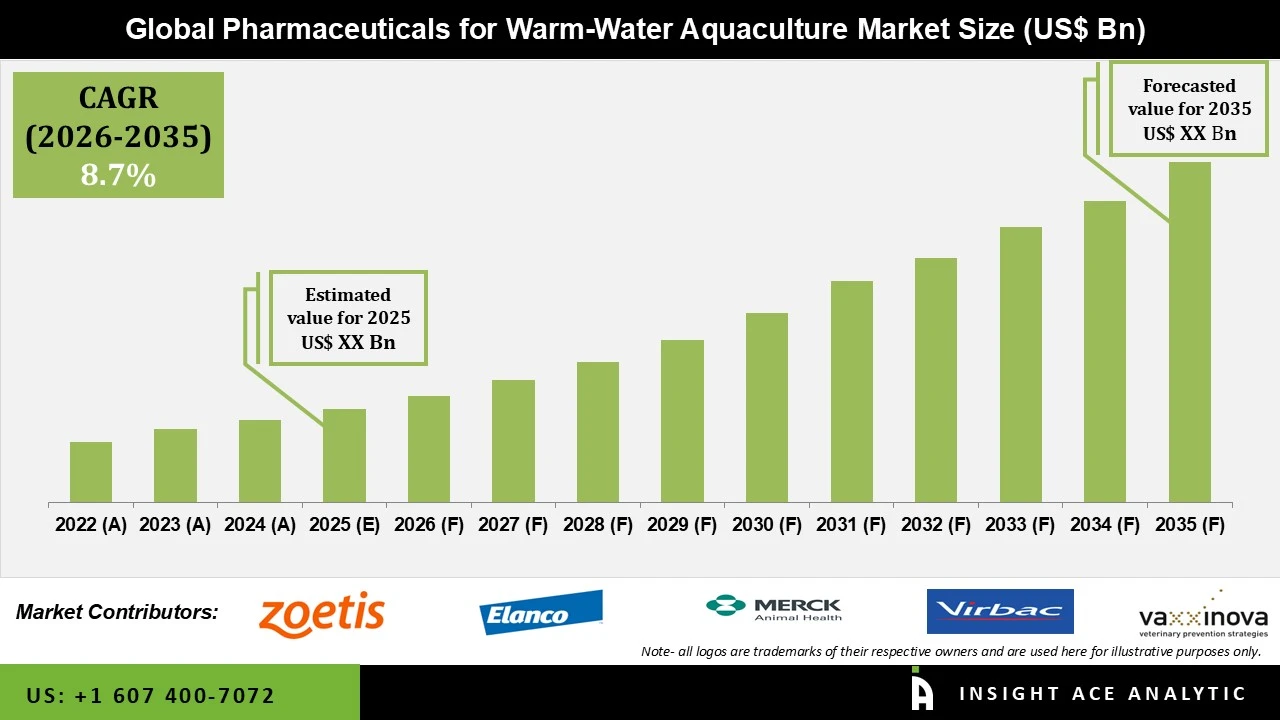

Pharmaceuticals for Warm Water Aquaculture Size is predicted to grow at a 8.7% CAGR during the forecast period for 2026 to 2035.

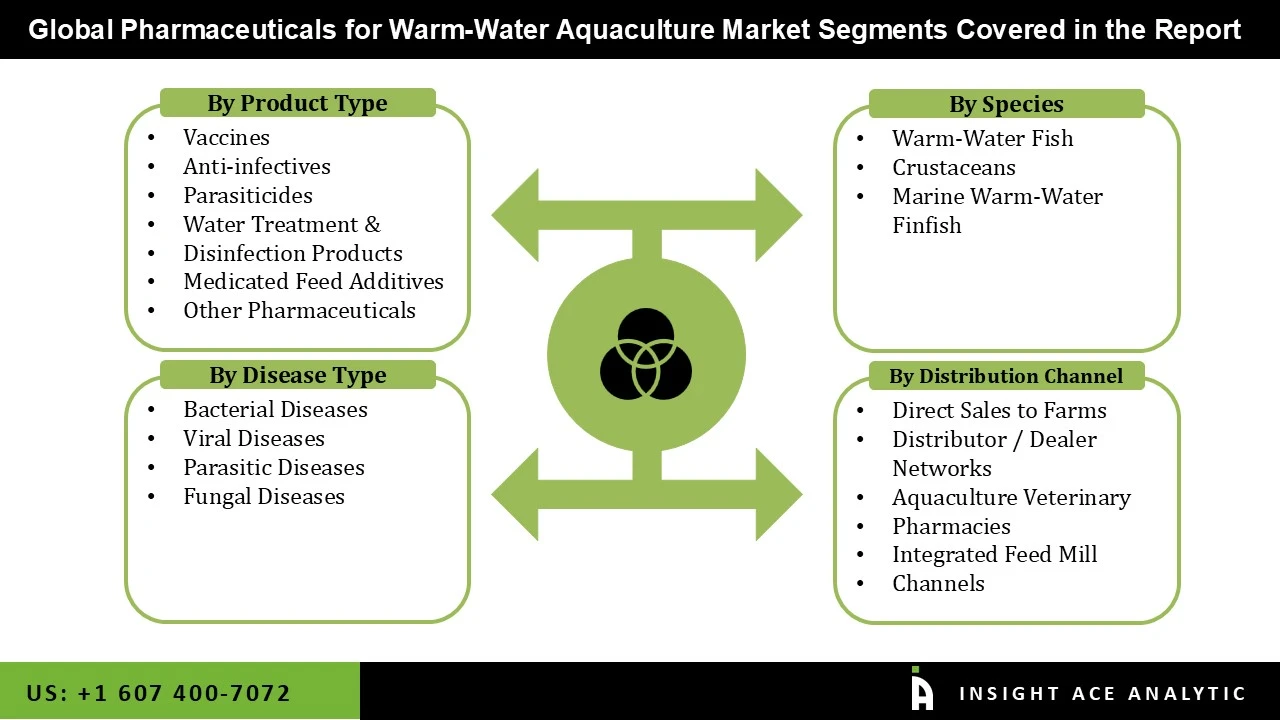

Pharmaceuticals for Warm-Water Aquaculture Market Size, Share & Trends Analysis Distribution By Product Type (Vaccines, Anti-Infectives, Parasiticides, Water Treatment And Disinfection Products, Medicated Feed Additives, And Other Pharmaceuticals), By Species (Warm-Water Fish, Crustaceans, And Marine Warm-Water Finfish), By Disease Type (Bacterial Diseases, Viral Diseases, Parasitic Diseases, And Fungal Diseases), By Distribution Channel (Direct Sales To Farms, Distributor/Dealer Networks, Aquaculture Veterinary Pharmacies, Integrated Feed Mill Channels) and Segment Forecasts, 2026 to 2035

The pharmaceuticals for warm-water aquaculture market is essential for maintaining the health and productivity of farmed fish such as tilapia, carp, catfish, and shrimp, which are widely cultivated across Asia-Pacific, Latin America, and Africa. With the rise of intensive aquaculture, disease outbreaks and water-borne infections have become major concerns, making vaccines, anti-infectives, parasiticides, medicated feeds, and water treatment products crucial for preventing bacterial, viral, parasitic, and fungal diseases while improving fish growth, survival, and farm profitability.

Innovations such as DNA, recombinant, and immersion vaccines, along with species-specific therapeutics, have further strengthened the role of pharmaceuticals in modern aquaculture. Overall, the pharmaceutical market for warm-water aquaculture supports the sustainability and resilience of modern aquaculture, driving economic growth and global protein supply by safeguarding the health of farmed warm-water species.

The pharmaceuticals market for warm-water aquaculture is driven by several key factors. Rising global demand for seafood has driven the rapid expansion of warm-water aquaculture, creating a greater need for pharmaceuticals to ensure healthy, productive fish stocks. Technological advancements in fish health, including DNA vaccines, recombinant vaccines, immersion vaccination techniques, and species-specific therapeutics, have improved the effectiveness of disease prevention and boosted adoption of pharmaceutical solutions.

There is also a strong focus on sustainable and safe aquaculture practices, as farmers and regulators increasingly prioritize responsible disease management and reduced antibiotic usage. Increasing incidences of viral, bacterial, parasitic, and fungal diseases in farmed warm-water species have further heightened the demand for vaccines, medicated feeds, and other therapeutics to minimize losses and maintain productivity. Moreover, the industry is witnessing a shift toward preventive healthcare, with farmers proactively using pharmaceuticals to protect fish health rather than treating diseases after they occur. Altogether, these factors boost the pharmaceuticals for warm-water aquaculture market globally.

The pharmaceuticals for warm-water aquaculture market faces several challenges that can impact adoption and effectiveness. The high cost of advanced vaccines, medicated feeds, and therapeutics often limits access for small-scale farmers. Additionally, limited awareness and technical expertise among aquaculture operators can lead to improper use of pharmaceuticals, thereby reducing their effectiveness.

Overuse or misuse of antibiotics and other treatments also increases the risk of drug resistance, posing long-term challenges for disease management. Furthermore, many vaccines and biologics require strict storage conditions, and cold chain and storage issues can hinder distribution and accessibility, particularly in remote or developing regions. Despite Challenges, one growing opportunity is to integrate fish health solutions with functional feeds, water treatment, and precision aquaculture technologies. This approach helps improve disease prevention, fish growth, and overall farm efficiency, while boosting profitability and sustainability in warm-water aquaculture.

• Zoetis Inc.

• Elanco Animal Health Inc.

• Merck Animal Health (Intervet)

• Virbac S.A.

• HIPRA

• Vaxxinova International B.V.

• Bayer Animal Health

• Ceva Santé Animale

• Phibro Animal Health Corporation

• Boehringer Ingelheim Animal Health

• Indian Immunologicals Limited

• Kyoritsu Seiyaku Corporation

• Kyoto Biken Laboratories Inc.

• Nisseiken Co. Ltd.

• KBNP Inc.

• KoVax Ltd.

• Veterquimica S.A.

• AquaTrek Animal Health

• CZ Vaccines

• Benchmark Animal Health

• Others

The growing global appetite for seafood is driving the pharmaceuticals market for warm-water aquaculture. As more people want fish and seafood, farmers are increasing production of species like tilapia, carp, catfish, and shrimp. This growth means there is a higher demand for pharmaceutical products such as vaccines, anti-infectives, parasiticides, and medicated feeds to keep stocks healthy and productive. These products help protect fish from diseases and support the continued growth and profitability of warm-water aquaculture around the world.

One of the main challenges in this market is the high cost of advanced vaccines, medicated feeds, and treatments. Because these products are expensive to develop and produce, small and medium-sized farmers, especially in developing countries, often cannot afford them. The high prices also make it harder for farmers to use new technologies like DNA and recombinant vaccines or immersion vaccination, which need extra investment. Farmers must weigh these costs against other expenses like feed, labor, and water management, which can lead to less use of important health products. This financial barrier raises the risk of disease, lowers survival rates, and reduces productivity, slowing market growth. Making these pharmaceuticals more affordable and easier to access is key to helping more farmers use them, improving fish health, and supporting sustainable and profitable aquaculture.

The pharmaceuticals market for warm-water aquaculture is segmented into four primary dimensions: product type, species, disease type, and distribution channel. By product type, the market includes vaccines, anti-infectives, parasiticides, water treatment and disinfection products, medicated feed additives, and other pharmaceuticals, catering to different health management needs of aquaculture farms. Segmentation by species includes warm-water fish, crustaceans, and warm-water marine finfish, reflecting the diversity of farmed aquatic animals in tropical and subtropical regions. The market is further categorized by disease type, including bacterial, viral, parasitic, and fungal diseases, which represent the major health challenges in warm-water aquaculture. Finally, distribution channels encompass direct sales to farms, distributor or dealer networks, aquaculture veterinary pharmacies, and integrated feed mill channels, highlighting the various pathways by which pharmaceutical products reach end users in the aquaculture industry.

Within the pharmaceuticals for warm-water aquaculture market, vaccines represent the most influential and growth-driving segment. Warm-water species such as tilapia, shrimp, catfish, and carp are highly vulnerable to viral and bacterial diseases that can spread rapidly and cause large-scale losses. Vaccines help farmers protect entire stocks at an early stage, significantly reducing mortality rates and improving overall farm productivity. The growing availability of viral, bacterial, multivalent, and oral or immersion vaccines has made disease prevention more practical and cost-effective, especially for large and intensive farming operations. As the industry increasingly shifts away from heavy antibiotic use toward preventive and sustainable health management, vaccines have become the preferred solution. Their ability to provide long-term protection, reduce treatment costs, and support responsible aquaculture practices makes vaccines the primary driver of global market growth.

Viral diseases represent the most influential disease segment driving market growth. Viral infections such as White Spot Syndrome Virus (WSSV), Tilapia Lake Virus (TiLV), and Iridovirus are highly contagious and often result in mass mortality and significant economic losses across fish and shrimp farms. Unlike bacterial or parasitic infections, viral diseases have limited treatment options, making preventive solutions such as vaccines and biosecurity-focused pharmaceuticals essential. As farmers increasingly prioritize early disease prevention to protect stock health and ensure consistent production, demand for antiviral vaccines and related pharmaceutical products continues to grow, positioning viral disease management as a core driver of the market.

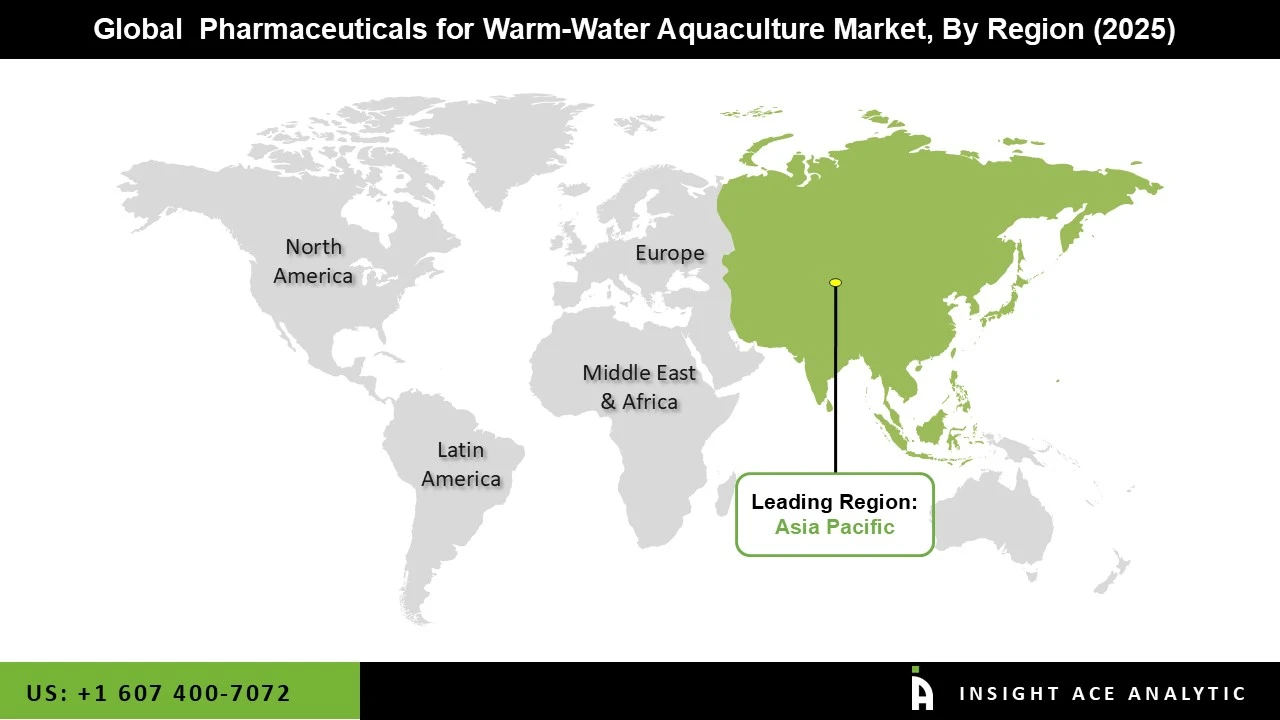

Asia Pacific is the leading region in the pharmaceutical market for warm-water aquaculture because it supports large-scale farming and is quickly modernizing its practices. The region's long coastlines, rivers, and inland waters make it ideal for farming warm-water species in both freshwater and brackish environments. As aquaculture moves from traditional to more commercial and intensive methods, the need for good disease prevention and treatment has grown. Local manufacturing of aquaculture pharmaceuticals keeps products widely available and affordable for farmers. Many regional veterinary pharmaceutical companies, along with partnerships between global and local distributors, have made it easier for farmers to get a variety of health products.

Also, climate changes like warmer water and seasonal shifts in water quality put more disease pressure on farms, which increases the use of preventive and therapeutic pharmaceuticals.

Stricter rules on aquatic animal health and export quality are also encouraging farmers to use approved pharmaceuticals and organized health programs. More investment in shrimp and freshwater fish hatcheries, along with better training and technical support, has made pharmaceuticals a regular part of farm management. All these factors help make Asia Pacific the top region in the warm-water aquaculture pharmaceuticals market.

• August 2024: ICAR CIBA, Chennai partnered with Indian Immunologicals Limited, Hyderabad to commercially produce the CIBA vaccine “Nodavac R” against viral nervous necrosis (VNN) in finfish. The vaccine, developed for Asian Seabass, aimed to prevent VNN, a viral disease causing high mortality in larval and juvenile stages.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Species, Disease Type, Distribution Channel and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Zoetis Inc., Elanco Animal Health Inc., Merck Animal Health (Intervet), Virbac S.A., HIPRA, Vaxxinova International B.V., Bayer Animal Health, Ceva Santé Animale, Phibro Animal Health Corporation, Boehringer Ingelheim Animal Health, Indian Immunologicals Limited, Kyoritsu Seiyaku Corporation, Kyoto Biken Laboratories Inc., Nisseiken Co. Ltd., KBNP Inc., KoVax Ltd., Veterquimica S.A., AquaTrek Animal Health, CZ Vaccines, Benchmark Animal Health, Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Vaccines

o Bacterial Vaccines

o Viral Vaccines

o Combined / Multivalent Vaccines

o Oral / Immersion Vaccines

• Anti-infectives

o Antibiotics

o Antivirals

o Antifungals

• Parasiticides

o Anti-parasitic Agents

o Anti-protozoan Agents

• Water Treatment & Disinfection Products

o Water Conditioners

o Biocides & Disinfectants

o Oxidizing Agents

• Medicated Feed Additives

o Medicated Growth Promoters

o Immunostimulants

o Gut-health Products

• Other Pharmaceuticals

• Bacterial Diseases

o Streptococcosis

o Columnaris / Flavobacteriosis

o Vibriosis

o Aeromoniasis

• Viral Diseases

o White Spot Syndrome Virus

o Tilapia Lake Virus (TiLV)

o Iridovirus

• Parasitic Diseases

o Sea lice (warm-water variants)

o Gill Parasites

o Ectoparasites

• Fungal Diseases

o Saprolegnia

o Water Mold Diseases

• Warm-Water Fish

o Tilapia

o Catfish

o Carps

o Pangasius

• Crustaceans

o Shrimp

o Prawns

o Crabs

• Marine Warm-Water Finfish

o Seabass

o Seabream

o Groupers Others

• Direct Sales to Farms

• Distributor / Dealer Networks

• Aquaculture Veterinary Pharmacies

• Integrated Feed Mill Channels

North America-

• The US

• Canada

Europe-

• Spain

• Italy

• Greece

• Turkey

• France

• Rest of Europe

Asia-Pacific-

• China

• India

• Vietnam

• Indonesia

• Thailand

• Bangladesh

• Rest of Asia Pacific

Latin Brazil

• Mexico

• Ecuador

• Rest of Latin America

Middle East & Africa-

• United Arab Emirates

• Egypt

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.