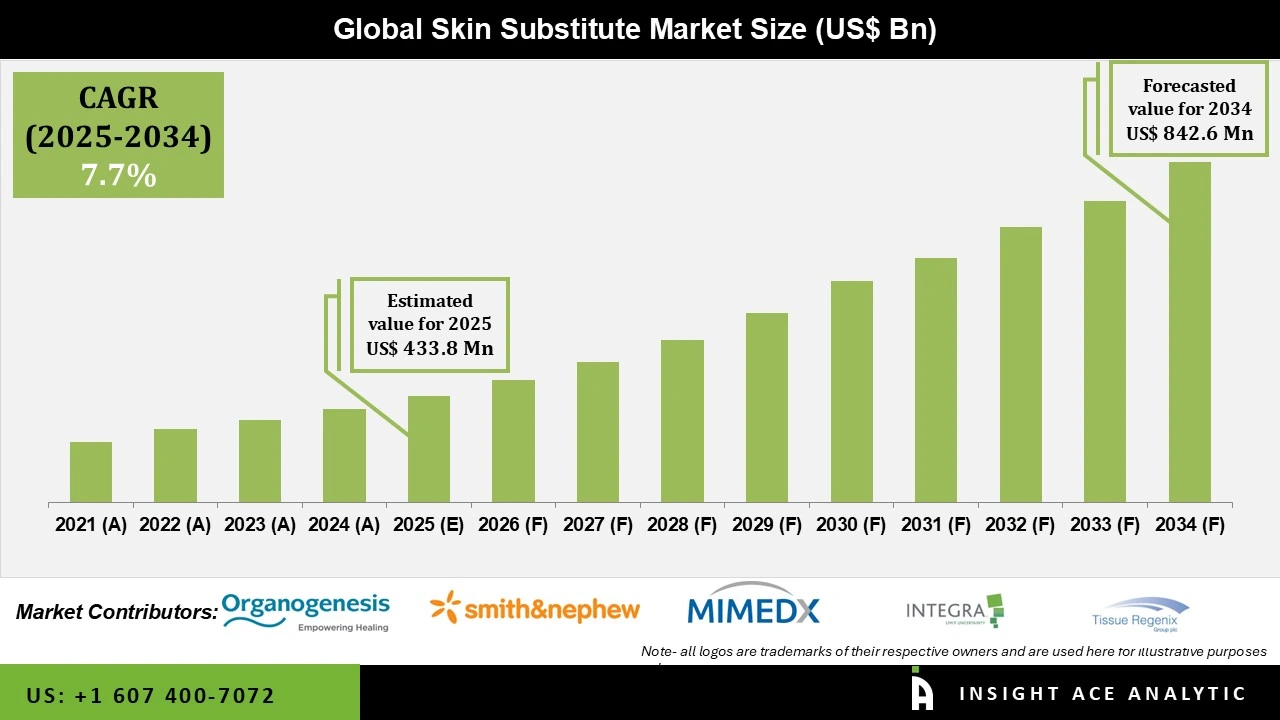

Global Skin Substitute Market Size is valued at USD 433.8 Mn in 2024 and is predicted to reach USD 842.6 Mn by the year 2034 at a 7.7% CAGR during the forecast period for 2025 to 2034.

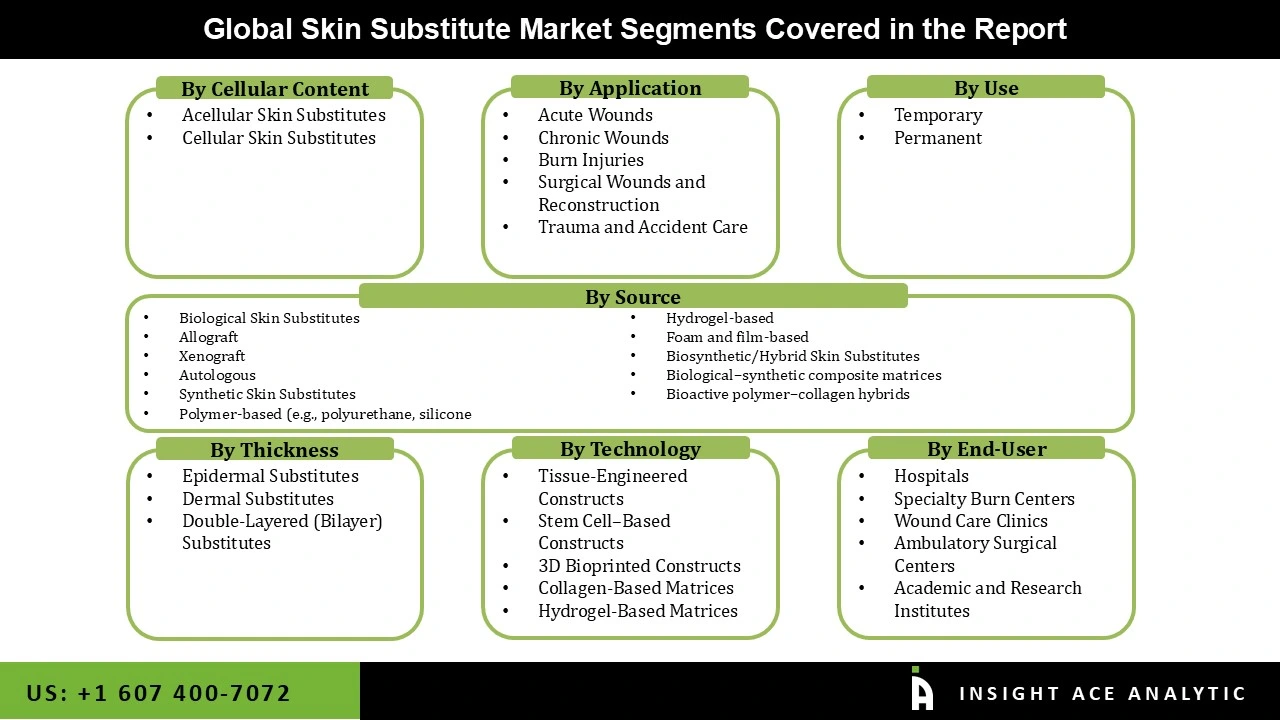

Skin Substitute Market Size, Share & Trends Analysis Distribution by Cellular Content (Acellular and Cellular), By Source (Biological Skin Substitutes (Allograft, Autologous, Xenograft), Synthetic Skin Substitutes (Polymer-based (e.g., Polyurethane, Hydrogel-based, Silicone, Foam and film-based), and Biosynthetic/Hybrid Skin Substitutes (Biological–synthetic Composite Matrices, Bioactive Polymer–collagen Hybrids)), By Use (Temporary and Permanent), By Application (Burn Injuries, Acute Wounds, Chronic Wounds, Surgical Wounds and Reconstruction, Trauma and Accident Care), By Technology (Tissue-Engineered Constructs, 3D Bioprinted Constructs, Stem Cell–Based Constructs, Collagen-Based Matrices, and Hydrogel-Based Matrices), By Thickness (Dermal Substitutes, Epidermal Substitutes, and Double-Layered (Bilayer) Substitutes), By End-use (Hospitals, Specialty Burn Centers, Ambulatory Surgical Centers, Wound Care Clinics, Academic and Research Institutes), and Segment Forecasts, 2025 to 2034

Skin substitutes made of natural, synthetic, or biosynthetic materials are used to repair large wounds and restore some or all of the skin's functions. In addition to providing either temporary or permanent closure, skin replacements reduce discomfort and protect the incision from infection, further injury, and water loss. They also encourage the wound to be covered in normal skin. Skin replacements provide a long-term solution for conditions including burns, trauma wounds, diabetes, or venous ulcers where skin transplants may not be practical. The growing prevalence of chronic wounds, improvements in skin replacement technologies, an increase in burn and trauma cases, and an aging population that is more susceptible to skin-related issues are the primary factors driving the global skin substitute market.

The rising incidence of chronic wounds, which are frequently associated with lifestyle-related conditions like diabetes and vascular diseases, is driving the demand for skin substitute products worldwide. Additionally, the technological developments in skin substitutes are another important factor driving the skin substitute market expansion. More complex and natural skin-mimicking alternatives have been created as a result of ongoing research and development efforts. These developments greatly improve the effectiveness of treating a variety of wounds and injuries, which further propels the expansion of the global market for skin substitutes. The necessity for sophisticated wound care treatments has also increased due to the rise in burn and trauma cases worldwide, which is driving up demand for skin substitutes in the global skin substitute market.

Furthermore, there is a developing market for skin substitutes made to treat skin-related problems, such as pressure ulcers and chronic wounds due to the aging population. Skin substitutes are important in the expanding market for aesthetic therapies, which goes beyond medical needs. Moreover, to promote growth in the global skin substitute market, governments all over the world are aggressively forming alliances with private companies. These partnerships include funding R&D, supporting innovative technologies, and streamlining regulatory procedures to expedite product approval. However, the increased cost of skin substitutes, especially biological substitutes, is the primary commercial barrier. The utilization of human or animal tissues to treat chronic wounds and specific production methods are the causes of this higher cost.

Driver

Increasing Chronic Disease Treatment

The global skin substitute market is primarily driven by the widespread use of these products to treat chronic illnesses. These substitutes provide efficient treatments for ailments like venous insufficiency ulcers and diabetic ulcers. They speed up the healing process by promoting wound closure and fostering tissue regeneration. The demand for these alternatives rises dramatically as their efficacy in treating chronic wounds becomes more widely recognized. The increased use broadens the market and stimulates continuous innovation, promoting the development of highly specialized and cutting-edge Skin substitute goods tailored to the unique needs of patients with long-term diseases. For instance, the MariGen Shield was introduced in April 2023 by Kerecis, a medical company that specializes in fish skin. To treat complex and chronic wounds, the invention combines the company's fish-skin graft with a silicone contact layer. The new product has fenestrations that make it easier for wounds to drain properly, creating the ideal environment for wound care. Additionally, it keeps the proper moisture levels that are necessary for promoting effective healing processes.

Restrain/Challenge

High Cost of Skin Substitutes

One major barrier to the market's expansion is the expensive cost of skin substitutes. These goods are made from human or animal tissues, and the specialist procedures needed to produce them increase the cost. The cost of these sophisticated alternatives can be unaffordable for many healthcare providers, especially in environments with limited resources. Furthermore, although if skin substitutes provide better results than conventional therapies, their expense may make them inaccessible, particularly for patients without sufficient insurance or in poor nations. It is anticipated that this price sensitivity will hinder the items' widespread acceptance, making skin substitute market expansion difficult.

The Biological Skin Substitutes category held the largest share in the Skin Substitute market in 2024. Allografts, xenografts, and acellular dermal matrices—biological skin substitutes made from human or animal tissues—offer intrinsic benefits in terms of biocompatibility, integration, and the stimulation of natural healing. Compared to many synthetic counterparts, their natural extracellular matrix (ECM) components more successfully promote angiogenesis, tissue remodeling, and cellular migration. Additionally, the biological skin substitutes benefit from a considerable body of clinical information gathered over decades as well as a well-established regulatory framework. Numerous top biological medicines have obtained FDA approval, CE marking, and other international certifications, making it simpler to enter the market and boosting physician confidence. When creating treatment guidelines and reimbursement policies, healthcare providers and payers frequently rely on this comprehensive clinical validation.

In 2024, the chronic wounds category dominated the Skin Substitute market. Diabetic foot ulcers (DFUs), venous leg ulcers (VLUs), and pressure ulcers are examples of chronic wounds that constitute a persistent and growing worldwide health burden. These difficult-to-heal lesions are becoming more common due to the global increase in diabetes, obesity, and aging populations. An estimated 15–34% of diabetes patients may develop diabetic foot ulcers at some point in their lives, resulting in a sizable and steady patient population in need of cutting-edge wound care treatments. The majority of patients with venous leg ulcers and pressure ulcers are elderly and immobile, and these demographic groups are constantly expanding. For producers of skin substitutes, this steady stream of patients ensures a sizable and expanding addressable market. Businesses that specialize in applications for chronic wounds can profit from volume growth brought on by an expanding therapeutic need.

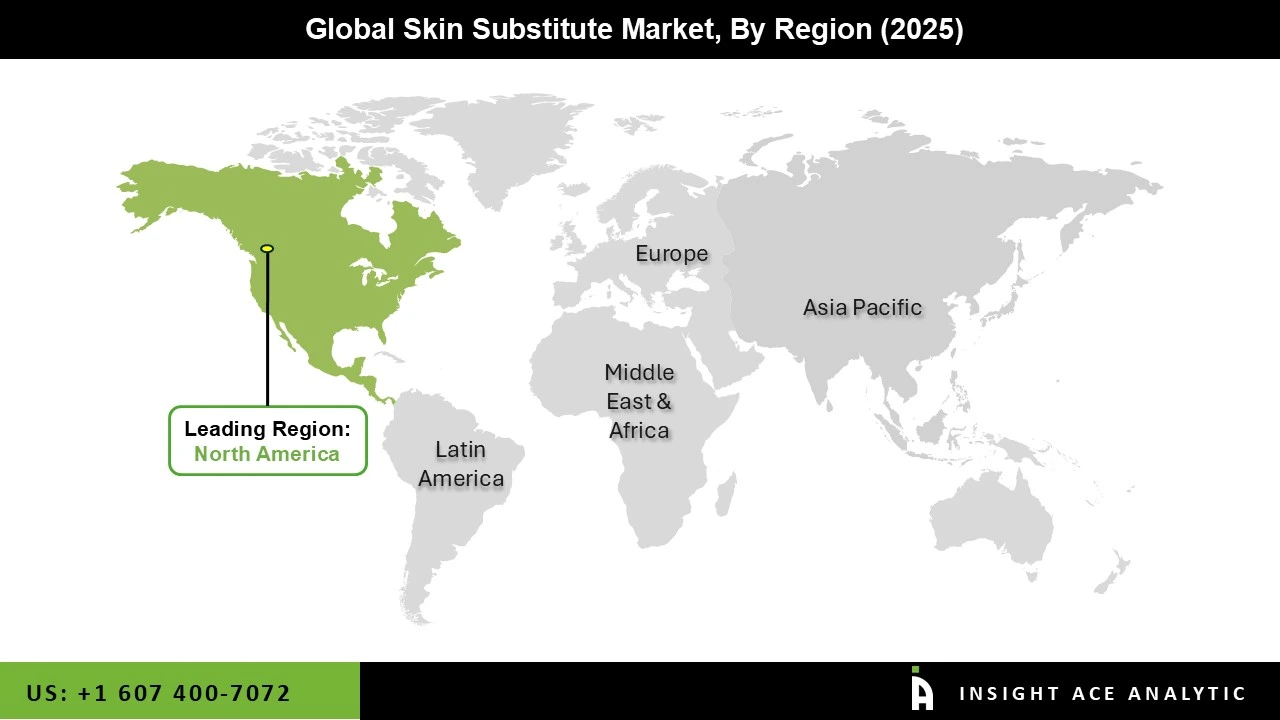

The Skin Substitute market was dominated by the North America region in 2024. This is mostly because of its strong healthcare systems and reputable hospitals, research facilities, and specialty clinics that specialize in regenerative medicine and wound care.

Additionally, the rising prevalence of chronic wounds and the high adoption of cutting-edge technologies further solidify the region's dominance in the skin substitute market. This supremacy is further reinforced by developments in regenerative medicine and growing government research assistance programs.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 433.8 Mn |

| Revenue forecast in 2034 | USD 842.6 Mn |

| Growth Rate CAGR | CAGR of 7.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Cellular Content, Source, Use, Application, Technology, Thickness, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | 3M Company, Organogenesis Inc, Smith+Nephew plc, MiMedx Group Inc, Integra LifeSciences Corporation, Tissue Regenix Group plc, Vericel Corporation, Stratatech Corporation, AlloSource, Acelity L P Inc, Mölnlycke Health Care AB, Coloplast A S, AVITA Medical Inc, PolyNovo Limited, and ConvaTec Group plc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Skin Substitute Market by Application-

Skin Substitute Market by Technology-

Skin Substitute Market by Thickness-

Skin Substitute Market by End-user-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.