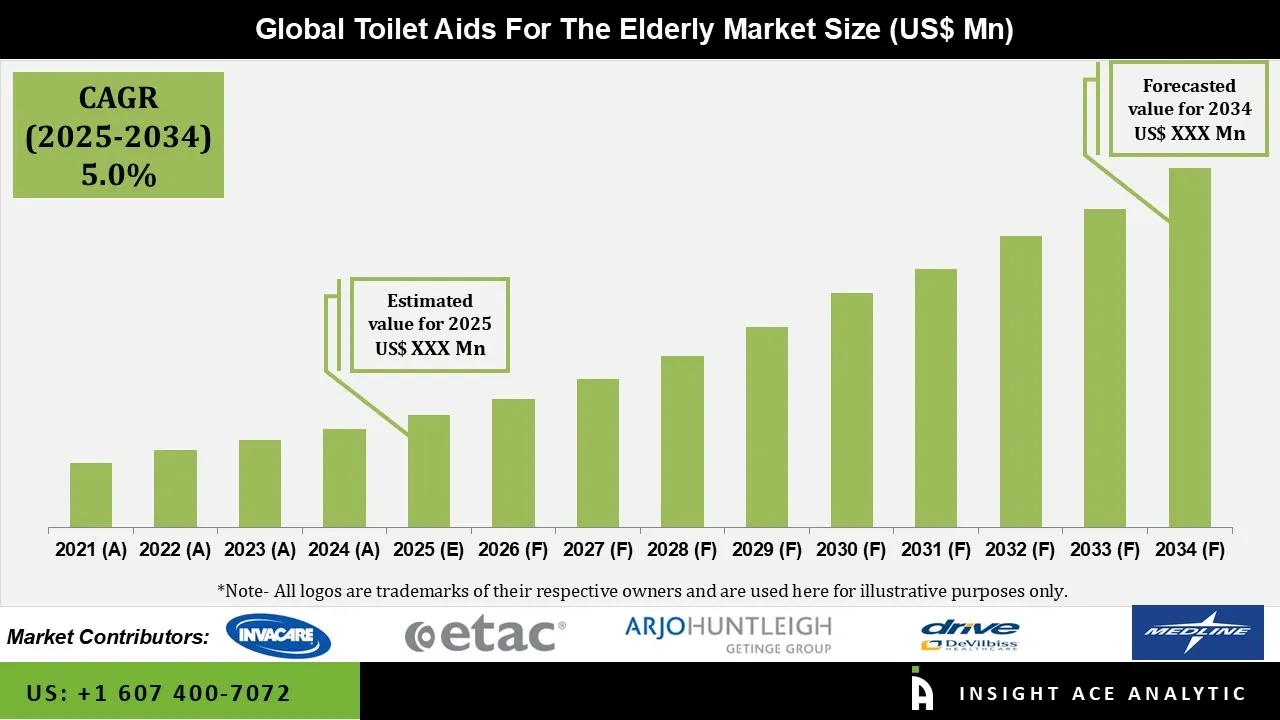

Toilet Aids For The Elderly Market Size is predicted to grow at a 5.0% CAGR during the forecast period for 2025 to 2034.

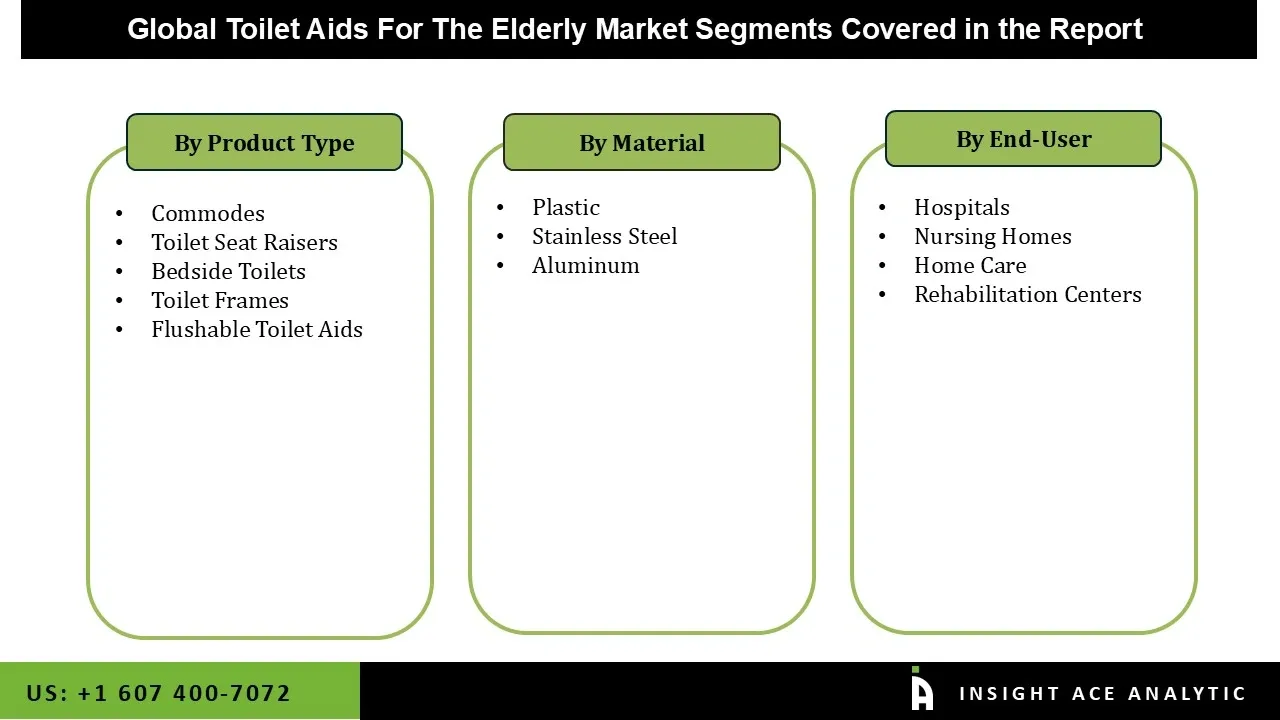

Toilet Aids For The Elderly Market Size, Share & Trends Analysis Distribution by Type (Commodes, Toilet Seat Raisers, Bedside Toilets, Toilet Frames, and Flushable Toilet Aids), By Material (Plastic, Aluminum, and Stainless Steel), By End-user (Hospitals, Home Care, Nursing Homes, and Rehabilitation Centers), and Segment Forecasts, 2025 to 2034

The toilet aids for the elderly are specially made assistive equipment that enable elders to use the restroom independently, safely, and comfortably. These devices, which offer extra assistance for those with restricted mobility, balance problems, joint pain, or muscle weakness, include commode chairs, grab bars, raised toilet seats, and toilet safety frames.

Toilet aids reduce the danger of slips and falls, which are among the most common causes of accidents among older individuals, by eliminating the need for excessive bending or straining. By empowering users to handle necessary daily tasks with little help, they also foster independence and dignity. The toilet aids for the elderly market is expanding due to several factors. The need for specialist toilet aids is fueled by the growing number of elderly people with chronic illnesses and impairments.

Additionally, the innovative products that meet a variety of demands, like grab bars, raised toilet seats, and bidet attachments, have also been developed as a result of technological improvements. These developments are attractive to both caregivers and users since they not only increase functionality but also improve user comfort and safety.

Furthermore, the continuous research and development process that attempts to meet the various needs of older consumers is another significant driver for the toilet aids for the elderly market. The market is also expanding as a result of businesses concentrating more on user-centric designs that provide better accessibility and usability. The need for toilet aids keeps growing as more people realize how important it is to maintain independence in day-to-day activities.

In addition, the toilet aids for the elderly market is anticipated to rise due to the rising incidence of age-related conditions like osteoporosis, dementia, and Alzheimer's. Thus, the use of toilet aid devices is anticipated to rise in the upcoming years due to increased flexibility, customization, portability, and decreased reliance on caretakers. Over the course of the forecast period, favorable reimbursement situations and several government programs to meet the needs of elderly persons are also anticipated to promote the toilet aids for the elderly market growth.

However, the expansion of the toilet aids for the elderly market will be constrained by the high cost of advanced items. Some specialized or technologically advanced toilet assistance can be costly, which is a barrier for people with low incomes. Additionally, there may be a lack of knowledge in some developing areas regarding the availability and advantages of these tools. As a result, the toilet aids for the elderly market will be restricted.

• Invacare Corporation

• GF Health Products

• Etac AB

• ArjoHuntleigh

• Medline Industries

• Drive DeVilbiss Healthcare

• Bischoff & Bischoff GmbH, Inc.

• Sunrise Medical

• Prism Medical

• Performance Health

The toilet aids for the elderly market is being stimulated by the increased demand for assistive devices that allow people to get care and support in their own homes, including help using the restroom. This is due to the growing preference for home healthcare services. In recent years, there has been a rise in the need for greater choice and flexibility in the provision of care among the elderly. For instance, according to EverNorth Health Services, 78% of clients said they would be very or somewhat inclined to use alternate forms of treatment, such as having a physician visit their house.

Moreover, these days, universal design principles that encourage the installation of toilet aid devices like grab bars, elevated toilet seats, and automated hygiene solutions are frequently included in investments made in new residential, commercial, and healthcare projects. The assistive devices are crucial to the development of modern infrastructure because of these properties, which help guarantee safety and independence for the elderly. Additionally, healthcare reforms aimed at enhancing the quality of life for older populations for home care coexist with expanding urban centers in emerging nations.

The intricacy of product designs and user interfaces frequently impedes the adoption of toilet aid devices. Many devices can be difficult for older individuals to use efficiently, especially those with sophisticated or automated functionality. This intricacy may cause annoyance and a decline in utilization. Additionally, the imprecise directions, confusing controls, and a lack of customization choices are common complaints from users and caregivers. Some users who are not familiar with technology may be intimidated by the presence of sensors, remote controls, or digital displays, which would limit these items' general accessibility. Furthermore, building items that strike a balance between innovation, usability, and simplicity is a constant struggle for producers. Thus, this is anticipated to limit the toilet aids for the elderly market growth over the forecast period.

Toilet aids for the elderly market is segmented based on type, material and end-use. Type segment is further segregated into commodes, toilet seat raisers, bedside toilets, toilet frames, and flushable toilet aids. Material segment is further segregated into plastic, aluminum, and stainless steel. End-user segment is further segregated into hospitals, home care, nursing homes, and rehabilitation centers.

The commodes segment held the largest share in the toilet aids for the elderly market in 2024. For those with limited mobility, specially made commodes are appropriate because they can be moved. All living things require commodes, and friendly commodes can significantly lessen the need for additional help that patients or the elderly require when using the restroom. They include a box to store the waste product that is mounted on a chair. The device is easy to clean and offers comfort to individuals with limited mobility due to old age. Additionally, people with limited mobility can benefit from these commodes because they are adjustable and adaptable. They can be used as a shower seat or on or over the toilet.

In 2024, the home care segment dominated the toilet aids for the elderly market. The residential homes, assisted living facilities, and private houses are examples of home care settings where people with impairments or mobility issues need toilet and bathroom assistance devices for everyday activities. The home care segment’s domination is a result of both the expanding availability of home care services and the growing inclination for aging in place. Moreover, by lowering the risk of falls and other injuries in one of the most dangerous parts of the house, these technologies improve the capacity to live independently and safely.

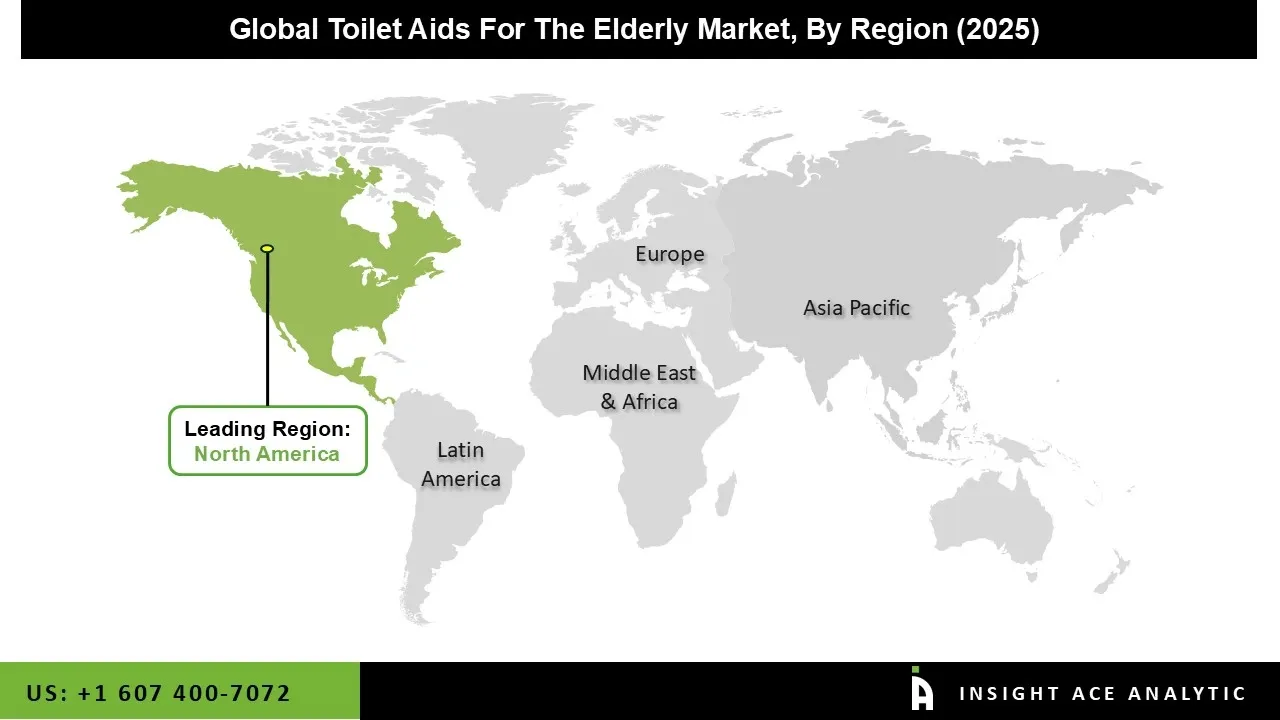

The toilet aids for the elderly market was dominated by the North America region in 2024, driven by significant healthcare spending, the region's aging population, and growing awareness of mobility difficulties. In addition, the advanced healthcare infrastructure, robust government support for elderly rights, and a high quality of living that permits substantial consumer spending on health-related goods are further major elements contributing to North America's dominance.

Manufacturers in the area are at the forefront of innovation, consistently creating assistive technology that is easier to use and more efficient. Additionally, because of the growing investments in R&D for the technological advancement of the aiding devices, the market for toilet aids for the elderly is anticipated to provide strong potential opportunities in this region.

April 2023: The Posey Wireless Toilet Sensor was introduced by US-based medical equipment company TIDI Products LLC. The technology is designed to help caregivers in hospitals and other healthcare facilities monitor patients who are at risk of falling and may attempt to leave the restroom on their own. The Posey On Cue PRO Alarm can be used in conjunction with this battery-operated sensor.

February 2023: The introduction of a Clean mobile shower commode chair was announced by Etac, a major player in the market. The chair can be accessed more easily thanks to its creative design with the front seat open. California Faucets introduced a new range of incredibly practical and fashionable grab bars the next month.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 5.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Material, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Invacare Corporation, GF Health Products, Etac AB, ArjoHuntleigh, Medline Industries, Drive DeVilbiss Healthcare, Bischoff & Bischoff GmbH, Inc., Sunrise Medical, Prism Medical, and Performance Health. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Toilet Aids For The Elderly Market- By Type

• Commodes

• Toilet Seat Raisers

• Bedside Toilets

• Toilet Frames

• Flushable Toilet Aids

Toilet Aids For The Elderly Market- By Material

• Plastic

• Aluminum

• Stainless Steel

Toilet Aids For The Elderly Market- By End-user

• Hospitals

• Home Care

• Nursing Homes

• Rehabilitation Centers

Toilet Aids For The Elderly Market-By Region

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.