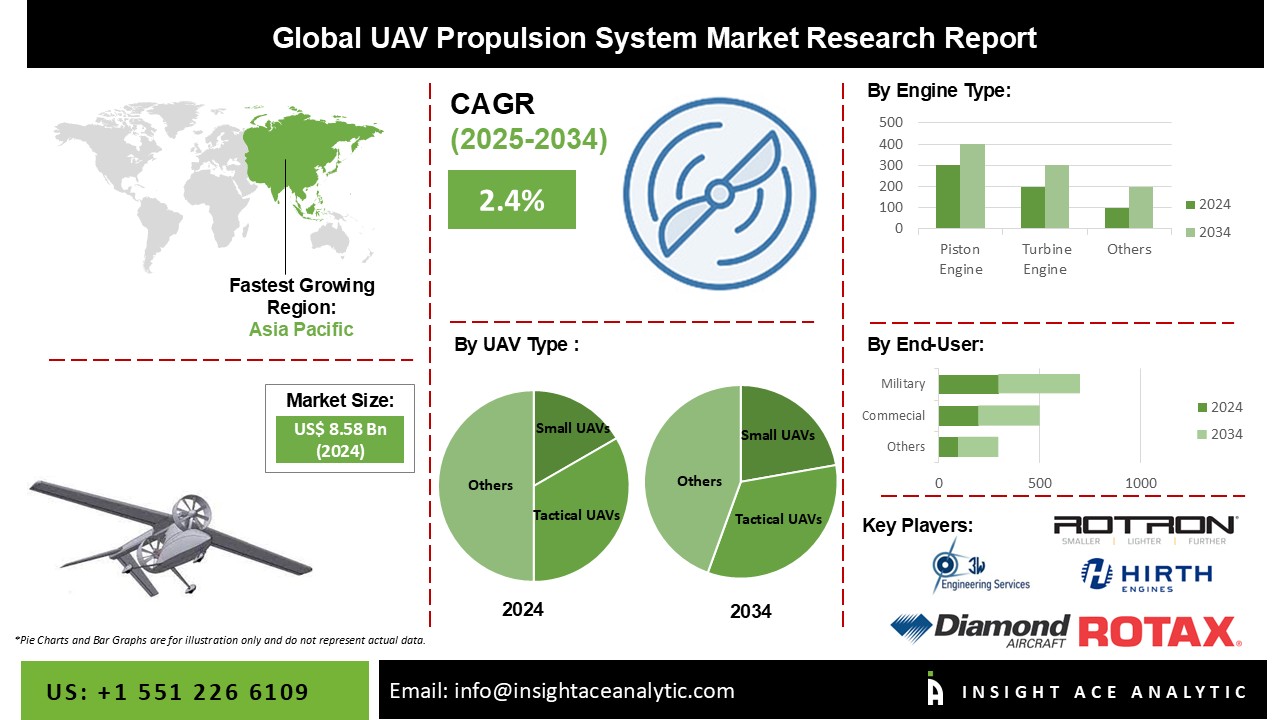

UAV Propulsion System Market Size is valued at 8.58 billion in 2024 and is predicted to reach 10.75 billion by the year 2034 at a 2.4% CAGR during the forecast period for 2025-2034.

Unmanned aerial vehicle propulsion systems are used to supply power to unmanned aerial vehicles. They usually have one or more engines, propellers, and/or rotors. These devices provide the propulsion required by UAVs for lift and flight. The expansion of the global UAV propulsion systems market has also been aided by expanding commercial applications and private enterprises' interest in expanding their UAV services portfolio by using the most innovative and efficient propulsion systems to expand their client base.

Furthermore, research institutes are key end consumers of propulsion systems since government agencies are actively involved in the development, design, and testing of the most recent UAVs and associated propulsion systems.

However, COVID-19 and the Russia-Ukraine war have had a substantial impact on the global supply chain relationship and raw material price system, these factors into account throughout the research of the war on the UAV Propulsion System Industry.

The UAV propulsion system market is segmented on the basis of UAV type, end user, engine horsepower, and engine type. Based on type, the market is segmented as Small UAVs (mini-UAVs and micro-UAVs), Tactical UAVs, Medium-Altitude Long-Endurance (MALE), High-Altitude Long-Endurance (HALE), and Vertical Take-off and Landing (VTOL). The end-user segment includes commercial, military, and civil government. By engine horsepower, the market is segmented into 10-50 HP, 51-100 HP, 101-150 HP, 151-200 HP, and Above 200 HP. The engine type segment includes piston engines, turbine engines, turbofan engines, electrically powered engines, Wankel engines, and solar-powered engines.

The commercial category is expected to hold a major share of the global UAV propulsion system market in 2024. Due to commercial UAV customization being relatively inexpensive, it opens the door to new functionality across a wide range of niche markets. Sophisticated UAVs have begun to do routine activities such as automatic agricultural fertilization, traffic incident monitoring, and surveying difficult-to-reach areas. Drones have been used in various commercial applications over the years, including aerial photography, express shipping and delivery, disaster management, gathering information or supplying essentials, geographical mapping of inaccessible terrain and locations, building safety inspections, unmanned cargo transport, precision crop monitoring, border control surveillance and law enforcement, storm tracking, and forecasting hurricanes and tornadoes.

The electrically powered engine segment is projected to grow at a rapid rate in the global UAV propulsion system market. Electrical propulsion systems offer greater flexibility in machinery installation because they are compact in nature, and because they lack several moving components of the drivetrain, they weigh less and thus contribute to weight savings and endurance enhancement of a specific UAV model. Furthermore, the rise of global green emission programs has aided in the adoption of environmentally friendly propulsion technology such as electric propulsion.

Asia Pacific UAV Propulsion System Market is expected to register the highest market share in terms of revenue in the near future. This rising demand is mostly due to increased orders for various UAV designs for various military and commercial purposes. Drone start-up investments are expected to expand in multiple nations across the region, necessitating the establishment of well-defined regulatory rules. The increased demand is mostly due to a rise in orders for various UAV designs in North America for a variety of military and commercial uses. Drone start-up investments are likely to grow across the region, necessitating the development of well-defined regulatory norms.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 8.58 Bn |

| Revenue forecast in 2034 | USD 10.75 Bn |

| Growth rate CAGR | CAGR of 2.4% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (Unit) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | UAV Type, End User, Engine Horsepower, And Engine Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | 3W International GmbH, BRP-Rotax GmbH & Co KG, Diamond Aircraft Industries (Austro Engine), Gemini Diesel (Superior Aviation Group), HIRTH ENGINES GMBH, Rotron Power Ltd., Suter Industries AG, UAV Engines Ltd., Advanced Innovative Engineering Ltd., Pratt & Whitney Inc. (Part of Raytheon Technologies), Avio Aero (GE Aviation), Rolls-Royce Holdings PLC, PBS India (Part of PBS Aerospace), and UAV Turbines Inc. (Subsidiary of Locust USA Inc.) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

UAV Propulsion System Market By UAV Type-

UAV Propulsion System Market By End User -

UAV Propulsion System Market By Engine Horsepower-

UAV Propulsion System Market By Engine Type-

UAV Propulsion System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.