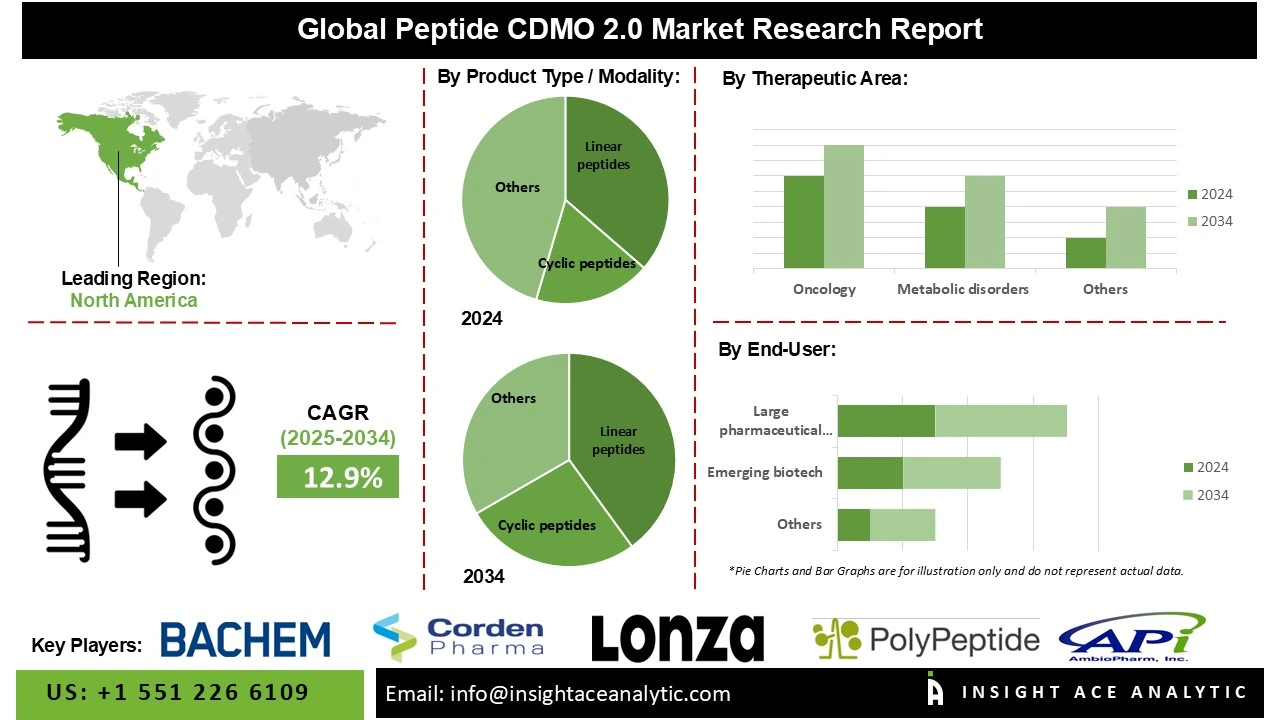

Global Peptide CDMO 2.0 Market Size is predicted to grow at a 12.9% CAGR during the forecast period for 2025 to 2034.

Peptide CDMO 2.0 Market, Share & Trends Analysis Report, By Product Type / Modality (Linear Peptides, Cyclic Peptides, Stapled Peptides, Peptide–Drug Conjugates (PDCs), Peptide–Oligonucleotide Conjugates, GLP-1 and Related Long-Acting Analogues, Oral Peptide Formulations), By Scale of Operation (Preclinical, Clinical (Phase I–III), Commercial), By Business Model, By Technology, By Therapeutic Area, By End User By Region, and Segment Forecasts, 2025 to 2034

The next generation of contract development and manufacturing organizations (CDMOs) specializing in peptide-based therapies is known as Peptide CDMO 2.0. It goes beyond conventional services by combining cutting-edge technologies, creative procedures, and tactical partnerships to speed up drug development and production. By optimizing peptide synthesis, purification, and production through automation, machine learning, and artificial intelligence (AI), these companies’ lower costs and increase efficiency while providing real-time monitoring, predictive analytics, and improved quality control.

The modern drug development industry has identified linear peptides as a significant area of focus due to their growing use as therapeutic agents for the treatment of complex diseases, including cancer, diabetes, cardiovascular disorders, and infectious diseases. Pharmaceutical companies are searching for safer, more efficient therapies, and are particularly attracted to them for their high selectivity, low toxicity, and ability to target specific biological pathways. This trend has been further accelerated by the evolution of Peptide CDMO 2.0 (Contract Development and Manufacturing Organization), which provides scalable, flexible, and rapid production capabilities.

The primary market driver is the integration of AI-driven process optimization, machine learning algorithms, and continuous manufacturing technologies. These tools substantially reduce production costs, improve process reproducibility, and enhance yield, thereby rendering linear peptide manufacturing more economically viable. The favorable conditions for innovation have been established by technological advancements in peptide synthesis automation, broadened R&D investments by biotech and pharmaceutical companies, and encouraging regulatory frameworks for peptide therapeutics. The importance of peptide CDMOs in the value chain has also expanded with the global push toward biopharmaceutical outsourcing, driven by the need for cost efficiency and specialized expertise. Peptide CDMO 2.0 has become a cornerstone of the swiftly evolving peptide therapeutics market, nurturing continuous innovation and accelerating the path from drug discovery to commercialization, which is driven by these factors and technological enablers.

Some of the Major Key Players in the Peptide CDMO 2.0 Market are

· Lonza Group AG

· CordenPharma

· Bachem Holding AG

· AmbioPharm

· PolyPeptide Group

· Evonik Health Care

· WuXi AppTec / WuXi TIDES

· Thermo Fisher Scientific (Patheon)

· Olon S.p.A.

· NOF Corporation

· Curapath

· eTheRNA Manufacturing

· Helix Biotech

· Phosphorex

· Creative Peptides

· Peptron Inc.

· Pepscan

· CSBio

· Neuland Laboratories

· Asymchem

· Sai Life Sciences

· AmbioPharm Shanghai

· Hybio Pharmaceutical

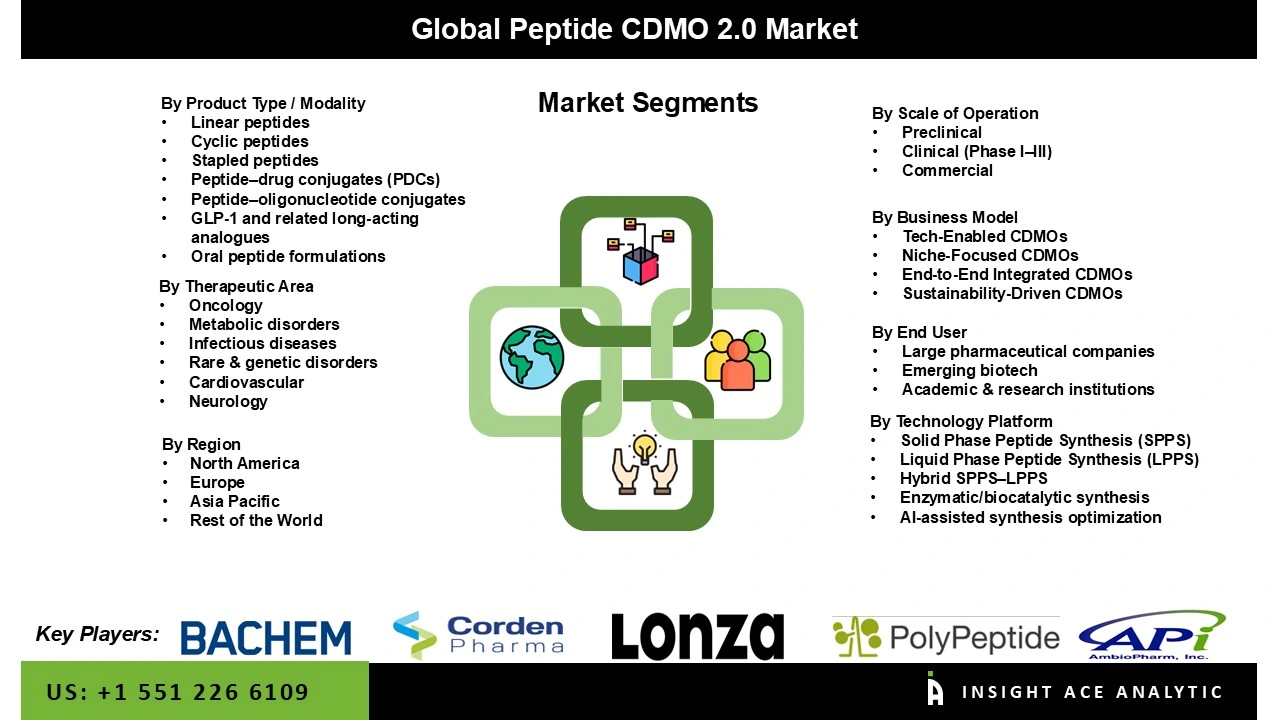

The Peptide CDMO 2.0 Market is segmented into product type/modality, scale of operation, business model, technology platform, therapeutic area, and end user. Based on the product type/ modality, the market is segmented into linear peptides, cyclic peptides, stapled peptides, peptide–drug conjugates (PDCS), peptide–oligonucleotide conjugates, GLP-1 and related long-acting analogues, and oral peptide formulations. Based on the scale of operation, the market is divided into preclinical, clinical (Phase I–III), and commercial. Based on the Business Model, the market is divided into tech-enabled CDMS, niche-focused CDMS, end-to-end integrated CDMS, and sustainability-driven CDMS. Based on the technology platform, the market is divided into solid phase peptide synthesis (SPPS), liquid phase peptide synthesis (LPPS), hybrid SPPS–LPPS, enzymatic/biocatalytic synthesis, AI-assisted synthesis optimization. Based on the therapeutic area, the market is divided into oncology, metabolic disorders, infectious diseases, rare & genetic disorders, cardiovascular, and neurology. Based on the End User, the market is divided into large pharmaceutical companies, emerging biotechs, and academic & research institutions.

The cyclic peptides segment is projected to experience the highest growth rate during the forecast period, primarily due to superior structural and pharmacological properties relative to linear peptides. Cyclic peptides demonstrate high efficacy in treating complex diseases, including cancer, infectious diseases, and autoimmune disorders, because of enhanced membrane permeability, increased binding affinity to biological targets, and improved stability against enzymatic degradation. These properties increase therapeutic potential, extend bioavailability, and lengthen half-life, positioning cyclic peptides as strong candidates for next-generation peptide-based pharmaceuticals. The rise of precision medicine and biologics has further increased demand for cyclic peptides, as their tunable conformations and structural diversity enable highly selective interactions with molecular targets. Consequently, pharmaceutical and biotechnology companies increasingly depend on peptide contract development and manufacturing organization (CDMO) 2.0 providers, who possess advanced manufacturing capabilities and specialized expertise for developing these complex molecules.

SPPS is critical for synthesizing both linear peptides (easier to produce) and cyclic peptides (requiring additional cyclization steps). Peptide CDMO 2.0 providers use SPPS to produce complex peptides with modifications like disulfide bonds, stapling, or conjugation, meeting the demand for advanced therapeutics. The increasing pipeline of peptide drugs, particularly for chronic diseases, drives demand for SPPS-based manufacturing. Peptide CDMO 2.0 providers meet this demand by offering high-throughput SPPS capabilities, ensuring rapid delivery of clinical and commercial supplies. Peptide CDMO 2.0 provides end-to-end services, from SPPS-based peptide synthesis to purification, analytical testing, and GMP-compliant manufacturing. This integrated approach streamlines development and reduces tech transfer challenges, accelerating time-to-market for peptide drugs.

North America has state-of-the-art facilities, advanced manufacturing technologies, and a skilled workforce, enabling Peptide CDMO 2.0 providers to deliver high-quality, complex peptides with precision. The region’s advanced analytical capabilities and quality control systems ensure compliance with stringent regulatory standards, making it a preferred hub for peptide production. Peptide CDMO 2.0 providers in North America support this demand by offering scalable, high-quality manufacturing and development services, leveraging advanced SPPS and digital tools. The growing trend toward personalized medicine has driven demand for customized peptide therapeutics in North America. Peptide CDMO 2.0 providers are adapting by offering flexible manufacturing platforms for small-batch production of tailored peptides, supported by advanced analytics and digital twins for process optimization.

· In January 2024, WuXi AppTec launched two new peptide manufacturing plants, one in Changzhou and another at their new Taixing API site in China, tripling their overall peptide synthesis capacity and increasing total Solid-Phase Peptide Synthesis (SPPS) reactor volume to 32,000 liters. These advanced facilities use digital operations and automated solvent delivery systems to improve production efficiency, consistency, and scalability.

· In May 2023, PolyPeptide and Numaferm signed a Preferred Partner Collaboration Agreement for peptide development and production, utilizing Numaferm's biochemical production platform and sustainable peptide manufacturing expertise, as well as PolyPeptide's cGMP manufacturing capabilities, regulatory expertise, and market access. The company specializes in the development and production of peptides and proteins. The parties have committed to maintaining the confidentiality of the agreement's specifics.

Global Peptide CDMO 2.0 Market- By Product Type / Modality

· Linear peptides

· Cyclic peptides

· Stapled peptides

· Peptide–drug conjugates (PDCs)

· Peptide–oligonucleotide conjugates

· GLP-1 and related long-acting analogues

· Oral peptide formulations

Global Peptide CDMO 2.0 Market – By Scale of Operation

· Preclinical

· Clinical (Phase I–III)

· Commercial

Global Peptide CDMO 2.0 Market – By Business Model

· Tech-Enabled CDMOs (automation, AI, data integration)

· Niche-Focused CDMOs (rare diseases, complex peptides)

· End-to-End Integrated CDMOs

· Sustainability-Driven CDMOs

Global Peptide CDMO 2.0 Market- By Technology Platform

· Solid Phase Peptide Synthesis (SPPS)

· Liquid Phase Peptide Synthesis (LPPS)

· Hybrid SPPS–LPPS

· Enzymatic/biocatalytic synthesis

· AI-assisted synthesis optimization

Global Peptide CDMO 2.0 Market – By Therapeutic Area

· Oncology

· Metabolic disorders (incl. obesity/diabetes)

· Infectious diseases

· Rare & genetic disorders

· Cardiovascular

· Neurology

Global Peptide CDMO 2.0 Market – By End User

· Large pharmaceutical companies

· Emerging biotechs

· Academic & research institutions

Global Peptide CDMO 2.0 Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.