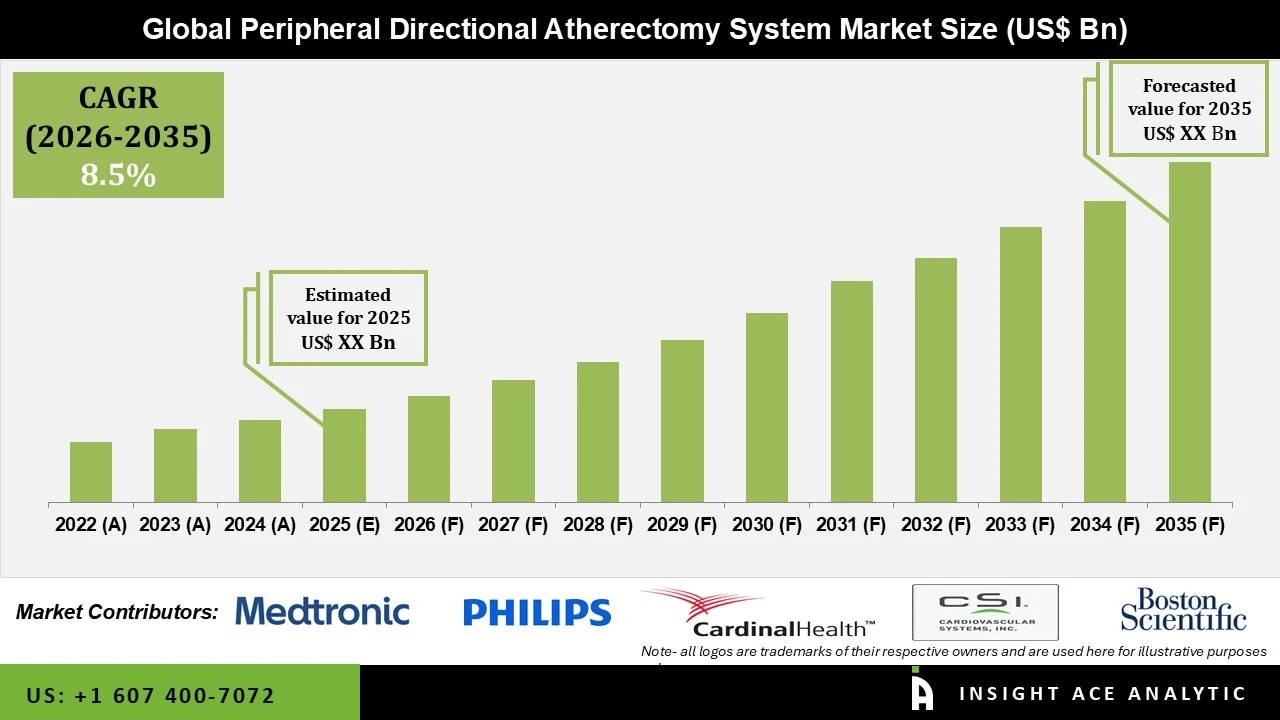

Peripheral Directional Atherectomy System Market Size is predicted to witness a 8.5% CAGR during the forecast period for 2026 to 2035.

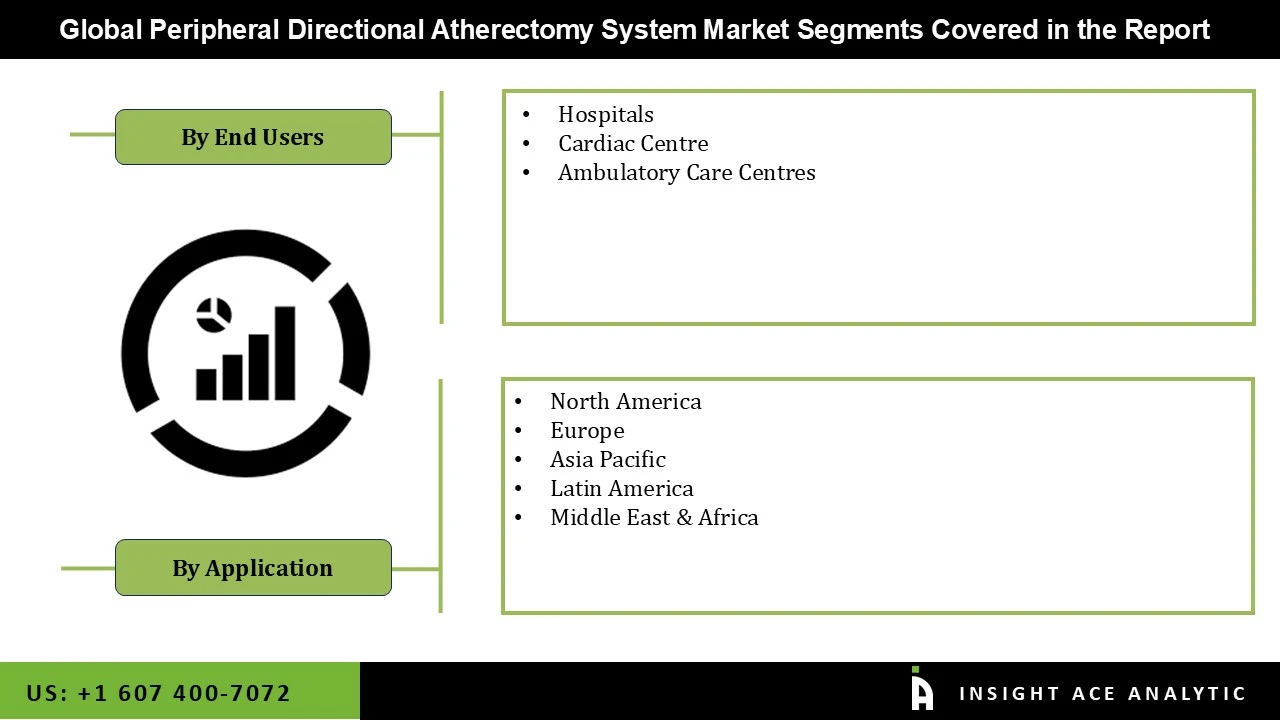

Peripheral Directional Atherectomy System Market Size, Share & Trends Analysis Report By End Users (Hospitals, Cardiac Centers, Ambulatory Care Centers), By Region, And by Segment Forecasts, 2026 to 2035

Atherectomy devices eliminate plaque and blood clots from within the arteries. Both peripheral and coronary artery atherosclerosis are addressed using these Peripheral Directional Atherectomy Systems. The accumulation of plaque or blood clots within the arteries leads to the obstruction of normal blood flow. The swift onset of the COVID-19 pandemic resulted in the postponement or cancellation of various elective cardiovascular procedures to minimize the risk of coronavirus transmission during hospital visits. Moreover, the impact on the supply chain was intensified by reduced disposable income.

Nonetheless, a positive influence on the market is anticipated once the pandemic subsides. Continuous progress in the realm of medical device technology has given rise to the creation of a more sophisticated and efficient peripheral directional Atherectomy System. These advancements enhance plaque removal's precision, efficacy, and safety, ultimately improving patient outcomes and expanding the market scope.

However, a shortage of skilled healthcare professionals might soon present additional challenges to the peripheral directional atherectomy system market. Due to pricing considerations, adopting peripheral directional atherectomy procedures, including the associated device costs, could face obstacles. Furthermore, the rising incidence of peripheral arterial diseases will offer potential growth opportunities for the Peripheral Directional Atherectomy System market in the forthcoming years.

Some Major Key Players In The Peripheral Directional Atherectomy System Market:

Market Segmentation:

The peripheral directional atherectomy system market is segmented based on end users. The market is segmented based on end-users into hospitals, cardiac centers and ambulatory care centres.

The hospital category will hold a major share in the global peripheral directional atherectomy system market 2022. clinical efficacy, patient preferences, technological advancements, and the potential for improved patient outcomes and operational efficiencies drive hospitals' increasing demand for peripheral directional atherectomy systems. Hospitals recognize the value of these systems in addressing peripheral arterial diseases while aligning with their commitment to quality patient care. As awareness about peripheral arterial diseases and available treatment options grows, patients and healthcare professionals are more likely to explore advanced solutions like peripheral directional atherectomy systems. This heightened awareness contributes to the overall demand for these systems.

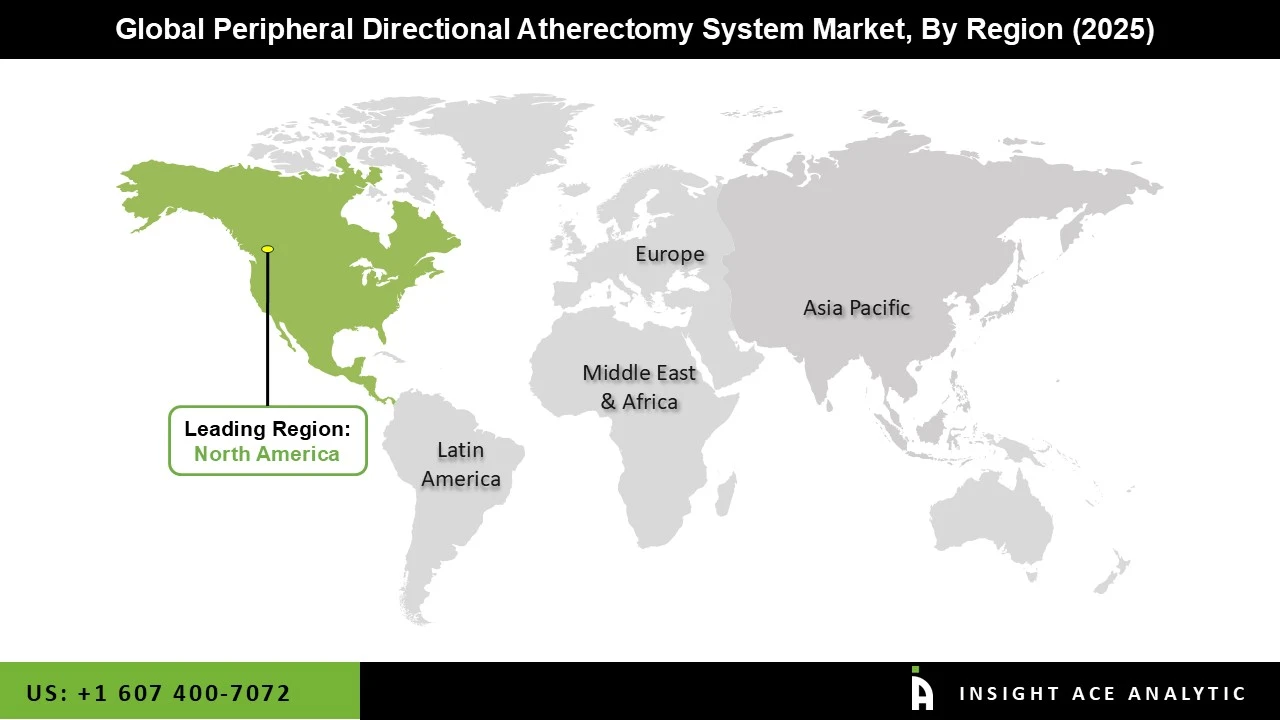

The North America Peripheral Directional Atherectomy System market is expected to register the highest share. Collaboration between hospitals and medical device manufacturers can drive the development and customization of atherectomy systems that align with specific hospital needs. This collaboration ensures that the systems integrate seamlessly into hospital workflows and patient care pathways, accelerating the growth in this regionIn addition, the Asia Pacific regional market is projected to develop rapidly in the global Peripheral Directional Atherectomy System market. Cultural perceptions of medical treatments and interventions can influence patient and physician preferences. Economic considerations, including healthcare budgets and reimbursement policies, also played a role in adopting new medical technologies.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By End-Users |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), Cardinal Health. (US), Cardiovascular Systems, Inc. (US), Boston Scientific Corporation (US), Minestrone Medical Inc. (US), Avinger (US) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Peripheral Directional Atherectomy System Market By End Users-

Peripheral Directional Atherectomy System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.