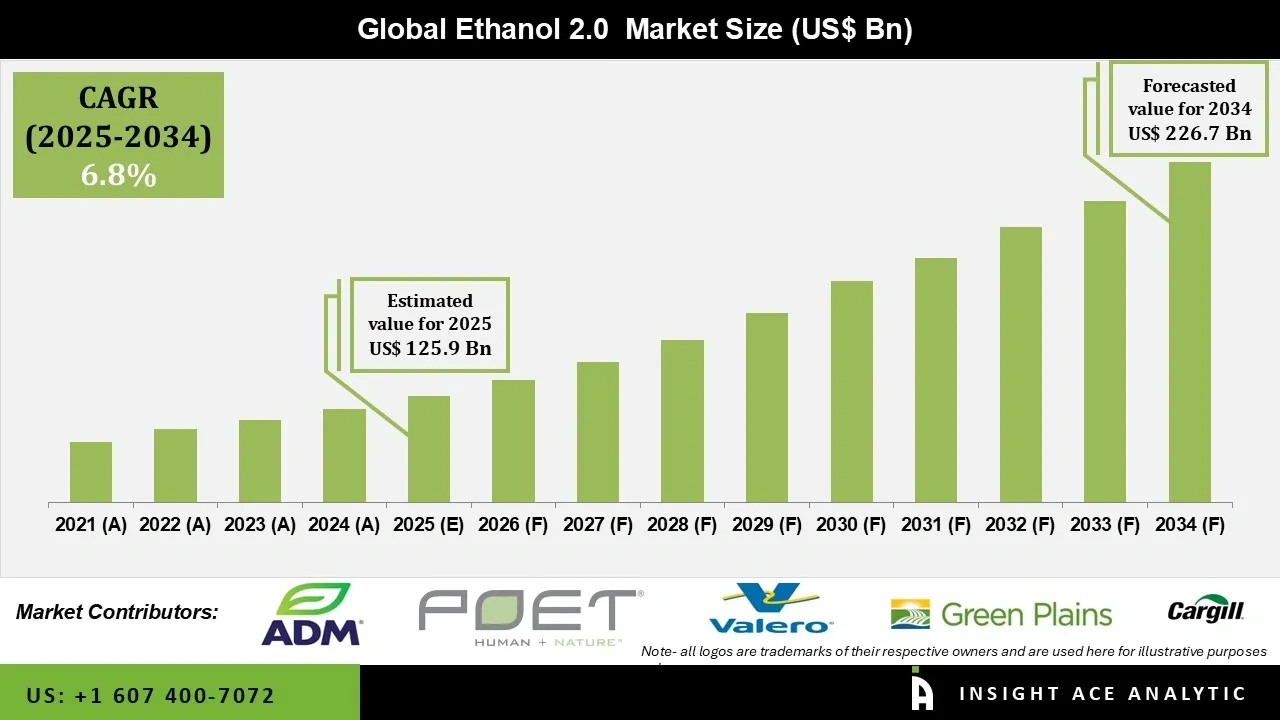

Ethanol 2.0 Market Size is valued at USD 125.9 Bn in 2025 and is predicted to reach USD 226.7 Bn by the year 2034 at a 6.8% CAGR during the forecast period for 2025 to 2034.

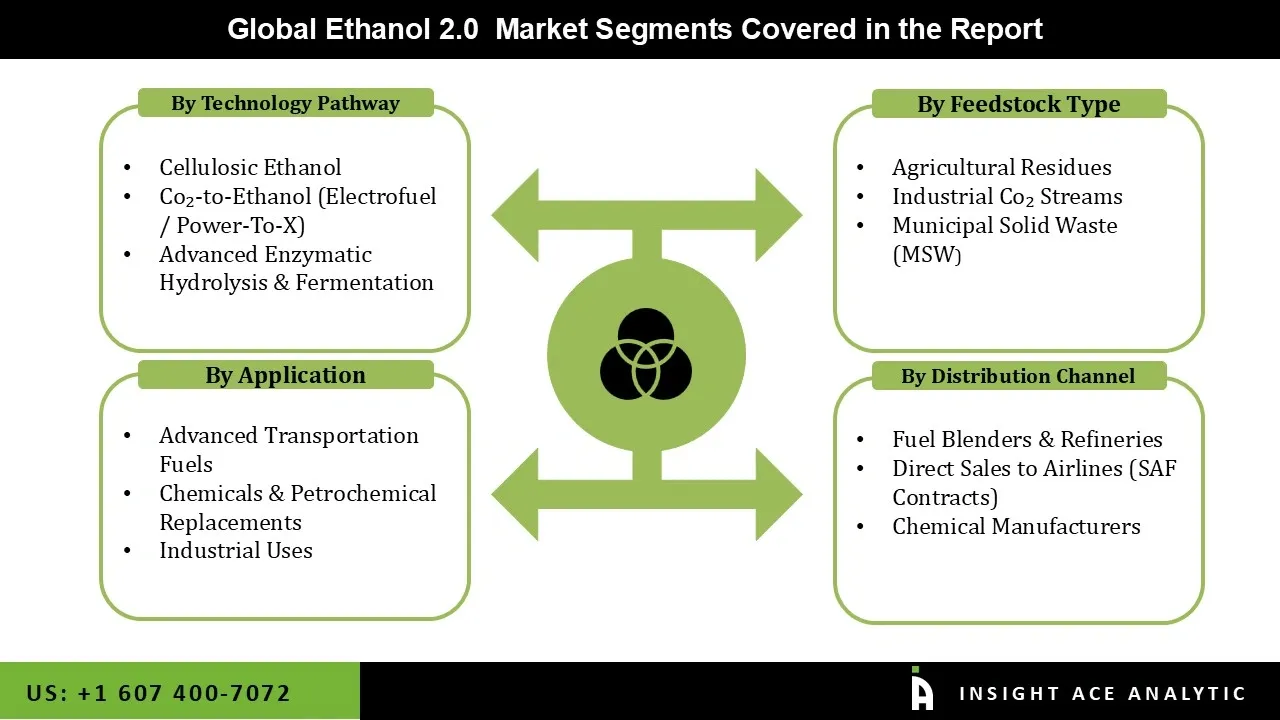

Ethanol 2.0 Market Size, Share & Trends Analysis Distribution by Feedstock Type (Industrial Co₂ Streams, Agricultural Residues, and Municipal Solid Waste (MSW)), Technology Pathway (Cellulosic Ethanol, Advanced Enzymatic Hydrolysis & Fermentation, and Co₂-to-Ethanol (Electrofuel / Power-To-X)), Application (Advanced Transportation Fuels, Industrial Uses, and Chemicals & Petrochemical Replacements), Distribution Channel (Fuel Blenders & Refineries, Chemical Manufacturers, and Direct Sales to Airlines (SAF Contracts)), and Segment Forecasts, 2025 to 2034

The next stage of ethanol production, termed as "ethanol 2.0," goes beyond traditional first-generation ethanol produced from food-based feedstocks like corn, sugarcane juice, or molasses. It mainly concentrates on cutting-edge and second-generation technologies that make use of renewable biomass that isn't used for food, such as forestry waste, agricultural wastes (rice straw, wheat straw, maize stover), and other lignocellulosic materials.

In order to transform complex biomass into fuel ethanol more effectively and with a smaller carbon impact, Ethanol 2.0 incorporates enhanced biochemical and thermochemical processes, such as advanced enzymatic hydrolysis and fermentation. The increased investments in cutting-edge biofuel technology, worldwide efforts to achieve carbon neutrality, and the expanding use of non-food feedstocks such as industrial byproducts, forestry waste, and agricultural leftovers are driving the ethanol 2.0 market's growth.

The ethanol 2.0 market has been continuously expanding due to the increased demand for gasoline ethanol substitutes as well as the global shift toward cleaner and renewable energy sources. Furthermore, there will be substantial growth prospects for more sustainable ethyl alcohol production methods in the near future due to technological advancements like improvements in distillation and fermentation techniques to make ethyl alcohol more efficient and quick developments in cellulosic ethanol produced from plant residues rather than food crops.

Moreover, the investments in advanced ethanol plants are being drawn by financial incentives such as carbon credits, tax breaks, and biofuel grants. Large-scale 2G ethanol deployment is made possible by initiatives like Brazil's RenovaBio program and the U.S. DOE's BETO program, which also promote collaborations with energy and technology firms. This is anticipated to boost the ethanol 2.0 market growth over the forecast period.

In addition to increasing operational efficiency and sustainability in production and application, the ethanol 2.0 market is implementing cutting-edge technologies like digital twins and artificial intelligence automation. The main technological developments in the ethanol 2.0 market are centred on enhancing the sustainability and efficiency of production from non-food biomass, mainly through the use of cutting-edge biomass conversion techniques, genetic engineering of microorganisms, and the incorporation of contemporary digital technologies like AI and IoT for process optimisation.

However, the ethanol 2.0 market's growth would be constrained by the high initial investment and upkeep costs. Ethanol 2.0 and sophisticated smart meters may result in significant, ongoing installation and operating costs. Managing these costs can be quite challenging for small businesses and economically struggling areas.

• Archer Daniels Midland (ADM)

• Green Plains Inc

• Cargill BP

• Praj Industries

• Alto Ingredients

• POET LLC

• LiYF 2G Bioethanol

• Universal Fuel Technologies

• Springbok Energy

• EthanBiofuel

• altM

• Valero Energy Corporation

• LanzaJet

• EVES ENERGY

• Green Energy Chemicals

• Triti

• Inovelsa Algae Tech

• Cheranna Energy

The ethanol 2.0 market's capacity to use a wide variety of non-food feedstocks is one of the main drivers of its positive revenue trajectory. Utilizing forest biomass, agricultural leftovers, and other waste products, the market guarantees a more varied and safe supply chain. This flexibility reduces the risks connected to traditional crop-based ethanol production, which supports steady revenue growth. Additionally, the increasing income in the ethanol 2.0 market is also largely driven by the urgent need to combat climate change and the strong global focus on environmental preservation. The demand for greener as well as more sustainable fuel substitutes, like ethanol 2.0, increases as societies realize how important it is to cut carbon emissions, increasing the market’s revenue growth.

The high production costs of the ethanol 2.0 manufacturing method are one of the major obstacles to the market's expansion. It is produced from non-food biomass, such as wood, agricultural waste, and grasses, as opposed to conventional ethanol, which is manufactured from food crops like corn or sugarcane. Even if the feedstocks are plentiful and renewable, the cost of turning them into ethanol is significantly greater because of the intricate and energy-intensive procedures required. Furthermore, ethanol 2.0 production necessitates sophisticated technologies like fermentation and enzymatic hydrolysis, which are currently less economical than conventional ethanol production techniques.

The Agricultural Residues category held the largest share in the Ethanol 2.0 market in 2025. Rice straw, rice husk, wheat straw, and maize stover are examples of agricultural wastes that are typically burned in many locations or left on the fields after harvests for use as fodder and landfill material. Branches, leaves, bark, and other parts of wood make up forestry wastes. The production of agricultural leftovers is inexpensive and widely accessible worldwide. Additionally, processing agricultural residue results in comparatively fewer greenhouse gas emissions, which is why it is becoming more and more well-liked as a very accessible and efficient feedstock segment.

In 2025, the cellulosic ethanol category dominated the Ethanol 2.0 market. In order to lessen the country's reliance on imported oil, cellulosic ethanol is being heavily promoted in a number of nations. The significant growth in the agricultural sec tor in a number of developing countries, including China, India, Brazil, and Indonesia, along with the growing prevalence of setting up large-scale commercial plants to produce these kinds of ethanol, are major factors anticipated to strengthen the growth of the global ethanol 2.0 market.

Furthermore, growing worry over anthropogenic climate change—which is further accelerated by the evidence of rising temperatures and their human causes—is driving a number of initiatives for cellulosic ethanol. The ethanol 2.0 market's growth was positively impacted by the usage of cellulosic ethanol, which is seen as a unique source of emissions reduction as compared to petroleum-based fuels used for transportation, heat, and electricity.

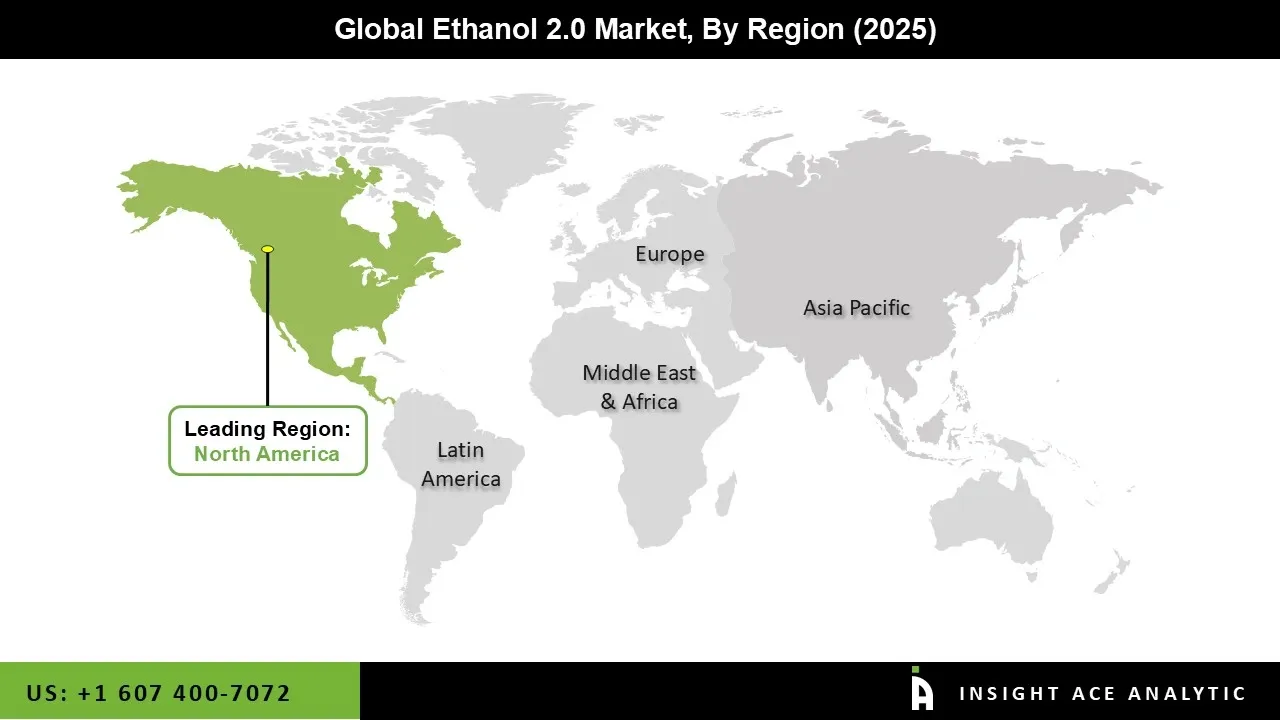

The Ethanol 2.0 market was dominated by the North America region in 2025, ascribed to the significant increase in the product's user base, the existence of a robust automobile industry, and stringent particulate emission regulations in nations like the US and Canada. Additionally, the area gains from government subsidies for low-carbon fuels, quick advancements in cellulosic ethanol, and active involvement by significant biofuel companies.

Furthermore, there has been a notable increase in ethanol 2.0 production throughout the region, primarily as a result of higher renewable fuel standard targets and a notable increase in motor gasoline consumption. These factors are likely to have a positive effect on the product's development and demand in the upcoming years.

In April 2025, The government of India expedited its ethanol blending initiative, successfully reaching a 20% national blend and establishing a new goal of 30% blending by 2030. Although reaching the 30% objective may include vehicle compatibility considerations, possible engine changes, or the development of new flex-fuel vehicles, this project intends to reduce oil imports, save foreign exchange, minimize emissions, and benefit farmers.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 125.9 Bn |

| Revenue forecast in 2034 | USD 226.7 Bn |

| Growth Rate CAGR | CAGR of 6.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Feedstock Type, Technology Pathway, Application, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Archer Daniels Midland (ADM), Green Plains Inc, Cargill BP, Praj Industries, Alto Ingredients, POET LLC, LiYF 2G Bioethanol, Universal Fuel Technologies, Springbok Energy, EthanBiofuel, altM, Valero Energy Corporation, LanzaJet, EVES ENERGY, Green Energy Chemicals, Triti, Inovelsa Algae Tech, and Cheranna Energy. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Ethanol 2.0 Market by Feedstock Type-

• Industrial Co₂ Streams

• Agricultural Residues

• Municipal Solid Waste (MSW)

Ethanol 2.0 Market by Technology Pathway-

• Cellulosic Ethanol

• Advanced Enzymatic Hydrolysis & Fermentation

• Co₂-to-Ethanol (Electrofuel / Power-To-X)

Ethanol 2.0 Market by Application-

• Advanced Transportation Fuels

• Industrial Uses

• Chemicals & Petrochemical Replacements

Ethanol 2.0 Market by Distribution Channel-

• Fuel Blenders & Refineries

• Chemical Manufacturers

• Direct Sales to Airlines (SAF Contracts)

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.