Global Regenerative Aesthetics Exosome Products Market Size is valued at USD 81.1 Million in 2024 and is predicted to reach USD 1689.7 Million by the year 2034 at a 35.9% CAGR during the forecast period for 2025-2034.

Regenerative aesthetics exosome products represent a cutting-edge advancement in skin rejuvenation and hair restoration, offering a minimally invasive approach. These nano-sized extracellular vesicles derived from stem cells contain a potent blend of growth factors, peptides, coenzymes, minerals, amino acids, and vitamins. Applied topically, they enhance skin health by boosting collagen and elastin production, improving oxygenation, and enhancing nutrition. When used alongside procedures such as microneedling, they effectively diminish fine lines, wrinkles, age spots, and redness while enhancing skin hydration and brightness. Unlike platelet-rich plasma (PRP) treatments, exosome products require no blood draws or specialized equipment, offering a more concentrated and streamlined solution.

Clinically proven formulations like Benev's Exosome Regenerative Complex and Exosome Regenerative Complex+ demonstrate efficacy in rejuvenating both skin and scalp tissue by addressing fundamental causes of ageing and fostering intercellular communication, thereby presenting a promising alternative to conventional aesthetic therapies. The regenerative aesthetics exosome products market is propelled by increasing demand for natural, minimally invasive solutions in skin rejuvenation. As awareness of regenerative medicine grows among consumers, there is a burgeoning market for exosome-based aesthetic products anticipated to expand swiftly.

· BENEV

· EXOCEL BIO

· Kimera Labs

· ELEVAI Labs, Inc.

· ExoCoBio, Inc.

· ANTEAGE

· Laboratorio Innoaesthetics, S.L.U.

· ZEO ScientifiX, Inc.

· Rion Aesthetics, Inc.

· Vytrus Biotech

· Croma Pharma

· RESILIÉLLE COSMETICS LLC

· Exoceuticals

· LA EXO

· JuveXo

· PrimaCure

· Cartessa Aesthetics

· DP Derm

· MCCM Medical Cosmetics

· Morphiya

· Advancexo

· Rixin Cosmetics

· Mibelle Biochemistry

· Creative Biolabs

· Exosomes Cosmetics

· Snow Fox

· Beekman 1802

· Swiss Perfection

· Wigmore Medical

· Thea Janus

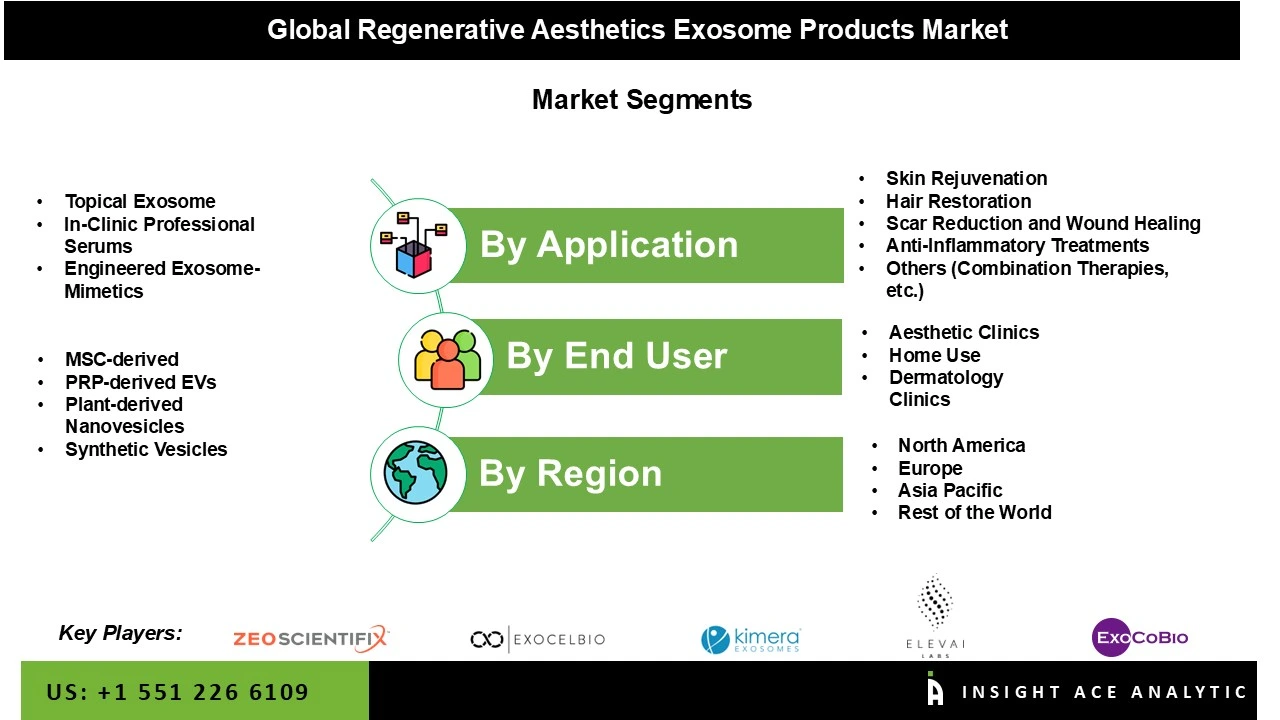

The regenerative aesthetics exosome products market is segmented by application and end user. Acording to the application the market is segmented into skin rejuvenation, hair restoration, scar reduction and wound healing, anti-inflammatory treatments, others(combination therapies, etc.) By end user market is categorized into aesthetic clinics, home use, dermatology clinics. THe home use segment is further classified into Retail Channels and E-commerce Platform.

Skin rejuvenation stands out as the primary driver of the regenerative aesthetics exosome products market due to several key factors. Exosomes have demonstrated notable efficacy in enhancing skin health by boosting collagen and elastin production, reducing fine lines & wrinkles, and improving skin elasticity. They also facilitate improved skin oxygenation, nutrition, and overall rejuvenation, particularly when integrated with procedures like microneedling to further diminish age spots and redness and enhance hydration. As the demand for minimally invasive, natural solutions for ageing skin increases, exosome-based products offer a compelling alternative to traditional aesthetic treatments like fillers and Botox. Supported by clinical evidence showing their ability to counteract dermal fibroblast senescence and stimulate skin regeneration, products such as Exosome Regenerative Complex are validated options in the market.

The aesthetic clinics segment is emerging as the fastest-growing category in the medical aesthetics market, driven by several key factors. Clinics, hospitals, and medical spas have seen significant adoption of advanced systems and technologies, enhancing patient care and early disease detection. This trend is fueled by the digitization of patient workflows and an increase in aesthetic procedures performed in these settings. There is also a rising need for minimally invasive procedures such as botulinum toxin as well as dermal fillers, which offer benefits like reduced side effects, shorter recovery times, and less discomfort. This growing preference for non-invasive treatments contributes to the accelerated growth of the aesthetic clinic's segment within the medical aesthetics industry.

In North America, particularly in the United States and Canada, the medical aesthetics market is led by a combination of factors. The region's dominance is fueled by the rising demand for least invasive cosmetic procedures and the robust healthcare infrastructure in both countries. The United States, in particular, benefits from the significant popularity of cosmetic procedures, encompassing both surgical and non-surgical options. This demand is further bolstered by a large pool of highly qualified plastic surgeons specializing in diverse medical aesthetic procedures. Additionally, the increasing number of clinics across the region contributes to the market's growth, reflecting a strong preference for advanced aesthetic treatments among consumers.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 81.1 Million |

| Revenue forecast in 2034 | USD 1689.7 Million |

| Growth Rate CAGR | CAGR of 35.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By End User, By Biological Source, By Product Format and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | BENEV, EXOCEL BIO, Kimera Labs, ELEVAI Labs, Inc., ExoCoBio Inc., ANTEAGE, Laboratorio Innoaesthetics, S.L.U., ZEO ScientifiX, Inc., Rion Aesthetics, Inc., Cosmedicine Co., Ltd., Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Regenerative Aesthetics Exosome Products Market by Application-

Regenerative Aesthetics Exosome Products Market by End User -

Regenerative Aesthetics Exosome Products Market By Product Format

Regenerative Aesthetics Exosome Products Market By Biological Source

Regenerative Aesthetics Exosome Products Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.