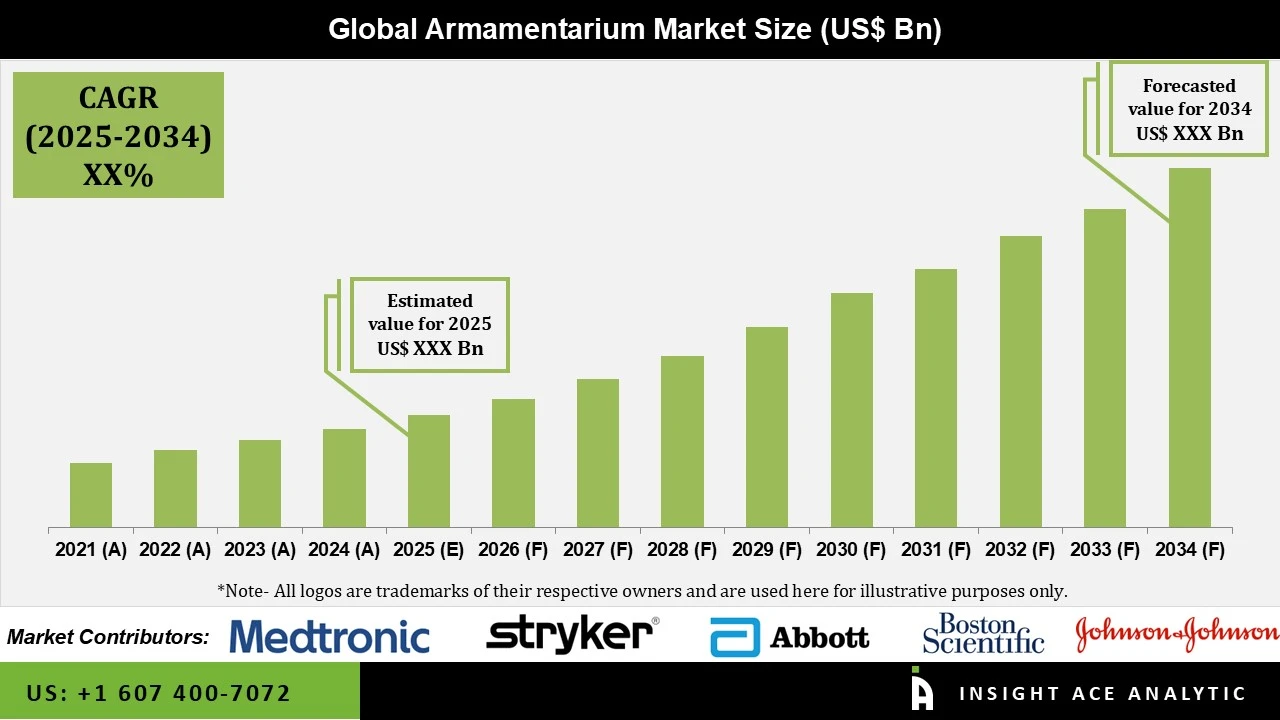

Global Armamentarium Market Size is valued at US$ xx Bn in 2024 and is predicted to reach US$ xx Bn by the year 2034 at an xx% CAGR during the forecast period for 2025-2034.

Armamentarium refers to the full spectrum of tools and resources a professional draws upon to perform tasks with precision and expertise. In clinical and scientific settings, it extends far beyond instruments on a tray, encompassing diagnostic technologies, treatment techniques, procedural protocols, and the practitioner’s accumulated knowledge and skills.

This comprehensive toolkit enables effective decision-making and efficient execution of complex procedures. By integrating both physical equipment and intellectual competencies, an armamentarium forms the foundation of competent practice, ensuring professionals can adapt to varied situations, address challenges, and deliver high-quality outcomes across medical, dental, and research environments. The global armamentarium market has expanded dramatically over the last few years due to advancements in technology, changing consumer tastes, and an increased emphasis on sustainable practices.

Additionally, the market for armamentarium is predicted to expand due to the increasing necessity for complicated surgical and dental treatments. Patients' growing desire for less invasive, cosmetic, and technologically advanced procedures is driving the need for well-stocked armamentaria in hospitals and dental offices. Moreover, in order to attract patients and conform to worldwide clinical standards, emerging economies are investing in the upgrading of healthcare facilities, including fully equipped armamentaria. Thus, the expansion in medical tourism and global healthcare development is predicted to enhance the market growth throughout the forecast period.

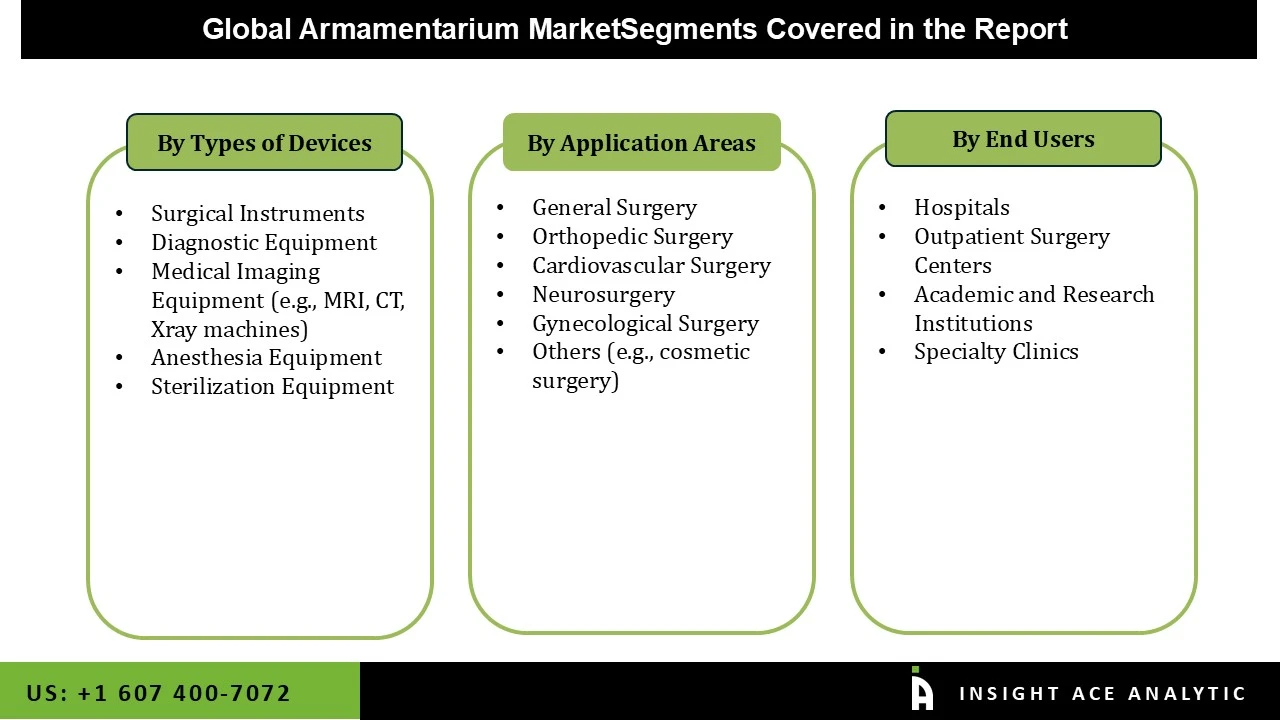

The armamentarium market is segmented by types of devices, application, and end-use. By types of devices, the market is segmented into diagnostic equipment, surgical instruments, sterilization equipment, anesthesia equipment, and medical imaging equipment (e.g., mri, ct, xray machines). By application, the market is segmented into general surgery, cardiovascular surgery, orthopedic surgery, gynecological surgery, neurosurgery, and others (e.g., cosmetic surgery). By end-use, the market is segmented into hospitals, outpatient surgery centers, specialty clinics, academic and research institutions.

In 2024, the surgical instruments segment held the largest share in the armamentarium market. It includes equipment like forceps, scissors, and scalpels that are necessary for a variety of surgical operations. These tools are becoming more sophisticated and are designed for minimally invasive techniques. The development of robotics, the use of artificial intelligence (AI) in surgical procedures, and improvements in minimally invasive techniques are all contributing factors to this increase. For instance, robotic devices are converting complicated operations into more effective and less invasive procedures, and AI-guided cameras are enabling solo surgeries with improved precision. Additionally, the increased desire for single-use equipment is addressing infection control problems and expediting sterilization methods.

Hospitals make up the largest segment, as they rely on an extensive range of medical instruments, surgical tools, and essential equipment to address diverse patient requirements from routine examinations to complex operations. To maintain precision, safety, and efficiency in diagnosis and treatment, hospitals must continually expand and modernize their armamentarium, especially with rising patient volumes driven by chronic diseases, trauma cases, and an aging population. Moreover, the growing adoption of advanced technologies such as automated instrument systems, digital diagnostic platforms, and minimally invasive surgical devices further accelerates demand as hospitals aim to improve clinical outcomes and reduce procedure times.

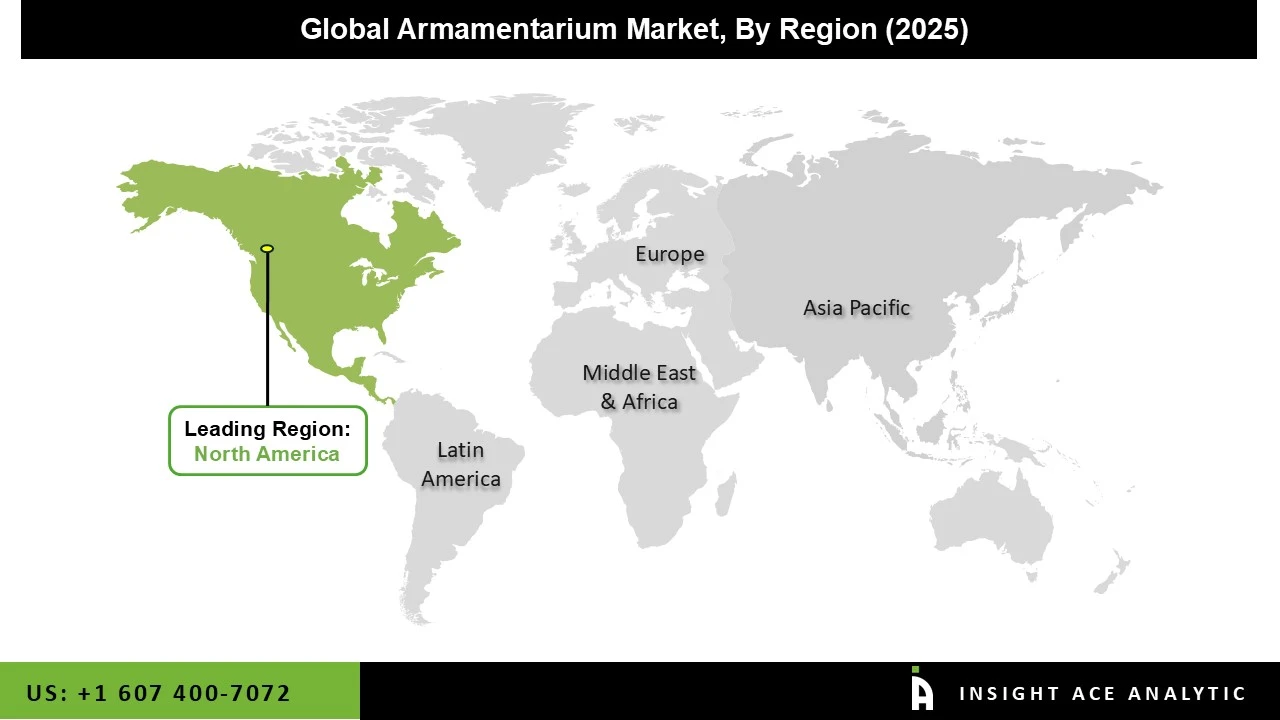

The North America region dominated the armamentarium market in 2024, driven by increases in healthcare spending and technological advancements. The development of minimally invasive surgical methods and the use of robotics and artificial intelligence (AI) in surgical procedures, which improve accuracy and reduce recovery times, are important motivators. Additionally, the region benefits from a robust healthcare infrastructure, with nearly 940 medical device manufacturing sites in the U.S., facilitating efficient production and distribution. The key businesses make strategic investments in production and R&D to propel the armamentarium market growth. Moreover, it is anticipated that large investments in U.S. production and R&D will create thousands of jobs, solidifying the region's leadership in medical technology.

Over the forecast period, the Asia Pacific is anticipated to grow at the fastest rate in the armamentarium market due to the rapid technological advancement throughout the region, growing medical infrastructure, and growing healthcare demand. Growing populations, particularly in China and India, are driving up demand for clinics, hospitals, and specialized care facilities that significantly rely on cutting-edge medical equipment. The policies that support domestic medical device production and government investment in healthcare modernization are also driving the armamentarium market expansion. Additionally, rising acceptance of minimally invasive procedures, supported by improvements in materials, sterilization technologies, and ergonomic tool design, is also propelling market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD xx Bn |

| Revenue Forecast In 2034 | USD xx Bn |

| Growth Rate CAGR | CAGR of xx% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Types of Devices, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Boston Scientific Corporation, Stryker Corporation, Smith & Nephew plc, B. Braun Melsungen AG, Olympus Corporation, Medtronic plc, Johnson & Johnson, ConMed Corporation, Abbott Laboratories, Hologic, Inc., Ethicon, Inc. , Terumo Corporation, Zimmer Biomet Holdings, Inc., Olympus Medical Systems Corporation, and Mylan N.V. / Pfizer Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.