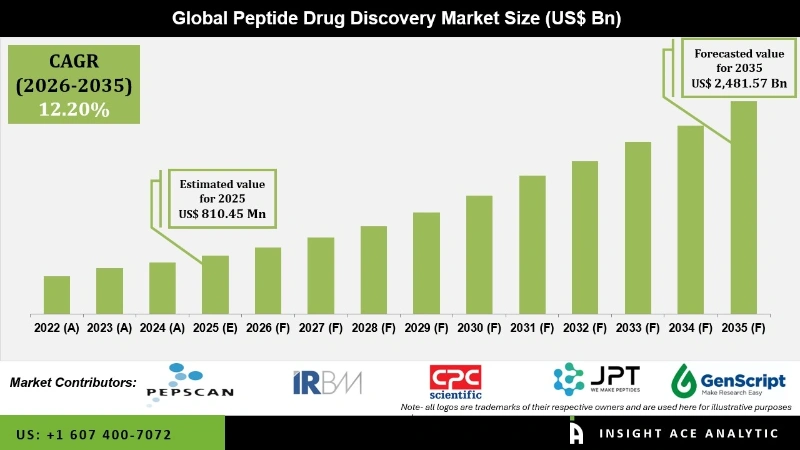

Peptide Drug Discovery Market Size is valued at 810.85 Mn in 2025 and is predicted to reach 2,481.57 Mn by the year 2035 at an 12.2% CAGR during the forecast period for 2026 to 2035.

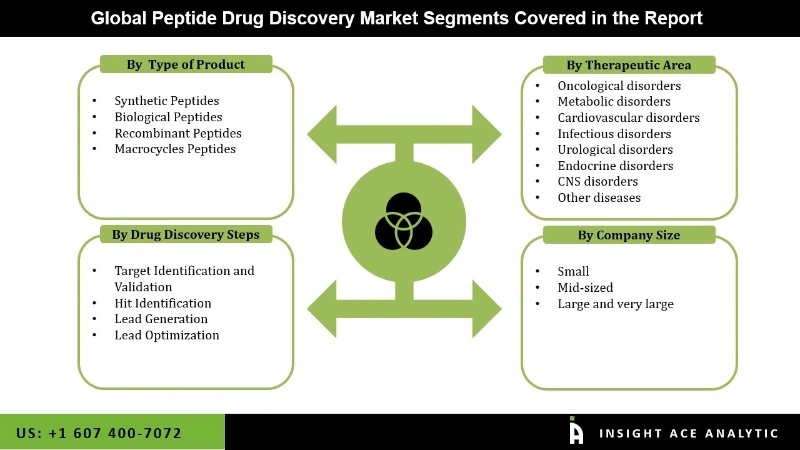

Peptide Drug Discovery Market Size, Share & Trends Analysis Distribution By Type Of Product (Synthetic Peptides, Biological And Recombinant Peptides And Macrocycles), Drug Discovery Steps (Target Identification And Validation, Hit Identification, Lead Generation And Lead Optimization), Therapeutic Area (Oncological Disorders, Metabolic Disorders, Cardiovascular Disorders, Infectious Disorders, Urological Disorders, Endocrine Disorders, CNS Disorders), By Company Size And Segment Forecasts, 2026 to 2035.

Peptide drug discovery represents a dynamic frontier in pharmaceutical research, offering a diverse array of therapeutic possibilities. The multifaceted nature of peptide drugs, sourced from natural, synthetic, or recombinant origins, underscores their adaptability to address a comprehensive spectrum of medical needs. Their specificity, potency, and favorable toxicity profiles have propelled over 80 peptide drugs onto the market, with applications spanning metabolic disorders like diabetes, oncology, infectious diseases, cardiovascular ailments, gastrointestinal issues, and neurological conditions. The rising prevalence of chronic diseases is a vital driver for the peptide drug discovery market. This growing need for effective treatments has driven heightened attention to peptide-based therapeutics, known for their high target specificity, low toxicity, and favourable safety profiles.

Furthermore, the rapid expansion of the Peptide CDMO (Pharmaceutical) Market, projected to reach $ 4,784.5 Mn by 2031, is a testament to the increasing demand for these drugs and the advancements in synthesis, modification, and delivery techniques that are facilitating their development. Importantly, peptides' inherent suitability for personalized medicine enables tailored therapies that optimize efficacy while minimizing adverse effects. As ongoing research fuels innovation in peptide design and application, the therapeutic landscape of this burgeoning market is set for further expansion, heralding a shift towards precision medicine and patient-centric treatment approaches.

Competitive Landscape

Some of the Key Players in Peptide Drug Discovery Market:

Market Segmentation:

The peptide drug discovery market is type of product, type of drug discovery steps, type of therapeutic area, and company size. By type of product the market is segmented into synthetic peptides, biological and recombinant peptides, and macrocycles. By drug discovery steps market is categorized into target identification and validation, hit identification, lead generation, and lead optimization. The therapeutic area market is categorized into oncological disorders, metabolic disorders, cardiovascular disorders, infectious disorders, urological disorders, endocrine disorders, CNS disorders, and other diseases. By company size the market is categorized into small, mid-sized, and large companies.

Synthetic Peptide Is Expected to Drive the Peptide Drug Discovery Market.

The synthetic peptide segment is a key driver of the peptide drug discovery market's robust growth. Synthetic peptides offer unique benefits, such as design flexibility, rapid production, and the ability to incorporate modifications for enhanced stability and potency. Their increasing use in pharmaceutical drugs is due to their high specificity, low toxicity, and therapeutic potential across various medical domains. Moreover, advancements in peptide synthesis technologies have significantly improved the efficiency and scalability of synthetic peptide production. Their cost-effectiveness compared to biological and recombinant peptides further cements their status as an ideal choice in the industry. Notably, their compatibility with personalized medicine approaches is a significant factor driving their demand.

The Oncology Disorder is Growing at the Highest Rate in the Peptide Drug Discovery Market.

The oncology disorders segment is the frontrunner in the Peptide Drug Discovery Market, driven by the global rise in cancer rates, with 1.9 million new cases reported in the US alone in 2022. Peptide-based therapies are gaining momentum in cancer treatment due to their targeted drug delivery capabilities, characterized by high specificity, small sizes, ease of modification, and high biocompatibility. These features make them particularly effective in combating cancer. As a result, the oncology disorders segment is expected to dominate the market, fueled by the growing demand for efficient treatments and the development of novel peptide-based therapies tailored for various cancer types.

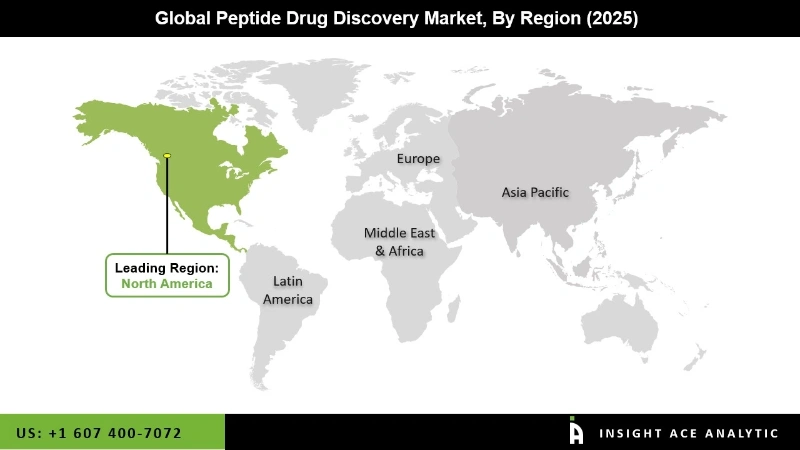

Regionally, North America Led the Peptide Drug Discovery Market.

North America is at the forefront of the peptide drug discovery market, leading the revenue rise. This is driven by factors such as the increasing prevalence of chronic disorders, improving healthcare expenditure, technological advancements, and growing disposable income. The region also experiences a surge in metabolic disorders, cancer, cardiovascular issues, gastrointestinal ailments, and central nervous system disorders, which amplifies the demand for effective peptide therapeutics. Additionally, North America, particularly the U.S. and Canada, benefits from an advanced healthcare infrastructure, which facilitates seamless research, development, production, and delivery of peptide-based treatments

Peptide Drug Discovery Market Report Scope

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 810.85 Mn |

| Revenue Forecast In 2035 | USD 2,481.57 Mn |

| Growth Rate CAGR | CAGR of 12.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Product, Type of Drug Discovery Steps, Type of Therapeutic Area |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | GenScript, JPT Peptide Technologies, CPC Scientific, IRBM, Creative Peptides, Pepscan, Peptides and Macrocycle Drug Discovery Platform, Providers, RA Pharmaceuticals, Pepticom, PeptiDream, Creative Biolabs, MeSCue-Janusys |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Peptide Drug Discovery Market by Type of Product -

Peptide Drug Discovery Market by Drug Discovery Steps -

Peptide Drug Discovery Market by Therapeutic Area -

Peptide Drug Discovery Market by Company Size -

Peptide Drug Discovery Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.