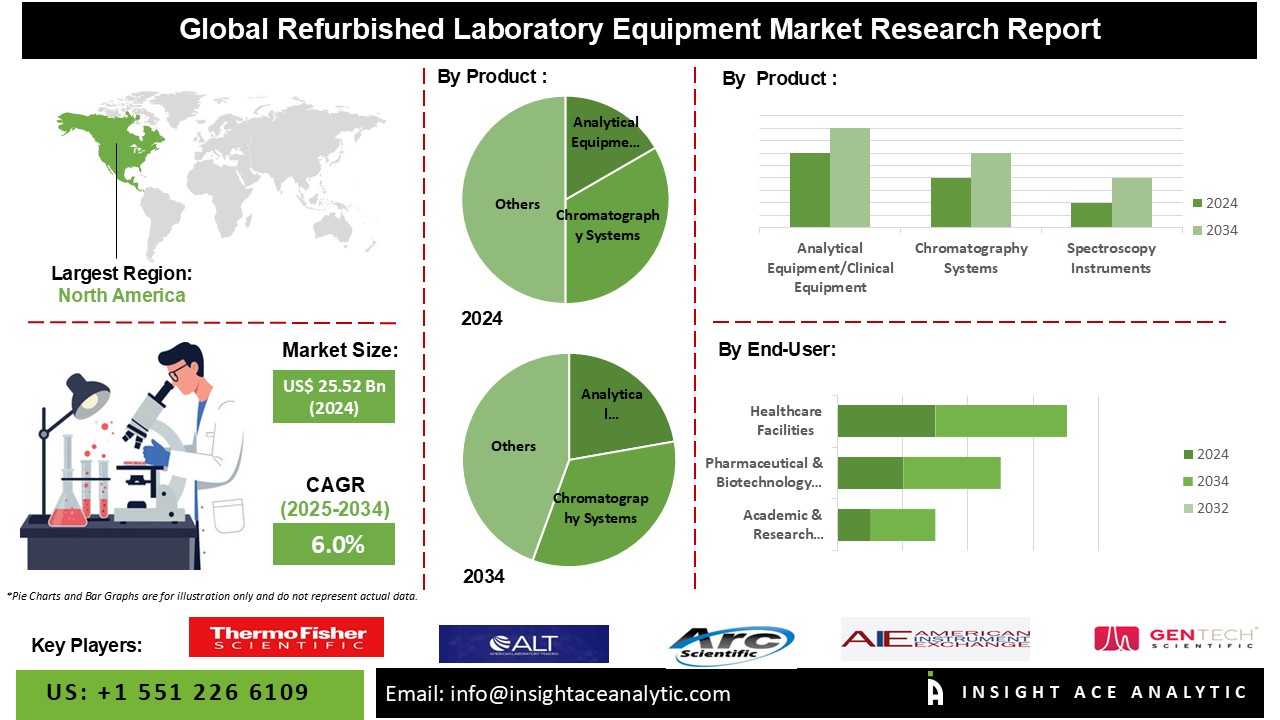

Refurbished Laboratory Equipment Market Size is valued at USD 25.52 Bn in 2024 and is predicted to reach USD 45.41 Bn by the year 2034 at a 6.0% CAGR during the forecast period for 2025-2034.

Refurbished laboratory equipment pertains to previously owned laboratory instruments and gear that have been repaired to a state of complete functionality and often resemble new conditions. This equipment goes through an extensive refurbishing process, which involves meticulous cleaning, repairing or replacing any broken or worn components, calibration, and rigorous quality assurance testing to ensure it meets the original manufacturer's standards. Refurbishing laboratory equipment is a cost-effective and ecologically responsible solution for laboratories that want to equip or improve their facilities without spending a lot of money on new equipment.

The rising demand for analytical equipment is a significant driver in the Refurbished Laboratory Equipment Market. Analytical equipment plays a crucial role in laboratory settings, enabling researchers, scientists, and technicians to analyze and characterize various substances, compounds, and materials accurately. By extending the lifespan of equipment through refurbishment, laboratories can reduce electronic waste and minimize their environmental footprint, contributing to sustainable laboratory practices.

Moreover, healthcare facilities expand their services or upgrade their existing equipment, they may require additional laboratory instruments and technology. Refurbished laboratory equipment enables facilities to access advanced technology and expand their capabilities without the significant financial investment required to purchase new equipment.

The refurbished laboratory equipment market is segmented on the basis of product and application. Based on product, the refurbished laboratory equipment market is segmented as analytical equipment, general equipment, specialty equipment, and support equipment. In this product segment, there are sub-categories in which Analytical Equipment comprises Chromatography Systems, Spectroscopy Instruments, Mass Spectrometers, Thermal Analyzers, Immunoassay Analyzers, Blood Gas Analyzers, Coagulation Analyzers and Others (elemental analyzers, particle size analyzers, etc.).

The General Equipment category includes Centrifuges, Incubators, Ovens, Autoclaves, Safety cabinets, Others (balances & scales, shakers & stirrers, etc.). The Specialty Equipment category comprises DNA Sequencers (PCR instruments, Flow Cytometers, Microscopes, Bioreactors, Others (microplate readers, x-ray diffraction systems, etc.,). By application, the refurbished laboratory equipment market is segmented into healthcare facilities, pharmaceutical & biotechnology companies, academic & research institutions, and others.

The analytical equipment category is expected to hold a major share of the global Refurbished Laboratory Equipment market in 2022. the rising demand for analytical equipment in the refurbished laboratory equipment market reflects the need for cost-effective, sustainable, and reliable solutions to support research and analytical activities in diverse laboratory settings. Analytical equipment remains essential for scientific discovery, quality assurance, and innovation across various industries, driving its continued prominence in the refurbished laboratory equipment market.

The healthcare facilities segment is projected to grow at a rapid rate in the global Refurbished Laboratory Equipment market. The rising demand for healthcare facilities drives the need for cost-effective, reliable, and sustainable laboratory equipment solutions. Refurbished laboratory equipment provides an accessible and practical option for healthcare facilities to acquire quality instruments and technology to support patient care, diagnostics, and research activities.

The North America Refurbished Laboratory Equipment market is expected to register North America boasts well-established healthcare and research infrastructure, including top-tier hospitals, academic institutions, and research laboratories. These facilities require a wide range of laboratory equipment for diagnostic, research, and testing purposes, driving the demand for refurbished laboratory equipment. In addition, Asia Pacific is predicted to grow at a rapid rate in the global Refurbished Laboratory Equipment market. The Asia-Pacific region is undergoing rapid industrialization, leading to the establishment of numerous manufacturing facilities, research laboratories, and healthcare institutions. These entities require laboratory equipment for various applications, driving the demand for refurbished options as cost-effective solutions.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 25.52 Bn |

| Revenue Forecast In 2034 | USD 45.41 Bn |

| Growth Rate CAGR | CAGR of 6.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Thermo Fisher Scientific, Inc., American Laboratory Trading, Inc., ARC Scientific LLC, American Instrument Exchange, Spectralab Scientific, Inc., GenTech Scientific LLC, International Equipment Trading Ltd., Copia Scientific Inc., Cambridge Scientific Instrument Company, LabX, Biophlox Global Pvt Ltd and Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Refurbished Laboratory Equipment Market By Product-

Refurbished Laboratory Equipment Market By End-User:

Refurbished Laboratory Equipment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.