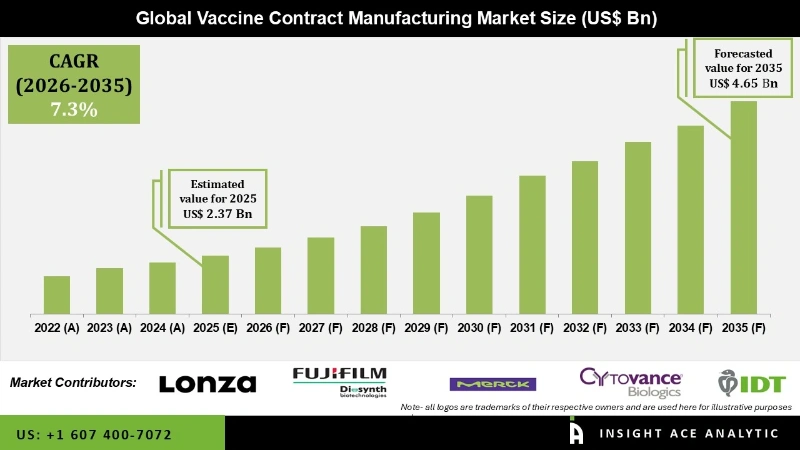

Vaccine Contract Manufacturing Market Size is valued at USD 2.37 Bn in 2025 and is predicted to reach USD 4.65 Bn by the year 2035 at a 7.30% CAGR during the forecast period for 2026 to 2035.

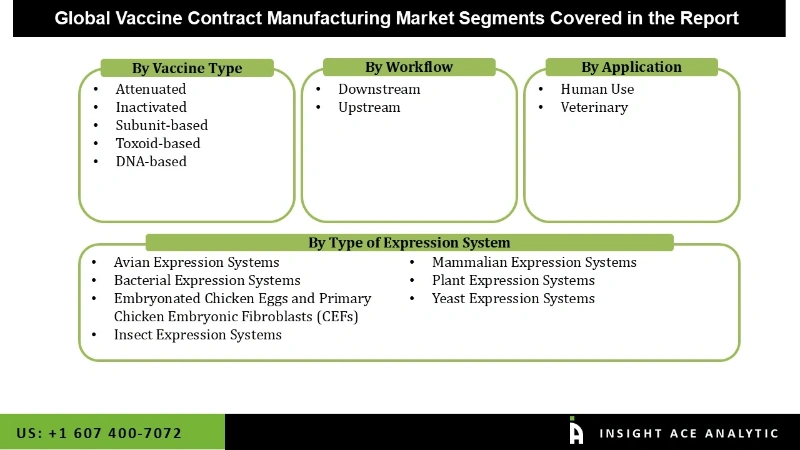

Vaccine Contract Manufacturing Market Size, Share & Trends Analysis Report By Vaccine Type (Attenuated, Inactivated, Subunit-based, Toxoid-based, DNA-based), By Type of Expression System, By Workflow, By Application, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Vaccine contract manufacturing plays a vital role in the pharmaceutical industry, contributing to the efficient and scalable production of vaccines to address various health challenges worldwide. With the expanding efforts in global vaccine distribution, the ability to manage various facets of vaccine manufacturing and logistics positions Contract Manufacturing Organizations (CMOs) to play an important role in ensuring fair access to vaccines worldwide. Consequently, diversifying services becomes a strategic manoeuvre that not only enhances the market presence of CMOs but also contributes to addressing global health challenges. Additionally, advancements in vaccine technology, driven by innovations such as genetic engineering, vaccine delivery technology, and proteomics, continue to shape the industry's dynamic landscape.

Moreover, the increasing implementation of strategic initiatives by key industry players, including activities such as business expansion, partnerships, and acquisitions, also reinforces the projected market growth. The rising global demand for vaccine contract manufacturing is set to propel market expansion.

The global market of vaccine contract manufacturing is segmented on the basis of Vaccine Type, Type of Expression System, Workflow, and Application. The vaccine Type segment is categorised into Attenuated, Inactivated, Subunit-based, Toxoid-based, and DNA-based. By Type of Expression System, the market is segmented into Avian Expression Systems, Bacterial Expression Systems, Embryonated Chicken Eggs and Primary Chicken Embryonic Fibroblasts (CEFs), Insect Expression Systems, Mammalian Expression Systems, Plant Expression Systems, and Yeast Expression Systems. The Workflow segment consists of Downstream and Upstream. As per the Application segment, the market is divided into Human Use and Veterinary.

Inactivated vaccinations consist of whole bacteria or viruses rendered non-viable or altered to prevent reproduction. Due to the absence of live bacteria or viruses, these vaccines are incapable of transmitting the diseases they are designed to protect against, even in individuals with severely weakened immune systems. This characteristic represents a significant benefit of this vaccine category.

The mammalian category is expected to hold a major share of the global Vaccine Contract Manufacturing market in 2024. The increasing prominence of mammalian cell culture technology has become a notable trend in the vaccine contract manufacturing market. Mammalian cell culture is gaining significance as a preferred method for vaccine production due to its ability to replicate complex biological systems and produce a wide range of proteins. This technology offers advantages such as enhanced yield, scalability, and the ability to produce more complex and effective vaccines. As a result, the rising utilization of mammalian cell culture in vaccine contract manufacturing is shaping the landscape of the market, contributing to its growth and innovation. This trend underscores the industry's ongoing efforts to improve vaccine manufacturing processes and meet the growing demand for safe and effective vaccines.

In recent years, the human-use category has dominated the market with the highest share. The extensive immunization coverage against various diseases in humans has resulted in this sector gaining the leading position in the market.

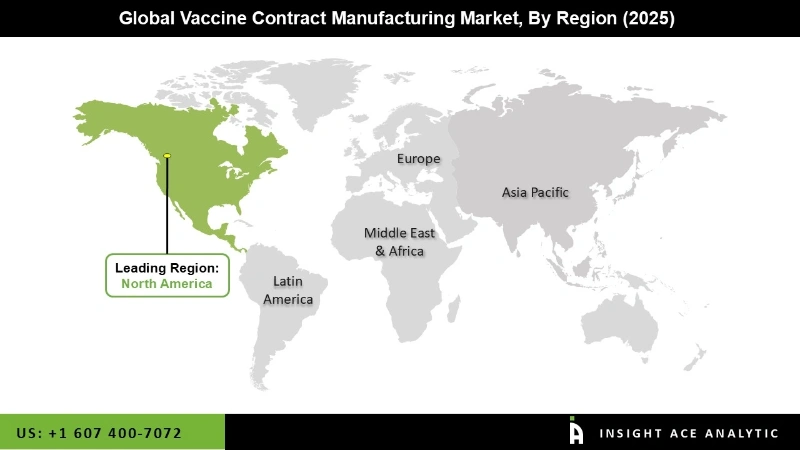

The North America Vaccine Contract Manufacturing market is expected to register the highest market share. Advantages include a well-established biotechnology and pharmaceutical sectors, a sizable population, and a strong emphasis on healthcare that drives up vaccine demand. The area is a desirable location for contract manufacturing organizations (CMOs) due to its advanced manufacturing infrastructure, highly qualified labour, and well-established regulatory frameworks. Leading vaccine developers and government programs to support vaccine production reinforce North America's leading position in the market and establish it as a main driver of the sector's expansion. In addition, Asia Pacific is estimated to grow at a rapid rate in the global Vaccine Contract Manufacturing market.

The area gains from having highly qualified labourers and sophisticated manufacturing resources. Furthermore, it is a desirable location for vaccine contract manufacturing due to its favourable regulatory conditions and lower labour costs. Hence, Asia-Pacific continues to play a significant role in expanding the global vaccine contract manufacturing market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.37 Bn |

| Revenue Forecast In 2035 | USD 4.65 Bn |

| Growth Rate CAGR | CAGR of 7.30% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Vaccine Type, By Type of Expression System, By Workflow, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Lonza, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., Ajinomoto Althea, Inc., Merck KgaA, Cytovance Biologics, Catalent, Inc., IDT Biologika GmbH, Albany Molecular Research, Inc., PRA Health Sciences, ICON plc., Pharmaceutical Product Development, LLC, Cobra Bio, Paragon Bioservices, Inc., Charles River Laboratories, Meridian Life Science (MLS), Eurogentec, GreenPak Biotech, Hong Kong Institute of Biotechnology, WuXi Biologics, Bharat Biotech, Biological E, Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Vaccine Contract Manufacturing Market By Vaccine Type

Vaccine Contract Manufacturing Market By Type of Expression System

Vaccine Contract Manufacturing Market By Workflow

Vaccine Contract Manufacturing Market By Application

Vaccine Contract Manufacturing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.