Specialty Carbon Black Market Size is valued at 3.0 billion in 2024 and is predicted to reach 7.6 billion by the year 2034 at an 10.0% CAGR during the forecast period for 2025-2034.

Amorphous carbon is utilized as a high-coverage pigment in printing inks, paints & coatings, and carbon paper in specialty carbon black, which is highly opaque and finely split. It is primarily utilized in vehicle tires and other rubber products as a reinforcing agent and is formed as soot from the incomplete combustion of hydrocarbons. Major firms are spending on R&D initiatives, corporate partnerships, and the growth of their manufacturing capabilities to enhance their position in the market.

On the other hand, demand for specialty carbon black is projected to increase due to consumer preference for lightweight, fuel-efficient cars. Adding conductivity and antistatic properties to plastics that range from highly conductive to insulating are launched to help the market grow throughout the forecast period.

Additionally, the substance is used as a reinforcement in various rubber products. Volume is increased, vulcanization is strengthened, and the physical qualities of rubber are advanced by carbon black filler rubber. Due to multiple attributes, such as its capacity to absorb UV radiation and convert it into heat and its strong resilience to abrasion and inclement weather, industrial rubber carbon black is in high demand. Due to its potential to deliver increased bank capacity and effective use of time, which aids in enhancing the battery lifecycle, specialty carbon black has had an increase in demand in recent years.

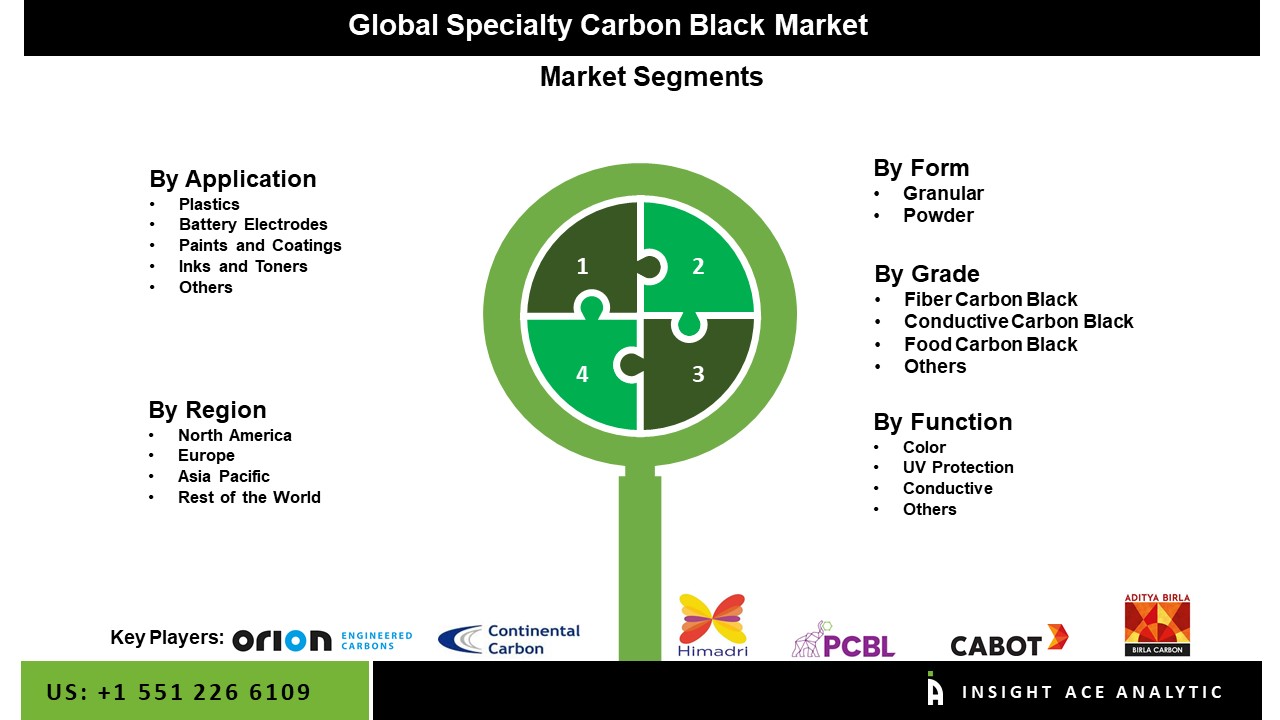

The specialty carbon black market is segmented on application, form, grade and function. Based on application, the market is divided into plastics, battery electrodes, paints and coatings, inks and toners and others. By form, the market is segmented into granules and powder. By grade, the market is segmented into fiber carbon black, conductive carbon black, food carbon black and others. Based on function, the market is segmented as color, UV protection, conductive and others.

The food carbon black category is expected to hold a significant share of the global specialty carbon black market in 2021. The primary force behind expanding the food packaging sector is the rising consumption of convenience foods in developing countries. The other two factors contributing to the expansion of the food packaging sector are aesthetic appeal and practicality. Growing per capita spending power and increased packaged food and beverage consumption due to evolving consumer lifestyles are expected to fuel market expansion over the forecast period.

In response to increasing concerns about the damaging effects of synthetic chemicals on the skin, the plastics category is expected to grow significantly in the worldwide specialty carbon black market.

Due to this, there is a growth in demand for speciality carbon black in the personal care industry, particularly in nations like the US, Germany, the UK, China, and India. This is because of the increasing acceptance of bio-based beauty products and personal hygiene products.

The North America specialty carbon black market is expected to register the highest market share in revenue soon. Potential market opportunities are predicted to result from rising demand for equipment damage to ensure the security of workers across numerous industries. It is also projected that increasing demand for textiles from the automobile sector to produce seatbelts, seat covers, and exterior accessories will promote market expansion in this area. In addition, the Asia Pacific region is projected to rise in the global specialty carbon black market. An increase in demand for specialty carbon black among regional end-use businesses, an increase in massive imports by numerous regional nations, and cheap production costs in the region are some of the primary drivers of the growth of the Asia Pacific specialty carbon black market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 3.0 billion |

| Revenue forecast in 2034 | USD 7.6 billion |

| Growth rate CAGR | CAGR of 10.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Kiloton and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Application, Form, Grade And Function |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Orion Engineered Carbons, Cabot Corporatio, Birla Carbon, PCBL Limited, Himadri Specialty Chemical Ltd., Continental Carbon, Imerys S.A., Mitsubishi Chemical Holdings Corporation, Tokai Carbon Co., Ltd., OMSK Carbon Group, Lion Specialty Chemicals Co., Ltd, Denka Company Limited, Geotech International B.V., Klean Industries Inc., Black Bear Carbon B.V, Beilum Carbon Chemical Limited, Zaozhuang Xinyuan Chemical Industry Co. Ltd, Hangzhou Dimacolor Co., Ltd. And Henan Xinxu Chemical Co., Ltd |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Specialty Carbon Black Market-

Specialty Carbon Black Marke By Application

Specialty Carbon Black Marke By Form

Specialty Carbon Black Marke By Grade

Specialty Carbon Black Marke By Function

Specialty Carbon Black Marke By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.