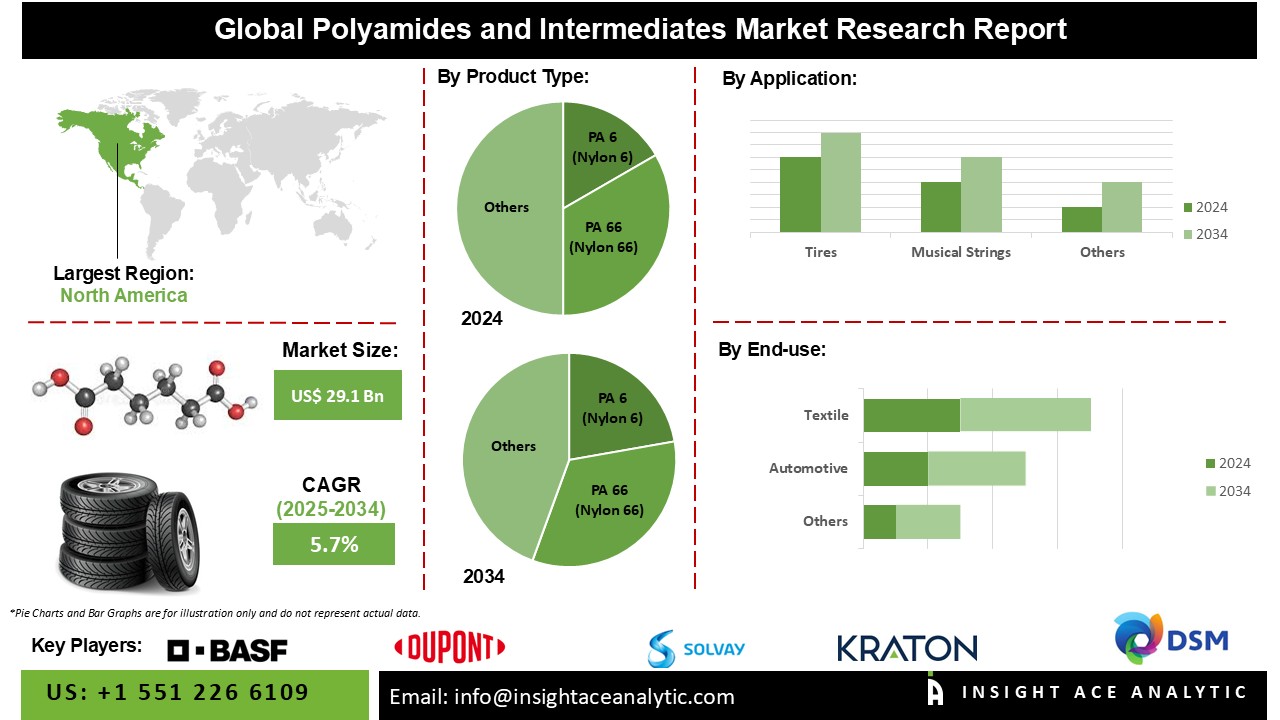

Polyamides and Intermediates Market Size is valued at USD 29.1 Bn in 2024 and is predicted to reach USD 50 Bn by the year 2034 at a 5.7% CAGR during the forecast period for 2025-2034.

High-performance polyamides can stand up to corrosive environments and high temperatures. Because they don't stick and have low friction, they can be used in many fields, such as aerospace, electronics, automobiles, and telecommunications. As per the market share by volume, the electrical and electronics business was second in 2022. As more companies allowed employees to work from home and more people built home offices, people's spending habits changed dramatically in favour of consumer electronics, which drove up demand for these goods.

Growing demand for polyamides all over the world. Polyamides are often used in the textile industry, consumer goods, and electrical appliances, among other places. In addition to being resistant to heat and electricity, they also have great tensile strength, resilience, and abrasion resistance. Polyamide is growing all over the world because the automotive industry needs lighter materials that are cheaper and easier to create. Bio-based polyamide is becoming more common because it is good for the environment.

The expansion of worldwide polyamide intermediate chemicals is attributable to the extensive usage of polyamide intermediate chemicals in various end-use industries, including consumer products, electronics, textiles, and automobiles. The adoption of polyamide intermediate chemicals is growing in the automobile industry due to replacing some alloy parts, including nuts and bolts, with these chemicals. This helps vehicles weigh less. As a result, increasing demand is promoting the market expansion for polyamide intermediate chemicals. However, the chemical qualities of the polyamide intermediates that absorb moisture reduce the tensile strength of the material, which may limit its adaptability.

Some Major Key Players In The Polyamides and Intermediates Market:

The Polyamides and Intermediates market is segmented on the basis of product, Distribution Channel, Application and End-Use. The product segment consists of PA 66 (Nylon 66), PA 6 (Nylon 6), PA12 (Nylon 12), and Others. Distribution Channels includes online market and offline retailers. The application includes Tires, Musical Strings, Bags, Conveyor Belts, and Others. As per the end-use segment, the market is segmented into Automotive, Textile, Aerospace, Electrical & Electronics, Healthcare, and Sports and leisure.

In the global polyamides and intermediates market throughout the forecast period, the bags sector is anticipated to experience reasonably fast revenue growth. The market for polyamide bags, including luggage, handbags, and backpacks, is constantly expanding. People choose PA bags for travel and commuting mainly because of their strength and resistance to abrasion.

Additionally, their small weight makes them more convenient for users. Additionally, polyamides can be made from recycled or bio-based resources, minimising the environmental impact of conventional plastics. Environmentally concerned people identify with this sustainability concept.

During the projection period, the textile is anticipated to increase more quickly. This is because polyamide fibres that resemble nylon are frequently used in the textile industry. These fibres are excellent for a variety of textile uses, including garments, sportswear, activewear, and industrial textiles. They are strong, durable, and abrasion-resistant.

Furthermore, PA fibres' inherent resilience and flexibility promote comfort, shape retention, and abrasion resistance, resulting in long-lasting performance. Polyamides have benefits such as increased durability, breathability, and water resistance when used in textile coatings and finishes. These coatings and finishes are used in a variety of industries, such as automotive textiles, outdoor fabrics, upholstery, and protective clothing.

Asia-Pacific has the biggest polyamide resin consumption, which is also expected to grow at the fastest rate during the forecast period.China and Japan have the largest revenue market shares for polyamides. This can be attributed to the fact that only China, where tariffs on vehicle purchases have been decreased as a result of a shortage of semiconductors globally. In 2022, Europe ranked as the second-largest user of polyamides worldwide.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 26.81 Bn |

| Revenue Forecast In 2034 | USD 43.62 Bn |

| Growth Rate CAGR | CAGR of 5.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Distribution Channel, Application, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | BASF SE, DuPont, DSM, Lanxess, Solvay, Kraton Corporation, Genomatica, Inc., Akzo Nobel N.V., Bayer AG, Eastman Chemical Company, Arkema, Mitsui Chemicals, Inc, Toray Industries Inc, Kolon Plastic Inc, DOMO Chemicals, Teijin, PolyOne, RTP company, Koch industries, Radici Group, DSM, Kuraray |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Polyamides and Intermediates Market By Product-

Polyamides and Intermediates Market By Distribution Channel

Polyamides and Intermediates Market By Application-

Polyamides and Intermediates Market By End-Use

Polyamides and Intermediates Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Polyamides and Intermediates Market Snapshot

Chapter 4. Global Polyamides and Intermediates Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis of Metaverse Industry

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. COVID-19 Impact on Metaverse Industry

Chapter 5. Market Segmentation 1: By Product type Estimates & Trend Analysis

5.1. By Product type & Market Share, 2024-2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021-2034 for the following By Product type :

5.2.1. PA 6 (Nylon 6)

5.2.2. PA 66 (Nylon 66)

5.2.3. PA 12 (Nylon 12)

5.2.4. Others

Chapter 6. Market Segmentation 2: By Distribution Channel Estimates & Trend Analysis

6.1. By Product type & Market Share, 2024-2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021-2034 for the following By Distribution Channel:

6.2.1. Online Market

6.2.2. Offline Retailer

Chapter 7. Market Segmentation 3: By Application Estimates & Trend Analysis

7.1. By Product type & Market Share, 2024-2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021-2034 for the following By Application:

7.2.1. Tires

7.2.2. Musical Strings

7.2.3. Bags

7.2.4. Conveyor Belts

7.2.5. Others

Chapter 8. Market Segmentation 4: By End Use Estimates & Trend Analysis

8.1. By Product type & Market Share, 2024-2034

8.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021-2034 for the following By End Use:

8.2.1. Automotive

8.2.2. Textile

8.2.3. Aerospace

8.2.4. Electrical & Electronics

8.2.5. Healthcare

8.2.6. Sports & Leisure

8.2.7. Others

Chapter 9. Polyamides and Intermediates Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Product type, 2021-2034

9.1.2. North America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Distribution Channel, 2021-2034

9.1.3. North America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

9.1.4. North America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By, End Use2021-2034

9.1.5. North America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts by country, 2021-2034

9.1.5.1. U.S.

9.1.5.2. Canada

9.2. Europe

9.2.1. Europe Polyamides and Intermediates Market revenue (US$ Million) by By Product type, 2021-2034

9.2.2. Europe Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Distribution Channel, 2021-2034

9.2.3. Europe Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Application 2021-2034

9.2.4. Europe Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By End Use,2021-2034

9.2.5. Europe Polyamides and Intermediates Market revenue (US$ Million) by country, 2021-2034

9.2.5.1. Germany

9.2.5.2. Poland

9.2.5.3. France

9.2.5.4. Italy

9.2.5.5. Spain

9.2.5.6. UK

9.2.5.7. Rest of Europe

9.3. Asia Pacific

9.3.1. Asia Pacific Polyamides and Intermediates Market revenue (US$ Million) by By Product type, 2021-2034

9.3.2. Asia Pacific Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Distribution Channel, 2021-2034

9.3.3. Asia Pacific Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

9.3.4. Asia Pacific Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By End Use, 2023-20

9.3.5. Asia Pacific Polyamides and Intermediates Market revenue (US$ Million) by country, 2021-2034

9.3.5.1. China

9.3.5.2. India

9.3.5.3. Japan

9.3.5.4. Australia

9.3.5.5. Rest of Asia Pacific

9.4. Latin America

9.4.1. Latin America Polyamides and Intermediates Market revenue (US$ Million) by By Product type, 2021-2034

9.4.2. Latin America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Distribution Channel, 2021-2034

9.4.3. Latin America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

9.4.4. Latin America Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By End Use, 2021-2034

9.4.5. Latin America Polyamides and Intermediates Market revenue (US$ Million) by country, (US$ Million) 2021-2034

9.4.5.1. Brazil

9.4.5.2. Rest of Latin America

9.5. Middle East & Africa

9.5.1. Middle East & Africa Polyamides and Intermediates Market revenue (US$ Million) by By Product type, (US$ Million)

9.5.2. Middle East & Africa Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Distribution Channel, 2021-2034

9.5.3. Middle East & Africa Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

9.5.4. Middle East & Africa Polyamides and Intermediates Market revenue (US$ Million) estimates and forecasts By End Use, 2021-2034

9.5.5. Middle East & Africa Polyamides and Intermediates Market revenue (US$ Million) by country, (US$ Million) 2021-2034

9.5.5.1. South Africa

9.5.5.2. GCC Countries

9.5.5.3. Rest of MEA

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. BASF SE

10.2.2. DuPont

10.2.3. DSM

10.2.4. Lanxess

10.2.5. Solvay

10.2.6. Kraton Corporation

10.2.7. Genomatica, Inc.

10.2.8. Akzo Nobel N.V.

10.2.9. Bayer AG

10.2.10. Eastman Chemical Company

10.2.11. Arkema

10.2.12. Mitsui Chemicals, Inc

10.2.13. Toray Industries Inc

10.2.14. Kolon Plastic Inc

10.2.15. DOMO Chemicals

10.2.16. Teijin,

10.2.17. PolyOne,

10.2.18. RTP company,

10.2.19. Koch industries,

10.2.20. Radici Group,

10.2.21. DSM,

10.2.22. Kuraray