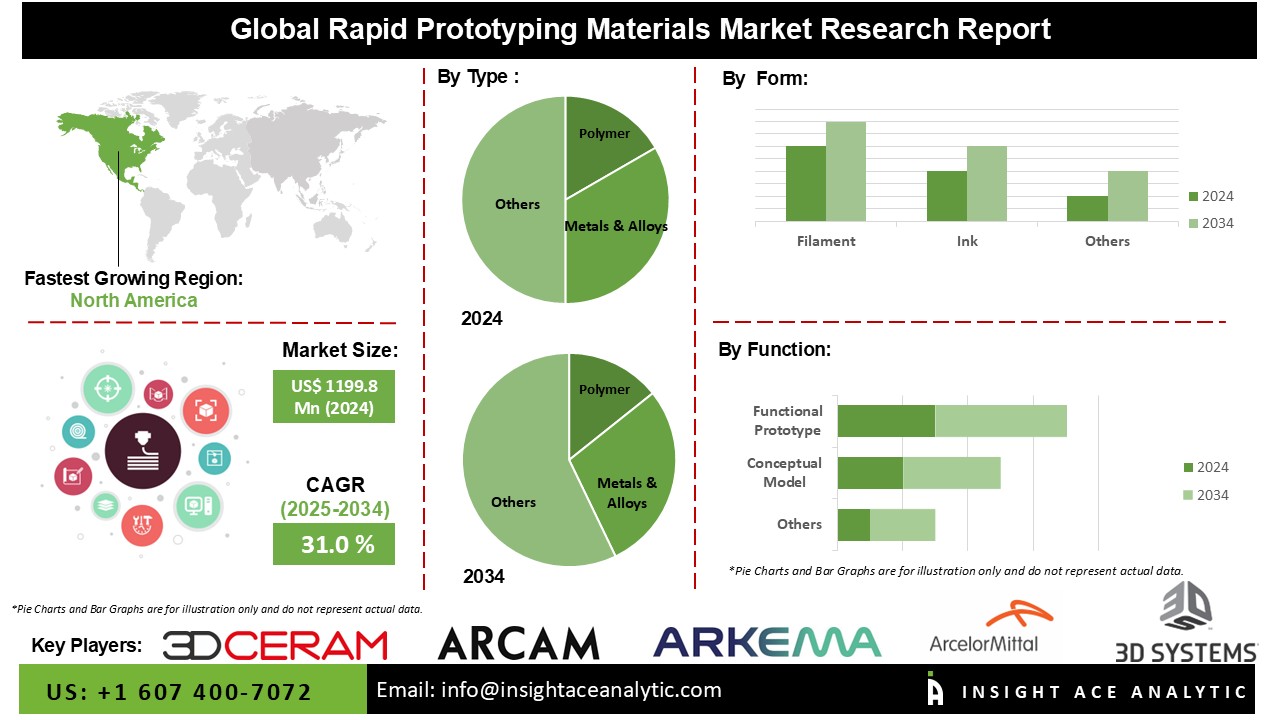

Rapid Prototyping Materials Market Size is valued at 1,199.8 million in 2024 and is predicted to reach 17,689.7 million by the year 2034 at a 31.0% CAGR during the forecast period for 2025-2034

Key Industry Insights & Findings from the Report:

Prototypes and low-volume manufacturing parts are made using 3D printing techniques called rapid prototyping (RP). Rapid prototyping materials are in high demand, and this growth is unparalleled. This increase is being driven by innovation and how quickly the corporate environment is changing.

More businesses are using rapid prototyping technologies as a result of the demand for quicker turnaround times and innovative product development. Prior to going into full production, businesses can swiftly produce prototypes and test them owing to rapid prototyping. Lowering the possibility of mistakes and delays helps to save time and money. It helps to quickly design and create complex designs and test them before moving into the production phase.

The market for materials for rapid prototyping is expanding due to the rising popularity of 3D printing. Businesses can swiftly generate finished items and prototypes using a number of various materials owing to 3D printing technology. Businesses benefit greatly from this flexibility when it comes to creating new products or enhancing old ones. Rising demand for products designed using 3D printing technology from numerous end-use industries is driving rapid prototyping materials market expansion.

The rapid prototyping materials market is segmented into type, form, function and end-use. On the basis of type, the market is divided into Polymer, metals & alloys, ceramics, and others. Based on form, the market is categorized into Filament, Ink, and Powder. Based on function, the market is categorized into Conceptual Model, Functional Prototype. On the basis of end-use, the market is segmented as aerospace & defense, healthcare, manufacturing & construction, consumer goods & electronics, transportation, and others.

The manufacturing and construction industries are projected to grow at a higher rate amongst all. The market for rapid prototyping materials is predicted to rise over the forecast period due to the expanding manufacturing and construction industries in developing nations as a result of rising industrial manufacturing and quick infrastructure development. Because of the rise of the automotive and transportation sectors, there will likely be an increase in demand for steel and aluminum.

The market is divided into Polymer, metal & alloys, ceramics, and others based on material. Due to their wide range of characteristics, including great strength, functionality, and durability, Polymer are the most widely used prototyping materials. Polymer are more affordable and come in a wide variety. Polymer including PA, PE, PEEK, ABS, PC, and PET have all been utilized to create prototypes. Polymer are the main material utilized for rapid prototyping as a result of rising demand.

Rapid prototyping materials market demand is expected to have a rapidly expanding market in the Asia Pacific area. The escalating significance of prototyping in the automobile industry will likely contribute significantly to regional growth in the foreseeable future. The government and defense sectors are also being encouraged to adopt products by increased government investment and favorable policies. Besides, North America is anticipated to grow at a significant rate over the forecast period because there are more service providers in the area and more developed 3D printing technology. In terms of all the major end-use industries, the United States is the top consumer of rapid prototyping technologies. The primary factors driving the market's growth are the advanced industrial sector and rapid urbanisation.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 1,199.8 Mn |

| Revenue forecast in 2034 | USD 17,689.7 Mn |

| Growth rate CAGR | CAGR of 31.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume (Tons), and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Form, Function and End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | 3D Systems Corporation; EOS GmbH (Electro-Optical Systems); Renishaw Plc; Stratasys Ltd.; Carpenter Technology Corporation; Arcam AB, Sandvik AB, LPW Technology Ltd., GKN PLC, Höganäs AB |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Rapid Prototyping Materials Market By Type outlook-

Rapid Prototyping Materials Market By Form outlook-

Rapid Prototyping Materials Market By Function outlook-

Rapid Prototyping Materials Market By End-use outlook-

Rapid Prototyping Materials Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.