The Global Precious And Base Metals Market Size is valued at 915.4 billion in 2023 and is predicted to reach 2300.9 billion by the year 2031 at an 12.34% CAGR during the forecast period for 2024-2031.

Base metals, such as copper or zinc, are fundamental metals used in industry or manufacturing. Copper, one of the essential metals, has grown in importance in recent years worldwide and regionally. Whereas Excellent electrical conductors include precious metals. They are utilized in the wiring of electrical equipment as a result. They have high melting points and are resistant to rust and corrosion. They are valued because of their great demand and uncommon traits. The business is driven by an increase in weddings where jewelry is regularly worn and a growth in young people's preference for plated jewelry. The market is expanding due to changing consumer preferences and rising disposable income.

Key Industry Insights & Findings from the report:

The economic effects of COVID-19 and the resulting sharply increased government spending are causing inflation to reappear in the majority of countries throughout the world. This has increased demand for and investment in precious and base metals because of the uncertain economic future that COVID-19 is causing. The market's anticipated expansion is being encouraged by the rise in precious metals trading activity.

Moreover, popular market organizations across a range of industrial verticals are investing in the regeneration of precious metals that can be used to produce heart defibrillators and artificial cochlea because of increasing environmental concerns. Because these metals are used to clean automobile exhaust fumes, governments in many nations enact strict emission rules, assisting market expansion. These variables are anticipated to contribute to growth during the predicted period. Additionally, mining process challenges may also impact the market's production rate. The total expansion of base metals and mining during the foreseeable period may need to be improved by these market difficulties.

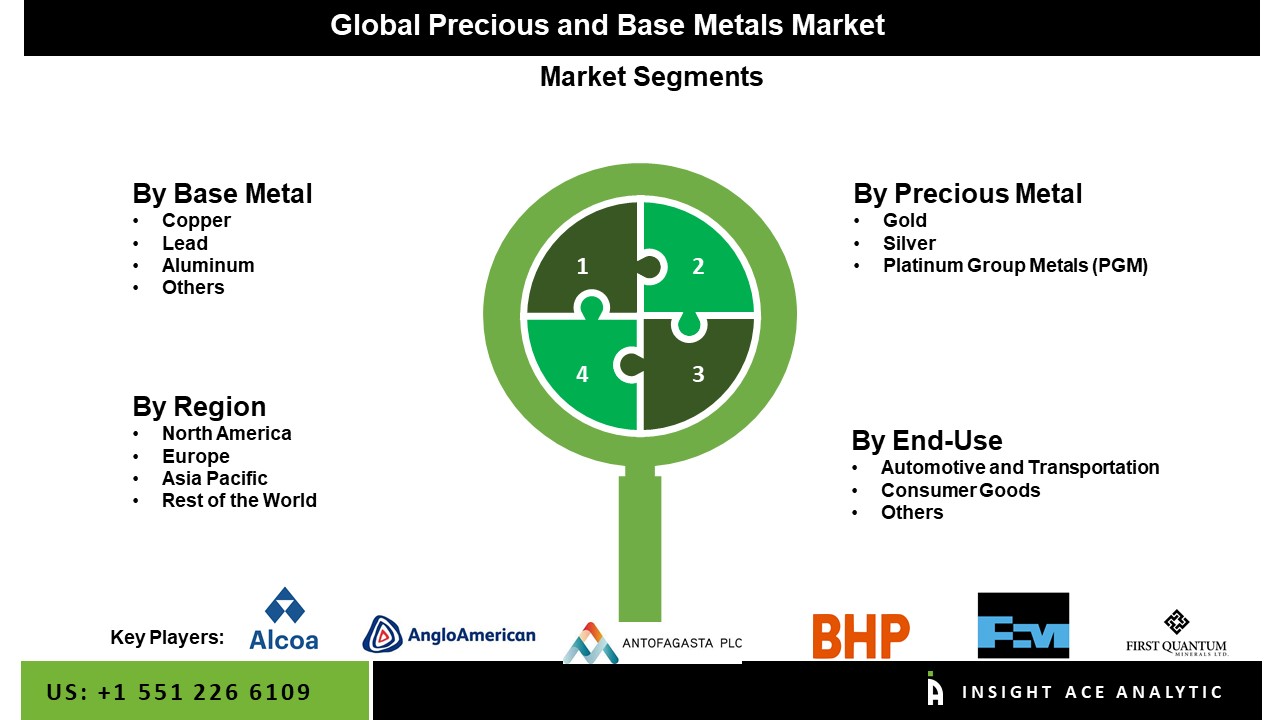

The precious and base metals market is segmented based on base metals, precious metals and applications. Based on base metals, the market is segmented as copper, lead, aluminum and other. The market is segmented by precious metals: gold, silver and PGM. Based on applications, the market is segmented as automotive and transportation, consumer goods and others.

The silver category is expected to hold a significant share of the global precious and base metals market in 2021. Due to its widespread use in the manufacturing and jewellery sectors and its low cost in comparison to its competitors, silver is predicted to dominate the market over the projection period. It is anticipated that Mexico and Peru will continue to be the principal silver commodity production centres. The Silver segment is growing as a result of numerous factors. However, the manufacturing and use of large quantities of cutlery, ornaments, and items used in chemical departments have always sparked interest in the market. The silver segment also deals with electronic devices and solar photovoltaic panels, using silver in some of these applications for insulation and conductivity. The rise of the silver market has been aided by the expanding use of oxide batteries that contain silver components.

The copper segment is projected to proliferate in the global precious and base metals market. The market is quickly developing as a result of the demand for copper. Compared to other base metals, copper is in prominent demand. In addition, this metal is expensive compared to others. There will be considerable demand for these natural resources in the coming years. The market will have tremendous growth potential due to the expansion of copper metals., especially in countries such as the US, Germany, the UK, China, and India.

The North American precious and base metals market holds a significant regional revenue share.

The North American precious and base metals market is expected to register the highest market share in revenue shortly. The region's demand for precious and base metals is projected to increase due to the easy access to silver mines in Mexico and the robust manufacturing bases in the United States and Canada. The three economies mentioned above' optimized value chains are also anticipated to significantly impact the market's expansion in the years to come.

In addition, Asia Pacific is projected to grow rapidly in the global precious and base metals market. The region includes the burgeoning superpowers China, Japan, and India. Of these, China has the most significant impact on the market for the precious metals sector. China's robust domestic manufacturing sector mainly drives the consumption of the commodities above. The rise of India as a rival regional superpower is a major element driving the market's expansion. The nation is Asia Pacific's second-largest purchaser of gold commodities. Due to the enormous wedding business, the nation boasts a robust jewelry market.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 915.4 billion |

| Revenue forecast in 2031 | USD 2300.9 billion |

| Growth rate CAGR | CAGR of 12.34% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Base Metal, Precious Metal, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Alcoa Corporation, Anglo American, BHP, Antofagasta plc, FreeportMcMoRan Inc., First Quantum Minerals Ltd., Glencore, Lundin Mining Corporation, Rio Tinto, Teck Resources Limited |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Precious and Base Metals Market-

By Base Metal

By Precious Metal

By End-Use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.