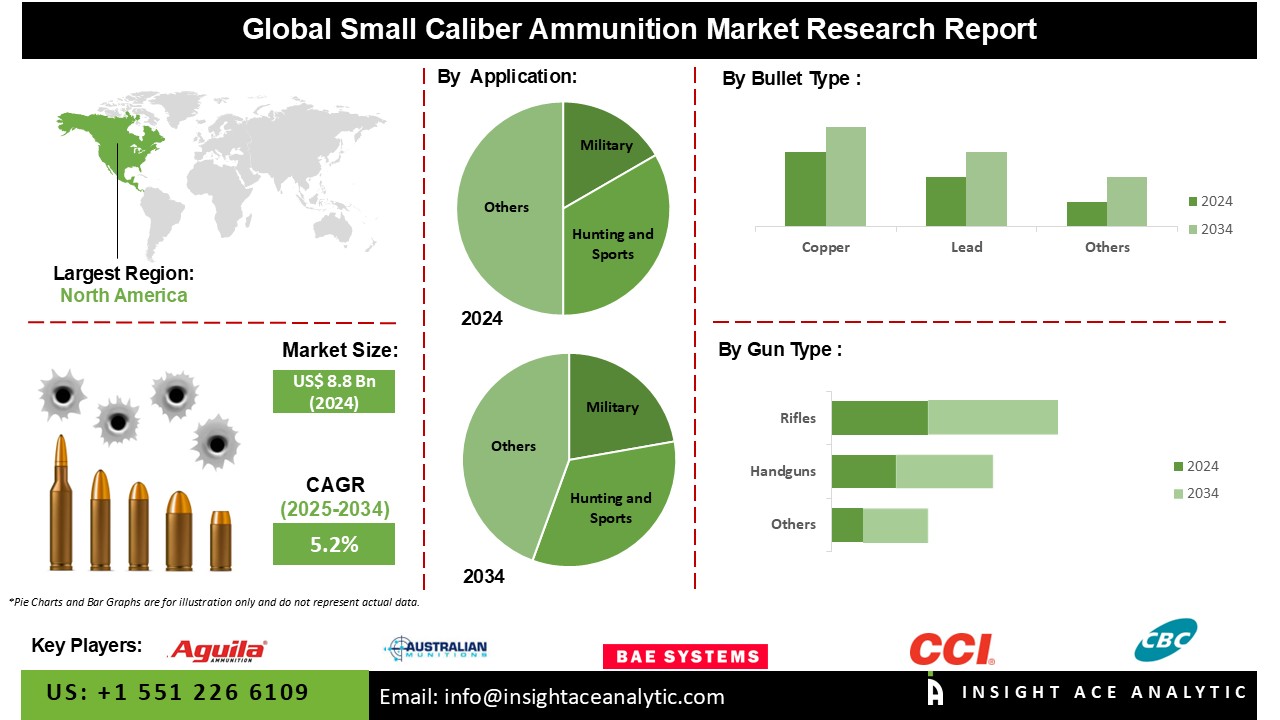

Small Caliber Ammunition Market Size is valued at USD 8.8 Bn in 2024 and is predicted to reach USD 14.4 Bn by the year 2034 at a 5.2% CAGR during the forecast period for 2025-2034.

Small caliber ammunition, commonly used in handguns and rifles, consists of cartridges with projectiles and components like casing, powder, and primer. It comes in various types, including full metal jacket, hollow point, and armour-piercing, serving purposes like self-defence, sport shooting, and military use. Regulations govern its purchase and use, and specialized companies manufacture it with a focus on quality and consistency.

The substantial increase in revenue within the global small-caliber ammunition market is primarily propelled by the escalating adoption of modernization initiatives by military forces worldwide. Escalating occurrences of armed intergovernmental and international conflicts have motivated numerous countries to bolster their military capabilities by procuring advanced ammunition and equipment.

Moreover, the progression of the lightweight and small-caliber ammunition sector yields positive effects across interconnected industries. This spurs the creation of firearms specifically tailored for these calibers, stimulates the production of firearm accessories designed for lightweight arms, and augments the demand for specialized training facilities and shooting ranges that cater to these specific ammunition types.

Furthermore, the demand for lightweight and compact ammunition extends beyond the military and law enforcement realms. Civilian shooters, encompassing concealed carry permit holders, sports enthusiasts, and recreational users, also seek ammunition choices that are easy to transport, possess reduced recoil, and offer an improved shooting experience. Consequently, the lightweight and small ammunition market broadens its scope to encompass a more diverse consumer base. In addition to this, there is an increasing emphasis within military and law enforcement agencies on outfitting their personnel with lighter equipment to enhance mobility and alleviate fatigue.

The small caliber ammunition market is segmented based on application, caliber type, gun type, and bullet type. The small caliber ammunition market is segmented as military, homeland security/law enforcement/government agency, hunting and sports and commercial (self-defense) based on application. By caliber type, the market is segmented into .22LR Caliber, 308 Caliber, 5.56mm Caliber, 7.62mm Caliber, 9mm Caliber, .223 Rem Caliber and 12 Gauge (Shotgun Shells). By gun type, the market is segmented into handguns, rifles, shotguns and others. The market is segmented by ammunition type into full metal jackets, tracer, incendiary, armor-piercing, and others. The market is segmented by bullet type into copper, lead, brass and others.

The tracer ammunition category will hold a major share of the global small-caliber ammunition market. The "tremendous demand" for tracer ammunition suggests a growing interest in utilizing this type of ammunition across various applications. This could be due to its effectiveness in enhancing shooting accuracy, training capabilities, and tactical advantages. The factors driving this demand could include advancements in tracer technology, evolving training methodologies, and the practical benefits it offers in real-world scenarios. As a result, manufacturers, military entities, law enforcement agencies, and civilian shooters increasingly seek tracer ammunition, contributing to its substantial demand within the small caliber ammunition market.

The rifles segment is projected to grow rapidly in the global small-caliber ammunition market. The growing utilization of rifles within the small caliber ammunition market" refers to the increasing use of rifles that require small caliber ammunition. This indicates that rifles that use smaller caliber ammunition are becoming more prevalent in the market. Small caliber ammunition refers to cartridges with smaller bullet diameters, often used in pistols, submachine guns, and rifles. The statement suggests that rifles designed to fire these smaller caliber cartridges are experiencing a rise in their use. This trend could be influenced by various factors, such as advancements in firearm technology, changing preferences of firearm users, military and law enforcement requirements, and evolving shooting practices.

The North American small-caliber ammunition market is expected to register the highest market share. The United States has a high civilian firearm ownership rate, driving the demand for corresponding ammunition. Many individuals own firearms for self-defense, hunting, sport shooting, and other purposes, leading to a consistent need for small-caliber ammunition. This market specifically pertains to North American countries, including the United States and Canada, with substantial demand for firearms and associated ammunition.

In addition, the Asia Pacific regional market is projected to grow rapidly in the global small-caliber ammunition market. South Korea commands the primary market share in the realm of small-caliber ammunition. At the same time, China is projected to exhibit the swiftest growth within the Asia Pacific region throughout the projected timeframe. The substantial civilian desire for small-caliber ammunition, driven by its application in self-defense scenarios, is poised to generate multiple avenues for expansion, inviting new participants to explore opportunities within this market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 8.8 Bn |

| Revenue Forecast In 2034 | USD 14.4 Bn |

| Growth Rate CAGR | CAGR of 5.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Caliber, By Gun Type, By Ammunition Type, By Bullet Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Aguila Ammunition, Australian Munitions, BAE Systems, CCI Ammunition, CBC Global Ammunition, Denel PMP, Elbit Systems, Global Ordnance, Hughes Precision Manufacturing Pvt. Ltd., Namo AS, Poongsan Corporation, Ultra Defense Corp, Vista Outdoor Operations LLC and Winchester Ammunition, DSG Technology AS, ST Engineering, Sierra Bullets, Remington Arms Company LLC, Rheinmetall Defense, Nosler, Inc., General Dynamics Corporation, Hornady Manufacturing Company, Inc., FN Herstal, Northrop Grumman Corporation, AMMO INC. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Small Caliber Ammunition Market By Application

Small Caliber Ammunition Market By Caliber

Small Caliber Ammunition Market By Gun Type

Small Caliber Ammunition Market By Ammunition Type

Small Caliber Ammunition Market By Bullet Type

Small Caliber Ammunition Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.