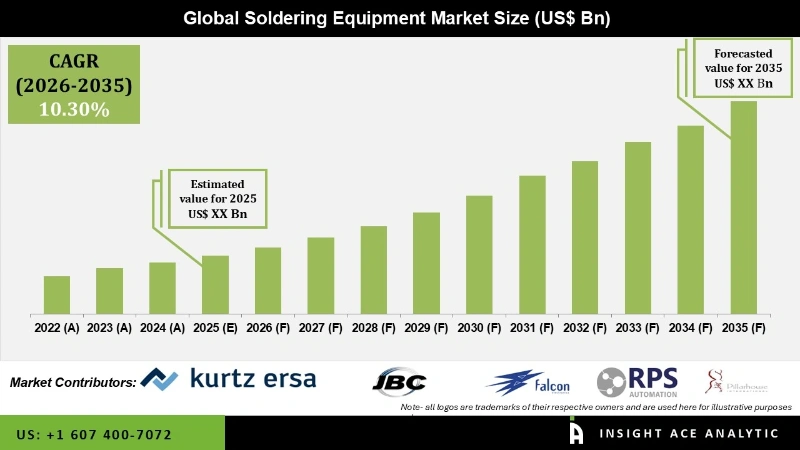

Soldering Equipment Market Size is predicted to witness a booming CAGR of 10.30% during the forecast period for 2026-2035.

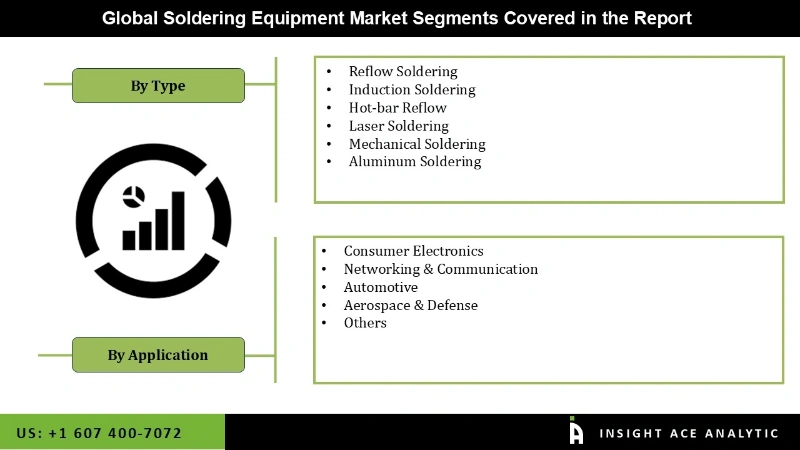

Soldering Equipment Market Size, Share & Trends Analysis Report by Product Type (Reflow Soldering, Induction Soldering, Hot-Bar Reflow, Laser Soldering, Aluminium Soldering), Application Type (Consumer Electronics, Networking & Communication, Automotive, Aerospace & Defence, Others), Region And Segment Forecasts, 2026 to 2035.

The solder is heated and made to flow onto the component using a soldering pot or bath. Additionally, it features a sponge or pad for cleaning the soldered-on component. It is typically smaller than a soldering iron and is secured with clamps or a stand on a workstation. When something is soldered, two or more metal components are joined together using a filler metal called solder.

Soldering equipment is a collection of tools and gadgets used in this operation. When metal bonding is necessary, soldering is a widely utilised method in many different industries, including jewellery manufacture, plumbing, and electronics. Soldering tools typically consist of a soldering iron or soldering gun, a soldering station, solder wire or solder paste, flux, a desoldering pump or solder sucker, a soldering stand, and other accessories. With the help of these devices, heat can be applied in a regulated manner to the metal parts in order to soften the solder and form a solid, dependable bond.

Numerous chances exist for businesses to profit from the rising demand for circuit board assembly and repair in the soldering equipment market. The demand for dependable and effective soldering equipment is being fueled by the adoption of cutting-edge technology in sectors including telecommunications, consumer electronics, automotive, and aerospace. The march towards smaller electronics necessitates accurate soldering procedures, which has led to the creation of specialised tools like fine-tip soldering irons and rework stations.

The market's revenue development is mainly driven by increased investments in production facilities and initiatives taken by governments of developing countries to promote foreign investment. Demand is additionally anticipated to be fueled in the near future by the robust rise in the automotive and electronics sectors. Manufacturers and suppliers now have attractive opportunities due to the growth of e-commerce. To reach a global audience, manufacturers and distributors are concentrating on selling their products through various e-commerce websites.

The Global Soldering Equipment market is segmented on the basis of type and application. Based on type, the market is segmented as Reflow Soldering, Soldering iron, Soldering pot, and Others. Application segment includes Consumer Electronics, Semiconductor, Repairing, Construction, and Others.

The reflow soldering category is expected to hold a major share of the global Global Soldering Equipment market. Due to its benefits, including accurate temperature control, excellent solder joint reliability, and compatibility with surface mount technology (SMT), reflow soldering is a process widely used across various sectors. The reflow soldering market is expanding as a result of the rising demand for tiny and miniaturised electronic products, particularly in the consumer electronics and telecommunications sectors.

The consumer electronics sector has the fastest growth in the market for soldering supplies. Increased demand for consumer electronic devices such as smartphones, tablets, laptops, gaming consoles, and wearable technology is driving the expansion of this market. Soldering equipment is necessary for the installation, upkeep, and repair of consumer electronics components.

The quick development of technology, the miniaturisation of electronic equipment, and the requirement for sturdy and excellent solder connections all add to the consumer electronics sector's supremacy. The demand for soldering tools in the consumer electronics industry is further fueled by the rising trend of smart homes, Internet of Things (IoT) gadgets, and the expanding market for electronic accessories.

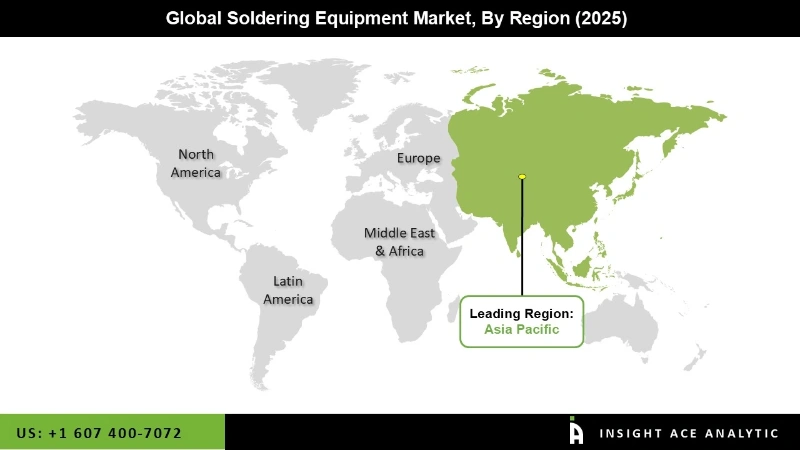

According to projections, Asia Pacific will lead the market for soldering equipment. The major causes of this increase are the area's brisk economic development, rising industrialisation, and expanding electronics manufacturing industry. In the Asia Pacific region, there are a number of developing nations with rapidly growing economies, including Taiwan, South Korea, China, India, and China.

There is a growing need for soldering equipment in the consumer electronics, automotive, and telecommunications sectors in this region. The demand for soldering equipment in the Asia Pacific region is also being boosted by benevolent government policies, rising disposable incomes, and international corporations' growth of manufacturing facilities.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 10.30% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Pillarhouse International, Hentec Industries, Flason Electronic Co. Ltd., Seho Systems Gmbh, Nordson Corporation., Blundell Production Equipment Ltd, Harris Products Group, and Radyne Corporation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Soldering Equipment Market By Type-

Global Soldering Equipment Market By Application-

Global Soldering Equipment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.