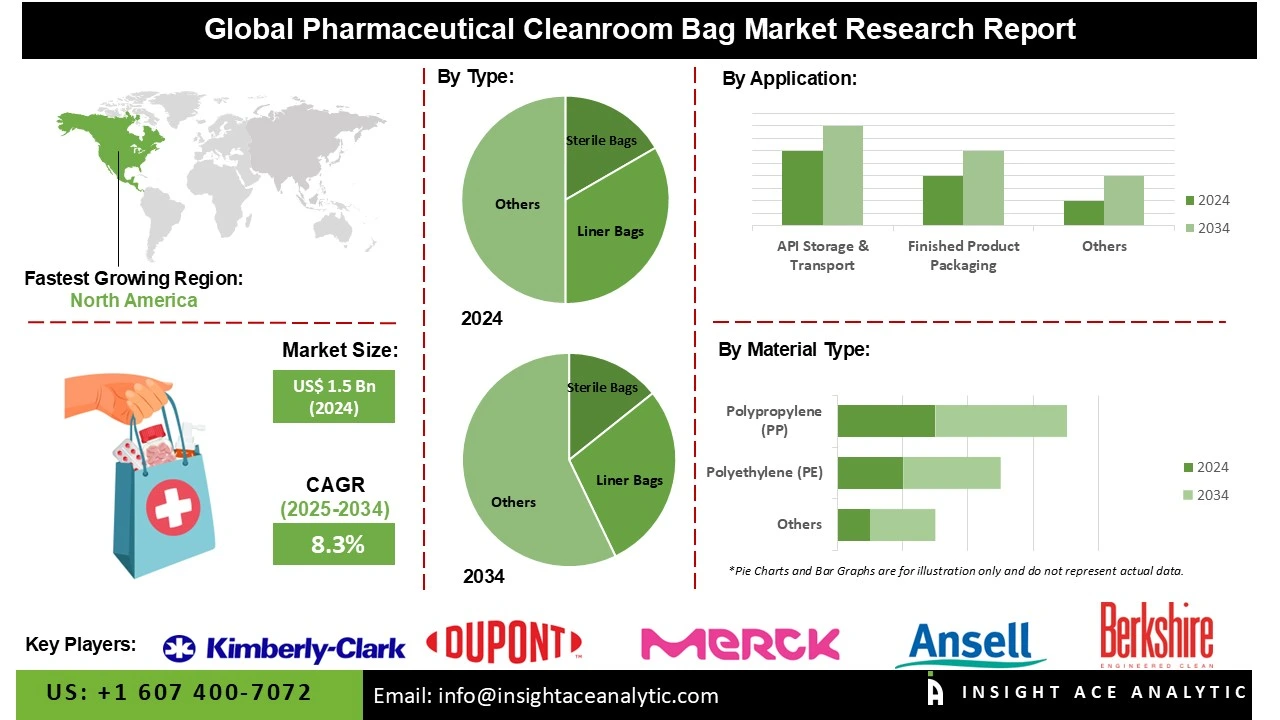

Global Pharmaceutical Cleanroom Bag Market Size is valued at US$ 1.5 Bn in 2024 and is predicted to reach US$ 3.3 Bn by the year 2034 at an 8.3% CAGR during the forecast period for 2025 to 2034.

Pharmaceutical Cleanroom Bag Market Size, Share & Trends Analysis Distribution By Type (Liner Bags, Sterile Bags, and Zipper Bags), By Material Type (Nylon, Polyethylene (PE), Polypropylene (PP), and Others), By Application (API Storage & Transport, Finished Product Packaging, Waste Disposal, and Equipment Covers), and Segment Forecasts, 2025 to 2034

Pharmaceutical cleanroom bags are essential for maintaining Aseptic conditions during pharmaceutical production. Sensitive pharmaceutical products are transported, dangerous materials are contained, and sterile components are packaged, among other uses. Throughout the supply chain, the bags are manufactured to meet strict quality and purity standards, preventing contamination and ensuring product integrity. The pharmaceutical industry's expansion, the growing adoption of cutting-edge cleanroom technology, and consumers' preference for disposable bags over reusable ones, driven by improved hygiene and long-term cost-effectiveness, are all contributing to the growth of the pharmaceutical cleanroom bags market.

The creation of specialized materials with improved barrier properties and increased sterility is an example of technological development that supports the growth of the pharmaceutical cleanroom bags market. Additionally, advanced cleanroom bags are preferred because strict regulatory environments require high-quality, contamination-free packaging.

The need for disposable cleanroom bags is driven by the growing use of single-use technology in pharmaceutical manufacturing, which reduces the risk of cross-contamination. Moreover, the concentration of pharmaceutical production in particular areas increases demand from major producers to supply these areas. These factors are anticipated to boost the pharmaceutical cleanroom bags market growth over the forecast period.

Some of the Key Players in Pharmaceutical Cleanroom Bag Market:

· Thermo Fisher Scientific Inc.

· Micronclean Limited

· DuPont de Nemours, Inc.

· Ansell Limited

· Merck KGaA

· Kimberly-Clark Corporation

· Berkshire Corporation

· Azbil Corporation

· Illinois Tool Works Inc.

· Cantel Medical Corporation

· Valutek

· Contec, Inc.

· KCWW

· Sterile Technologies Inc.

· Texwipe

· Others

The pharmaceutical cleanroom bag market is segmented by type, material type, and application. By type, the market is segmented into liner bags, sterile bags, and zipper bags. By material type, the market is segmented into nylon, Polyethylene (PE), polypropylene (PP), and others. By application, the market is segmented into api storage & transport, finished product packaging, waste disposal, and equipment covers.

The sterile bags segment is witnessing strong growth as manufacturers enhance aseptic processing and fill-finish operations for biologics, sterile injectables, and vaccines. This expansion is driven by increasingly stringent contamination-control requirements in ISO Class 5–8 cleanroom environments. Compliance with stricter global GMP regulations and rising audit scrutiny is fueling demand for pre-validated, particulate-free packaging featuring full documentation (CoC/CoA), lot traceability, and tamper-evident designs to minimize batch failure risks and reduce quality assurance burdens.

Furthermore, the growing use of single-use bioprocessing technologies across upstream and downstream workflows supports the adoption of gamma- and E-beam-compatible sterile bags that offer high cleanliness, low extractables, and robust barrier performance, suitable for cryogenic and cold-chain applications.

The polypropylene (PP) segment of the pharmaceutical cleanroom bags market is expanding due to rising sterile manufacturing volumes in biologics and injectable products, coupled with stricter GMP and ISO 14644 contamination-control standards. The demand for packaging that ensures sterility, durability, and cost efficiency further supports this growth. PP’s high melting point and excellent thermal stability make it suitable for autoclave and steam-sterilization cycles, while its compatibility with gamma and EtO sterilization extends its use across various aseptic processes. Additionally, PP offers superior stiffness-to-weight ratio, puncture and tear resistance, and low particle shedding, making it ideal for component kitting, work-in-process (WIP) handling, and sterile sampling in Grade A–D cleanroom environments.

In 2024, the North America region dominated the pharmaceutical cleanroom bags market. The region's strong pharmaceutical sector is the main driver of its market supremacy. Some of the largest pharmaceutical companies in the United States, such as Johnson & Johnson, Pfizer, and Merck, require extensive cleanroom facilities for both drug manufacturing and research. In compliance with FDA regulations, these companies uphold strict cleanliness standards, which require premium cleanroom supplies, such as specialty films and bags for material handling and storage.

The Asia Pacific region is anticipated to see the fastest growth in the pharmaceutical cleanroom bags market over the forecast period, driven by the region's strong presence of large pharmaceutical enterprises, particularly in countries such as China, Japan, and India. The pharmaceutical cleanroom bag market may benefit from the region's more affordable clinical trial market circumstances. Additionally, the pharmaceutical cleanroom bag market is expected to grow due to increased government support for pharmaceutical companies, ongoing research, and a trained labor force in the region.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.5 Bn |

| Revenue Forecast In 2034 | USD 3.3 Bn |

| Growth Rate CAGR | CAGR of 8.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Material Type, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Thermo Fisher Scientific Inc., Micronclean Limited, DuPont de Nemours, Inc., Ansell Limited, Merck KGaA, Kimberly-Clark Corporation, Berkshire Corporation, Azbil Corporation, Illinois Tool Works Inc., Cantel Medical Corporation, Valutek, Contec, Inc., KCWW, Sterile Technologies Inc., and Texwipe. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pharmaceutical Cleanroom Bag Market by Type

· Liner Bags

· Sterile Bags

· Zipper Bags

Pharmaceutical Cleanroom Bag Market by Material Type

· Nylon

· Polyethylene (PE)

· Polypropylene (PP)

· Others

Pharmaceutical Cleanroom Bag Market by Application

· API Storage & Transport

· Finished Product Packaging

· Waste Disposal

· Equipment Covers

Pharmaceutical Cleanroom Bag Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.