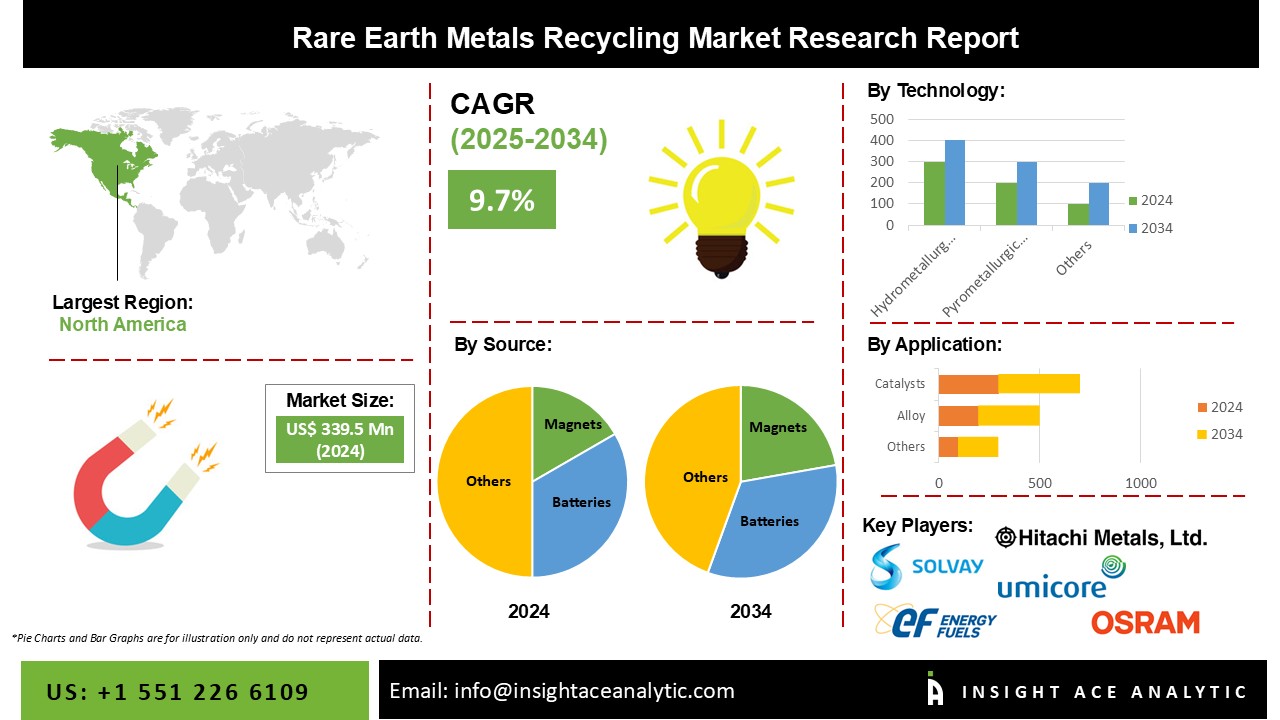

Rare Earth Metals Recycling Market Size is valued at 339.5 million in 2024 and is predicted to reach 847.1 million by the year 2034 at a 9.7% CAGR during the forecast period for 2025-2034.

Mining is the method used to obtain rare earth metals. However, mining has several drawbacks, including being expensive and inefficient because it takes a lot of lands to remove even a little amount of rare earth metals. Additionally, the extraction process creates a significant amount of radioactive and hazardous waste, which negatively influences the environment.

Due to the increased demand for rare earth metals in products like smartphones, electric vehicles, wind turbines, laptops, and others, the global market for rare earth recycling is anticipated to experience rapid expansion over the review period. The environmental and financial problems related to mining rare-earth metals are the main factors driving the recycling business.

Rare earth substance recycling market growth is anticipated to increase with the widespread adoption of e-waste recycling. Growing adoption of bio-based packaging materials owing to their non-toxic nature, the requirement for less raw material for production, low production cost, and easy disposal is expected to drive the global Rare earth metals recycling market expansion.

A combination of economic, environmental, and regulatory factors is driving the growth of the rare earth metals recycling market. As the demand for these metals continues to grow and concerns about primary resource availability and environmental impacts increase, the importance of recycling as a solution will only become more apparent.

However, while the rare earth metals recycling market progress presents significant opportunities, it also faces several challenges that must be addressed to ensure its growth and sustainability. The challenges will require collaboration between governments, industry, and other stakeholders.

The Rare earth metals recycling market is segmented based on application, source and technology. The market is segmented into alloy, catalyst, permanent magnets, glass, ceramics, phosphor, polishing materials and hydrogen storage alloys based on application. Based on source, the market is segmented into FCC, Fluorescent lamps, Magnets, Batteries and Industrial processes. Based on the technology, the market is segmented into Hydrometallurgical and Pyrometallurgical.

the permanent magnet segment is anticipated to dominate the rare earth metals recycling market. Permanent magnets are widely used in many applications, including electric motors, wind turbines, hard disk drives, and speakers. The demand for permanent magnets is expected to continue to grow due to their use in many high-tech products. Recycling end-of-life products allows rare earth metals to be extracted and reused in producing new magnets, reducing reliance on primary sources. In addition, the growing demand for electric vehicles (EVs) and renewable energy technologies such as wind and solar power is expected to drive the growth of the permanent magnet market.

EVs use permanent magnets in their electric motors, and wind turbines use them in their generators. As the adoption of EVs and renewable energy technologies continues to increase, the demand for permanent magnets is expected to grow, driving the demand for recycled rare earth metals. Overall, the permanent magnet segment is anticipated to dominate the rare earth metals recycling market due to the growing demand for permanent magnets in high-tech applications and the increasing need to reduce the reliance on primary sources of rare earth metals.

The pyrometallurgical technology segment is expected to dominate the rare earth metals recycling market. Pyrometallurgical methods involve high-temperature processing of end-of-life products to extract rare earth metals. Several reasons why pyrometallurgical technology is expected to dominate the rare earth metals recycling market. Pyrometallurgical methods are highly efficient and can recover a high percentage of rare earth metals in end-of-life products. They can also process many feedstocks, including complex materials such as magnets and batteries. Pyrometallurgical methods typically require lower capital costs than hydrometallurgical methods. They also have lower operational costs, requiring less energy and fewer chemicals to extract rare earth metals.

Pyrometallurgical methods can be easily adapted to different feedstocks and produce a range of rare earth metal products. This flexibility makes them well-suited to processing end-of-life products, which can vary in composition. Pyrometallurgical methods are highly scalable and can process large volumes of end-of-life products. This is important as the number of end-of-life products containing rare earth metals is expected to increase in the coming years.

The Asia Pacific rare earth metals recycling market is expected to register the highest market share in revenue shortly. This can be attributed to APAC's government's increasingly recognizing the importance of recycling rare earth metals and implementing regulations and initiatives to promote the recycling of end-of-life products. APAC is home to several major players in the rare earth metals recycling market, such as China Minmetals Corporation, Ganzhou Qiandong Rare Earth Group Co., Ltd., and Japan Metals & Chemicals Co., Ltd. These companies have significant expertise in rare earth metals recycling and are driving rare earth metals recycling market demand in APAC.

Overall, APAC is anticipated to dominate the rare earth metals recycling market due to the high demand for rare earth metals, high generation of end-of-life products, government regulations and initiatives, and the presence of major players in the market.

Besides, the expansion of industrial players in countries such as Germany and the UK is to blame for the expansion of the European market. Over the upcoming years, high-level research and development operations across these countries will be projected to continuously develop new products, paving the way for moderate market expansions in the rare earth recycling industry.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 339.5 Mn |

| Revenue forecast in 2031 | USD 847.1 Mn |

| Growth rate CAGR | CAGR of 9.7% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Application, Source And Technology |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Solvay SA, Hitachi Metals, Ltd, Umicore, Osram Licht AG, Energy Fuels, Inc, Global Tungsten & Powders Corp and REEcycle Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Rare Earth Metals Recycling Market By Application-

Rare Earth Metals Recycling Market By Source

Rare Earth Metals Recycling Market By Technology

Rare Earth Metals Recycling Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.