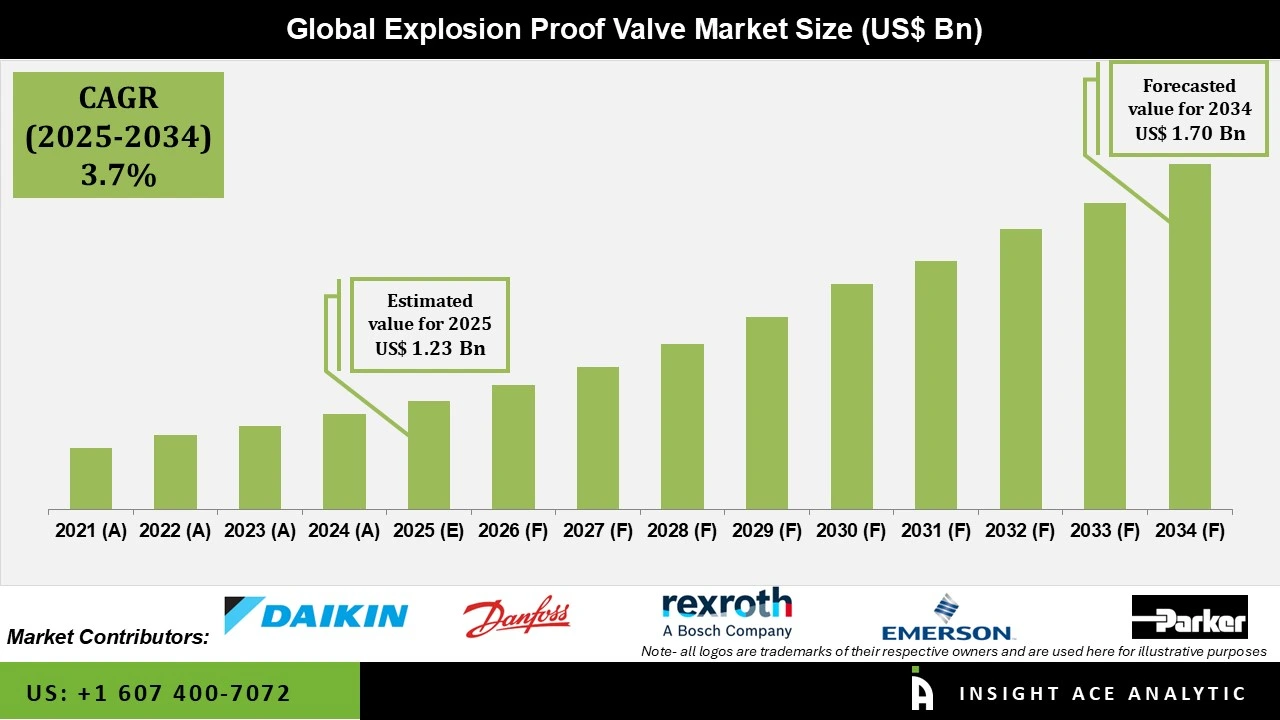

Global Explosion Proof Valve Market is valued at US$ 1.23 Bn in 2025 and it is expected to reach US$ 1.70 Bn by 2034, with a CAGR of 3.7% during the forecast period of 2025-2034.

Explosion-proof valves are specialised safety components designed for hazardous industrial environments containing flammable gases, vapours, or combustible dust. They play a vital role in oil & gas refineries, chemical processing plants, mining operations, and petrochemical facilities by preventing sparks, excessive heat, or electrical faults that could trigger catastrophic explosions.

These robust valves provide secure flow control for liquids and gases in high-pressure systems, ensuring operational continuity without compromising safety. Certified to global standards like ATEX and IECEx, their durable construction makes them essential for modern industrial hazard management. The explosion-proof valve market is expanding rapidly, driven by automation advancements and escalating safety requirements across high-risk sectors.

The rising need for safe fluid control in dangerous industries drives market growth. Over 350 million tons of hazardous waste were generated worldwide in 2023, highlighting the scale of risk management required. New innovations like digital monitoring, smart pressure controls, and IoT integration expand valve capabilities. Stricter safety regulations and growing industrial automation push companies to upgrade to explosion-proof systems. These factors create strong, steady demand across high-risk sectors.

High costs remain the biggest barrier. Specialised materials, rigorous certification (ATEX, IECEx), and precision engineering make explosion-proof valves expensive and challenging for smaller plants. However, opportunities are growing in extreme applications like high-temperature processing and underwater mining. Demand for custom valves in hydrogen plants, LNG facilities, and deep-sea operations is surging. As safety standards tighten globally and manufacturing costs decline, the market will expand into new high-value segments.

Some of the Key Players in the Explosion-Proof Valve Market:

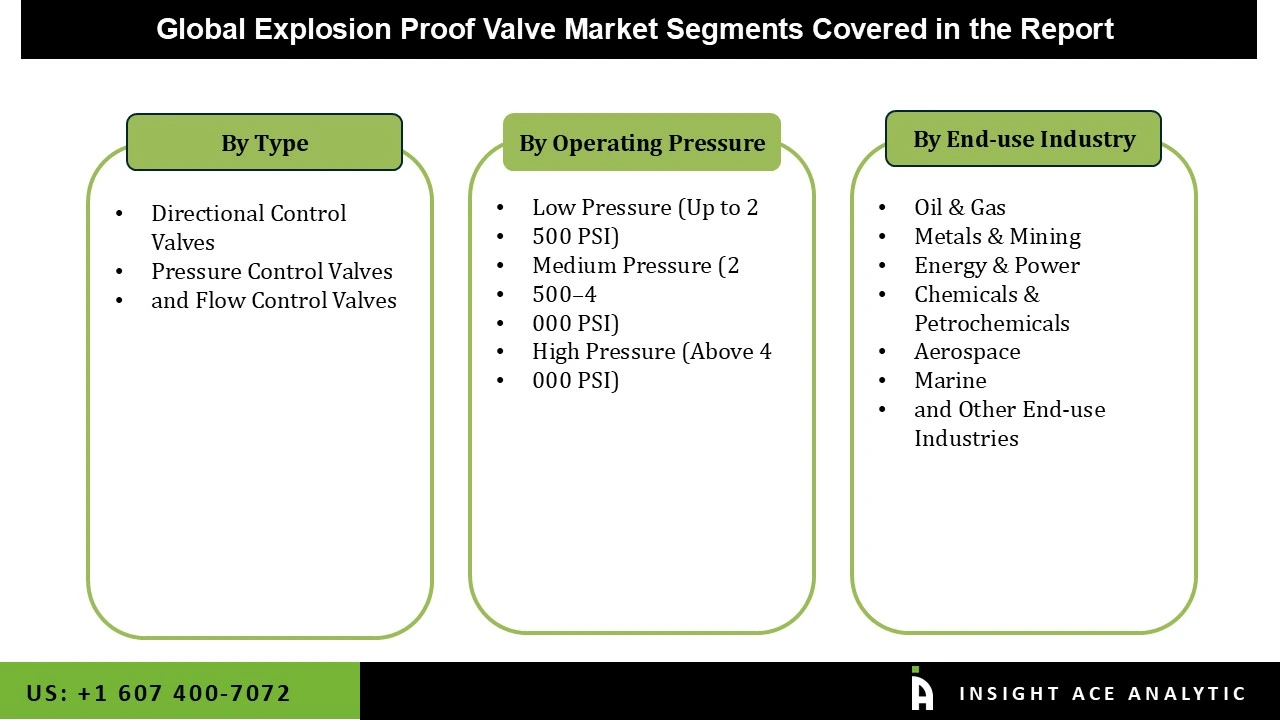

The explosion proof valve market is segmented by type, operating pressure, and end-use industry. By type, the market is segmented into directional control valves, pressure control valves and flow control valves. By operating pressure, the market is segmented into low pressure (up to 2500 psi), medium pressure (2500-4000 psi), and high pressure (above 4000 psi). By end-use industry, the market is segmented into oil & gas, metals & mining, energy & power, chemicals & petrochemicals, aerospace, marine and other end-use industries.

The Directional Control Valves category led the Explosion Proof Valve market in 2024. This convergence is due to its crucial function in controlling fluid routes in hazardous situations, such as directional control valves. They are the most commonly used type because of their dependability, versatility across many applications, and significance in guaranteeing safe system operations. Industries that prioritise operational safety and precision control under strict compliance standards contribute to the demand.

The largest and fastest-growing End-use Industry is Oil & Gas, a trend driven by its substantial activities in hazardous and high-risk areas. Strong demand is maintained by the industry's requirement for dependable flow control, strict adherence to safety regulations, and continuous production cycles. Its dominant position in adoption is further reinforced by ongoing exploration efforts and infrastructural investment.

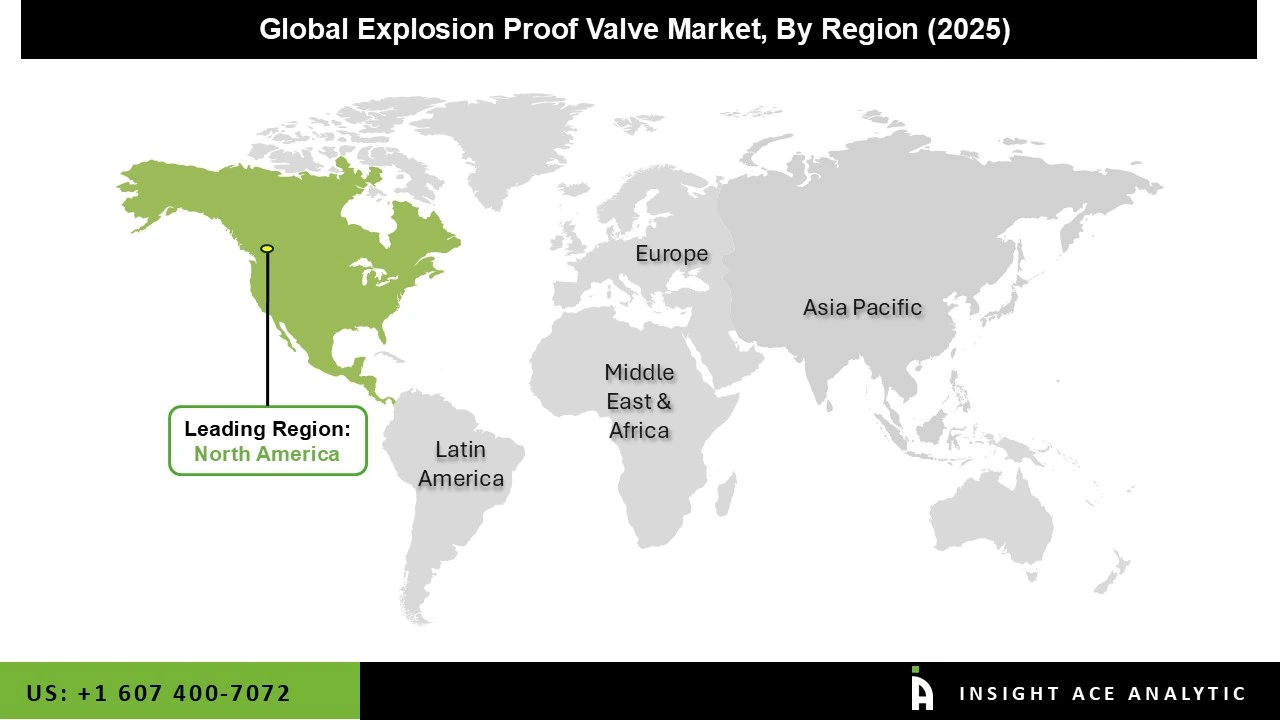

North America dominated the explosion-proof valve market in 2024, with the United States serving as the primary catalyst for growth. Rigorous safety standards in the mining, chemical, and oil and gas industries generate substantial demand for certified equipment. Organizations are required to utilize ATEX/IECEx-compliant valves to adhere to compliance regulations. Large refineries, shale gas initiatives, and sophisticated manufacturing plants guarantee consistent and dependable demand. This regulated environment confers upon North America the largest market share.

Asia-Pacific represents the most rapidly expanding market for explosion-proof valves, attributable to swift industrial development. Significant expansions in power generation, chemical manufacturing, and hydrocarbon refining capacities necessitate the use of certified safety equipment. Governments are implementing more rigorous safety regulations, while multinational corporations require systems that adhere to international standards. This combination propels dynamic regional development.

Recent Developments:

Explosion Proof Valve Market by Type-

· Directional Control Valves

· Pressure Control Valves

· Flow Control Valves

Explosion Proof Valve Market by Operating Pressure-

· Low Pressure (Up to 200 PSI)

· Medium Pressure (2500-4000 PSI)

· High Pressure (Above 4000 PSI)

Explosion Proof Valve Market by End-use Industry-

· Oil & Gas

· Metals & Mining

· Energy & Power

· Chemicals & Petrochemicals

· Aerospace

· Marine

· Other End-use Industries

Explosion Proof Valve Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.