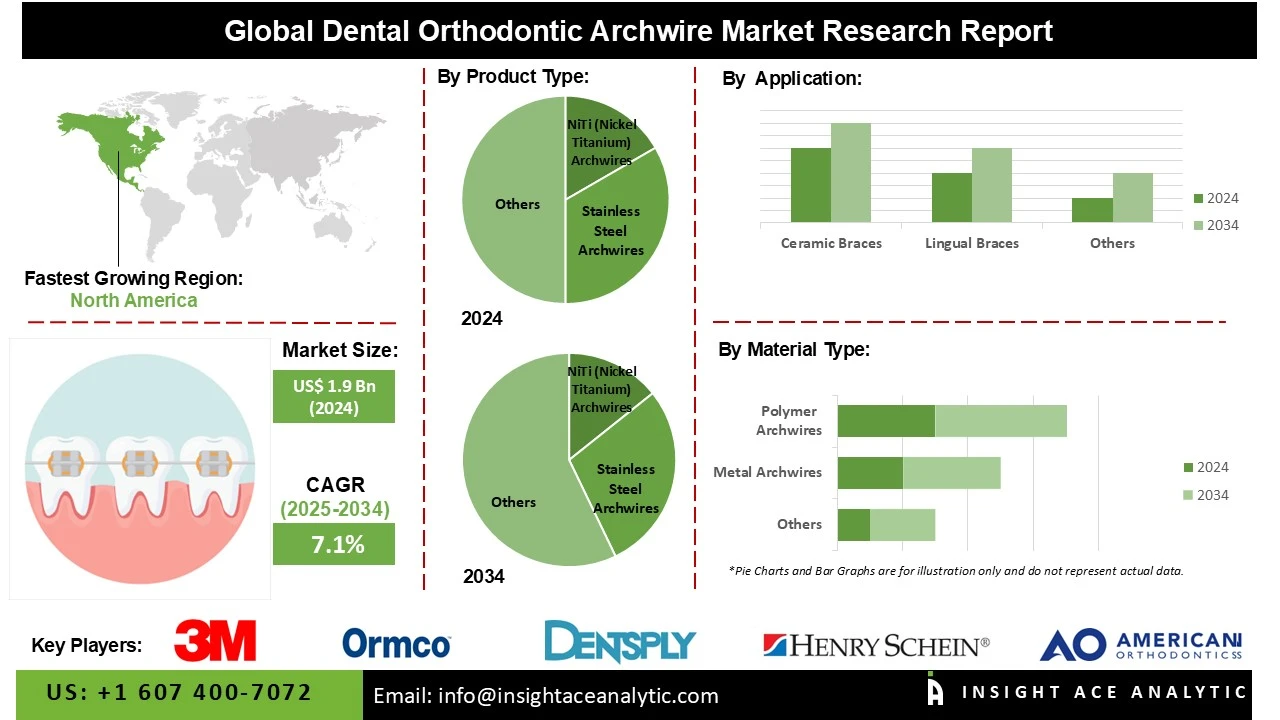

Global Dental Orthodontic Archwires Market Size is valued at US$ 1.9 Bn in 2024 and is predicted to reach US$ 3.7 Bn by the year 2034 at an 7.1% CAGR during the forecast period for 2025-2034.

Dental orthodontic archwires are the core working component of fixed braces. These thin, flexible wires connect the brackets on teeth and apply gentle, continuous force to move teeth into correct alignment over time. Available in materials like nickel-titanium (NiTi), stainless steel, and beta-titanium, they vary in shape, size, and properties (super-elastic, heat-activated, or shape-memory) to suit different treatment stages. Archwires are essential for correcting crowding, spacing, bite issues, and jaw misalignment, making them indispensable in both traditional and modern orthodontic practices worldwide.

Growing public awareness of oral health and aesthetics is the strongest driver of the orthodontic archwire market. People now better understand that straight teeth not only improve smiles but also prevent tooth decay, gum disease, and jaw problems. Social media, celebrity endorsements, dental health campaigns, and easy access to information have made orthodontic treatment desirable across all age groups. Adults, in particular, are seeking discreet and faster solutions, while parents are choosing early intervention for children. This shift in mindset is increasing patient footfall at orthodontic clinics globally and directly boosting demand for high-quality archwires.

Advancements in digital orthodontics are rapidly transforming the archwire market. Tools like 3D intraoral scanners, CBCT imaging, and CAD/CAM software enable precise treatment planning and fully customized archwire sequences. Heat-activated NiTi wires can now be robotically bent (e.g., SureSmile, Insignia) to match each patient’s exact dental anatomy, reducing treatment time by 20–30% and minimizing discomfort. AI-powered platforms predict tooth movement more accurately, allowing fewer adjustments and better outcomes. As orthodontists worldwide adopt these digital workflows, demand surges for premium, custom-manufactured archwires, driving both market revenue and continued innovation in the sector.

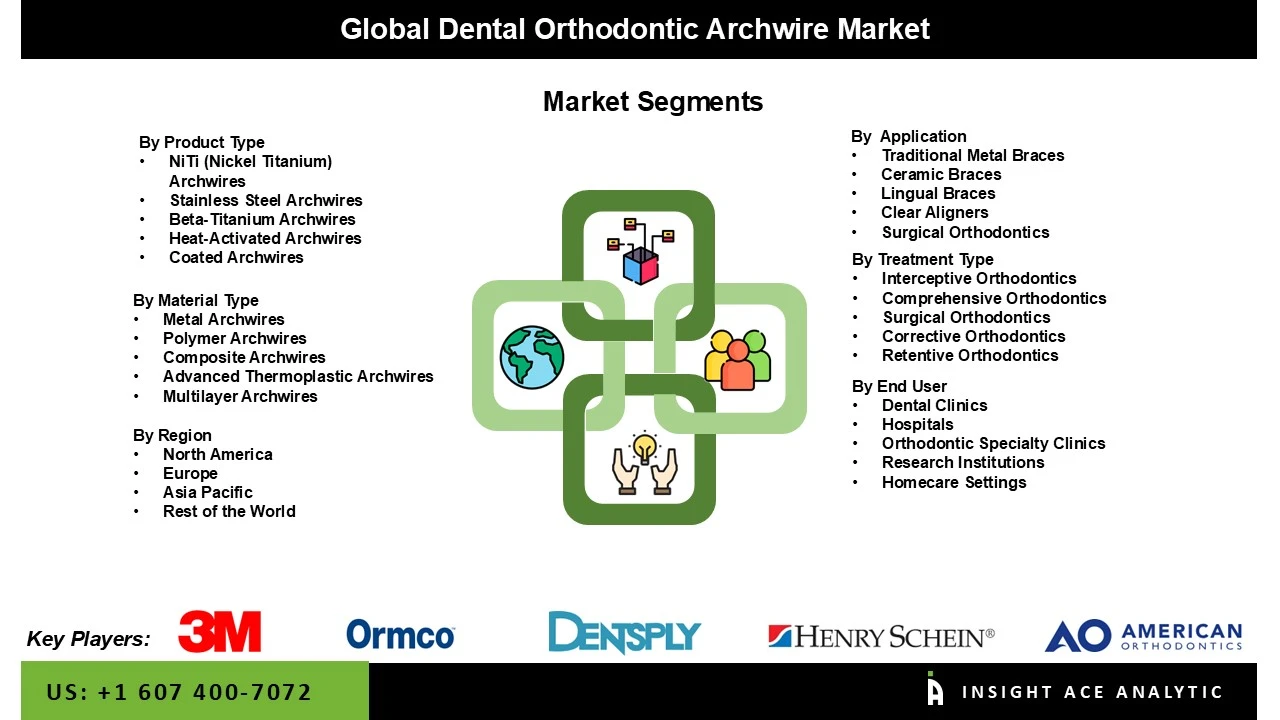

The dental orthodontic archwires market is segmented by product type, treatment type, material type, applications, end-user and by region. By product type (niti, stainless steel, beta-titanium, heat-activated, coated), treatment type (interceptive, comprehensive, surgical, corrective, retentive), material type (metal, polymer, composite, advanced thermoplastic, multilayer), application (traditional metal braces, ceramic braces, lingual braces, clear aligners, surgical orthodontics), and end-user (dental clinics, hospitals, orthodontic specialty clinics, research institutions, homecare settings).

In 2024, the nickel titanium held the major market share over the projected period. NiTi archwires deliver continuous, gentle forces, improving patient comfort and decreasing chairside adjustments compared to stainless steel. Growing demand for aesthetic, efficient orthodontic treatments and increasing cases of malocclusion fuel their utilization. Advancements in NiTi technology, such as heat-activated and superelastic variants, further expand treatment outcomes, boosting their preference among orthodontists and driving overall market expansion.

The dental orthodontic archwires market is dominated by removable orthodontics due to rising demand for removable orthodontics. Patients increasingly need clear aligners and removable braces owing to their comfort, aesthetics, and ease of oral hygiene maintenance. This trend fuels the requirement for advanced archwires compatible with hybrid and combination treatments, where removable devices are paired with fixed appliances. Additionally, technological advancements in archwire materials, including nickel-titanium and coated wires, enhance efficiency and treatment outcomes, further helping market expansion globally.

North America is the biggest market for orthodontic archwires. Many people here have crooked teeth, care a lot about their smile, and can afford treatment. Insurance often covers braces, there are plenty of orthodontists, and patients quickly get the newest wires (like super-elastic or heat-activated ones). All of this keeps North America in the top spot.

Europe is growing the fastest. More kids and adults want straighter teeth, and they are willing to pay for modern treatments. Countries like Germany, France, and the UK help cover costs, and people have more money to spend. Dentists here love the latest wires that work better and feel more comfortable. Because of these reasons, Europe’s market is expanding quickly.

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.