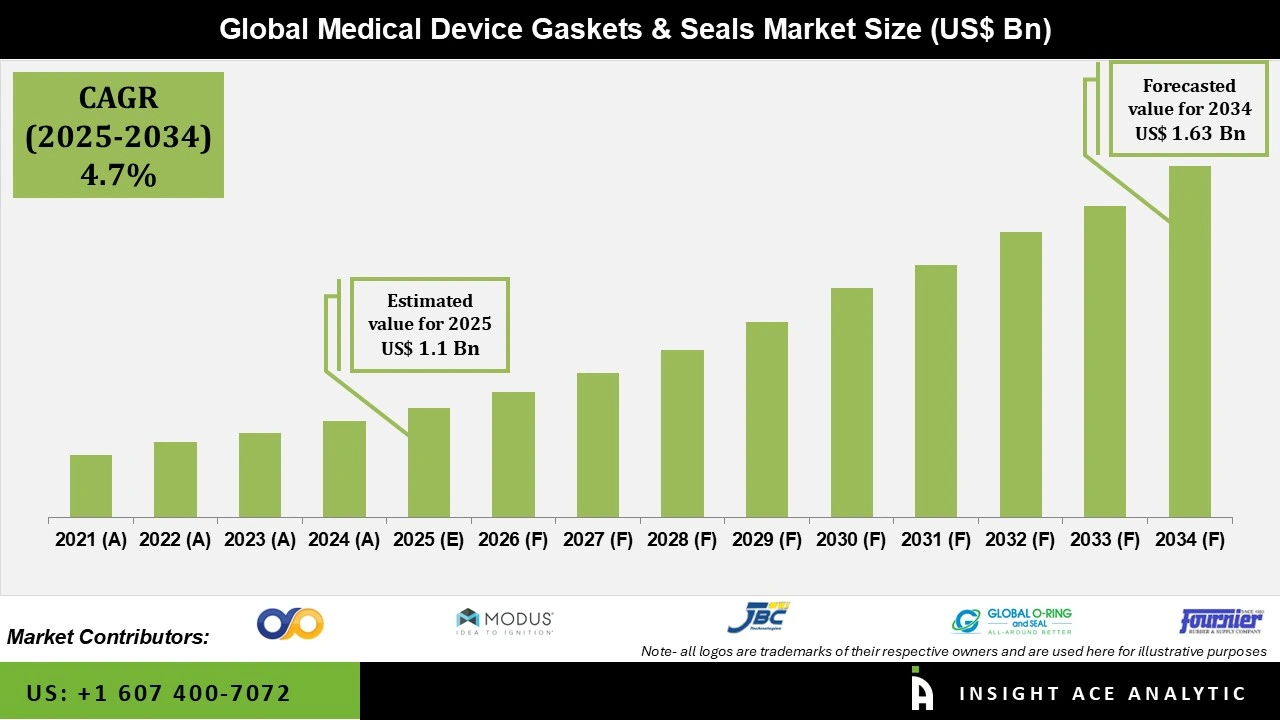

Global Medical Device Gaskets & Seals Market Size is valued at US$ 1.0 Bn in 2024 and is predicted to reach US$ 1.6 Bn by the year 2034 at an 4.7% CAGR over the forecast period 2025-2034.

Medical device gaskets and seals are essential for shielding equipment from dust, fluids, impurities, and electromagnetic interference. In addition to resisting heat, flame, electrostatic discharge, and electrical conductivity, they should possess enough mechanical strength, chemical resistance, and hygienic sealing characteristics. Gaskets and seals for medical devices should be made of materials that satisfy both functional and regulatory criteria.

The medical device gaskets and seals market is driven by the growing demand for medical equipment resulting from expanding healthcare infrastructure and a rise in chronic illnesses. The market is additionally influenced by the growing number of operations and the most recent advancements in medical technology.

Furthermore, the medical device gaskets and seals market is expanding as a result of the rising demand for high-performance medical equipment. By halting fluid leaks, pollution, and equipment failure, gaskets and seals guarantee dependability and safety. They are essential components of machinery that work with delicate biological materials. Additionally, the market for medical device gaskets and seals has expanded due to the growing usage of sophisticated technologies, including infusion pumps, imaging systems, and surgical instruments. The need for sophisticated gasket materials and designs will continue to increase as the global healthcare system invests in next-generation technologies across various care settings. It is projected that this will accelerate the medical device gaskets and seals market expansion.

Which are the Leading Players in Medical Device Gaskets & Seals Market?

· Global O-Ring and Seal, LLC

· MSP Seals, Inc.

· DP Seals

· Fournier Rubber & Supply Co.

· Precision Polymer Engineering, Ltd.

· SBR Life Sciences

· JBC Technologies

· Modus Advanced

· Stockwell Elastomerics

· Tapecon

· Trelleborg Sealing Solutions

Market Segmentation:

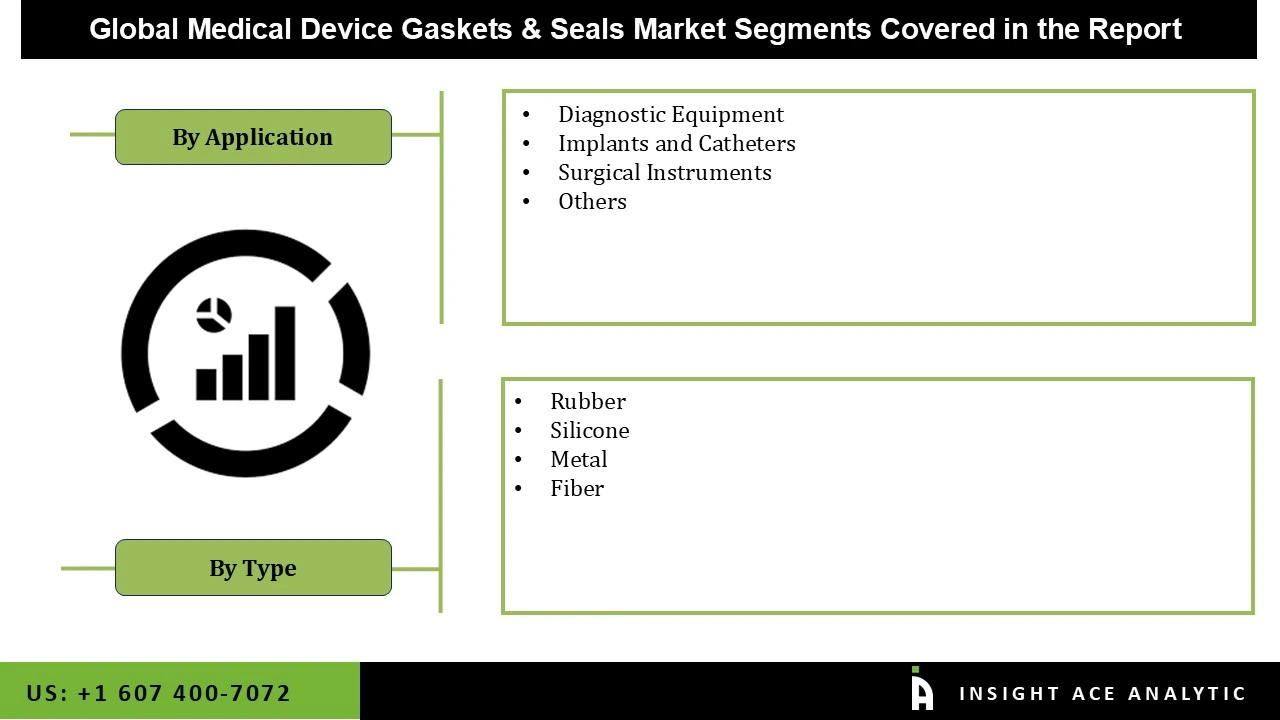

The medical device gaskets & seals market is segmented by type and application. By type, the market is segmented into rubber, metal, fiber, and silicone. By application, the market is segmented into implants and catheters, diagnostic equipment, surgical instruments, and others.

By Type, the Rubber Segment is Expected to Drive the Medical Device Gaskets & Seals Market

Since rubber is essential to maintaining the performance and safety of medical devices, it led the market for gaskets and seals in 2024. Rubber's flexibility, resilience, and resistance to chemicals make it perfect for a variety of medical devices, including respiratory systems, syringes, and infusion pumps. Further driving demand is the growing use of disposable medical equipment, which requires efficient sealing to avoid contamination. Rubber is favored in healthcare applications due to its affordability and capacity to adhere to stringent hygienic requirements.

Implants and Catheters Segment is Growing at the Highest Rate in the Medical Device Gaskets & Seals Market

During the forecast period, the implants & catheters segment is expected to register a significant rise in its share of the medical device gaskets and seals market. This growth is driven by the increasing volume of surgical procedures and the rising prevalence of chronic diseases. Implants and catheters are among the most frequently used devices in surgical settings, with applications spanning medical valves, catheter systems, biocompatible coatings for stents, cardiac resynchronization devices, and neurostimulation devices. Because these devices come into direct contact with the human body, they require gaskets and seals that meet stringent biocompatibility and regulatory standards.

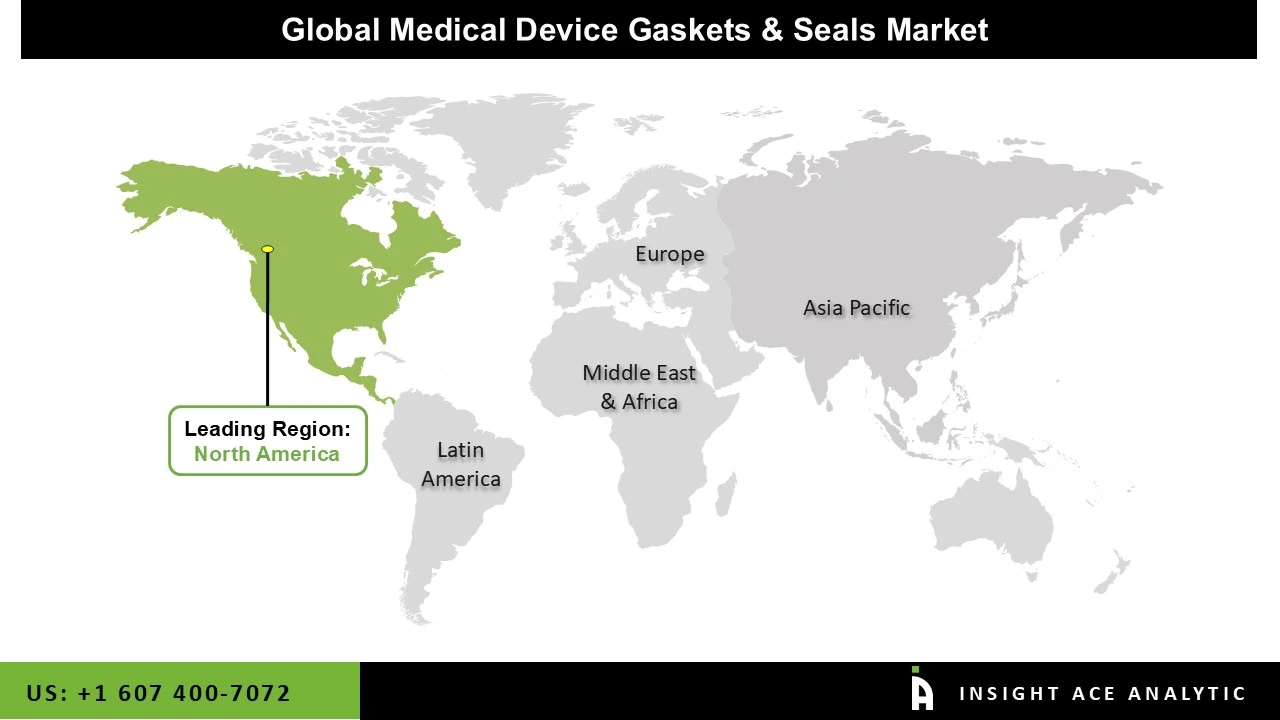

Why North America Led the Medical Device Gaskets & Seals Market?

In 2024, the medical device gaskets and seals market was dominated by North America. The market is driven by the existence of major competitors, increased investments and alliances, and sophisticated healthcare infrastructure. The rising number of operations in the area is another factor propelling the market. According to reports, Canada performs over a million surgeries every year. Modern research and development facilities support the most recent advancements in medical technology. Additionally, the safety and efficacy of medical devices in the area are governed by strict regulatory agencies such as the US FDA.

Over the course of the projection period, the Asia-Pacific region is expected to grow at the quickest rate in the market. The market is driven by the growing number of surgeries, attractive industrial infrastructure, rising rates of chronic illnesses, and expanding R&D activities. According to reports, inpatient care accounts for around 70% of healthcare spending, with surgeries accounting for over 70% of these expenses. Furthermore, the favorable government regulations and standards for medical equipment also boost the industry.

Medical Device Gaskets & Seals Market Report Scope

Medical Device Gaskets & Seals Market by Type

· Rubber

· Metal

· Fiber

· Silicone

Medical Device Gaskets & Seals Market by Application

· Implants and Catheters

· Diagnostic Equipment

· Surgical Instruments

· Others

Medical Device Gaskets & Seals Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.