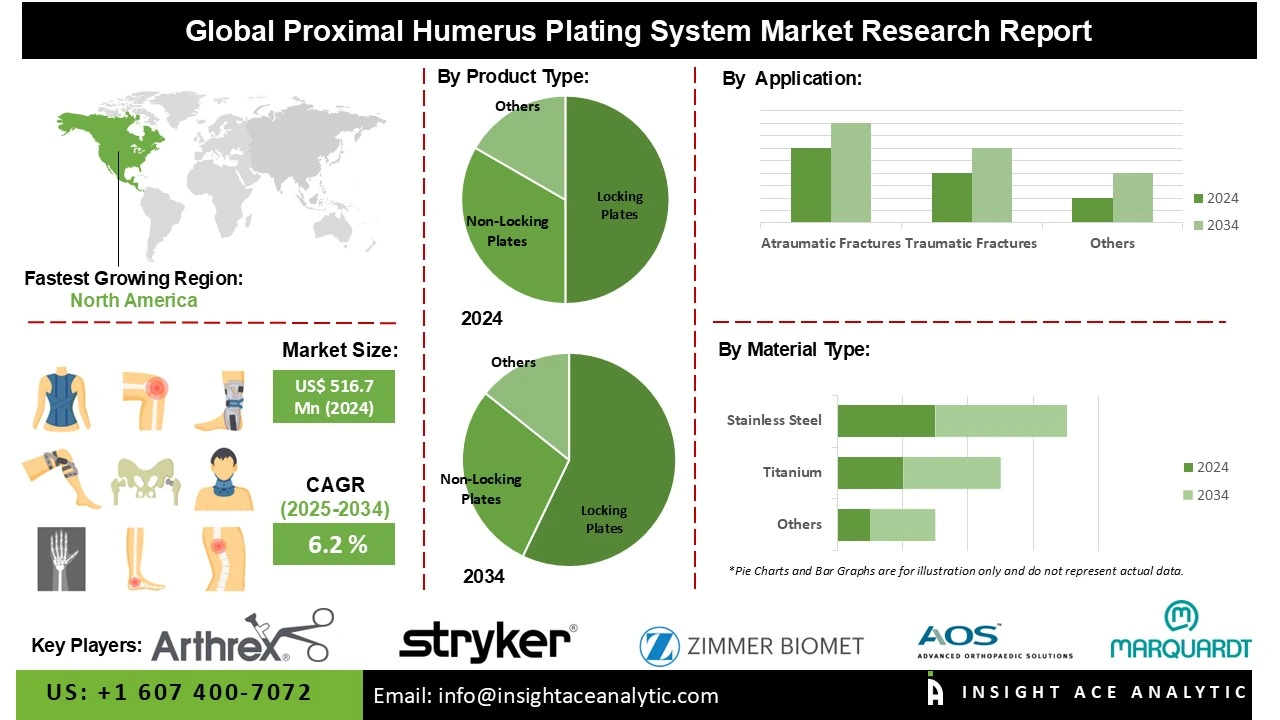

Global Proximal Humerus Plating System Market Size is valued at US$ 516.7 Mn in 2024 and is predicted to reach US$ 924.6 Mn by the year 2034 at an 6.2% CAGR during the forecast period for 2025-2034.

Proximal humerus plating systems are sophisticated tools that have significantly improved the surgical treatment of complex shoulder fractures. Their evolution towards locked, anatomic designs with multiple fixation options has provided surgeons with the means to achieve stable fixation even in challenging cases, ultimately aiming to restore better shoulder function for patients.

The proximal humerus plating system market is growing due to the increasing prevalence of fractures, particularly in elderly adults with osteoporosis and those engaged in sports or high-impact activities. These technologies facilitate efficient stabilization, enabling expedited recovery and enhanced functional outcomes. The rise in traffic accidents and workplace injuries exacerbates fracture occurrences, hence increasing demand. Advances in plating technology, including anatomically contoured plates and minimally invasive techniques, expand surgical precision and decrease complications. Growing healthcare infrastructure, higher patient awareness, and emphasis on improving post-surgical mobility also fuel market adoption globally.

The proximal humerus plating system market is expanding as orthopaedic treatments increasingly shift toward minimally invasive surgical techniques. These systems deliver improved fixation, reduced soft tissue damage, and faster recovery compared to traditional open surgeries. Increasing cases of fractures due to ageing populations, osteoporosis, and sports injuries are fueling demand. Minimally invasive plating systems also reduce post-operative complications, hospital stays, and rehabilitation time, making them highly preferred by both surgeons and patients. Continuous advancements in plate design and materials further help adoption, driving steady market growth globally.

Some of the Key Players in the Proximal Humerus Plating System Market:

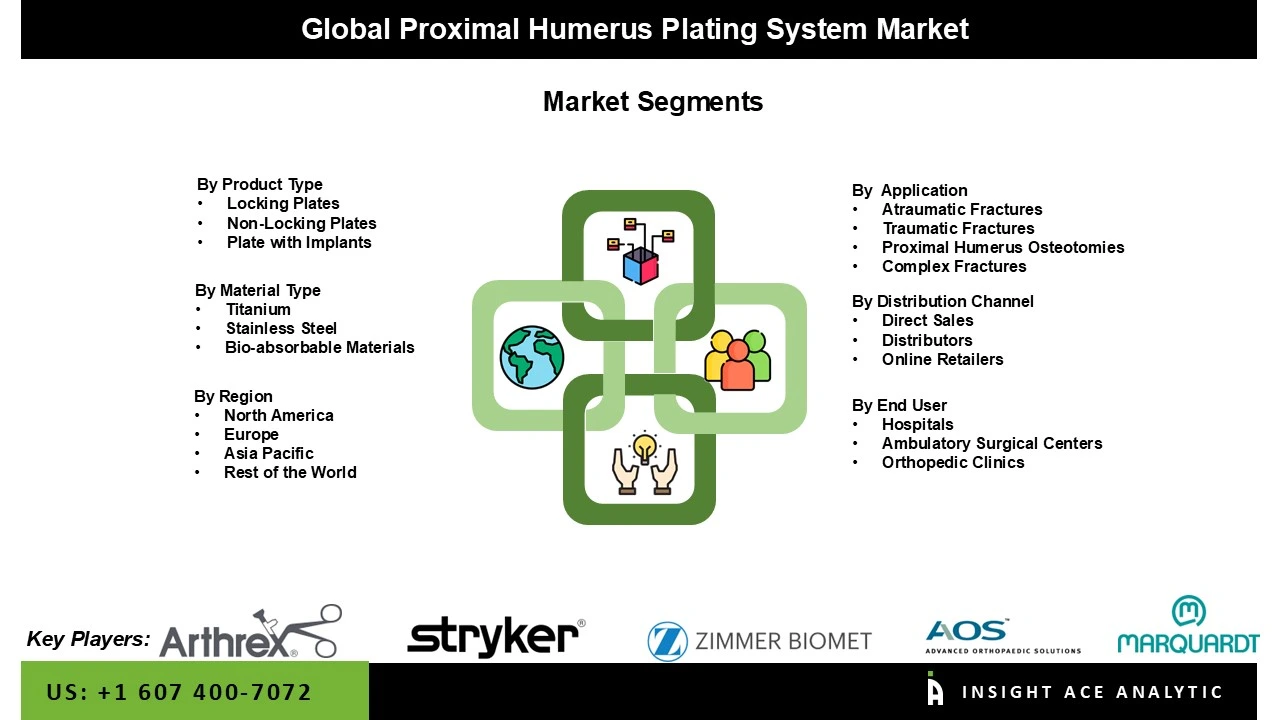

The proximal humerus plating system market is segmented by product type, material type, distribution channel, application type, and end-user. By product type, the market is segmented into locking plates, non-locking plates, and plates with implants. By material type, the market is segmented into titanium, stainless steel, and bioabsorbable materials. By application type, the market is segmented into atraumatic fractures, traumatic fractures, proximal humerus osteotomies, and complex fractures. By distribution channel comprises direct sales, distributors, and online retailers. By end-user, the market is segmented into hospitals, ambulatory surgical centres, and orthopaedic clinics.

In 2024, durability, cost-effectiveness, and widespread availability of stainless-steel proximal humerus plating drive the stainless-steel segment and expand market growth. Stainless steel offers strong fixation and biocompatibility, making it suitable for fracture stabilisation in orthopaedic surgeries. The increasing prevalence of osteoporosis and trauma-induced fractures, especially in the senior demographic, is propelling demand. Furthermore, advancements in plating system designs and increased adoption of surgical interventions contribute to the market’s expansion.

The proximal humerus plating system market is dominated by complex fractures due to the rising incidence of complex fractures caused by osteoporosis, road accidents, and sports injuries. Complex proximal humerus fractures often require stable fixation to restore shoulder function, making plating systems a preferred choice for treatment. Advanced implant design, including anatomically contoured plates and locking screw technology, contributes to superior surgical results and reduced complications. A growing geriatric population, rising surgical intervention rates, and growing awareness about advanced orthopaedic solutions are driving demand for these systems globally.

North America dominates the market for proximal humerus plating systems due to the region’s rising incidence of fractures caused by road accidents, sports injuries, and age-related osteoporosis. The increasing number of elderly people, particularly in the U.S., makes them vulnerable to bone fragility and complicated fractures, thereby driving demand for advanced fixation systems. The evolving technology in plating systems, such as anatomically shaped configurations and minimally invasive surgical procedures, is improving patient success rates. Better healthcare infrastructure and favourable reimbursement policies also favour regional market growth.

Europe is the second-largest market for proximal humerus plating systems. This is due to the increasing prevalence of osteoporosis and fractures of old age, especially among the ageing population. Greater involvement in sports and outdoor recreation also leads to greater trauma cases, which encourages the demand for sophisticated fixation systems. Advances in plating systems, including minimally invasive technology and better biocompatibility, improve the outcomes of surgery and recovery rates. Increased healthcare infrastructure, supporting reimbursement policies, and increased awareness among surgeons of new orthopaedic solutions also drive market growth in the regions.

Proximal Humerus Plating System Market by Product Type-

· Locking Plates

· Non-Locking Plates

· Plate with Implants

Proximal Humerus Plating System Market by Material Type -

· Titanium

· Stainless Steel

· Bio-absorbable Materials

Proximal Humerus Plating System Market by Application Type-

· Atraumatic Fractures

· Traumatic Fractures

· Proximal Humerus Osteotomies

· Complex Fractures

Proximal Humerus Plating System Market by End-User-

· Hospitals

· Ambulatory Surgical Centers

· Orthopedic Clinics

Proximal Humerus Plating System Market by Distribution Channel-

· Direct Sales

· Distributors

· Online Retailers

Proximal Humerus Plating System Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.