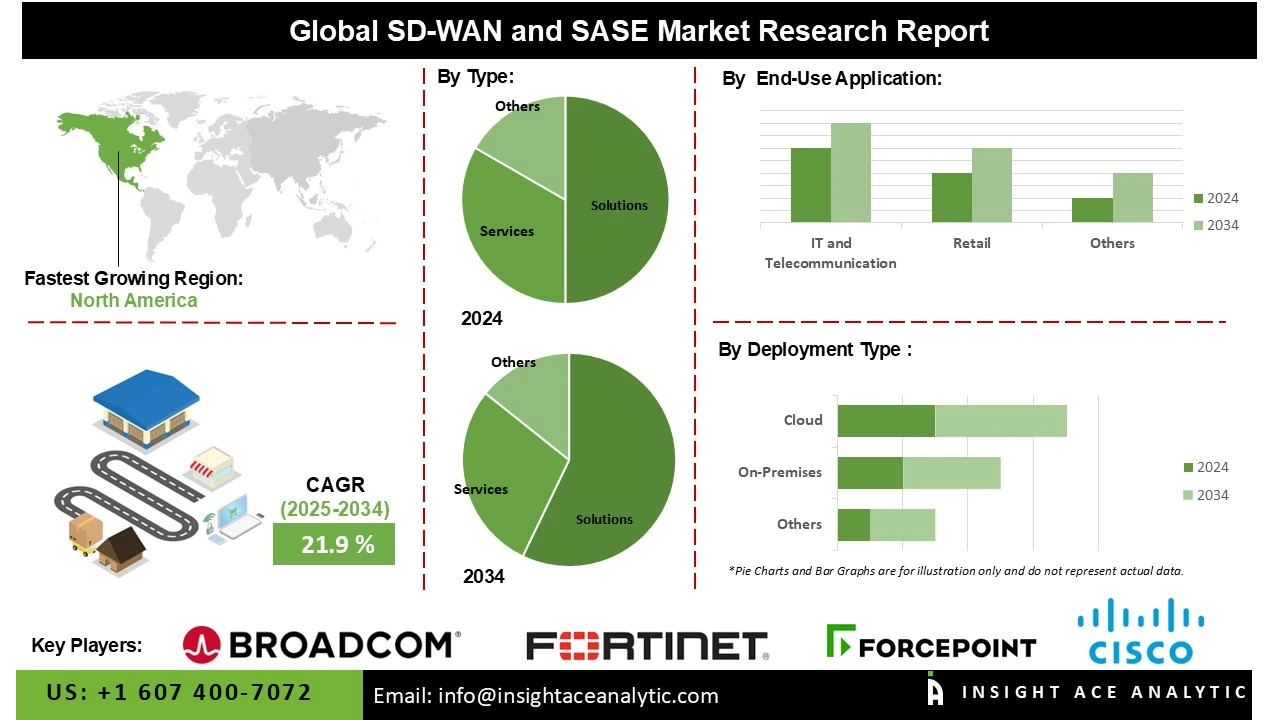

Global SD-WAN and SASE Market Size is predicted to grow at an 21.9% CAGR during the forecast period for 2025-2034.

SD-WAN optimizes connectivity across distributed networks, while SASE integrates networking and security into a unified cloud-based framework, allowing secure, scalable, and efficient access for modern enterprises. The SD-WAN and Secure Access Service Edge (SASE) market is experiencing significant growth, fueled by the rising adoption among small and medium-sized enterprises (SMEs).

SMEs are increasingly turning to cost-efficient, scalable, and secure network solutions to facilitate cloud migration, remote work, and digital transformation efforts. SD-WAN provides streamlined management and optimized bandwidth usage, while SASE combines the enhanced security capabilities of zero-trust and secure web gateways. This merging of technologies diminishes complexity and operational expense, making them extremely appealing to SMEs. The need for flexibility, improved performance, and strong cybersecurity is a major force driving SD-WAN and SASE adoption globally.

The SD-WAN and secure access service edge (SASE) market is expanding rapidly as enterprises modernize their IT infrastructures to support hybrid work models and digital transformation. A key driver is the rising adoption of cloud applications, which demand seamless, secure, and high-performance connectivity across distributed networks. Traditional WAN architectures struggle to provide efficient access to cloud-hosted services, creating demand for SD-WAN’s dynamic path selection and SASE’s integrated security framework. By delivering scalability, reduced latency, and cost efficiency, SD-WAN and SASE enable organizations to ensure secure, optimized access to business-critical cloud applications, fueling strong market growth globally.

Some of the Key Players in the SD-WAN and SASE Market:

· Cisco Systems, Inc.

· Tata Communications

· Hewlett Packard Enterprise Development LP

· Nokia

· Broadcom Inc.

· Fortinet, Inc.

· Oracle

· Huawei Technologies Co., Ltd.

· Juniper Networks, Inc.

· Ciena Corporation

· Citrix Systems, Inc.

· Hillstone Networks

· Telefonaktiebolaget LM Ericsson

· ARYAKA NETWORKS, INC.

· Forcepoint

The SD-WAN and SASE market is segmented by application, type, deployment mode, and enterprise size. By application, the market is segmented into IT & telecommunication, retail, financial services, & insurance (BFSI), manufacturing, and (healthcare, utilities, automotive, others). By type, the market is segmented into solutions, and services. By deployment mode, the market is segmented into on-premises, and cloud. By enterprise size, the market is segmented into small & medium enterprises, and large enterprises.

In 2024, the solutions held the major market share due to the rising demand for integrated security and networking frameworks that reduce complexity while ensuring seamless connectivity across multiple locations. Organizations are adopting solutions such as Cisco SD-WAN, VMware SASE, Fortinet Secure SD-WAN, and Palo Alto Prisma Access to improve performance, optimize bandwidth, and enhance zero-trust security capabilities.

The SD-WAN and SASE market is dominated by banking, financial services, & insurance (BFSI) due to the increasing need for secure, reliable, and scalable network connectivity. Financial institutions and insurance providers are embracing cloud-based software, digital banking, and remote working solutions, triggering demand for sophisticated network security and traffic optimization. Compliance with regulations, cyber threat protection, and low-latency, high-performance connectivity needs also fuel adoption, allowing BFSI companies to improve operational efficiency, customer satisfaction, and secure data transfer.

North America dominates the market for SD-WAN and SASE due to region’s surge in cloud adoption, remote work, and demand for secure, flexible network solutions. Enterprises are shifting from traditional WAN to cloud-native architectures for advance scalability, performance, and cost efficiency. Rising cyber threats and regulatory compliance requirements are driving the adoption of SASE, which integrates networking and security. Additionally, the presence of leading technology vendors and advanced IT infrastructure in the region accelerates market growth.

Moreover, Europe's SD-WAN and SASE market is also fueled due to increasing need for secure, reliable, and flexible networking solutions. The expansion of remote work, cloud adoption, and digital transformation initiatives across enterprises drives need for scalable connectivity and enhanced cybersecurity. Regulatory compliance requirements, along with the requirement to reduce operational costs and optimize network performance, further accelerate adoption. Investments in cutting-edge network infrastructure and European organizations’ focus on secure cloud access are key growth drivers.

SD-WAN and SASE Market by Application

· IT & Telecommunication

· Retail

· Banking, Financial Services, and Insurance (BFSI)

· Manufacturing

· Others (Healthcare, Utilities, Automotive, Others)

SD-WAN and SASE Market by Type

· Solutions

· Services

SD-WAN and SASE Market by Deployment Type

· On-Premises

· Cloud

SD-WAN and SASE Market by Enterprise Size

· Small and Medium Enterprises

· Large Enterprises

SD-WAN and SASE Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.