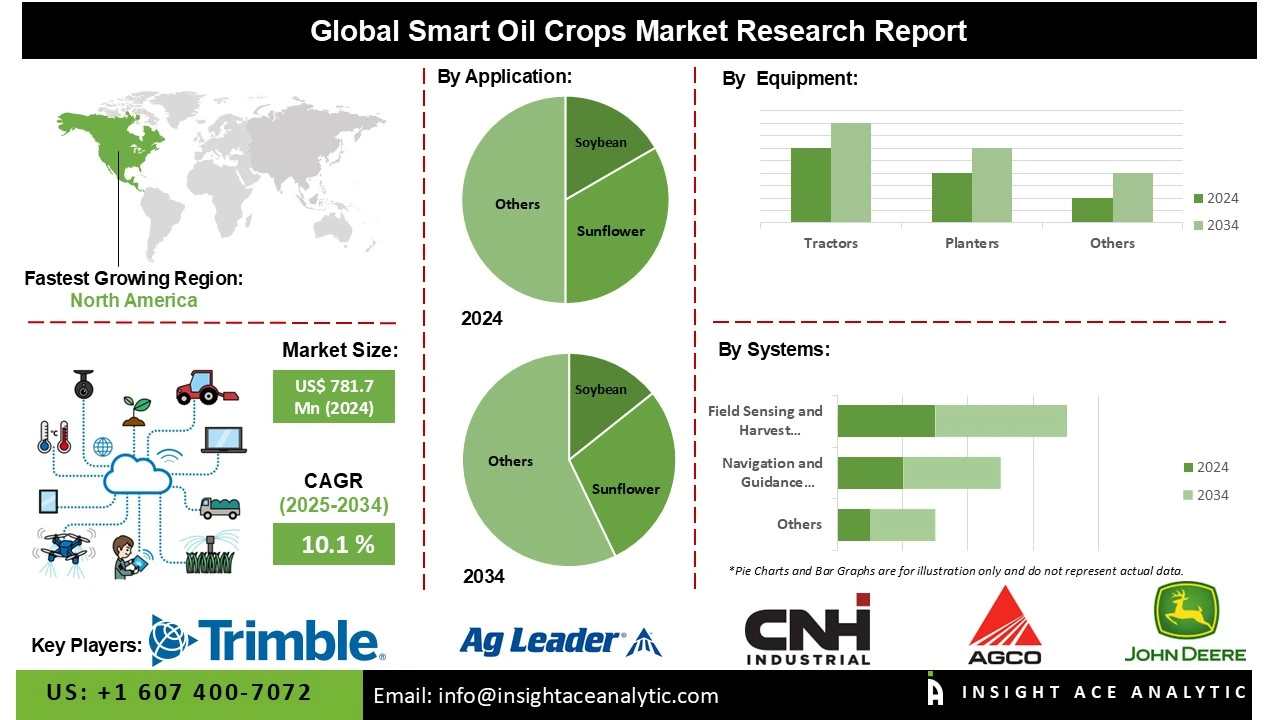

Smart Oil Crops Market Size is valued at US$ 781.7 Mn in 2024 and is predicted to reach US$ 1,952.1 Mn by the year 2034 at an 10.1% CAGR during the forecast period for 2025-2034.

"Smart oil crops" are oil crops cultivated using advanced technologies and environmentally friendly practices to enhance resource efficiency, quality, and production. Precision agricultural techniques, such as data analytics, drones, sensors, and Internet of Things devices, are implemented to oversee these crops. These devices enable the real-time monitoring of soil health, parasites, weather, and fertiliser requirements.

The objectives of smart oil crop cultivation include reducing resource wastage, minimising environmental impact, increasing oil yield, and lowering input costs. The industry for smart oil crops has been expanding significantly as agricultural technology continues to evolve in response to challenges such as resource constraints, climate change, and the necessity to increase production.

In addition, the market for smart oil crops has been steadily expanding as a result of the growing demand for environmentally responsible, high-yielding oilseeds to meet the world's biofuel and food needs. The market is further stimulated by national initiatives aimed at reducing environmental impact and enhancing agricultural security, as well as increased government and private investment. Furthermore, it is anticipated that the market for smart oil crops will expand rapidly in response to the increasing momentum of international initiatives promoting sustainable agriculture and self-reliance. This will be essential for the future security of food and biofuels, as well as for increasing domestic oilseed production.

Some of the Key Players in Smart Oil Crops Market:

· Deere & Company

· CNH Industrial N.V.

· AGCO Corporation

· Trimble Inc.

· Ag Leader Technology

· Topcon Corporation

· Valmont Industries, Inc.

· Corteva

· KUBOTA Corporation

· Kinze Manufacturing

· Lindsay Corporation

· Netafim

· Jain Irrigation Systems Ltd.

· BASF

· Farmers Edge Inc.

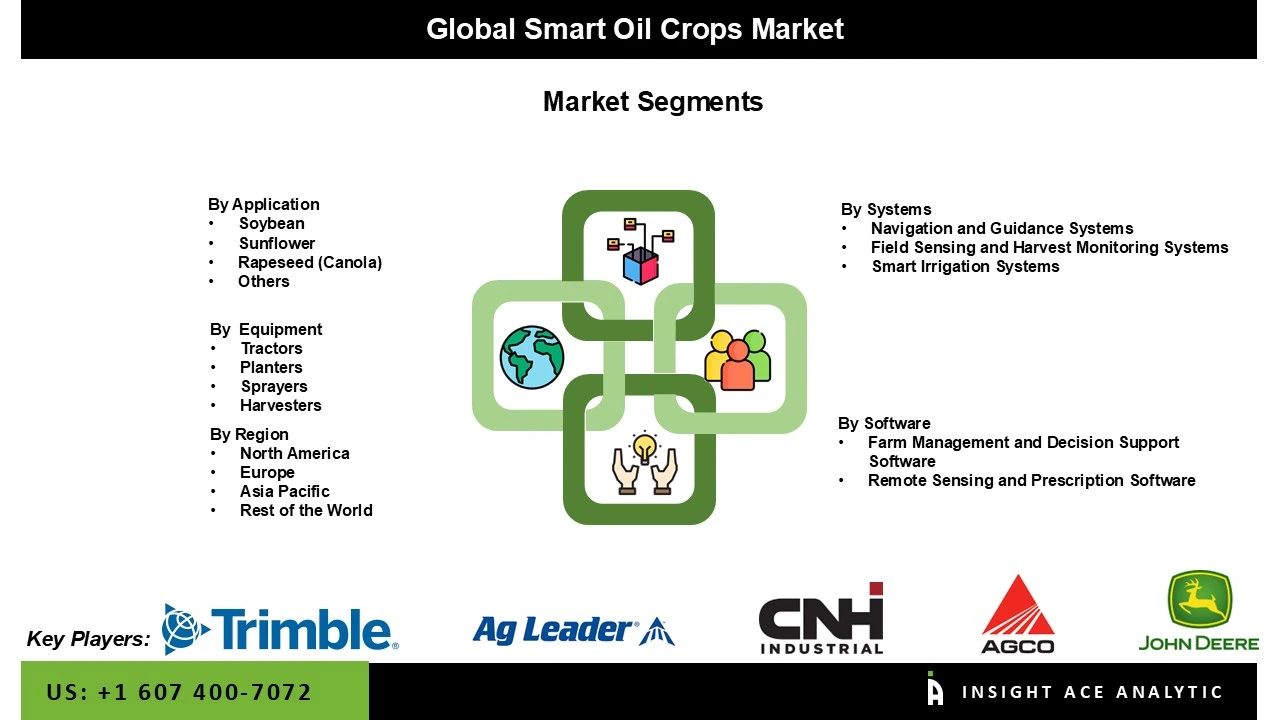

The smart oil crops market is segmented by equipment, software, systems, and application. By equipment, the market is segmented into planters, sprayers, tractors, and harvesters. By software, the market is segmented into remote sensing and prescription software, farm management and decision support software. By systems, the market is segmented into smart irrigation systems, navigation and guidance systems, field sensing and harvest monitoring systems. By application, the market is segmented into sunflower, soybean, rapeseed (canola), and others.

The increasing need for higher productivity with resource efficiency, combined with the growing adoption of precision agriculture methods, is propelling high growth in the planters segment of the smart oil crop market. For soybean, sunflower, rapeseed, and peanut oil crops, smart planters with GPS, sensors, and automated systems enable uniform seed distribution, optimal spacing, and reduced waste, all of which directly enhance yield quality. An increasing number of farmers are adopting advanced and mechanised planting techniques to improve efficiency and mitigate labour scarcity. Secondly, government-initiated programs supporting modern farm technologies and the growing awareness of sustainable practices are driving the expansion of this segment.

The smart oil crops market is experiencing swift growth in the soybean segment due to its healthy profile, versatility, and escalating demand from various industries. It is usually well known that soybeans are an essential crop for food, feed, and industrial purposes as they are rich in protein and healthy oils.

The market for soybean oil and soybean protein derivatives in food processing and functional foods has grown exponentially due to increased consumer awareness of vegetarian diets and the demand for alternatives to animal-derived products. Additionally, the expansion of the biofuel industry, particularly biodiesel, has created new applications for soybean oil, driving the growth of the smart oil crops market.

In 2024, the largest share of the smart oil crop market in North America was held. The growth of oil crop projects in the region is the factor behind this. North America has also been at the forefront of new technology adoption in the oil and gas industry, following significant investments in research and development of digital technology. The oil and gas industry has grown and become more efficient due to supportive laws and an emphasis on safety measures, creating an environment conducive to innovation.

Throughout the forecast period, the smart oil crops market in the Asia Pacific is expected to expand at the highest rate. With growing energy needs and modernisation, the Asia Pacific will become a key centre for the smart oil crops. To meet their growing energy requirements, countries such as China and India are placing a greater emphasis on oil and gas exploration and production, which presents a vast potential for the growth of the smart oil crops industry.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 781.7 Mn |

| Revenue Forecast In 2034 | USD 1,952.1 Mn |

| Growth Rate CAGR | CAGR of 10.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Equipment, By Software, By Systems, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Deere & Company, CNH Industrial N.V., AGCO Corporation, Trimble Inc., Ag Leader Technology, Topcon Corporation, Valmont Industries, Inc., Corteva, KUBOTA Corporation, Kinze Manufacturing, Lindsay, Corporation, Netafim, Jain Irrigation Systems Ltd., BASF, and Farmers Edge Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Smart Oil Crops Market by Equipment-

· Planters

· Sprayers

· Tractors

· Harvesters

Smart Oil Crops Market by Software -

· Remote Sensing and Prescription Software

· Farm Management and Decision Support Software

Smart Oil Crops Market by Systems-

· Smart Irrigation Systems

· Navigation and Guidance Systems

· Field Sensing and Harvest Monitoring Systems

Smart Oil Crops Market by Application-

· Sunflower

· Soybean

· Rapeseed (Canola)

· Others

Smart Oil Crops Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.