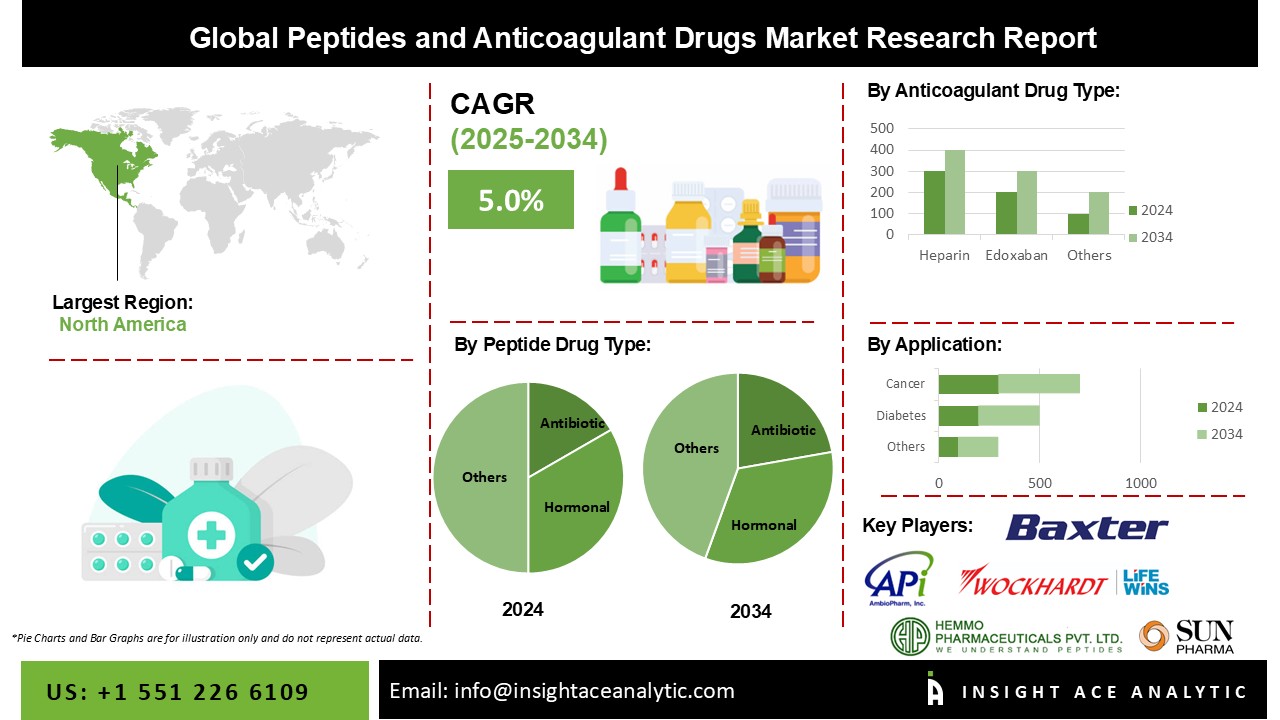

Peptide and Anticoagulant Drugs Market Size is predicted to develop with a 5.0% CAGR during the forecast period for 2025-2034.

Blood thinners are anticoagulants, which are chemical agents that decrease blood coagulation and the time it takes for blood to clot. Anticoagulants are a type of medicine that is used to treat thrombotic disorders. Oral anticoagulants are available in pill, tablet, and injectable forms. Heparin is an injectable anticoagulant that is routinely used in hospitals to keep blood clots from forming. DVT is treated with subcutaneous injections of LMWHs twice a day.

Peptides, also known as amide bonds, are peptide bonds that connect long-chain amino acids. Peptides are a type of therapeutic material that is composed of small molecules and proteins. Peptide therapeutic properties are used to treat a wide range of illnesses. The rising healthcare expenditure, which aids in the improvement of infrastructure, is a factor impacting the growth rate of the peptide and anticoagulant medicines market. Furthermore, several government organizations intend to improve healthcare infrastructure by boosting financing, which would have an impact on market dynamics.

However, COVID-19 initially had a significant impact on market expansion. During the pandemic, several peptide-based vaccines and medication candidates were presented, which aided in the treatment of COVID-19 infections. As a result, the pandemic had a considerable impact on market growth. However, now that the epidemic has passed, the market will likely rise steadily over the projection period.

The peptide and anticoagulant drugs market is categorized on the basis of peptide drug type, anticoagulant drug type, administration route, and application. Based on peptide drug type, the market is segmented as an antibiotic, hormonal, antifungal, ace inhibitor, and others. The anticoagulant drug type segment include heparin, edoxaban, apixaban, dabigatran, rivaroxaban, and others. The market is segmented by administration route into oral, injectable, and others. The other applications segment include neurological disorders, metabolic disorders, gastrointestinal disorders, diabetes, cancer, cardiovascular disorder, infectious diseases, and others.

The cancer category is expected to hold a major share in the global peptide and anticoagulant drugs market in 2024. Cancer patients are increasingly being treated with peptide and anticoagulant medicines. Historically, these medications have been used to prevent cardiovascular, diabetic, and neurological problems. Nonetheless, their ability to induce and strengthen antigen-specific immune responses has long been recognized as a potentially useful tool in cancer treatment.

The antibiotic segment is projected to grow at a rapid rate in the global peptide and anticoagulant drugs market. Antibiotic peptides are small peptides that play an important function in the innate immune system and are abundant in nature. Antibiotic peptides are tiny bioactive proteins that have piqued the interest of researchers as potential next-generation antibiotics.

The North America Peptide and Anticoagulant Drugs Market is expected to register the highest market share in terms of revenue in the near future. Due to the rising incidence of chronic diseases, particularly cancer, the region is experiencing rapid market expansion. Investment in pharmaceutical and biotechnology industries will fuel the North American peptide and anticoagulant medications market. Furthermore, the provision of cash for drug development processes draws a large number of worldwide companies. During the projection period, the Asia Pacific region is expected to grow profitably. Because of the rising burden of cancer and cardiovascular disorders in nations such as India, China, and Japan, the market is expanding at a rapid pace.

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 5.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Material, Precursor And End Users |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Baxter, Celsus, Biofer, Hemmo Pharma, AmbioPharm, Wockhardt, Sun Pharmaceutical Industries, Bachem, Pfizer, Leo Pharma, Abbott Laboratories, Takeda, Aspen, Teva, Eli Lilly, Sanofi, Novo Nordisk, F. Hoffmann-La Roche Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc, Novartis AG, and Merck & Co., Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Peptide and Anticoagulant Drugs Market By Peptide Drug Type -

Peptide and Anticoagulant Drugs Market By Anticoagulant Drug Type-

Peptide and Anticoagulant Drugs Market By Administration Route-

Peptide and Anticoagulant Drugs Market By Application-

Peptide and Anticoagulant Drugs Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.