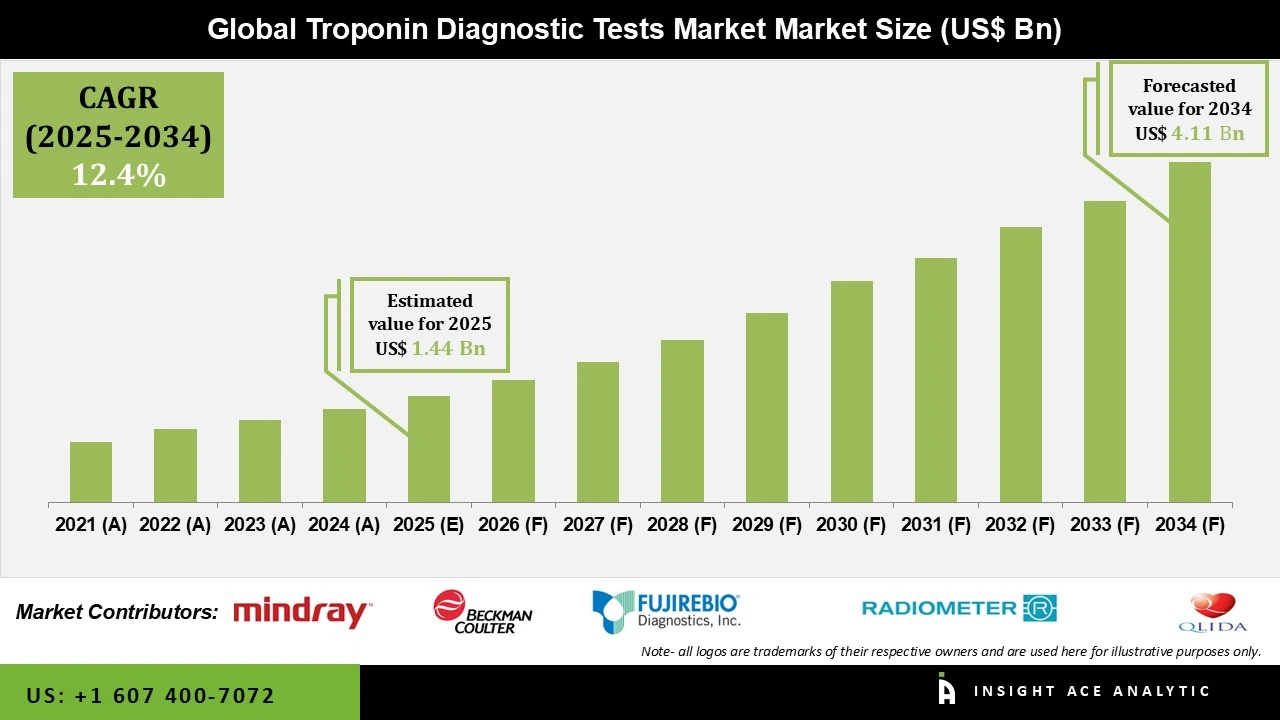

Global Troponin Diagnostic Tests Market Size is valued at US$ 1.44 Bn in 2025 and is predicted to reach US$ 4.11 Bn by the year 2034 at an 12.4% CAGR during the forecast period for 2025 to 2034.

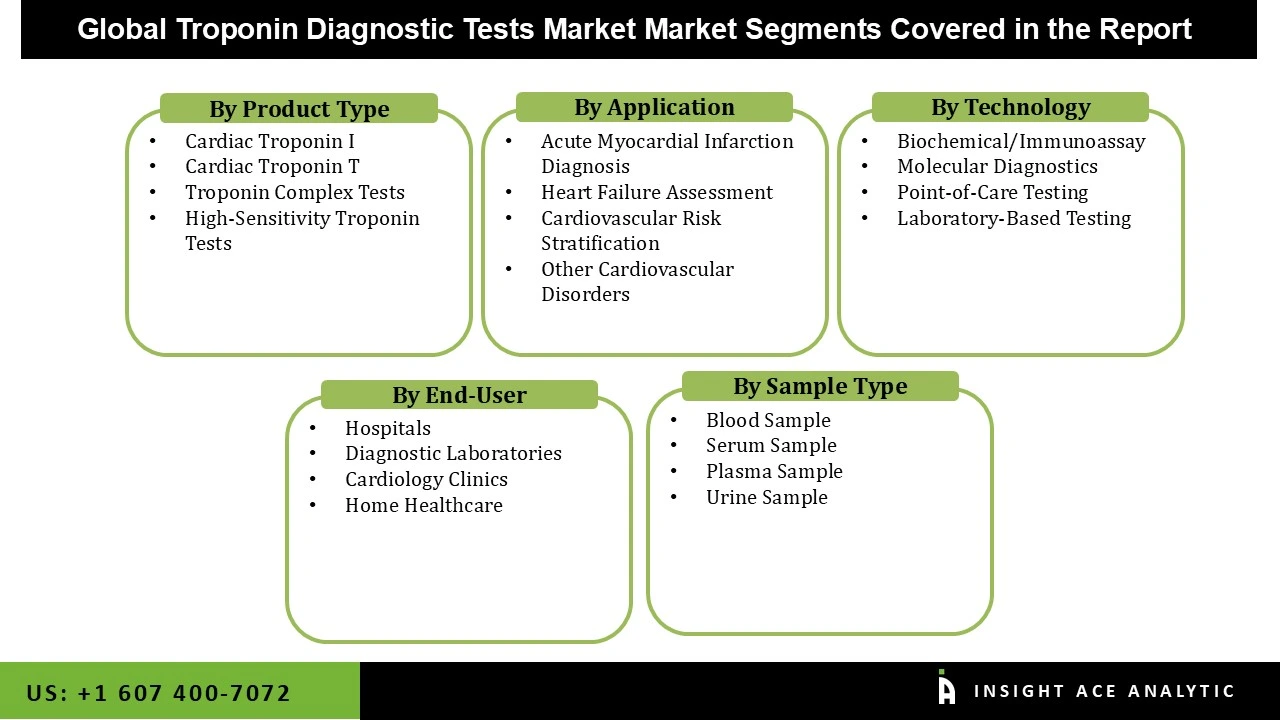

Troponin Diagnostic Tests Market Size, Share & Trends Analysis Distribution, By Product Type (Cardiac Troponin I, Cardiac Troponin T, Troponin Complex Tests, and High-Sensitivity Troponin Tests), By Technology (Biochemical/Immunoassay, Molecular Diagnostics, Point-of-Care Testing, and Laboratory-Based Testing), By Application (Acute Myocardial Infarction Diagnosis, Heart Failure Assessment, Cardiovascular Risk Stratification, and Other Cardiovascular Disorders), By End-User (Hospitals, Diagnostic Laboratories, Cardiology Clinics, and Home Healthcare), By Sample Type - Blood Sample, Serum Sample, Plasma Sample, and Urine Sample), and Segment Forecasts, 2025 to 2034

Troponin tests are used primarily in emergency care to confirm or rule out heart attacks, alongside ECGs, enabling rapid triage and timely treatment. They detect myocardial injury from other causes too, including heart failure, myocarditis, pulmonary embolism, arrhythmias, and kidney disease, guiding further evaluation. High-sensitivity assays support early rule-in/rule-out protocols and improve prognosis assessment for patients with acute coronary syndromes.

Clinicians also monitor perioperative cardiac injury and chemotherapy-related cardiotoxicity using serial troponins to catch subtle damage early. The applications of troponin diagnostic tests extend beyond emergency departments; they are increasingly being utilized across various healthcare settings, including outpatient clinics and primary care. The global troponin diagnostic tests market is expanding due to the need for precise and prompt diagnosis backed by advancements in troponin testing technologies.

The increasing prevalence of cardiovascular diseases is another element propelling the troponin diagnostic tests market. The market is expanding because rising frequency of lifestyle-related disorders, technical breakthroughs in testing procedures, and higher healthcare spending. According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, accounting for approximately 32% of all deaths. However, high expense of sophisticated diagnostic tools, especially in low- and middle-income nations are some of the obstacles impeding the growth of the troponin diagnostic tests sector. Over the course of the forecast period, opportunities for the troponin diagnostic tests market will be created by specific advancements in troponin testing technologies.

Some of the Key Players in Troponin Diagnostic Tests Market:

· Mindray Medical Inteational Ltd

· Nanosphere Inc AXO Science SAS

· Beckman Coulter Inc

· British Heart Foundation

· Fujirebio Diagnostics Inc John Hopkins University

· QLIDA Diagnostics

· Radiometer Medical ApS

· Orangelife

· Ortho-Clinical Diagnostics Inc

· Others

The troponin diagnostic tests market is segmented by product type, technology, application, end-user, and sample type. By product type, the market is segmented into cardiac troponin I, cardiac troponin T, troponin complex tests, and high-sensitivity troponin tests. By technology, the market is segmented into biochemical/immunoassay, molecular diagnostics, point-of-care testing, and laboratory-based testing. By application, the market is segmented acute myocardial infarction diagnosis, heart failure assessment, cardiovascular risk stratification, and other cardiovascular disorders. By end-user, the market is segmented into hospitals, diagnostic laboratories, cardiology clinics, and home healthcare. By sample type, the market is segmented into blood sample, serum sample, plasma sample, and urine sample.

The troponin complex tests segment led the troponin diagnostic tests market in 2024. This convergence is fueled by mobile apps because they enable guideline‑preferred high‑sensitivity 0/1‑hour rule‑in/rule‑out pathways in emergency departments, scaling daily use for chest‑pain triage. By targeting native cTnI–TnC/ternary complexes rather than free subunits, they measure more stable circulating forms, boosting analytical robustness and minimizing degradation‑related misses. This stability supports precise serial testing and a wider diagnostic window, which directly improves early triage decisions and safe discharge rates.

The biochemical/immunoassay segment is the largest and fastest-growing technology in troponin diagnostics, driven by the demand for reliable, accessible, and cost-effective care. Immunoassays lead the market because clinical guidelines consistently recommend high-sensitivity troponin as the primary biomarker for cardiac injury, ensuring standardized and widespread adoption. These assays are integrated into advanced automated laboratory platforms offered by major diagnostic manufacturers, enabling high throughput, excellent analytical accuracy, and consistent workflows. Their compatibility with accelerated diagnostic protocols such as the rapid 0/1-hour rule-in/rule-out algorithm—supports quicker decision-making in busy emergency departments. As a result, immunoassay-based systems handle the bulk of routine troponin testing, reinforcing their dominance and strong growth momentum.

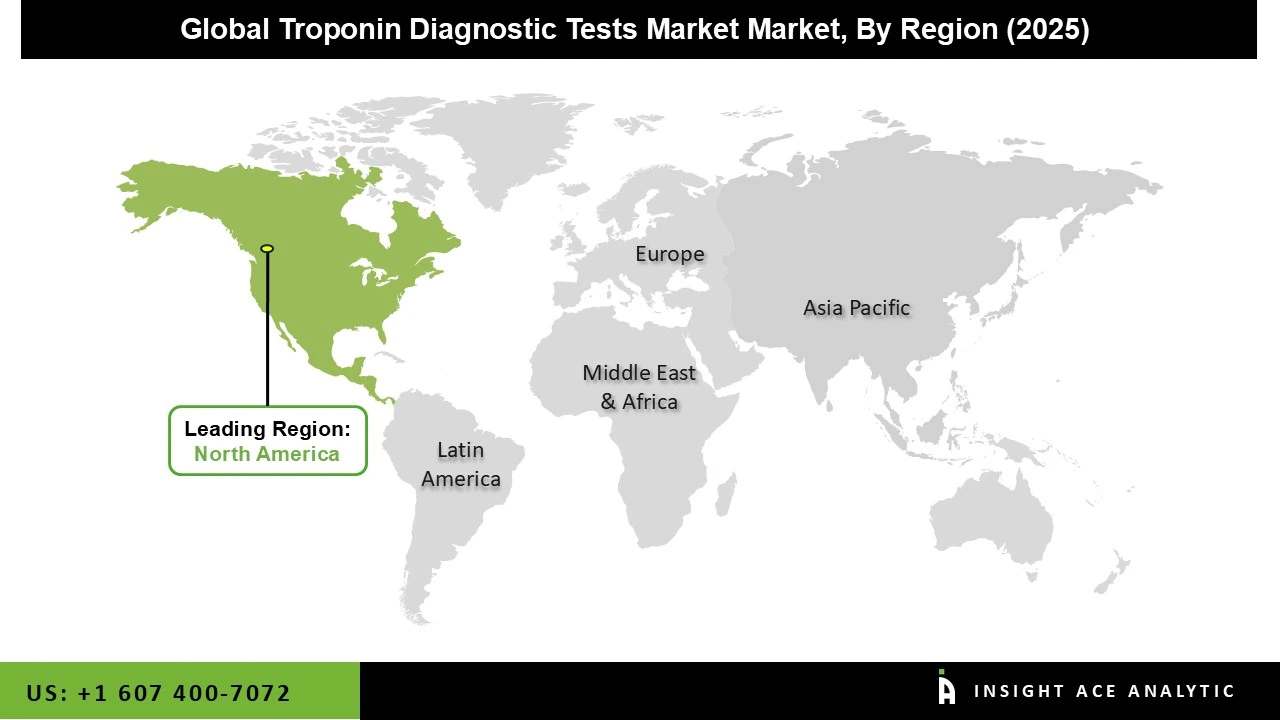

North America leads the troponin diagnostic tests market due to its advanced healthcare infrastructure, high adoption of high-sensitivity cardiac biomarkers, and strong presence of major diagnostic companies. The region experiences a high incidence of cardiovascular diseases, driving consistent demand for rapid and accurate troponin testing in hospitals and emergency departments. Supportive clinical guidelines, widespread availability of automated laboratory platforms, and continuous investments in diagnostic innovation further strengthen market growth. Additionally, well-established reimbursement systems and early integration of high-sensitivity assays across healthcare facilities enable faster clinical decision-making, positioning North America as the dominant regional market for troponin diagnostic tests.

Asia-Pacific region is witnessing the fastest and most robust growth in the Troponin Diagnostic Tests market due to rising healthcare investments,. Government-supported healthcare modernization, rapid urbanization, and expanding digital connectivity are accelerating adoption across hospitals and diagnostic centers. China and India lead the regional landscape, supported by increasing consumer healthcare spending, large patient populations, and significant infrastructure development. Strategic investments in advanced technologies including automation, robotics, and sustainable energy further strengthen their dominance. Collectively, these factors position Asia-Pacific as the most dynamic and high-growth market for troponin diagnostic testing.

Troponin Diagnostic Tests Market by Product Type

· Cardiac Troponin I

· Cardiac Troponin T

· Troponin Complex Tests

· High-Sensitivity Troponin Tests

Troponin Diagnostic Tests Market by Technology

· Biochemical/Immunoassay

· Molecular Diagnostics

· Point-of-Care Testing

· Laboratory-Based Testing

Troponin Diagnostic Tests Market by Application

· Acute Myocardial Infarction Diagnosis

· Heart Failure Assessment

· Cardiovascular Risk Stratification

· Other Cardiovascular Disorders

Troponin Diagnostic Tests Market by End-User

· Hospitals

· Diagnostic Laboratories

· Cardiology Clinics

· Home Healthcare

Troponin Diagnostic Tests Market by Sample Type

· Blood Sample

· Serum Sample

· Plasma Sample

· Urine Sample

Troponin Diagnostic Tests Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.