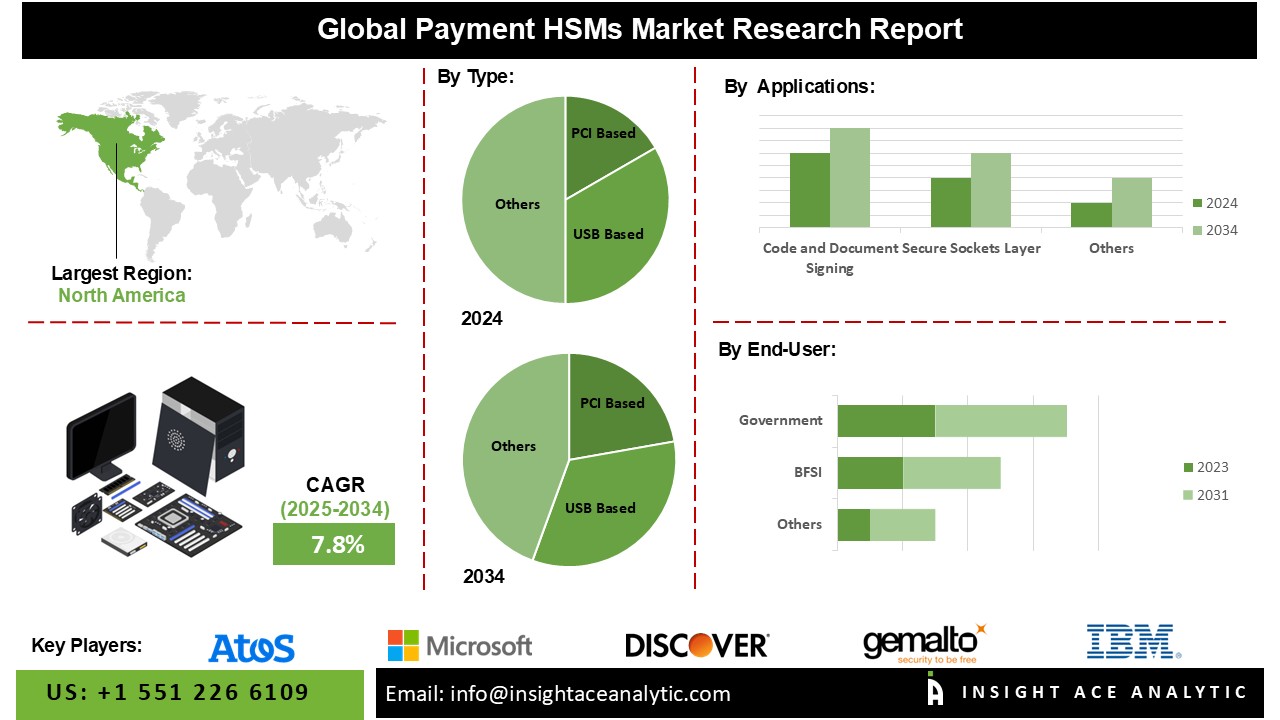

Payment HSMs Market Size is predicted to grow at an 7.8% CAGR during the forecast period for 2025-2034.

Payment Hardware Security Modules (HSMs) are specialized, tamper-resistant hardware devices used primarily by the retail banking industry to protect cryptographic keys and customer Personal Identification Numbers (PINs) during the issuing of payment cards and the subsequent processing of credit and debit card transactions. They provide native cryptographic support for major card scheme applications and undergo rigorous independent hardware certification under global standards such as FIPS 140-2 and PCI HSM. Payment HSMs play a crucial role in safeguarding sensitive information, such as cryptographic keys and PINs, used in payment transactions.

The growth of the Payment HSM market is driven by the need for compliance with stringent regulations like the Payment Card Industry Data Security Standard (PCI DSS). These regulations set strict guidelines for the handling and protection of sensitive data, and HSMs help financial institutions and payment systems meet these requirements. By using HSMs to secure sensitive data and transactions, organizations can demonstrate their commitment to security and build trust with customers. The ability of HSMs to facilitate secure data encryption, PIN generation and validation, EMV transaction processing, and secure data decryption makes them indispensable in the payment ecosystem.

The payment HSMs market is by type, applications, end user. By type the market is segmented into PCI based, USB based, Network based. By applications, the market is categorized into code and document signing, secure sockets layer. By End User the market is categorized into BFSI, government, technology and communications, manufacturing industry, energy and utilities, retail and consumer products, and others.

The PCI Based segment is driving the Payment HSMs market due to its high security standards, increased demand for payment security, regulatory compliance, and versatility in applications. Designed to meet stringent PCI security requirements, PCI Based HSMs offer robust protection for sensitive data, crucial for preventing fraud and data breaches. The rapid growth of e-commerce and digital payments heightens the need for secure payment solutions, and PCI Based HSMs provide advanced cryptographic capabilities essential for secure transactions. Compliance with PCI standards is mandatory, helping businesses protect information and avoid penalties, while their adaptability across various payment environments makes them a preferred choice for financial institutions and payment processors.

The Secure Sockets Layer (SSL) segment is experiencing significant growth in the Payment HSMs market due to the rising e-commerce and digital payments, heightened cybersecurity concerns, and regulatory compliance requirements. The surge in online transactions has intensified the demand for secure communication channels, with SSL playing a crucial role in encrypting data transmitted over the internet. The increasing cyber threats and data breaches have led organizations to prioritize the security of their payment systems, driving the adoption of Payment HSMs that support SSL encryption. Additionally, compliance with data protection regulations like PCI DSS mandates the use of SSL to encrypt sensitive data in transit, further boosting the demand for SSL-equipped Payment HSMs across various industries.

Technological advancements, high demand for payment security, an established financial sector, and regulatory compliance are driving the growth of the Payment HSMs market in North America. Leading technology companies and financial institutions in the United States spearhead innovation in payment security solutions, emphasizing the adoption of advanced technologies like Payment HSMs to enhance transaction security. The increasing volume of online transactions and rising cyber threats heighten the demand for secure payment processing solutions. North America's well-established banking sector, coupled with stringent regulations such as PCI DSS, further drives the adoption of HSM technology to protect sensitive payment data and ensure compliance.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 7.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Applications, By End User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | American Express, ATOS, AWS, Azure, Discover, FutureX, Gemalto NV, Google, Hewlett-Packard Enterprise Development LP, IBM Corporation, Infineon Technologies, JCB International, Kryptus, Mastercard, Microchip Technology, Microsoft Corporation, Procenne, STMicroelectronics (Switzerland), SWIFT, Thales e-Security, Inc. Ultra-Electronics, UnionPay, Utimaco GmbH, Visa Inc., Worldline, Yubico, Intexus, Securosys, Broadcom Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Payment HSMs Market by Type -

Payment HSMs Market by Applications -

Payment HSMs Market by End User -

Payment HSMs Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.