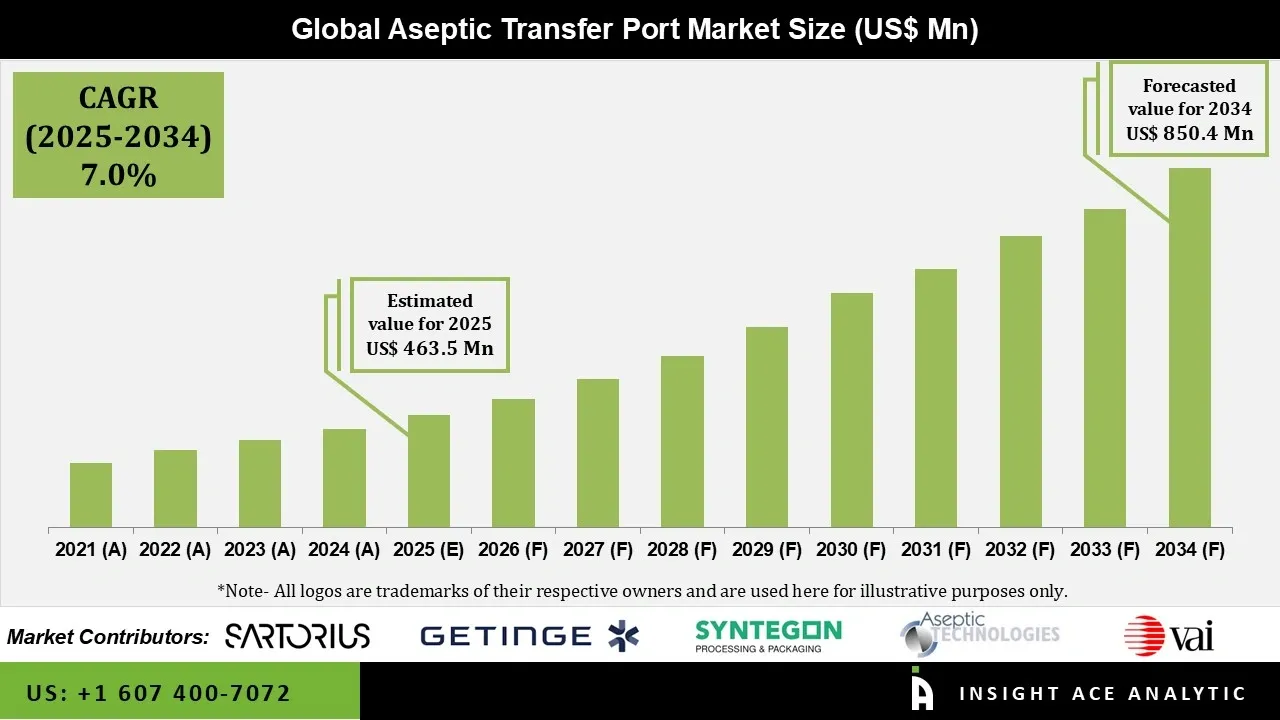

Aseptic Transfer Port Market Size is valued at USD 463.5 Mn in 2025 and is predicted to reach USD 850.4 Mn by the year 2034 at a 7.0% CAGR during the forecast period for 2025 to 2034.

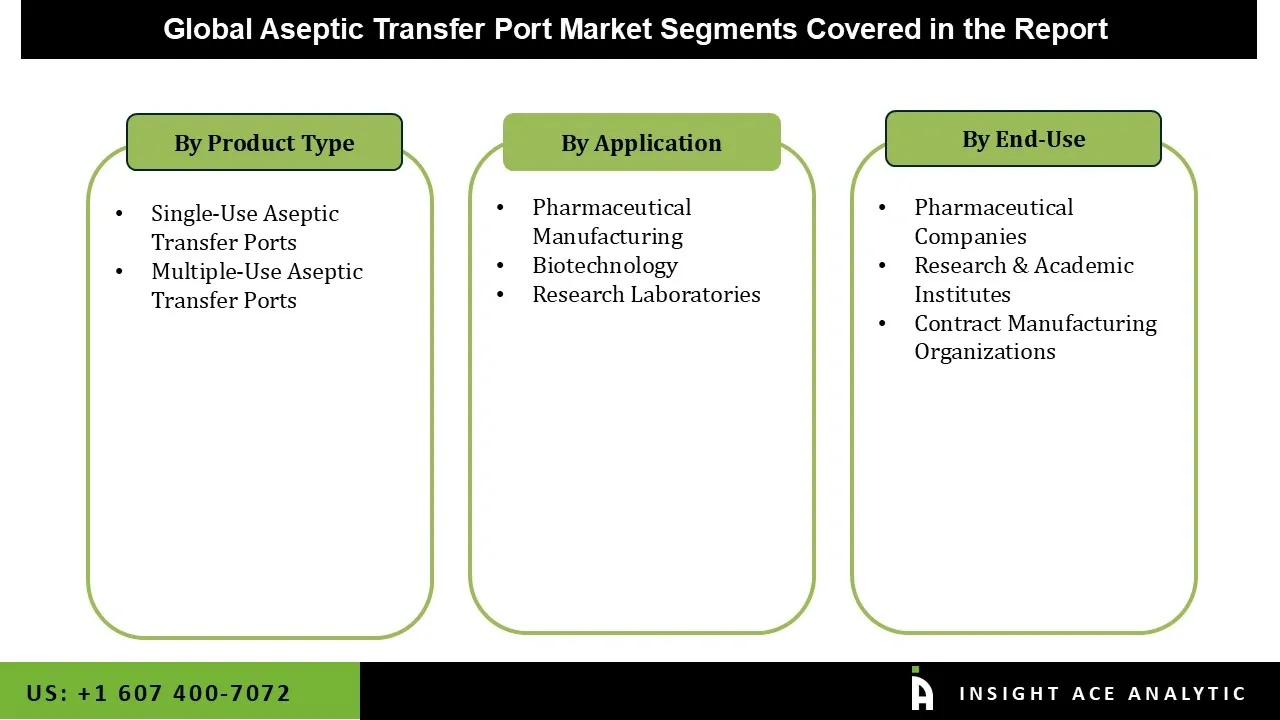

Aseptic Transfer Port Market Size, Share & Trends Analysis Distribution by Type (Single-Use Aseptic Transfer Ports and Multiple-Use Aseptic Transfer Ports), Application (Biotechnology, Pharmaceutical Manufacturing, and Research Laboratories), End-user (Pharmaceutical Companies, Contract Manufacturing Organizations, and Research & Academic Institutes), and Segment Forecasts, 2025 to 2034

Aseptic transfer ports are specialised sterile connection devices that are mostly used in cleanrooms, biotechnology, and pharmaceutical settings to safely move liquids, powders, or small components between two sealed systems without exposing the contents to outside contamination. Establishing a temporary, safe route between containers, such as bags, bottles, isolators, or bioreactors, enables closed, sterile transfer.

The aseptic transfer ports greatly reduce the risk of microbiological contamination, cross-contamination, and product loss by eliminating open handling and human contact. The pharmaceutical and biotechnology industries' growing adoption of sophisticated aseptic processing technologies and the increasing demand for sterile pharmaceutical products are driving strong expansion in the aseptic transfer port market.

In addition, rapid transfer ports (RTPs) are gaining popularity for their ability to move materials quickly and effectively while preserving sterility, significantly boosting the aseptic transfer port market. Additionally, as more advanced RTP systems are incorporated into production processes to increase productivity and decrease human interaction, automation is gaining traction. The advanced data logging and monitoring features within aseptic transfer ports are being pushed by the emphasis on data integrity and digitalization. Flexible and adaptive transfer solutions are becoming increasingly necessary due to the increased demand for improved therapies and personalized medicine. Moreover, the ongoing focus on reducing environmental impacts is driving the development of environmentally friendly materials and production techniques for aseptic transfer ports.

The biopharmaceutical industry's ongoing growth, rising investments in medication research and development, and a global drive for better healthcare infrastructure will drive the aseptic transfer port market growth. However, there are obstacles to overcome, such as the high upfront costs of implementing new aseptic technologies and certain regulatory barriers. Despite these obstacles, the aseptic transfer port market is likely to grow over the long term due to ongoing technological advancements and rising demand for sterile pharmaceutical products.

Additionally, the market's course is being shaped by several trends. Due to its inherent advantages, which include lower cleaning and sterilising costs, the removal of cross-contamination hazards, and increased process efficiency, single-use systems are becoming more and more popular over reusable ones, which is greatly accelerating the aseptic transfer port market growth.

• Sartorius Stedim Biotech

• Aseptic Technologies

• Getinge AB

• Syntegon Technology GmbH

• Veltek Associates Inc.

• Germfree Laboratories

• Flexifill Ltd.

• Extract Technology Ltd.

The increasing need for automated products in aseptic transfer processes is driving the expansion of the aseptic transfer port market. By reducing human intervention, automation improves the dependability and efficiency of aseptic operations while reducing the risk of contamination and human error. Additionally, automated procedures provide higher production, scalability, and consistency, all of which are critical for managing substantial quantities of delicate pharmaceutical items. Furthermore, the use of automated aseptic transfer products reduces total costs and downtime associated with manual processes while increasing operational efficiency. Moreover, the substantial increase in investment in the pharmaceutical industry is driving demand for aseptic transfer ports. The rising need for stringent quality standards and pharmaceutical products that comply with regulations is driving these expanding investments in automation.

The procedures involved in aseptic transfer ports are intricate and require a significant initial investment. The equipment and technology required for aseptic transfer ports are expensive and subject to significant depreciation risk. With a minimum ten-year shelf life, setting up the aseptic transfer port is a one-time procedure. However, many pharmaceutical businesses are unable to set up an internal aseptic transfer port due to the high cost of the equipment and systems. Additionally, they require ongoing maintenance after installation. Furthermore, the single-use bags are used for aseptic transfer ports. The expansion of the aseptic transfer ports market is thus hindered by the high cost of aseptic processing equipment, which limits many purchasers and compels them to use the traditional terminal sterilization approach.

Aseptic transfer port market is segmented based on type, application, end-user. Type segment includes single-use and multiple-use aseptic transfer ports. Application segment includes biotechnology, pharmaceutical manufacturing, and research laboratories. End-user segment includes pharmaceutical companies, contract manufacturing organizations, and research & academic institutes.

The Single-Use Aseptic Transfer Ports category held the largest share in the Aseptic Transfer Port market in 2024 because it preserves the sterility of components and reduces the possibility of contamination, doing away with the necessity of the thorough cleaning and sterilizing processes connected with multi-use systems. Additionally, the company's increased adaptability and ability to meet changing client demands are credited with the growth of the single-use segment. As a result, businesses are investing in the single-use segment, which is driving growth in the aseptic transfer port market.

In 2024, the Pharmaceutical Companies category dominated the Aseptic Transfer Port market. The production and processing of medications and other pharmaceutical products are subject to strict regulations in the highly regulated pharmaceutical sector. Therefore, it is crucial to maintain sterility and an aseptic environment to ensure the production of high-quality, potent medications. As a result, pharmaceutical companies that provide aseptic transfer ports are essential to medication producers.

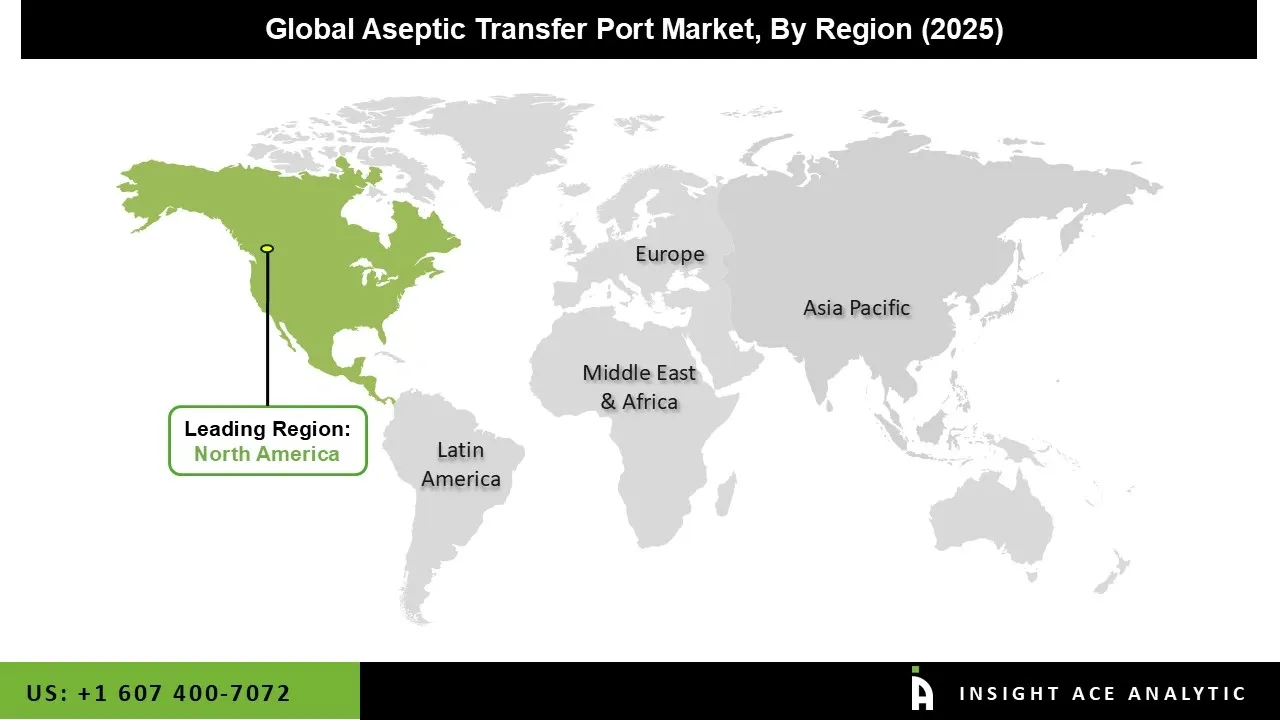

The Aseptic Transfer Ports market was dominated by the North America region in 2024. The pharmaceutical industry's high level of technical advancement is a primary driver of market expansion in North America. Another important aspect driving the aseptic transfer port market's expansion is the numerous significant developments in the United States.

Numerous well-known pharmaceutical firms in the United States are involved in R&D and the production of novel medications. Further propelling the market throughout the forecast period are major market players' mergers, acquisitions, and expansions to bolster their market positions and introduce improved products in North America.

• In March 2024, GeminiBio introduced its Aseptic Assurance System, which supported closed-system manufacturing for advanced cell therapies. The system helped reduce contamination risks and minimized human errors two major challenges in aseptic processing.It enabled enclosed and streamlined workflows, helping manufacturers maintain sterility during material transfers and cell-handling steps.

• In June 2022, Getinge AB introduced the sleeveless DPTE-BetaBag along with the DPTE-EXO, an automated aseptic transfer solution. The sleeveless DPTE-BetaBag worked with the company’s DPTE Alpha Port to ensure safe and sterile transfer of materials into isolators and cleanrooms. By removing the traditional bag sleeve, it simplified handling and reduced waste while maintaining sterility.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 463.5 Mn |

| Revenue forecast in 2034 | USD 850.4 Mn |

| Growth Rate CAGR | CAGR of 7.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Sartorius Stedim Biotech, Aseptic Technologies, Getinge AB, Syntegon Technology GmbH, Veltek Associates Inc., Germfree Laboratories, Flexifill Ltd., and Extract Technology Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Aseptic Transfer Port Market by Type-

• Single-Use Aseptic Transfer Ports

• Multiple-Use Aseptic Transfer Ports

Aseptic Transfer Port Market by Application-

• Biotechnology

• Pharmaceutical Manufacturing

• Research Laboratories

Aseptic Transfer Port Market by End-user-

• Pharmaceutical Companies

• Contract Manufacturing Organizations

• Research & Academic Institutes

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.