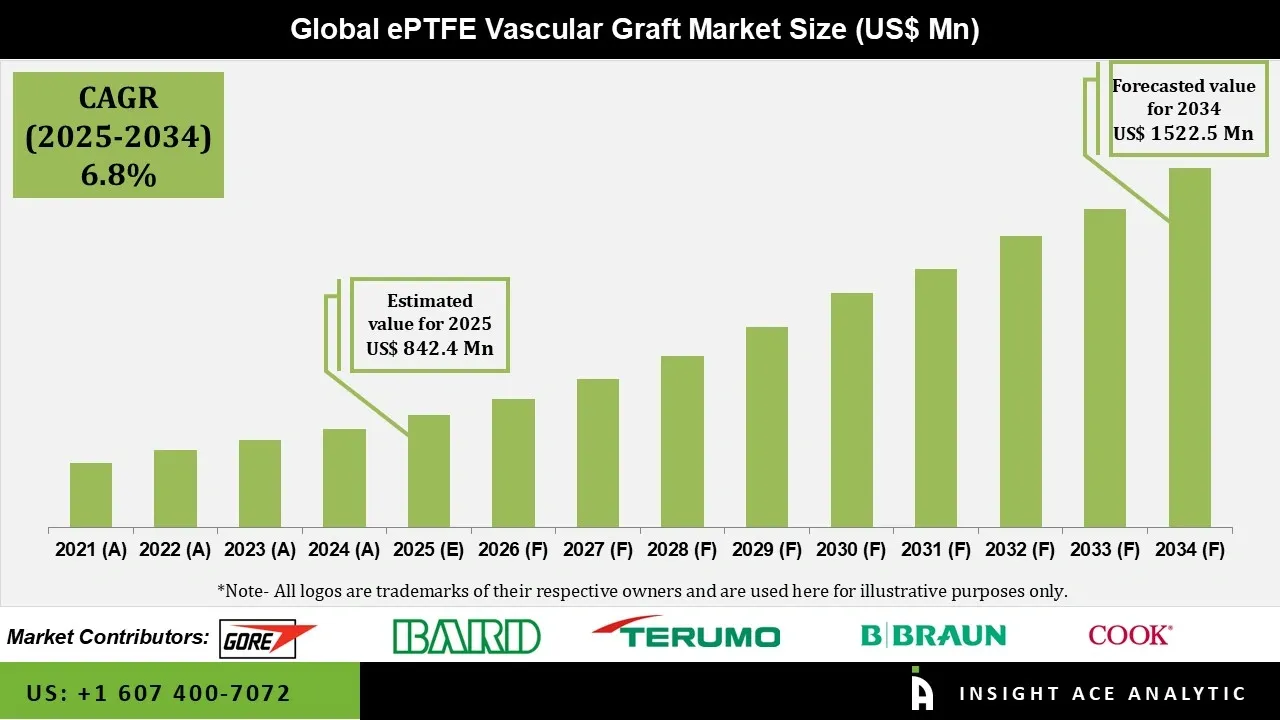

ePTFE Vascular Graft Market Size is valued at USD 842.4 Mn in 2025 and is predicted to reach USD 1,522.5 Mn by the year 2034 at a 6.8% CAGR during the forecast period for 2025 to 2034.

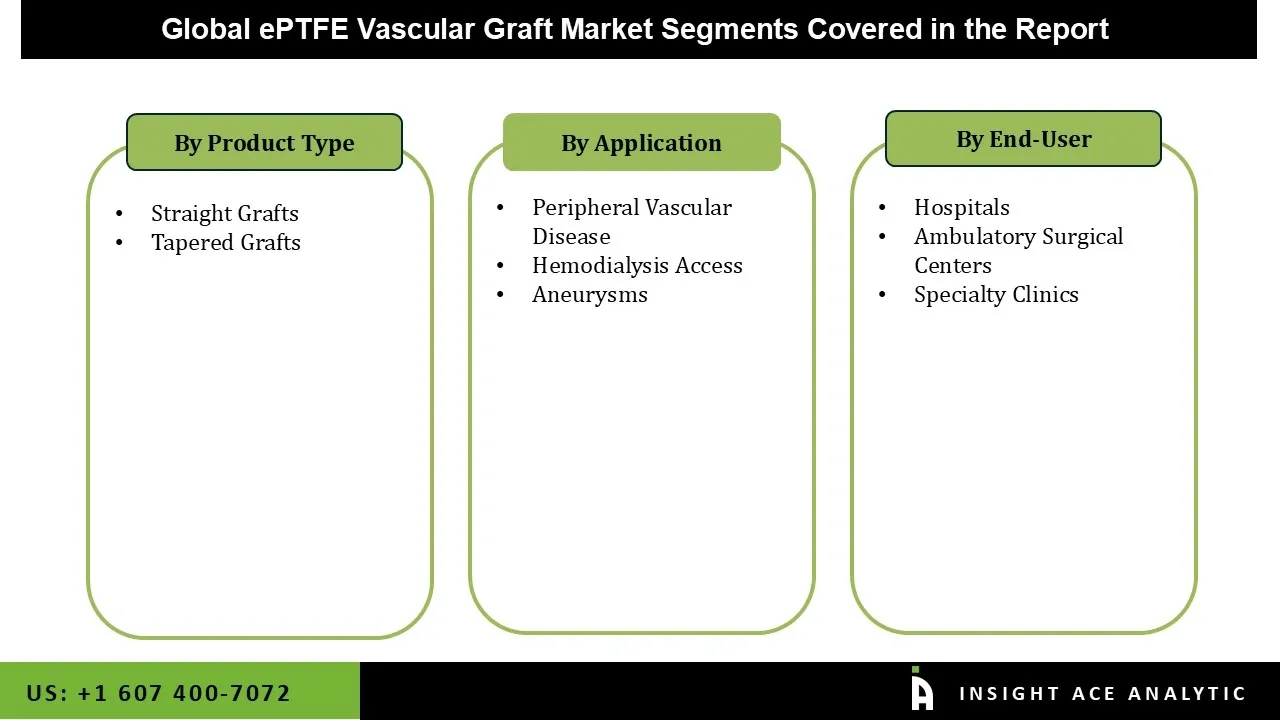

ePTFE Vascular Graft Market Size, Share & Trends Analysis Distribution by Type (Straight Grafts and Tapered Grafts), Application (Hemodialysis Access, Peripheral Vascular Disease, and Aneurysms), End-user (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics), and Segment Forecasts, 2025 to 2034

A synthetic blood artery substitute called an ePTFE (expanded polytetrafluoroethylene) vascular graft is used in vascular surgery to replace or repair damaged or clogged arteries and veins. It is composed of PTFE that has been specifically extended to provide a microporous structure, which enables it to assist tissue ingrowth while being robust, flexible, and biocompatible. These grafts are frequently utilized in treatments including cardiovascular reconstructions, hemodialysis access for patients with kidney failure, and peripheral artery bypass. Due to the increased prevalence of cardiovascular illnesses and the growing need for minimally invasive surgical treatments, the global ePTFE vascular graft market is anticipated to expand at a notable rate.

The rising incidence of vascular conditions such as peripheral artery disease and aortic disease, as well as the growing need for cutting-edge hemodialysis treatments, are further factors contributing to the ePTFE vascular graft market's strong trajectory. These intricate medical operations are made possible by the technological developments in ePTFE materials, which offer higher biocompatibility and mechanical qualities. Additionally, the aging global population, which is increasingly prone to cardiovascular problems, and the rising number of minimally invasive surgeries both significantly contribute to the ePTFE vascular graft market's optimistic outlook.

Furthermore, the ePTFE vascular graft market expansion is being impacted by the growing use of minimally invasive surgical methods. Although ePTFE grafts are mainly utilized in open surgical procedures, novel graft designs that are compatible with minimally invasive techniques may be developed as a result, significantly extending their application.

However, there are certain obstacles to the ePTFE vascular graft market expansion despite the optimistic forecast. These include the high expense of the operations, the possibility of ePTFE graft-related problems (such as thrombosis or infection), and the development of substitute graft materials such as bioabsorbable vascular grafts. On the other hand, over the course of the projection period, continued research and development initiatives aimed at enhancing graft biocompatibility and lowering long-term problems are anticipated to lessen these difficulties and support the ePTFE vascular graft market growth.

• Medtronic plc

• Cook Medical

• W. L. Gore & Associates, Inc.

• Terumo Corporation

• B. Braun Melsungen AG

• CryoLife, Inc.

• LeMaitre Vascular, Inc.

• Maquet Holding B.V. & Co. KG

• Bard Peripheral Vascular, Inc.

• Getinge AB

• JOTEC GmbH

The ePTFE vascular graft market is predicted to rise in the future due to the aging population. Vascular disorders are more common in the elderly population, and by mending the injured aorta and reestablishing blood flow, vascular grafts are crucial in treating vascular disorders, including aortic dissection. When the inner layer of the aorta splits, enabling blood to pass between the layers of the aortic wall, a dangerous condition known as aortic dissection develops. For instance, according to research released in October 2022 by the World Health Organization (WHO), a Swiss organization in charge of global public health, one in six people worldwide is predicted to be 60 or older by 2030. Thus, the ePTFE vascular graft market is expanding due to the growing aging population.

The market growth is anticipated to be severely hampered by the higher cost of ePTFE vascular grafts as compared to other treatment options. Premium pricing structures are expected to be maintained by the complex manufacturing processes and strict quality control requirements. Patient access is also anticipated to be hampered by limited reimbursement coverage in a number of healthcare systems. It is anticipated that the high procedural costs of graft implantation surgeries may discourage adoption in healthcare facilities with little funding. Furthermore, the market expansion in underdeveloped economies is anticipated to be significantly limited by financial obstacles.

The ePTFE Vascular Graft market is segmented across three primary dimensions: product type, clinical application, and end-user setting. By type, grafts are categorized into straight grafts and tapered grafts, designed to accommodate different anatomical and surgical requirements. Segmentation by application reflects the major clinical uses, including hemodialysis access, peripheral vascular disease bypass, and aneurysms repair. The market is further defined by end-user, with the primary providers being hospitals, ambulatory surgical centers, and specialized vascular or specialty clinics, indicating the distribution of these surgical procedures across various healthcare environments.

The straight grafts category held the largest share in the ePTFE Vascular Graft market in 2024, driven by the growing prevalence of cardiovascular conditions that call for dependable vascular bypass treatments, such as peripheral artery disease and aortic aneurysms. Straight ePTFE grafts are favored for long-term implantation because of their reliable lumen diameter, superior biocompatibility, and resistance to infection and thrombosis. The need for straight grafts is being further increased by the growing number of hemodialysis access procedures, particularly in patients with end-stage renal illness.

In 2024, the hospitals category dominated the ePTFE Vascular Graft market. Most vascular treatments, such as peripheral artery interventions, bypass surgeries, and aneurysm repairs, are carried out in hospitals. Higher procedural volumes are a result of the rising incidence of cardiovascular illnesses, which maintains the need for vascular grafts in hospital settings. Additionally, the hospitals have the imaging facilities, operating rooms, and catheterization labs required for complicated vascular treatments. The adoption of sophisticated grafts is made easier by this infrastructure, which permits the use of both endovascular and open graft methods.

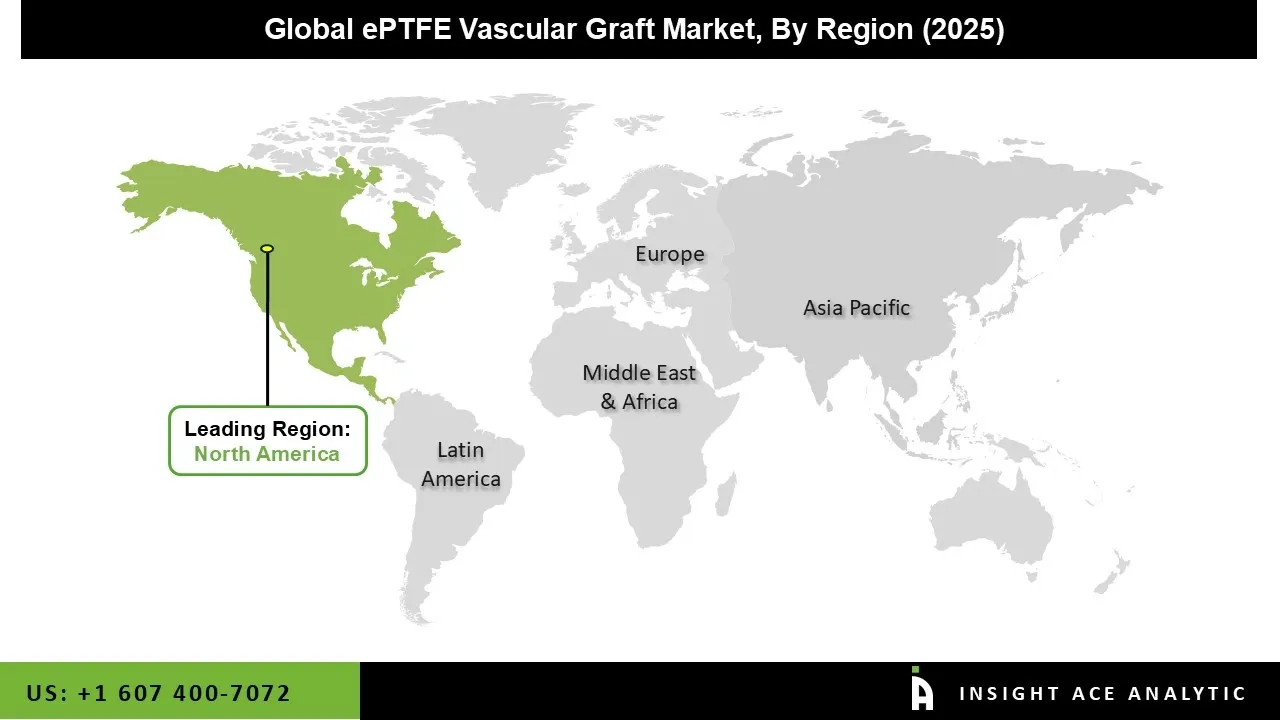

The ePTFE Vascular Grafts market was dominated by the North America region in 2024, driven by the growing incidence of chronic renal disease, peripheral artery disease (PAD), and cardiovascular disorders that necessitate hemodialysis access. The need for long-lasting and biocompatible vascular grafts is being greatly increased by an aging population and rising incidence of diabetes and hypertension.

Further factors driving the ePTFE vascular graft market expansion include the robust presence of top medical device makers, high healthcare spending, advantageous reimbursement rules in the United States, and the rising number of minimally invasive vascular and endovascular treatments. The market for ePTFE vascular grafts in North America continues to grow steadily due to increased awareness of early diagnosis and prompt surgical intervention, as well as continuous research and development in bioengineered graft materials.

March 2025: Terumo Corporation announced a strategic partnership with Jiangsu Huadong Medical Appliance Co., Ltd. to jointly develop and market next-generation ePTFE vascular grafts for the Asia-Pacific market, utilizing Terumo's worldwide distribution network and Huadong's production capabilities.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 842.4 Mn |

| Revenue forecast in 2034 | USD 1,522.5 Mn |

| Growth Rate CAGR | CAGR of 6.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Medtronic plc, Cook Medical, W. L. Gore & Associates, Inc., Terumo Corporation, B. Braun Melsungen AG, CryoLife, Inc., LeMaitre Vascular, Inc., Maquet Holding B.V. & Co. KG, Bard Peripheral Vascular, Inc., Getinge AB, and JOTEC GmbH. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

ePTFE Vascular Graft Market by Type-

• Straight Grafts

• Tapered Grafts

ePTFE Vascular Graft Market by Application-

• Hemodialysis Access

• Peripheral Vascular Disease

• Aneurysms

ePTFE Vascular Graft Market by End-user-

• Hospitals

• Ambulatory Surgical Centers

• Specialty Clinics

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.