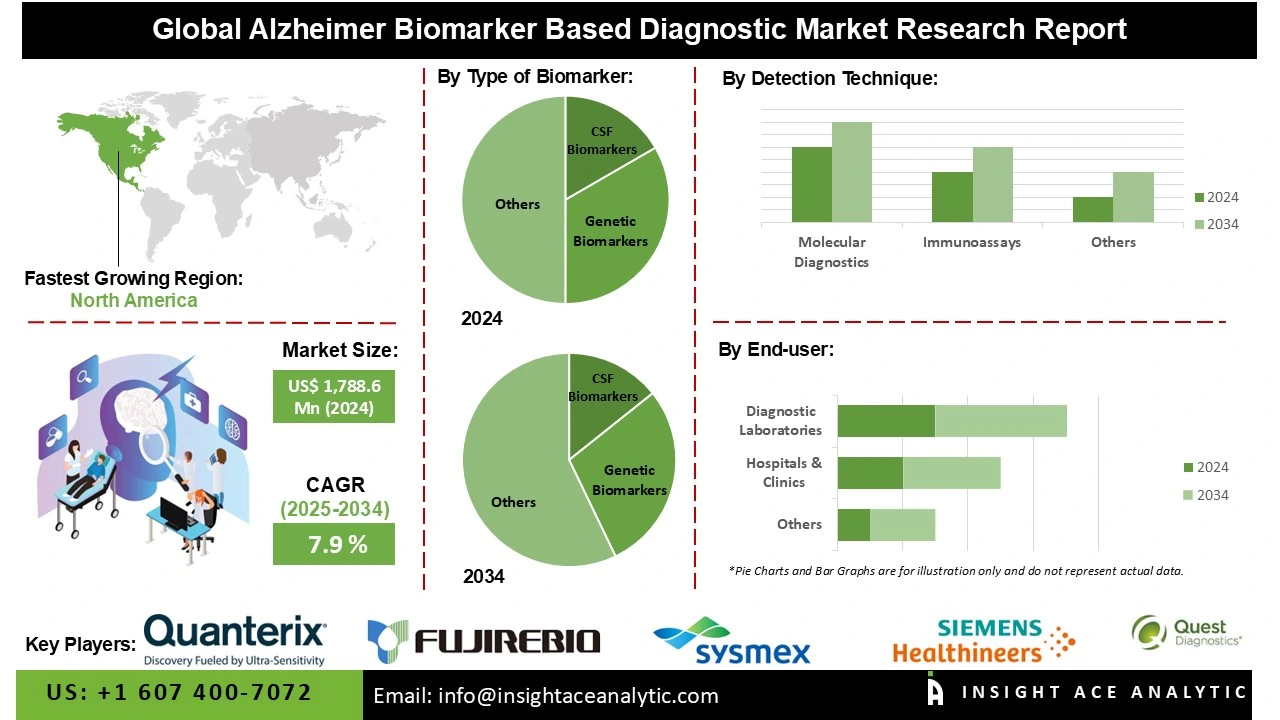

Global Alzheimer Biomarker Based Diagnostic Market Size is valued at US$ 864.3 Mn in 2024 and is predicted to reach US$ 1,788.6 Mn by the year 2034 at an 7.9% CAGR during the forecast period for 2025 to 2034.

Alzheimer Biomarker Based Diagnostic Market Size, Share & Trends Analysis Distribution by Type of Biomarker (CSF Biomarkers (Amyloid Beta, Tau Protein, Others), Genetic Biomarkers (Apolipoprotein E, Others), and Blood Biomarkers)), by Detection Technique (Molecular Diagnostics, and Immunoassays), by End-user (Hospitals & Clinics, Diagnostic Laboratories, and Others), and Segment Forecasts, 2025 to 2034

The Alzheimer's Disease Diagnostic Biomarker is mainly applied to figure out and confirm a diagnosis of Alzheimer's disease clinically and accurately using biomarkers - specifically, the amyloid-beta, tau, and neurofilament light chains. These diagnostic markers facilitate clinicians to manage disease progression, personalize treatment, and measure treatment response.

They are used in clinical trials for patient stratification and evaluating drug effects, which may uniquely contribute to the drug development pipeline. Additionally, biomarker-based diagnostic Alzheimer's assessments may facilitate preventative care, risk assessment, and early intervention for improved outcomes for patients. The biomarkers provide investigators the opportunity to assess biomarker outcomes in exploring disease mechanisms and, when developing novel therapies, prove useful in assessing drug application, implicating a dual role as biomarkers in the clinical and research pursuits of neurodegenerative disorders.

The global market for Alzheimer's biomarker-based diagnostics is growing, driven primarily by the rising worldwide prevalence of Alzheimer's disease and other dementias, especially within ageing populations. This growth is further boosted by the rapidly increasing adoption of biomarker tests, which enable rapid and accessible detection, facilitating timely intervention, personalized treatment, and efficient disease management in on-demand healthcare services.

Demographic trends underscore this expansion. According to the World Health Organization (WHO), there were 125 million people aged 80 years or older in 2018. Furthermore, the WHO estimated that the proportion of the worldwide population aged 60 years as well as over would nearly double, rising from 12% in 2015 to 22% by 2050.

Despite this positive outlook, several factors are restraining market growth. These include the high cost of diagnostic tests, limited accessibility in lower-income regions, regulatory challenges, and ethical concerns surrounding early diagnosis in the absence of a cure.

The Alzheimer Biomarker Based Diagnostic market is segmented by Type of Biomarker, Detection Technique, and End-user. By Type of Biomarker, the market is segmented into CSF Biomarkers, including Amyloid Beta, Tau Protein, and Others; Genetic Biomarkers, including Apolipoprotein E, and Others; and Blood Biomarkers. By Detection Technique, the market is segmented into Molecular Diagnostics and Immunoassays. As per the end-user, the market is segmented into Hospitals & Clinics, Diagnostic Laboratories, and Others.

The blood biomarkers category led the alzheimer biomarker based diagnostic market in 2024. This convergence is due to their generally non-invasive and cost-effective nature, and relative ease of use compared to testing blood with imaging or cerebrospinal fluid (CSF); these tests will become more widely used. Blood-based biomarkers, such as amyloid-beta, tau proteins, or neurofilament light chains (NfL), can provide a reliable association with clinical diagnosis for the early detection or monitoring of disease. Growing acceptance and use of blood-based tests in the clinical space and clinical research, along with the effect of more healthcare providers willing to advocate for their patients to have early diagnosis, means that patient compliance and accessibility to testing will keep on growing. With additional advances in technology and regulatory clearances for blood-based diagnostic tests, the blood-based biomarker market will continue to dominate testing not only in developed markets but also in emerging markets.

The largest and fastest-growing detection technique, molecular diagnostics, is due to its high sensitivity, specificity, and ability to diagnose Alzheimer’s disease based on its biomarker profiles and other related proteins. Molecular detection techniques, including PCR (Polymerase Chain Reaction), immunoassays and the use of next-generation sequencing, provide precise identification and quantification of important proteins like amyloid-beta and tau protein(s) for supporting earlier diagnosis and personalized therapies. The use of molecular detection methods also enables elderly and dementia patient stratification in clinical drug trials and assists with drug development. In addition, continued technology innovation in molecular diagnostics, the greater use of artificial intelligence (AI) analytics with biomarker research, and increasing demand for non-invasive and accurate diagnostic solutions, is driving the greater molecular diagnostics share in the detection market segment globally.

North America dominated the Alzheimer Biomarker Based Diagnostic market in 2024. The United States is at the forefront of this expansion. This is due to the advanced healthcare framework, wide adoption of advanced diagnostic technologies, and strong research and clinical trial networks. Meanwhile, a combination of rigorous government initiatives and investment, and widespread awareness programs (all of which continue to proliferate) also materially elevate the market confidence. Further, an accelerated aging population and high incidence of Alzheimer’s disease will continue to promote demand for early and accurate biomarker-based diagnostics in the market.

Advanced healthcare framework, widespread adoption of advanced diagnostic technologies, and strong research and clinical trial networks in the Asia-Pacific area, the Alzheimer Biomarker Based Diagnostic market is expanding at the strongest and fastest rate in this region. Meanwhile, a combination of rigorous government initiatives and investment, and widespread awareness programs (all of which continue to proliferate) also materially elevate the market confidence. Further, an accelerated aging population and high incidence of Alzheimer’s disease will continue to promote demand for early and accurate biomarker-based diagnostics in the market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 864.3 Mn |

| Revenue Forecast In 2034 | USD 1,788.6 Mn |

| Growth Rate CAGR | CAGR of 7.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Biomarker, By Detection Technique, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Quanterix Corporation, Fujirebio Diagnostics, Lantheus Holdings Inc., Sysmex Corporation, Quest Diagnostics Inc., Siemens Healthineers AG, Enzo Life Sciences, Inc., Thermo Fisher, Scientific, Inc., AnaSpec, Inc., Merck KGaA, Cell Signaling Technology, Inc., Imagilys, NanoSomiX, QIAGEN, 23andMe, Inc., and C₂N Diagnostics |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Alzheimer Biomarker Based Diagnostic Market by Type of Biomarker-

· CSF Biomarkers

o Amyloid Beta

o Tau Protein

o Others

· Genetic Biomarkers

o Apolipoprotein E

o Others

· Blood Biomarkers

Alzheimer Biomarker Based Diagnostic Market by Detection Technique-

· Molecular Diagnostics

· Immunoassays

Alzheimer Biomarker Based Diagnostic Market by End-user-

· Hospitals & Clinics

· Diagnostic Laboratories

· Others

Alzheimer Biomarker Based Diagnostic Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.