By Token Type

Real Estate Tokenization Market- By End-User

Real Estate Tokenization Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.