Global Solid-State Battery Market Size is valued at USD 886.1 Mn in 2024 and is predicted to reach USD 24343.2 Mn by the year 2034 at a 40.4% CAGR during the forecast period for 2025-2034.

The solid-state battery is shorthand for a certain rechargeable battery category that uses solid electrolytes and solid electrodes instead of the polymer gel or liquid electrolytes used in lithium-ion or lithium polymer batteries.

Solid-state batteries are being propelled by rising demand for high-energy-density batteries in consumer electronics, transportation, and renewable energy sectors. Because of their greater energy storage capacity compared to standard lithium-ion batteries, silicon anode batteries are well suited for uses that necessitate continuous power. Demand for silicon-anode batteries is rising due to the trend toward greener forms of energy and the rise of electric vehicles.

The global trend of governments enacting rules and laws to curb carbon emissions and encourage the use of sustainable energy sources bodes well for developing the solid-state battery market. Furthermore, incorporating flexible and lightweight batteries into wearable devices, as well as the longer shelf life of solid-state batteries compared to conventional batteries, are all factors expected to drive the market value higher in the coming years.

However, the market growth is hampered by the strict regulatory and high-cost criteria for the safety and health of solid-state batteries and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity solid-state batteries because of the high-quality components it requires. The current production cost of solid-state batteries is higher than that of lithium-ion batteries. Widespread implementation is hindered by the price gap, which is especially problematic in price-sensitive industries like the consumer electronics and automotive sectors. In the wake of the COVID-19 epidemic and subsequent lockdown, there was a decline in consumer demand for solid-state rechargeable batteries. This impacted Many businesses, including those who make and recycle batteries.

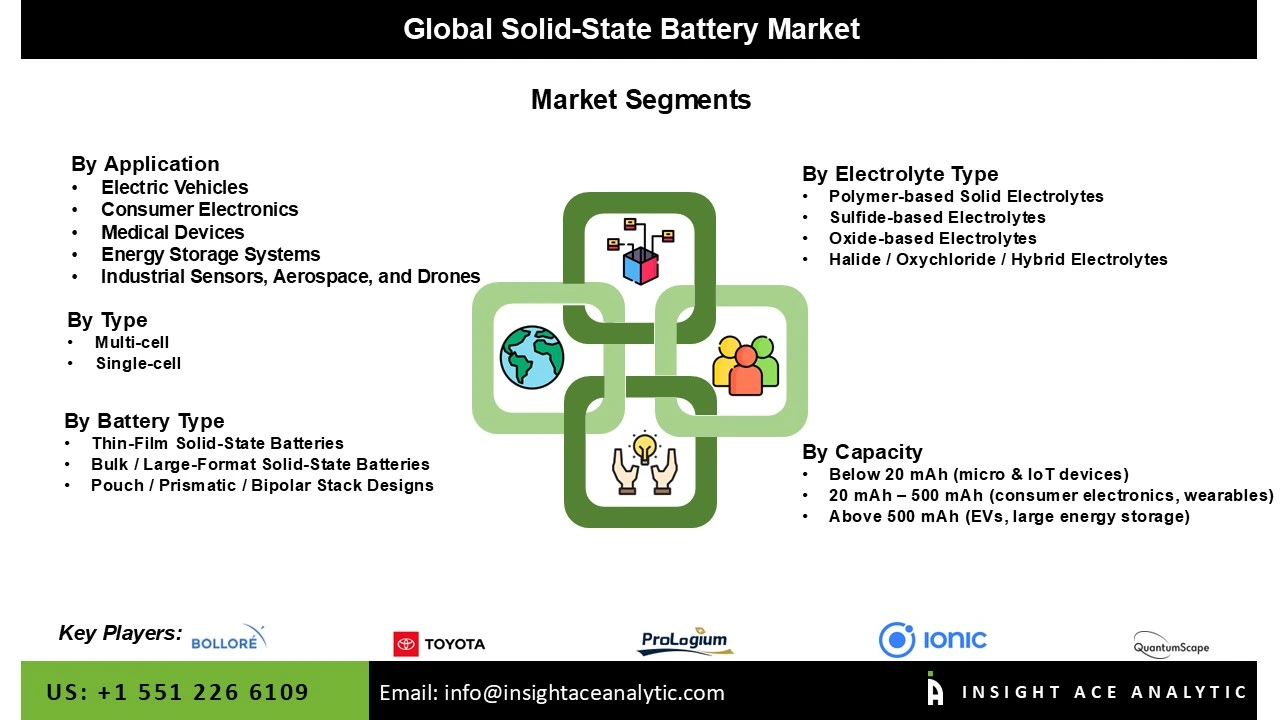

The solid-state battery market is segmented based on application, electrolyte type, battery type, and capacity. According to the application, the market is categorised into electric vehicles, consumer electronics, medical devices, energy storage systems, and others. By electrolyte type, the market is segmented into polymer, sulfide, oxide, and others. By battery type, the market is segmented into thin film, bulk, and others. By capacity, the market is segmented into below 20mAh, 20mAh to 500mAh, and above 500mAh.

The consumer electronics solid-state battery is expected to lead with a major global market share in 2022. consumer electronics accounted for the bulk of the solid-state battery industry. Rapid urbanization and rising incomes in emerging countries may be to blame for this trend. These countries also spend more on consumer goods like laptops, smartphones, and desktops.

The thin film makes up the bulk of solid-state battery usage because smart gadgets constantly demand new features, like increased security, greater specific energy and power capacities, smaller form factors, and better materials. These thin-film batteries can be used in various electronic devices, wireless sensors, smart cards, medical equipment, memory backup power systems, and solar cell energy storage solutions, especially in countries like the US, Germany, the U.K., China, and India.

The North American solid-state battery market is expected to record the maximum market share in revenue in the near future. It can be attributed to the fact that its people tend to be well-off and educated. Increasing solid-state battery use in the region meets the rising need for batteries across various industries, including smart cards, packaging, and electric vehicles. In addition, Asia Pacific is estimated to grow rapidly in the global solid-state battery market due to advancements in the renewable energy sector, an ever-increasing need for battery energy storage devices, and a massive consumer user base for consumer and portable electronics.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 886.1 Mn |

| Revenue Forecast In 2034 | USD 24343.2 Mn |

| Growth Rate CAGR | CAGR of 40.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Application, Battery Type, Electrolyte Type and Capacity |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | QuantumScape Corporation, Solid Power, Inc., ProLogium Technology Co., Ltd., Blue Solutions (Bolloré Group), Ilika plc, Factorial Energy, TDK Corporation, Samsung SDI Co., Ltd., LG Energy Solution Ltd., Nissan Motor Co., Ltd., Toyota Motor Corporation, Ganfeng Lithium Co., Ltd., Natrion Inc., Ampcera Inc., Ion Storage Systems, Inc., LionVolt B.V., Prieto Battery, Inc., BYD Co., Ltd., CATL (Contemporary Amperex Technology Co., Limited), Panasonic Holdings Corporation, Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Solid-State Battery Market By Application-

Solid-State Battery Market By Electrolyte Type-

Solid-State Battery Market By Battery Type-

Solid-State Battery Market By Capacity-

Solid-State Battery Market By Type-

Solid-State Battery Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.