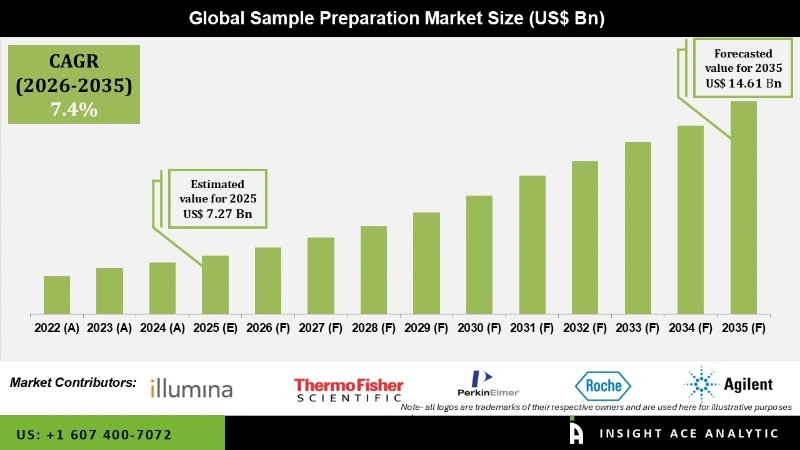

Global Sample Preparation Market Size is valued at USD 7.27 billion in 2025 and is predicted to reach USD 14.61 billion by the year 2035 at a 7.4% CAGR during the forecast period for 2026 to 2035.

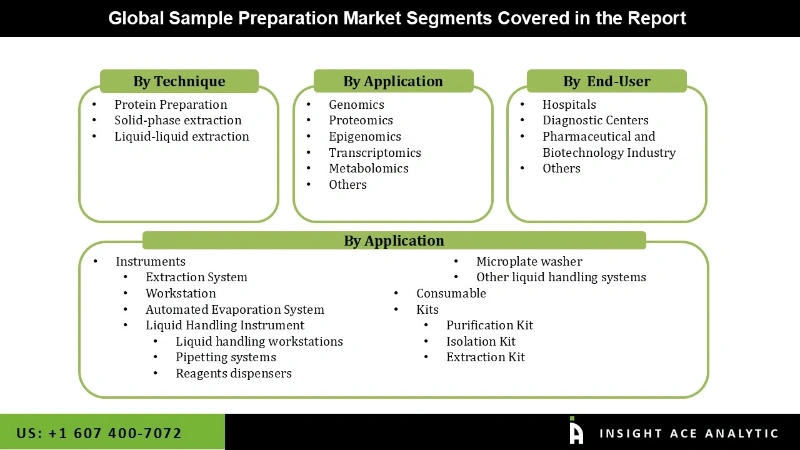

Sample Preparation Market Size, Share & Trends Analysis Report By Product (Instruments, Consumable), By Technique (Protein Preparation, Solid-Phase Extraction & Liquid-Liquid Extraction), By Application (Genomics, Proteomics, Epigenomics), End-User (Hospitals, Diagnostic Centers, Pharmaceutical & Biotechnology Industry), & Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The process of extracting analytes from sample matrices into the final analyte solution is known as sample preparation. Drawing, handling, and preparing samples following the standards of contemporary microbiology are all part of the process. It consists of biological and chemical samples for analyzing raw materials to find undesired components in different chemical compounds.

It offers greater separation in chromatography, higher throughput, easier automation, increased sensitivity, and detection of certain functional groups. The sample preparation technique is therefore widely applied across numerous industry sectors. In the coming years, it is projected that more money will be spent on pharmaceutical-related research and development, fueling the industry's expansion. The major companies in the market are concentrating on the development of new products and obtaining regulatory approval. With the ultimate objective of purifying and isolating the analyte from complicated matrixes, improvements in the sample preparation procedure are significant for pharmaceutical research and analysis.

Additionally, the market is anticipated to advance due to the industry's rapid growth and the opening up of numerous opportunities in the biotechnology sector. However, the market may be constrained by elements including the high cost of workstations, challenges in creating established protocols for sample preparation, lack of experience in producing technologically complex products, and less informed consumers.

The sample preparation market is segmented on the product, technique, application, and end-user. On the basis of product, the market is segregated into instruments (extraction system, workstation, automated evaporation system, liquid handling instrument (liquid handling workstations, pipetting systems, reagents dispensers, microplate washer, other liquid handling systems)), consumables and kits (purification kit, isolation kit, extraction kit). Based on technique, the market is segregated into protein preparation, solid-phase extraction and liquid-liquid extraction. Based on application, the sample preparation market is segmented into genomics, proteomics, epigenomics, transcriptomics, and metabolomics. Based on end-user, the market is segregated into hospitals, diagnostic centers, the pharmaceutical and biotechnology industry and others.

The protein preparation category witnessed the highest revenue share, and it is anticipated that they will further continue to maintain that position during the anticipated time. The total market is projected to grow rapidly due to the proteomics field's ongoing innovation. Because contaminants are removed during the extraction procedure from the sample, the repeatability of the data is decreased, which might lead to the loss of proteins. By creating a novel strategy, Babraham Institute researchers upgraded the traditional proteomics sample preparation techniques in July 2022. The method increases the inclusion of challenging biological proteins to collect, increasing the readouts of proteomics.

The genomics category is anticipated to grow at a significant rate over the forecast period. The total growth rate is anticipated to increase as companies take more strategic actions in the market for genomics applications. For instance, Bionano Genomics, Inc. and Hamilton stated in October 2022 that they were working together to develop a solution to extract and isolate Ultra High Molecular Weight DNA as the first step in the sample preparation procedure. In optical genome mapping, long string vantage points are used. The development of tailored medicine through genomics research is one of the main drivers of this application.

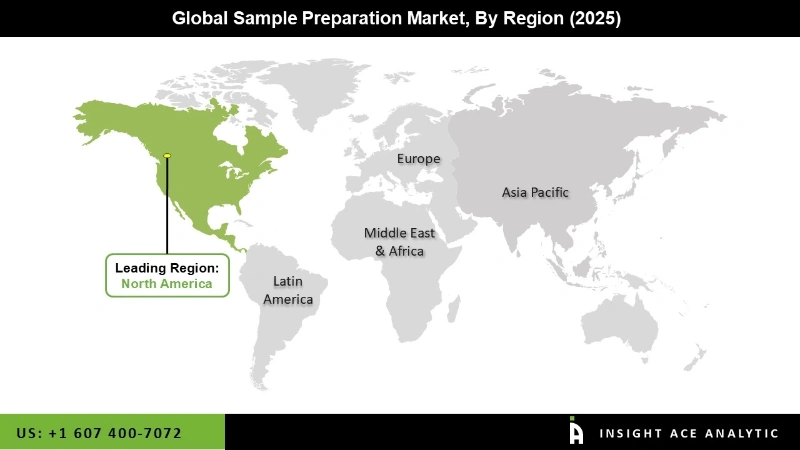

North America sample preparation market is expected to register the highest market share in revenue in the near future. The region's established providers and buyers of sample preparation solutions play a key role in accounting for the greatest market share. As a result, this expedites delivery from supplier to the customer at a low cost. Additionally, expanding access to and availability of capital through public and private investors aids new businesses in entering the market. In addition, the Asia Pacific is projected to grow rapidly in the global sample preparation market. This is a result of sequencing being used more frequently in China and India for various purposes, including the creation of individualized medications. Additionally, it is projected that the market will have considerable development potential during the projection period due to the Asia Pacific region's growing interest in genomics and proteomics research.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 7.27 Bn |

| Revenue forecast in 2035 | USD 14.61 Bn |

| Growth rate CAGR | CAGR of 7.4% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, Technique, Application, And End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Merck KgaA, Thermo Fisher Scientific Inc., Bio-RAD Laboratories Inc., Tecan Group Ltd., Agilent Technologies Inc., Hamilton Company, Promega Corporation, Illumina Inc., Roche Applied Science, Danaher Corporation and Qiagen N.V. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Sample Preparation Market By Product -

Sample Preparation Market By Technique-

Sample Preparation Market By Application-

Sample Preparation Market By End User-

Sample Preparation Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.