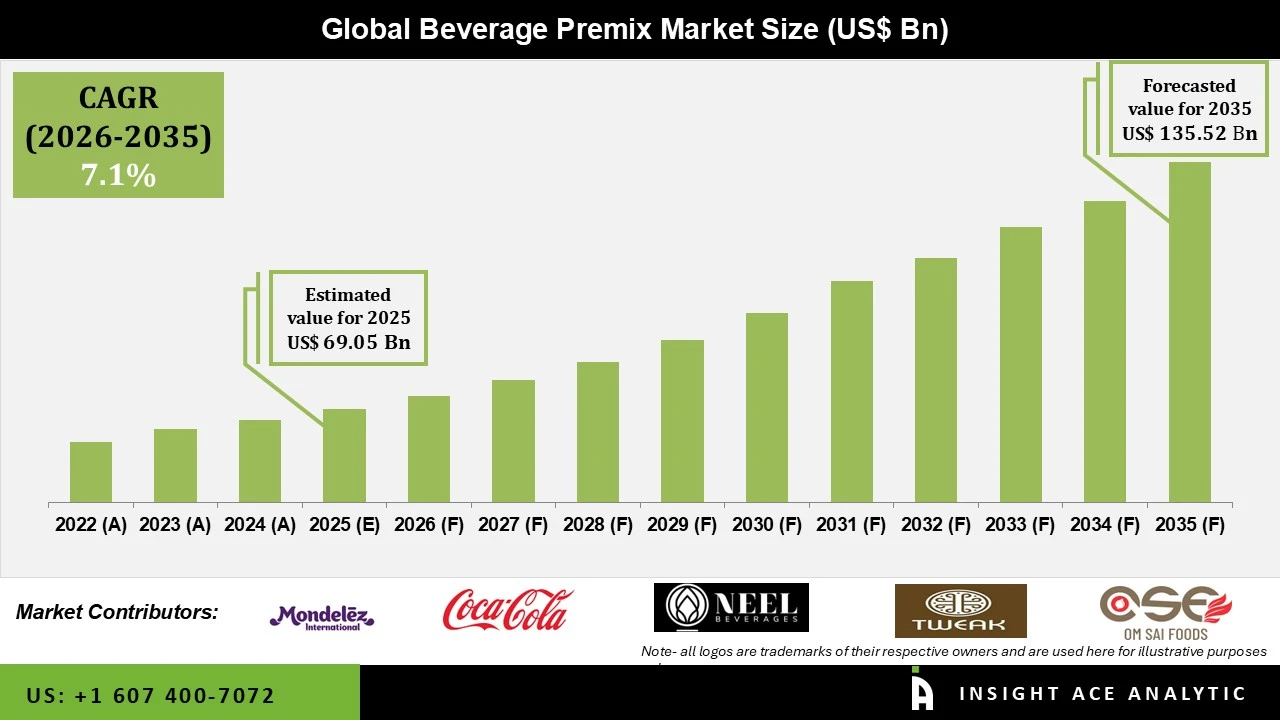

Beverage Premix Market Size is valued at USD 69.05 Billion in 2025 and is predicted to reach USD 135.52 Billion by the year 2035 at a 7.1% CAGR during the forecast period for 2026 to 2035

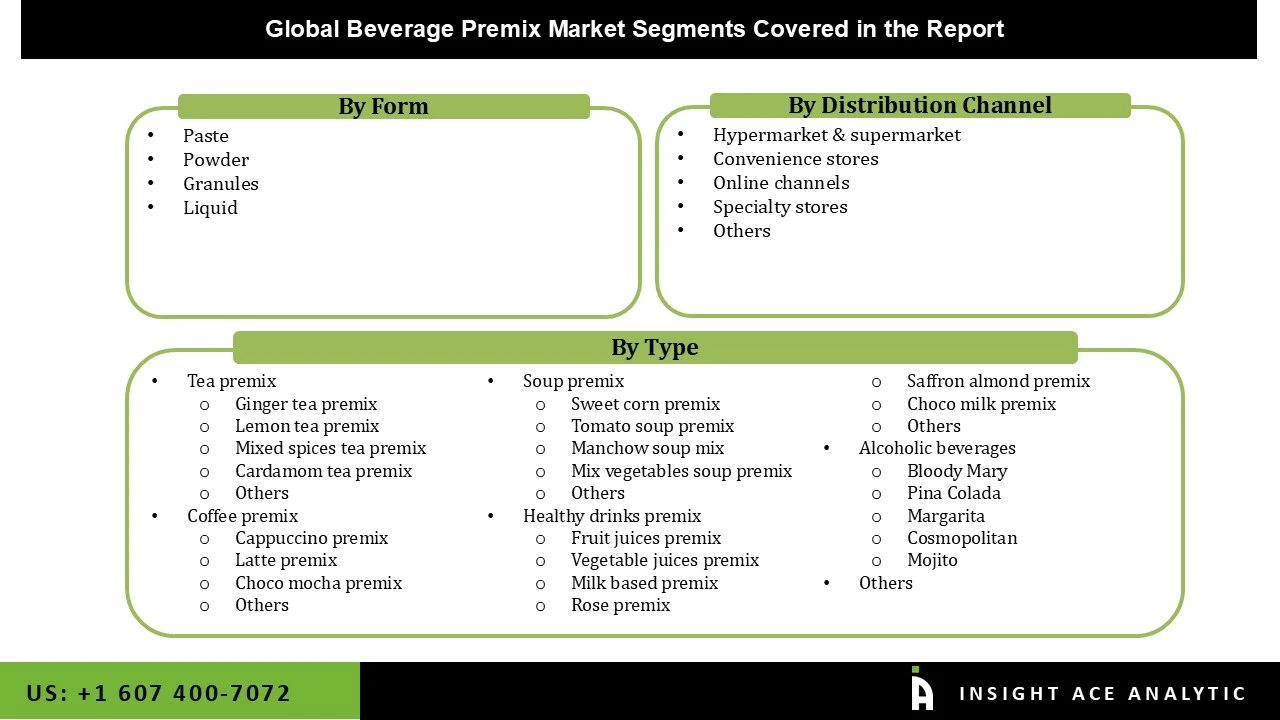

Beverage Premix Market Size, Share & Trends Analysis Report By Form (Paste, Powder, Granules, Liquid), By Type (Tea Premix, Coffee Premix, Soup Premix, milk-Based Premix, Others), By Distribution Channel, By Region, And by Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Premixed beverages are gaining popularity among fitness enthusiasts because they save time creating energy drinks from scratch. People are becoming more health concerned and drinking more beverages like protein shakes and energy drinks. One of the primary drivers cited is rising consumer health consciousness, predicted to stimulate demand for instant beverage premix in developing countries.

The growing working population and increasing demand for handy drinks will likely fuel market expansion. Furthermore, convenient packaging and long shelf life are two additional elements that are likely to drive growth. Factors such as rising disposable income, a hectic lifestyle, and a demanding work schedule are projected to fuel demand for instant beverage premix over the projection period. Customers are increasingly inclined to consume health-oriented beverages, such as instant premix, considered necessary items.

The market is expected to rise significantly in the following years due to increased demand for ready-to-drink beverages from business spaces and airports, among other places. Additionally, the rising availability of various nutrition drink premixes and the growing health consciousness among consumers are factors pushing individuals to drink at home rather than in restaurants and cafés. This aspect is expected to boost product demand shortly.

The beverage premix market is segmented on the form, type and distribution channel. Based on form, the market is segmented into paste, powder, granule and liquid. Based on type, the beverage premix market is segmented into tea premix (ginger tea premix, lemon tea premix, mixed spices tea premix, cardamom tea premix, others), coffee premix (cappuccino premix, latte premix, choco mocha premix, others), soup premix (sweet corn premix, tomato soup premix, man chow soup mix, mix vegetables soup premix, others), healthy drinks (premix, fruit juices premix, vegetable juices premix, milk-based premix, rose premix, saffron almond premix, choco milk premix, others), alcoholic beverage (bloody mary, pina colada, margarita, cosmopolitan, mojito, others) and others. Based on distribution channels, the market is segmented into hypermarkets & supermarkets, convenience stores, online channels, speciality stores and others.

The paste segment is anticipated to hold the highest share of the market during the forecast period. Beverage premix pastes are more convenient to store and use and have a longer shelf life, and many clients are learning about the advantages of using these pastes. Instant coffee manufacturers, for example, have drawn inspiration from Algona coffee to create instant coffee pastes. This combination will save customers time when preparing coffee from scratch while simultaneously providing them with the benefits of instant coffee.

Coffee premix grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the expected time. Because they contain caffeine and have an enticing taste and aromatizing aroma, instant coffee premixes are widely used in corporate cafeterias and Quick Service Restaurants (QSR). Because of the increased use of instant coffee premixes in corporate settings, the instant coffee premix category has become one of the most appealing investment prospects.

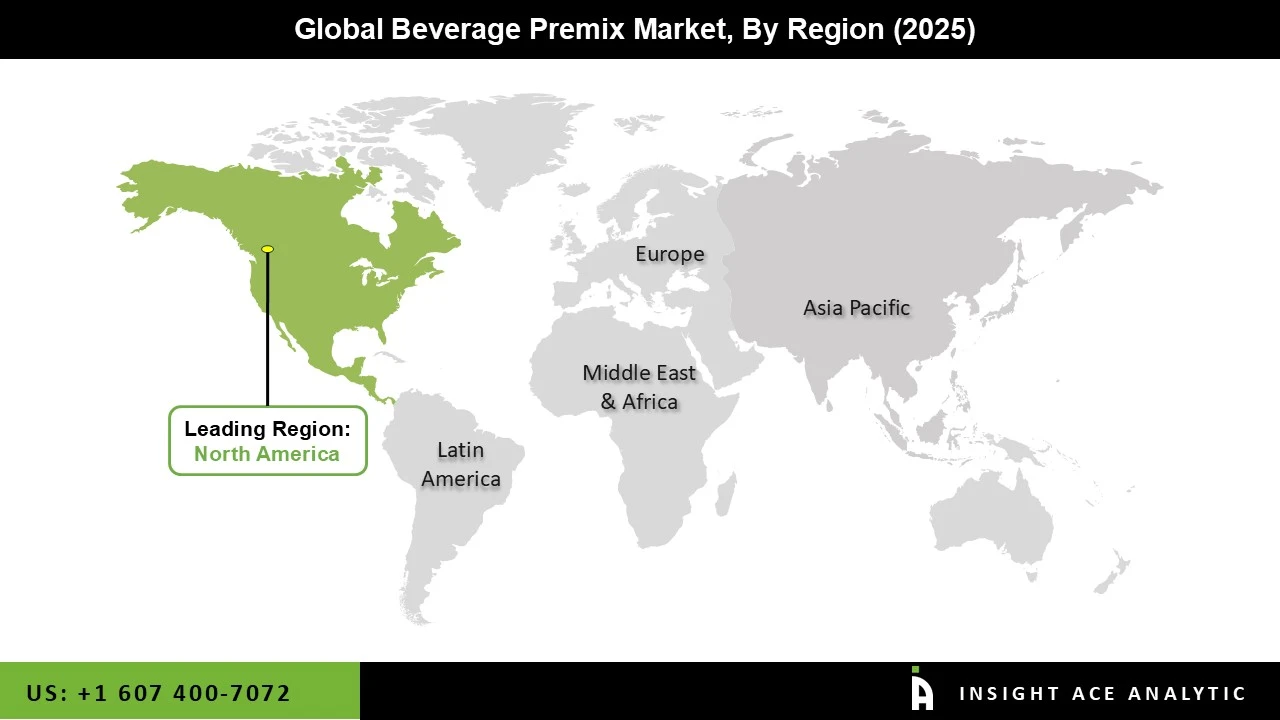

The North American beverage premix market is expected to register the highest market share in revenue soon. The United States is the leading revenue contributor in the region. The widespread presence of corporate offices and the increasing need for instant beverage premixes from corporate cafeterias are the primary drivers of product demand in North American countries. In addition, Asia Pacific is projected to grow rapidly in the global beverage premix market. Because of the growing popularity of millennials in developing economies such as China and India To be competitive, businesses are focused on R&D investments to retain taste and extend the shelf life of their products. Over the projected period, these factors are expected to broaden the scope of expansion for the instant beverage premix market.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 69.05 Billion |

| Revenue forecast in 2035 | USD 135.52 Billion |

| Growth rate CAGR | CAGR of 7.1% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Form, Type, Distributioin Channel |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Mondelez International, Inc., The Coca-Cola Co., Panama Foods, Neel Beverages Pvt Ltd., Tweak Beverages, Om Sai Foods, Ito En Inc., Nestlé, Unilever, Wagh Bakri, CCL Products Ltd, Girnar, and many others. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Form

By Type

By Distribution Channel

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.