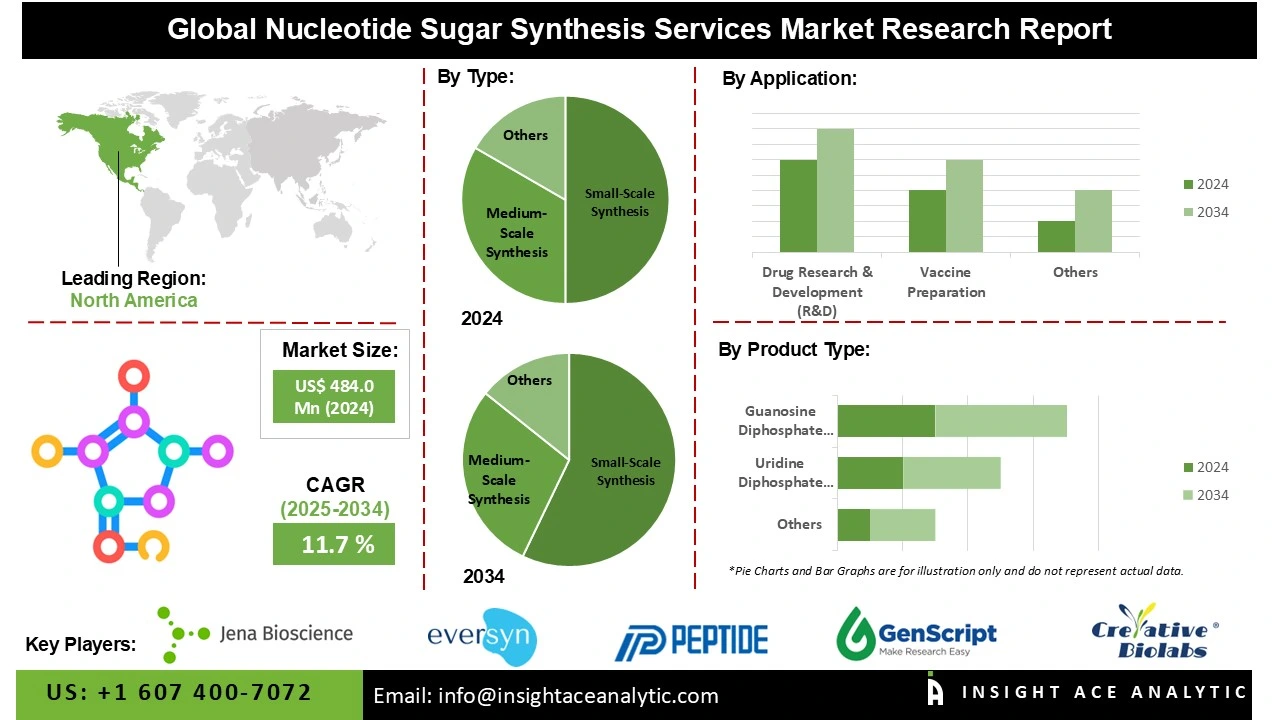

Global Nucleotide Sugar Synthesis Services Market Size is valued at US$ 440.0 Mn in 2024 and is predicted to reach US$ 1,306.2 Mn by the year 2034 at an 11.7% CAGR during the forecast period for 2025 to 2034.

Nucleotide Sugar Synthesis Services Market Size, Share & Trends Analysis Distribution, By Type (Small-Scale Synthesis, Medium-Scale Synthesis, and Large-Scale Synthesis), By Product Type (Uridine Diphosphate (UDP) Sugars, Cytidine Monophosphate (CMP) Sugars, Guanosine Diphosphate (GDP) Sugars, and Others), By Application (Vaccine Preparation, Drug Research & Development (R&D), Genetic Engineering and Cell Therapy, Diagnostics, and Academic Research), and Segment Forecasts, 2025 to 2034

Nucleotide sugar synthesis services include a range of products designed to meet specific client requirements. Custom synthesis of different nucleotide sugars, including those with modifications or artificial connections, is one of these. To ensure excellent purity and quality standards, services also include characterization and purification of the synthesized products. Pricing is directly affected by the complexity of the nucleotide sugar structure, with more complex structures fetching higher prices.

The nucleotide sugar synthesis services market is expanding rapidly due to the growing need for specialized oligosaccharides and glycoconjugates in biotechnology, pharmaceutical, and academic research.

The growing incidence of chronic illnesses such as diabetes and cancer, which require the development of new medicinal glycobiologics, is driving growth in the nucleotide sugar synthesis services market. Furthermore, nucleotide sugars are being used in new fields, such as drug delivery systems, vaccine development, and diagnostics, driven by advances in glycobiology research. However, there may be certain limitations on the expansion of the nucleotide sugar synthesis services market. Difficulties in the economical and efficient synthesis of complex nucleotide sugars may constrain the growth. Furthermore, the expansion of the nucleotide sugar synthesis services market may also be affected by regulatory hurdles in the development and approval of novel glycobiologics.

Some of the Key Players in Nucleotide Sugar Synthesis Services Market:

· CD BioGlyco

· Creative Biolabs

· Jena Bioscience GmbH

· GenScript Biotech Corporation

· Peptide Institute, Inc.

· Eversyn Technologies

· Oxeltis

· BOC Sciences

· Tokyo Future Style, Inc.

· FUJIMOTO CHEMICALS CO., LTD

· Thermo Fisher Scientific

· Merck KGaA

· Agilent Technologies

· Eurofins Scientific

· Twist Bioscience

· Others

The nucleotide sugar synthesis services market is segmented by type, product type, and application. By type, the market is segmented into small-scale synthesis, medium-scale synthesis, and large-scale synthesis. By product type, the market is segmented into uridine diphosphate (UDP) sugars, cytidine monophosphate (CMP) sugars, guanosine diphosphate (GDP) sugars, and others. By application, the market is segmented into vaccine preparation, drug research & development (r&d), genetic engineering and cell therapy, diagnostics, and academic research.

The cytidine monophosphate (CMP) sugars segment held the largest share in the market in 2024. The category of CMP-sugars, particularly CMP-Neu5Ac and its derivatives, is expanding as biopharma's need for reliable sources of sialyl donors to regulate glycosylation grows. Improved sialylation increases stability and half-life and lowers immunogenicity of monoclonal antibodies, enzymes, and other biologics, so demand from glycoengineering and biologics development is a major growth driver. Additionally, improvements in enzymatic and chemoenzymatic pathways (such as efficient syntheses and strong bacterial CMP-sialic acid synthases) have reduced costs and increased yield, making the commercial supply of CMP-sugars more feasible and appealing to drug developers.

The genetic engineering & cell therapy segment of the nucleotide sugar synthesis services market is expanding rapidly, driven by the increasing need for precise glycoengineering capabilities essential for developing next-generation biologics and advanced cell therapies. As manufacturers and research institutions work to enhance the safety, potency, and in-vivo durability of Monoclonal antibodies, recombinant glycoproteins, and engineered cell products including CAR-T cells and stem-cell therapies—the demand for custom nucleotide sugars and scalable chemoenzymatic synthesis pathways continues to rise. These tailored solutions are critical for achieving controlled and reproducible glycosylation profiles. Furthermore, advancements in glycan-profiling technologies, modular chemoenzymatic toolkits, and high-efficiency enzymatic synthesis workflows are reducing development uncertainty and accelerating project timelines. Combined with the growing complexity of glycoengineering processes, these improvements are driving greater reliance on specialized outsourcing partners capable of delivering high-purity, fit-for-purpose nucleotide sugars at scale.

In 2024, the North American region dominated the nucleotide sugar synthesis services market, as it was home to large pharmaceutical and biotechnology companies developing medications and vaccines. The region's well-established research infrastructure and significant financing for biological research are the main drivers of the need for customized nucleotide sugars. The United States dominates the region due to a high concentration of glycobiology-focused biotech firms, academic institutions, and service providers. Moreover, demand in North America is influenced by macroeconomic factors, including increased healthcare R&D spending, government support for life sciences, and favorable patent regimes for novel biosynthetic processes.

Over the projection period, the nucleotide sugar synthesis services market is expected to grow at the fastest rate in the Asia Pacific, driven by increasing biotech research, expanding medical applications, and alliances between CROs and academic institutions. Countries like China and India are providing substantial support for glycomics research, which employs nucleotide sugars in drug discovery and vaccine development. Additionally, the region's highly skilled workforce and cost-competitive environment make it more appealing to service providers worldwide. Due to substantial government subsidies, rapid expansion of glycoscience R&D, and the presence of major bioscience clusters, China holds the largest market share in the Asia Pacific. Furthermore, Asia Pacific's shift to cell-based therapies and tailored medicine is creating a substantial market for glycosylation-related services.

Nucleotide Sugar Synthesis Services Market by Type

· Small-Scale Synthesis

· Medium-Scale Synthesis

· Large-Scale Synthesis

Nucleotide Sugar Synthesis Services Market by Product Type

· Uridine Diphosphate (UDP) Sugars

· Cytidine Monophosphate (CMP) Sugars

· Guanosine Diphosphate (GDP) Sugars

· Others

Nucleotide Sugar Synthesis Services Market by Application

· Vaccine Preparation

· Drug Research & Development (R&D)

· Genetic Engineering and Cell Therapy

· Diagnostics

· Academic Research

Nucleotide Sugar Synthesis Services Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.