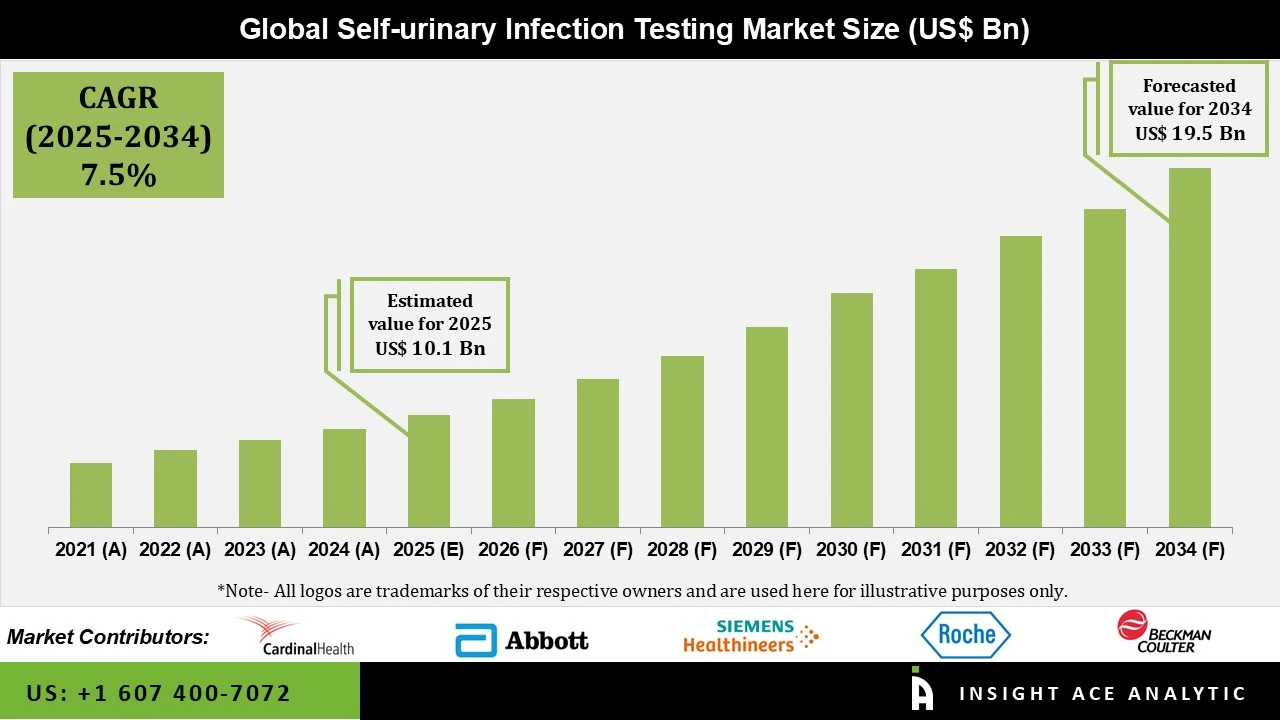

Global Self-urinary Infection Testing Market Size is valued at US$ 9.7 Bn in 2025 and is predicted to reach US$ 19.5 Bn by the year 2034 at an 7.5% CAGR during the forecast period for 2025-2034.

Urinary tract infection (UTI) testing solutions that allow people to identify UTIs at home without a lab visit are referred to as the self-urinary infection testing market. This market is important because it provides consumers with rapid, simple, and private testing alternatives, enabling prompt diagnosis and treatment. Since self-testing allows for more precise infection diagnosis, early detection helps prevent complications and the misuse of antibiotics.

The increasing prevalence of UTIs, advancements in diagnostic technology, and growing awareness of self-testing are all factors contributing to the expansion of the self-urinary infection testing market. Millions of individuals worldwide suffer from UTIs, one of the most prevalent bacterial illnesses. Prompt treatment and the avoidance of consequences depend on an early and precise diagnosis.

Several additional factors are contributing to the growth of the self-urinary infection testing market, including the demand for simple and cost-effective diagnostic tools, increasing focus on self-care and preventive healthcare, and rising awareness of UTI symptoms and the importance of early detection. The expansion of telemedicine and remote healthcare has further accelerated adoption, as consumers can now monitor their health independently and seek timely medical advice when necessary. Despite these advantages, the market faces challenges that could limit its growth. One of the most significant concerns is the accuracy and reliability of self-testing products. Variations in sample collection, handling, and interpretation can lead to false-positive or false-negative results, potentially causing unnecessary anxiety or delaying appropriate treatment.

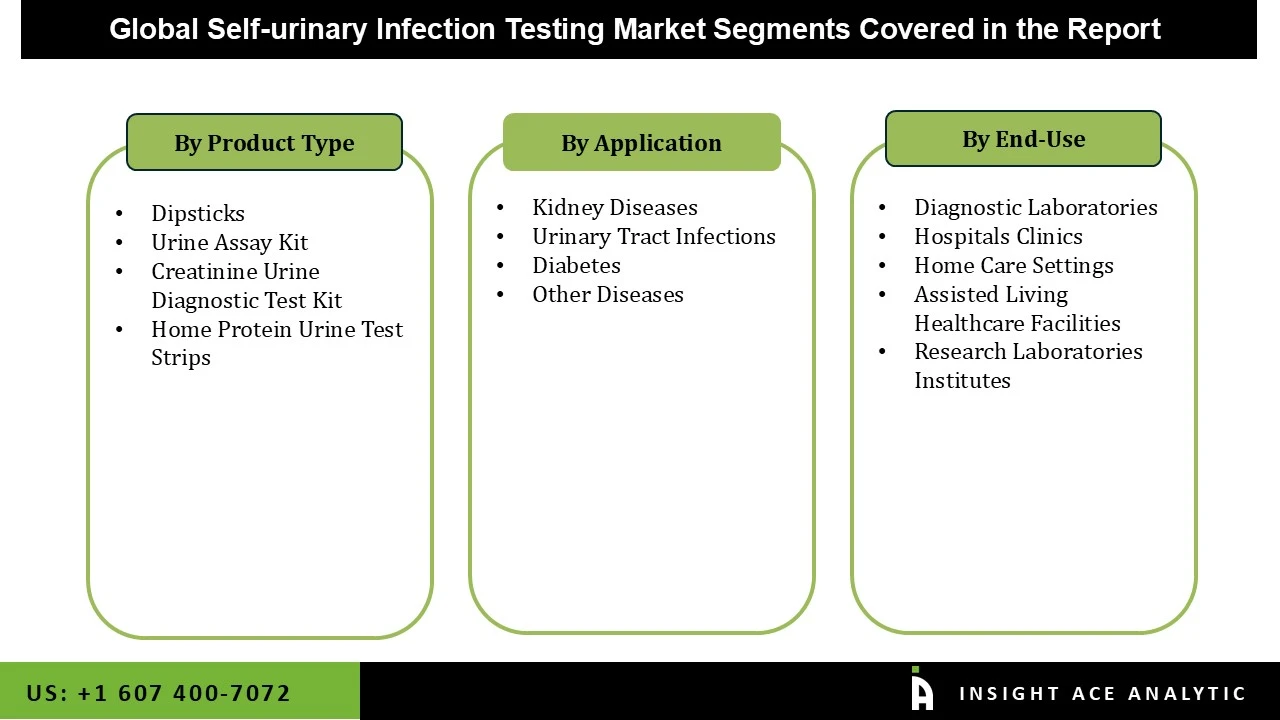

The self-urinary infection testing market is segmented by product, application, and end-use. By product, the market is segmented into urine assay kit, dipsticks, home protein urine test strips, and creatinine urine diagnostic test kit. By application, the market is segmented into diabetes, kidney diseases, urinary tract infections, and others. By end-use, the market is segmented into hospitals clinics, diagnostic laboratories, home care settings, research laboratories institutes, and assisted living healthcare facilities.

In 2024, the dipsticks segment dominated the self-urinary infection testing market. The price, quick result delivery, and simplicity of use of dipsticks for testing for urinary infections are driving growth in this sector. Both home users and medical experts have embraced them due to their portability and low training requirements. The diagnostic efficiency has increased due to the capacity to identify various factors, including protein, nitrites, and leukocytes, in a single test. Dipsticks continue to be the favored option as the need for accessible and reasonably priced testing solutions grows, solidifying their position as the industry leader.

In 2024, the diagnostic laboratories segment was the largest segment in the self-urinary infection testing market, with the highest share. The extensive dependence on laboratory confirmation for self-testing findings and the ability of labs to process large numbers of tests more accurately are the reasons for this leadership. Efficient result management is made possible by the growing use of digital platforms and automated analyzers in laboratories, which supplement self-urinary infection testing kits. Additional factors propelling adoption include the integration of lab data with electronic medical records and an increase in patient inflows for confirmatory testing. As a result, diagnostic labs remain the primary end user segment in the market for self-urinary infection testing.

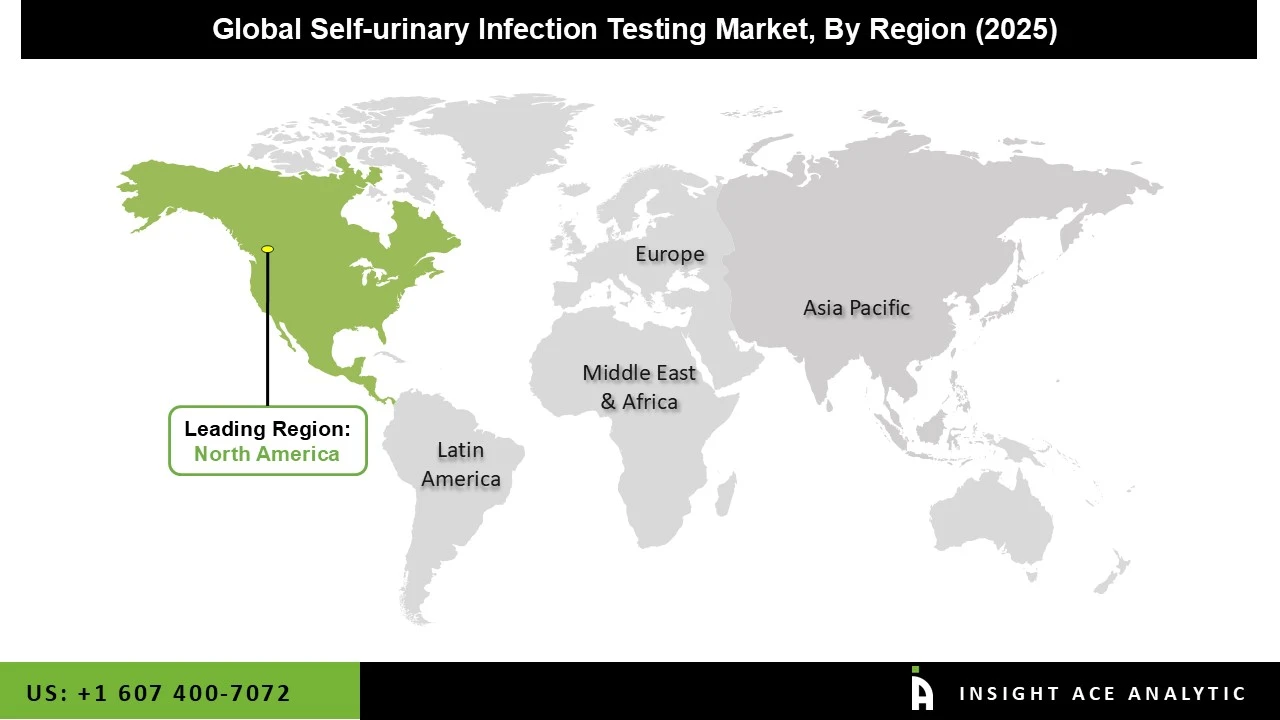

The market for self-urinary infection testing was dominated by North America in 2024 because of its advanced healthcare systems, high levels of self-care and preventative healthcare awareness, and easy access to state-of-the-art diagnostic equipment. Due to the growing demand for convenient diagnostic options, self-UTI testing tools have gained popularity in these regions. Additionally, the self-urinary infection testing market is expected to grow significantly due to the increasing use of urinalysis in the treatment of liver disease and UTIs, the growth of urinalysis research, and the general rise in public awareness of urinalysis.

The market for self-urinary infection testing is anticipated to expand significantly in the Asia-Pacific region because of the region's huge population, rising healthcare costs, and growing awareness of urinary health issues. Due to factors such as urbanization, shifting lifestyles, and an increased focus on preventive healthcare, countries like China, India, and Japan are expected to play a significant role in driving the market's growth in this region. In addition, the prevalence of UTIs and nephropathic illnesses is increasing, which raises demand for diagnostic systems, especially self-diagnostic ones, a diagnostic system category with the fastest rate of growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 9.7 Bn |

| Revenue Forecast In 2034 | USD 19.5 Bn |

| Growth Rate CAGR | CAGR of 7.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Cardinal Health, Abbott, Siemens Healthcare Private Limited, F. Hoffmann-La Roche Ltd, Scanwell Health, Inc., Nova Biomedical, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., ARKRAY, Inc., Sysmex Middle East FZ-LLC, Quidel Corporation, ACON Laboratories, Inc., 77 Elektronika Kft, URIT MEDICAL ELECTRONIC Co., LTD., Dirui, Q Bio, Inc., bioM rieux SA, Abaxis, Shenzhen Mindray Bio-Medical, Electronics Co., Ltd., and Healthy.io Ltd |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.