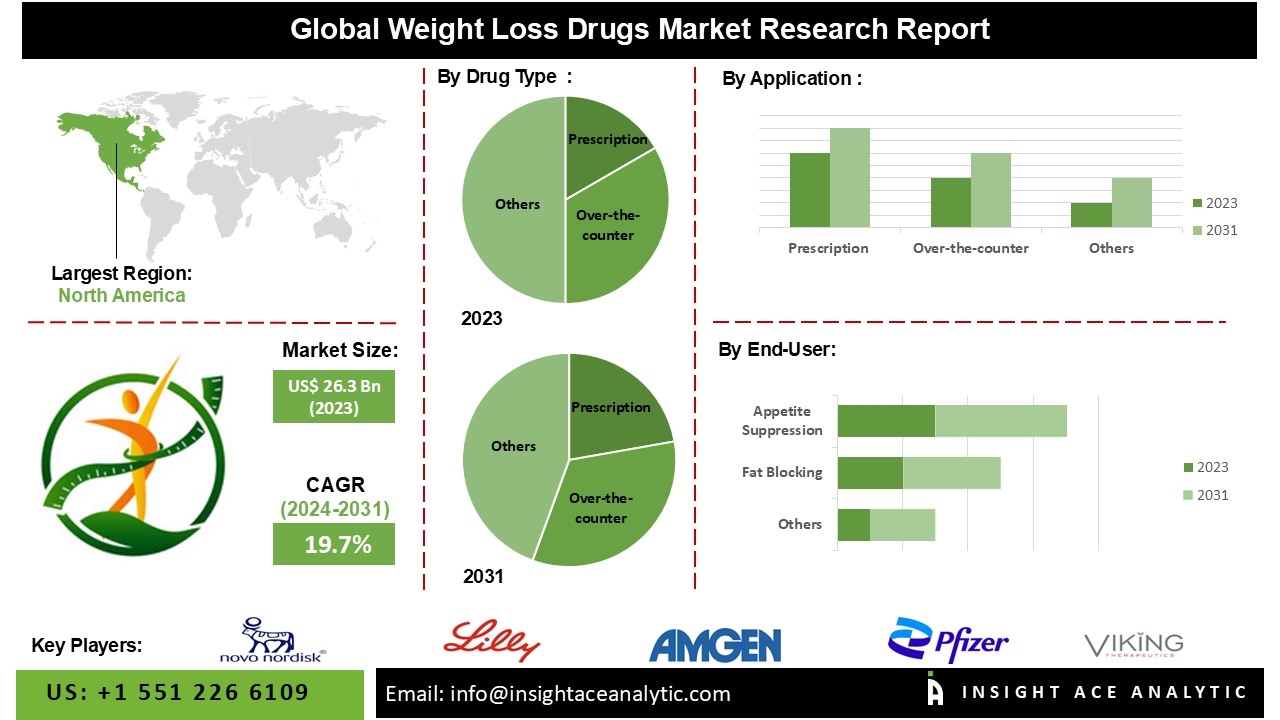

Weight Loss Drugs Market Size is valued at USD 26.3 billion in 2023 and is predicted to reach USD 108.9 billion by the year 2031 at a 19.7% CAGR during the forecast period for 2024-2031.

The weight loss drugs market is witnessing significant growth due to the global rise in obesity rates and related health concerns. With awareness of the health risks especially associated with obesity, there's a growing demand for effective weight management solutions. These drugs work by suppressing appetite, reducing fat absorption, or increasing metabolism. Factors such as unhealthy dietary habits and genetic predispositions contribute to the growing obesity epidemic, further fueling the market's expansion.

Moreover, advancements in drug development and increased research in obesity treatment drive innovation in this market. However, challenges such as safety concerns, side effects, and limited long-term efficacy of weight loss drugs persist. Regulatory hurdles and stringent approval processes also impact market growth. Despite these challenges, the weight loss drugs market is estimated to continue growing as the demand for effective weight management solutions remains strong.

The COVID-19 has had a significant impact on the weight loss drugs market. Initially, the market experienced disruptions due to lockdowns, restrictions on movement, and reduced healthcare facility access, which led to decreased patient visits and prescriptions for weight management drugs as healthcare resources were diverted towards managing the pandemic. It increased the risk of the obese population, leading to COVID-19 mortality, which increased the demand for weight loss drugs during COVID-19. However, increased awareness about healthy lifestyles and weight concerns during the pandemic is expected to maintain the demand for anti-obesity drugs even post-pandemic period.

The weight loss drugs market is segmented by product type, application, and distribution channel. The market is divided into prescription and over-the-counter. By application, the market segments include appetite suppression, fat blocking, and others. Finally, by distribution channel, the segmentation includes hospital pharmacy, retail pharmacy, and online pharmacy.

Appetite suppressants hold significant market share in the weight loss drugs market due to their established history, efficacy, wide availability, and cost-effectiveness. Drugs like Phentermine have been trusted for decades, providing effective short-term weight loss by reducing appetite. Their affordability, including generic options, makes them accessible to a broader population. Appetite suppressants are often prescribed as part of comprehensive weight loss plans, supporting dietary adherence. Regulatory approvals and inclusion in clinical guidelines bolster their credibility. Patient preferences for rapid, noticeable effects and ease of use further drive their popularity. Despite the emergence of newer drugs like GLP-1 receptor agonists, appetite suppressants remain essential for initiating weight loss and supporting behavioral changes in weight management strategies.

The online pharmacy segment in the weight loss drugs market involves the distribution of weight loss medications through digital platforms. Online pharmacies offer convenience, accessibility, and discretion for individuals seeking weight loss treatments. Customers can consult with healthcare professionals remotely, obtain prescriptions, and purchase medications online, often at lower prices compared to traditional pharmacies. These platforms provide a wide range of weight loss drugs, including prescription and over-the-counter options. However, challenges such as the risk of counterfeit drugs, regulatory compliance, and the need for accurate medical assessments persist. Despite challenges, the online pharmacy segment continues to grow due to its convenience and increasing consumer preference for digital healthcare solutions.

The North American weight loss drugs market is expected to have the highest market share in terms of revenue in the near future. It can be attributed to the high demand for weight loss drugs due to the youth's fitness trends and health awareness. Besides, the rise in cases of lifestyle-related diseases has triggered the need for weight loss drugs in the common population. Moreover, North America is a rapidly growing market for weight loss drugs attributed to the popularity of dietary supplements and weight loss drugs. Europe is seen to grow at a significant rate in the global Weight Loss Drugs Market due to growing concerns for weight loss drugs attributed to the growing prevalence of obesity: rapid industrialization, government initiatives, and increasing funding in various industries.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 26.3 Bn |

| Revenue Forecast In 2031 | USD 108.9 Bn |

| Growth Rate CAGR | CAGR of 19.8% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Drug Type, By Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Novo Nordisk A/S, Eli Lilly & Co., Amgen Inc., Pfizer Inc., Viking Therapeutics Inc., Structure Therapeutics Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc, and Sandoz International GmbH. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Weight Loss Drugs Market- By Drug Type

Weight Loss Drugs Market- By Application

Weight Loss Drugs Market- By Distribution Channel

Weight Loss Drugs Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.