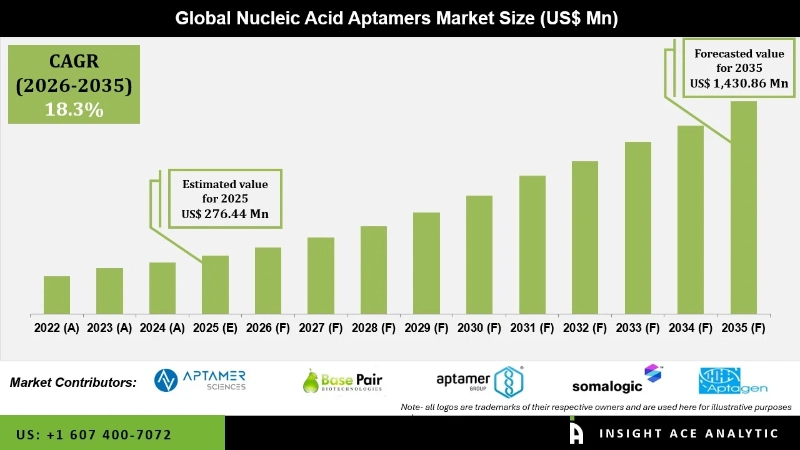

Nucleic Acid Aptamers Market Size is valued at USD 276.44 Mn in 2025 and is predicted to reach USD 1,430.86 Mn by the year 2035 at a 18.3% CAGR during the forecast period for 2026 to 2035.

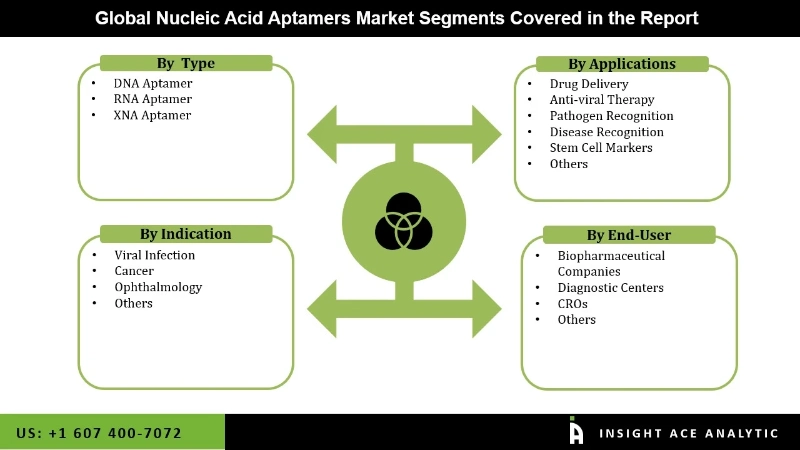

Nucleic Acid Aptamers Market Size, Share & Trends Analysis Report By Type (DNA Aptamer, RNA Aptamer, XNA Aptamer), By Application (Drug Delivery, Anti-viral Therapy, Pathogen Recognition, Disease Recognition, Stem Cell Markers, Others), By Indication (Viral Infection, Cancer, Ophthalmology, Others), By End-User, By Region, And By Segment Forecasts, 2026-2035.

Nucleic acid aptamers are concise, individual strands of DNA or RNA that have a strong affinity for certain targets, such as proteins or tiny molecules. They are chosen via a procedure known as SELEX and are recognized for their stability, strong attraction, and minimal immune response. Aptamers find applications in diagnostics, therapies, and targeted drug delivery, providing benefits such as facile synthesis and the capability to operate in diverse settings.

The rising disposable income, improvements in aptamer creation technology, and more funding for businesses and academic institutions are all elements propelling the market forward. Additionally, more and more medical fields are looking to these tiny molecules for a variety of reasons, including the many benefits they provide over well-established antibodies.

The competitive advantages of nucleic acid aptamers have drawn the attention of many researchers, who have recently made improvements in drug delivery, target cell death, and drug purification. Researchers are motivated to develop new nucleic acid aptamers because of their small molecular size, low immunogenicity, cheap manufacturing cost, and fewer side effects in comparison to antibodies. This could lead to industry expansion. The ongoing development of novel and improved nucleic acid aptamers is propelling market expansion.

However, due to the high costs, stringent regulatory constraints, and a general lack of knowledge of nucleic acid treatments among both patients and healthcare professionals, the nucleic acid aptamers industry is expected to slow down market growth. The rapid advancement of research and development, the increased focus on the efficacy of RNA aptamers, and the surge in investment and interest in nucleic acid-based treatments for infectious diseases were all beneficial effects of the COVID-19 pandemic for the nucleic acid aptamers business. Furthermore, the demand for nucleic acid aptamers is expected to rise due to innovative treatments receiving substantial funding from pharmaceutical firms and governments.

The nucleic acid aptamers market is segmented based on type, application, indication, and end-user. By type, the market is segmented into DNA aptamer, RNA aptamer, and XNA aptamer. By the application, the market is segmented into drug delivery, anti-viral therapy, pathogen recognition, disease recognition, stem cell markers, and others. By indication, the market is segmented into viral infection, cancer, ophthalmology, and others. By end-user, the market is segmented into biopharmaceutical companies, diagnostic centres, CROs, and others.

The DNA aptamer in the nucleic acid aptamers category is expected to lead with a significant global market share in 2023 because it’s very stable, easy to change, and cheap to make. Its demand is further driven by its adaptability in numerous applications, such as pharmaceuticals, biosensors, and diagnostics. Further, DNA aptamers are becoming more popular as a result of rising investment in R&D and improvements in DNA synthesis technologies, which is growing the worldwide market.

The biopharmaceutical companies segment is predicted to grow rapidly in the nucleic acid aptamers market because there is a growing need for novel diagnostic and therapeutic solutions and a growing investment in R&D. Aptamers are appealing for drug discovery and development due to their many advantages, including high specificity, stability, and cost-effectiveness. Nucleic acid aptamers are in high demand in this market because of the increasing fascination with targeted therapeutics and customized medicine, which is growing the biopharmaceutical companies segment growth.

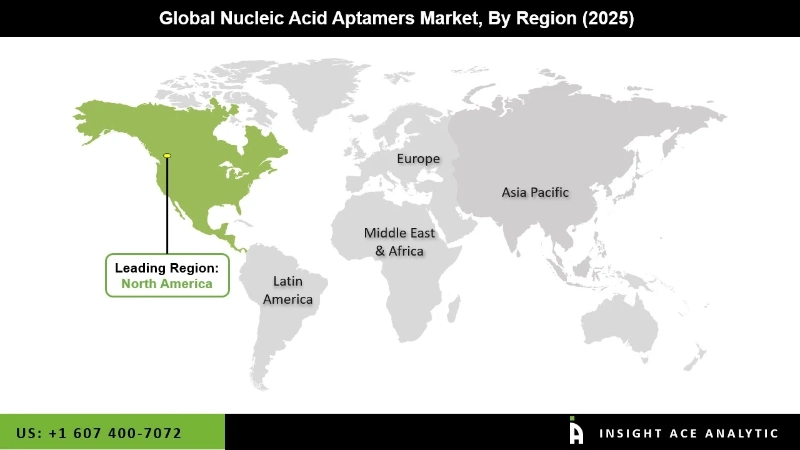

The North American nucleic acid aptamers market is expected to report the highest market revenue share in the near future because of the growing popularity of cutting-edge diagnostic and treatment options, improved healthcare infrastructure, and substantial funding for biotechnology research. The market is also being propelled even higher by a strong pharmaceutical industry and government programs that are encouraging. In addition, the Asia-Pacific region is expected to grow quickly in the global nucleic acid aptamers market because due to the increasing need for cutting-edge diagnostic and therapeutic solutions, the expansion of biotechnology research, and the expansion of healthcare infrastructure investments, which is growing the market demand in this area.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 276.44 Mn |

| Revenue Forecast In 2035 | USD 1,30.86 Mn |

| Growth Rate CAGR | CAGR of 18.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, Indication and End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Aptagen Labs, Aptamer Group, Base Pair Biotechnologies, NeoVentures Biotechnology Inc., Aptamer Sciences, Inc., SomaLogic Operating Co., Inc., AptaTargets SL., and Aptus Biotech S.L. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Nucleic Acid Aptamers Market By Type-

Nucleic Acid Aptamers Market By Applications-

Nucleic Acid Aptamers Market By Indication-

Nucleic Acid Aptamers Market By End-User-

Nucleic Acid Aptamers Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.