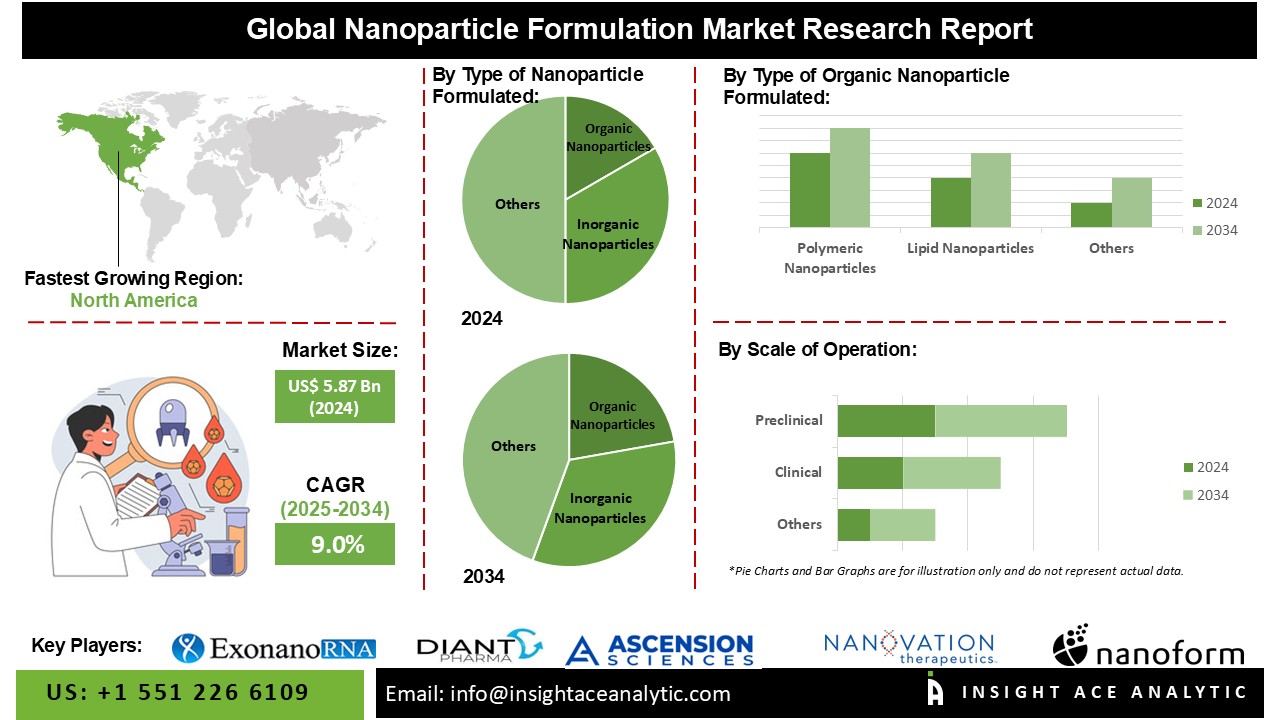

Nanoparticle Formulation Market Size is valued at 5.87 billion in 2024 and is predicted to reach 13.74 billion by the year 2034 at an 9.0% CAGR during the forecast period for 2025-2034.

Nanoparticles are particles in the nanometer scale from 1 to 100 nm in diameter. These particles have proven helpful in many areas, including biomedicine, commonly for implants & drug delivery. Drug delivery with nanoparticles is an exciting field in which therapeutic compounds use nanoparticles as carriers to improve absorption, solubility, stability and decrease toxicity of the body.

Natural ingredients are back in fashion and useful because of their low toxicity and fewer side effects. However, natural compounds generally have low bioavailability and solubility, meaning the digestive system cannot readily absorb them. A feasible solution to these hitches is the usage of nanoparticles as drug delivery systems to act as delivery vehicles for therapeutics. Nanoparticles can provide many advantages for drug delivery, such as site-specific delivery and increased bioavailability. Additionally, nanoparticles aid in treating various disease conditions, including cancer, infectious diseases, cardiovascular disorders, and neurological disorders.

Due to the challenges related to process development, consistency of the constructs & reproducibility, biopharma companies started to opt for contract manufacturing services to save time and reduce the complexity of nanoparticle formulations.

Many research firms are seeking novel nanoparticle delivery technologies and focusing on more patient-centricity in drug development.

The Nanoparticle Formulation Market is categorized into type of nanoparticle formulated, type of organic nanoparticle formulated, type of inorganic nanoparticle formulated, and scale of operation. The type of nanoparticle formulated segment comprises organic nanoparticles, inorganic nanoparticles, and carbon-based nanoparticles. By type of organic nanoparticle formulated, the market is divided into polymeric nanoparticles, lipid nanoparticles, viral nanoparticles, protein-based nanoparticles, and other organic nanoparticles.

The type of inorganic nanoparticle formulated segment consists of metal nanoparticles, quantum dots, silica nanoparticles, magnetic nanoparticles, and other inorganic nanoparticles. Based on the scale of operation, the market is segmented into preclinical, clinical, and commercial.

Due to several advantages of lipid nanoparticles in therapeutics, pharma companies are collaborating with industries specializing in lipid nanoparticle formulation to expand their capabilities and improve product quality. In September 2022, NeoVac and Aragen Life Sciences Private Limited announced an agreement to create a lipid product that will enable the development of lipid nanoparticles (LNP) for use in producing RNA vaccines for various diseases. In 2021, WACKER collaborated with CordenPharma. Both companies reported that they intend to jointly develop novel methods for manufacturing Lipid Nanoparticles (LNPs) to meet the growing market demand.

The clinical category is expected to retain a significant share of the nanoparticle formulation market over the forecast period. Many ongoing clinical studies on drug therapies and vaccines for treating various diseases, including cancer, cardiovascular diseases (CVDs), and infectious diseases, are expanding the clinical segment of the market.

Factors such as the surging demand for targeted therapies, innovations in nanoparticle delivery systems, and increasing research efforts in drug development technologies are responsible for the blooming of the nanoparticle formulation market in North America, followed by Europe. At the same time, the Asia Pacific regional market is predicted to witness steady growth in the next few years. Increasing inventions, the introduction of nanoparticle delivery systems, and growing chronic diseases will likely drive the nanoparticle formulation market in this region.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 5.87 Bn |

| Revenue Forecast In 2034 | USD 13.74 Bn |

| Growth Rate CAGR | CAGR of 9.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Nanoparticle Formulated, By Type of Organic Nanoparticle Formulated, By Type of Inorganic Nanoparticle Formulated, By Scale of Operation |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Ascension Sciences, DIANT Pharma, ExonanoRNA, Nanoform, NanoVation Therapeutics, NanoVelos, NTT Biopharma, Organoid-X BioTech, Vaxinano, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Nanoparticle Formulation Market By Type of Nanoparticle Formulated-

Nanoparticle Formulation Market By Type of Organic Nanoparticle Formulated-

Nanoparticle Formulation Market By Type of Inorganic Nanoparticle Formulated-

Nanoparticle Formulation Market By Scale of Operation-

Nanoparticle Formulation Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.