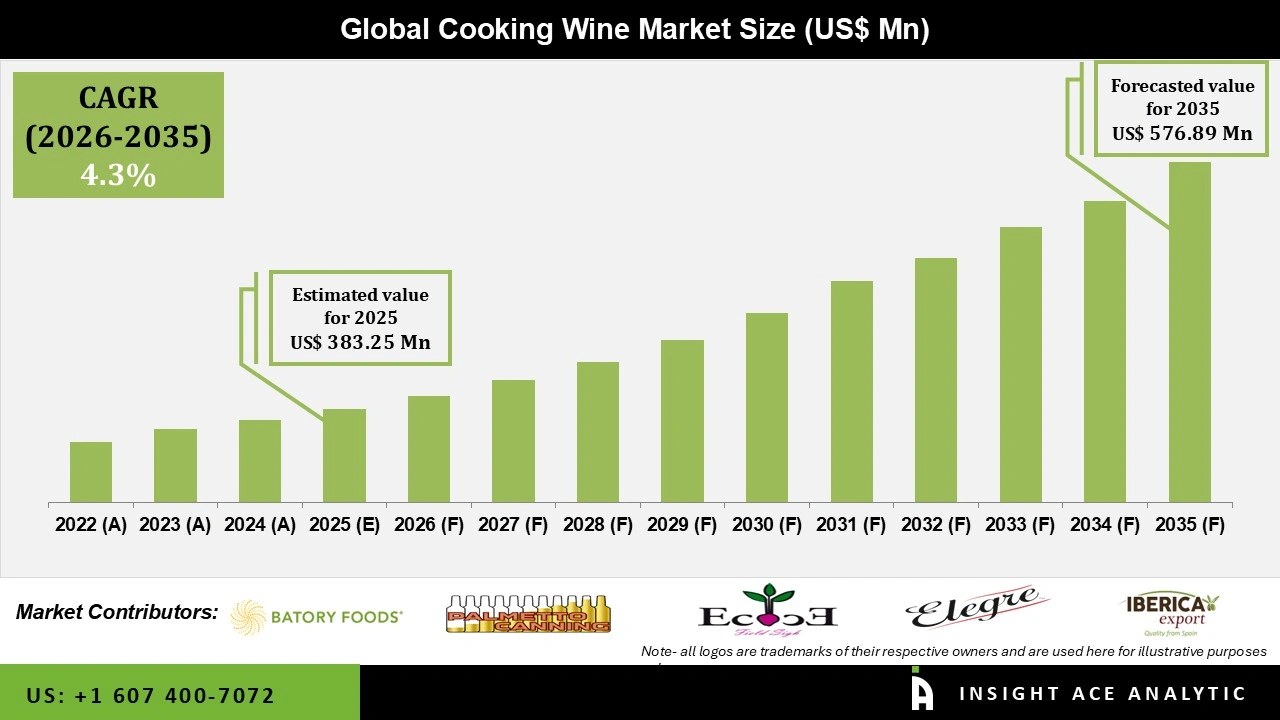

Global Cooking Wine Market Size is valued at USD 383.25 Mn in 2025 and is predicted to reach USD 576.89 Mn by the year 2035 at a 4.3% CAGR during the forecast period for 2026 to 2035.

Cooking Wine Market, Share & Trends Analysis Report, By Product (White Wine, Dessert Wine, Red Wine, Others), By Application (B2B, B2C), By Region, and Segment Forecasts, 2026 to 2035

Cooking wine differs from a typical bottle of wine, as it is designed specifically for use in cooking rather than drinking. It contains added salt and preservatives, which extend its shelf life and prevent spoilage, making it a convenient ingredient that remains usable long after being opened. These modifications also enable it to be legally sold in supermarkets, even in areas where alcohol regulations might otherwise apply.

While not suitable for sipping, cooking wine serves a variety of purposes in the kitchen. It enhances the depth of flavor in stews and braised dishes during slow cooking, adds complexity and brightness to sauces by balancing richness with acidity, and, in some cases, sweet cooking wines are used in baking to add flavor and moisture. For most home cooks, a single bottle lasts a long time, and only those managing a restaurant would need to purchase it in bulk.

The growing global focus on health and wellness has led to increased interest in low-alcohol and alcohol-free cooking wines, appealing to consumers who avoid alcohol for personal, religious, or health reasons. These alternatives offer the same depth of flavor as traditional wines without the associated effects of alcohol. Cooking wine, in general, contains higher levels of salt and preservatives like sodium and sulfites to extend shelf life after opening. Some may also include added sugars or flavorings to enhance taste, tenderize meat, or contribute rich umami and acidity to sauces.

The rise of social media through food influencers, YouTube channels, and Instagram cooking videos has made recipes, techniques, and ingredients like cooking wine more accessible and popular among home cooks. Additionally, the expanding global foodservice industry, supported by international chains and independent restaurants, continues to embrace diverse culinary techniques that incorporate wine into their menus. This has fueled demand for both domestic and imported cooking wines.

Manufacturers are now introducing a range of products tailored to home kitchens and professional dining establishments alike. While casual eateries may use inexpensive wines in bulk, upscale and specialty restaurants rely on higher-quality wines to craft sophisticated marinades, reductions, and sauces, or to deglaze pans and build complex flavor profiles.

• AAK AB

• Batory Foods

• PALMETTO CANNING

• ECOVINAL, S.L.U.

• Elegre

• Iberica Export

• Marina Foods, Inc.

• Stratas Foods

• The Kroger Co.

• Mizkan America Inc.

• Roland Foods, LLC

The Cooking Wine Market is segmented based on product and Application. Based on Product, the market is segmented into white wine, dessert wine, red wine, and others. Based on application, the market is divided into B2B and B2C.

Based on Product, the market is segmented into white wine, dessert wine, red wine, and others. Among these, the white wine segment is expected to have the highest growth rate during the forecast period. White wine is highly versatile and widely used in cooking a broad range of dishes, particularly poultry, seafood, vegetables, and creamy sauces. Its mild flavor profile allows it to blend seamlessly with other ingredients without overpowering the dish, making it a preferred choice for both home cooks and professional chefs. Additionally, white cooking wines are more commonly available in retail stores, often offered at affordable prices. Their extended shelf life, due to added preservatives, further enhances their practicality and popularity in everyday cooking.

Based on application, the market is divided into B2B and B2C. Among these, the hot and humid climate segments dominate the market. Restaurants, hotels, catering services, and food manufacturers purchase cooking wine in bulk, contributing to significantly higher sales volumes compared to individual consumers. As a staple ingredient in commercial kitchens, cooking wine is used daily in the preparation of sauces, marinades, and reductions, resulting in consistent and large-scale consumption. The continued expansion of international restaurant chains, along with the growing global trend of dining out, further drives demand within the B2B segment, solidifying its dominance in the cooking wine market.

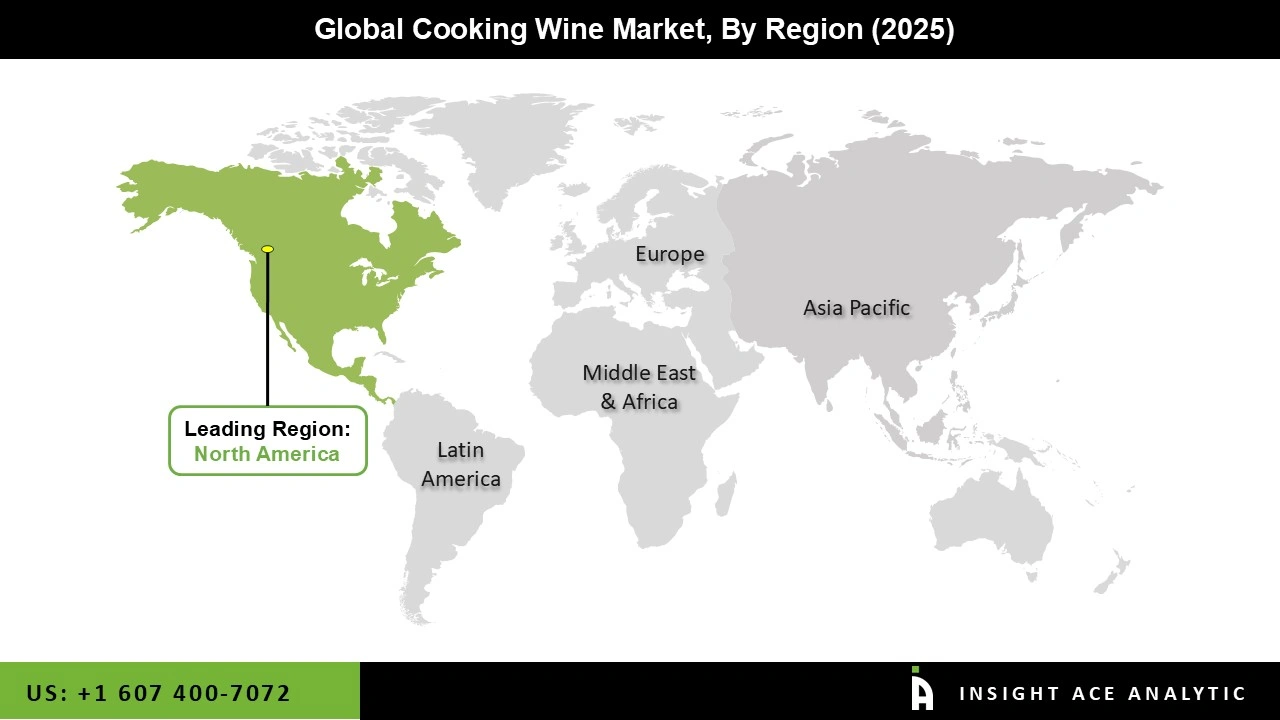

Europe currently holds the largest share of the global cooking wine market. This dominance is attributed to the region's rich culinary traditions, where wine has been a fundamental ingredient in cooking for centuries. Countries like France, Italy, and Spain are particularly influential, with their extensive use of cooking wine in various dishes.

The European market's established demand and cultural integration of wine in cuisine contribute to its leading position in the global cooking wine market. Another significant market factor that has influenced the cooking technique with wine is the regional customers' move toward better eating habits. As customers become increasingly picky about the ingredients they use in their cooking, the demand for high-end cooking wines among affluent groups also helps to expand the regional market.

• In October 2024, AAK declared that it was selling its foodservice plant in New Jersey, USA, and that it had reached an agreement with Stratas Foods to do so. AAK's long-term plan to streamline its operations in the Foodservice division, which produces over 300 specialized goods such sauces, dressings, condiments, frying oils, cooking wines, and supplies, includes this breakthrough. In order to increase its footprint in the UK and the Nordic region, the business also announced plans to make large investments in its European Foodservice sector.

• In June 2023, Batory Foods declared the purchase of Tri-State Companies, a well-known Ohio-based food ingredient wholesaler and logistics company. In the Midwest, Northeast, and Southeast regions of the United States, Batory's services have been strengthened with the addition of Tri-State's 100,000-square-foot, multi-temperature zone distribution center.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 383.25 Mn |

| Revenue Forecast In 2035 | USD 576.89 Mn |

| Growth Rate CAGR | CAGR of 4.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, And End-User. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | AAK AB, Batory Foods, PALMETTO CANNING, ECOVINAL, S.L.U., Elegre, Iberica Export, Marina Foods, Inc., Stratas Foods, The Kroger Co., Mizkan America Inc, Roland Foods, LLC |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• White Wine

• Dessert Wine

• Red Wine

• Others

• B2B

• B2C

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.