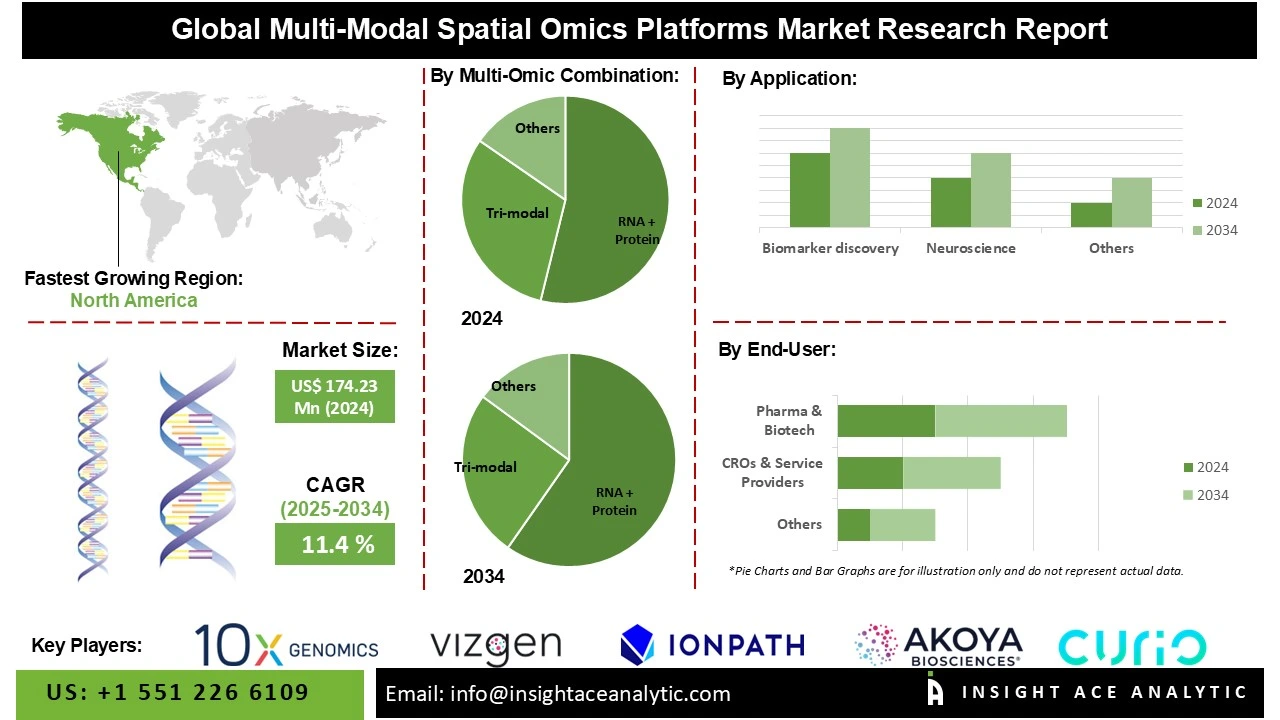

Global Multi-Modal Spatial Omics Platforms Market Size is valued at USD 174.23 Mn in 2024 and is predicted to reach USD 504.55Mn by the year 2034 at a 11.4% CAGR during the forecast period for 2025 to 2034.

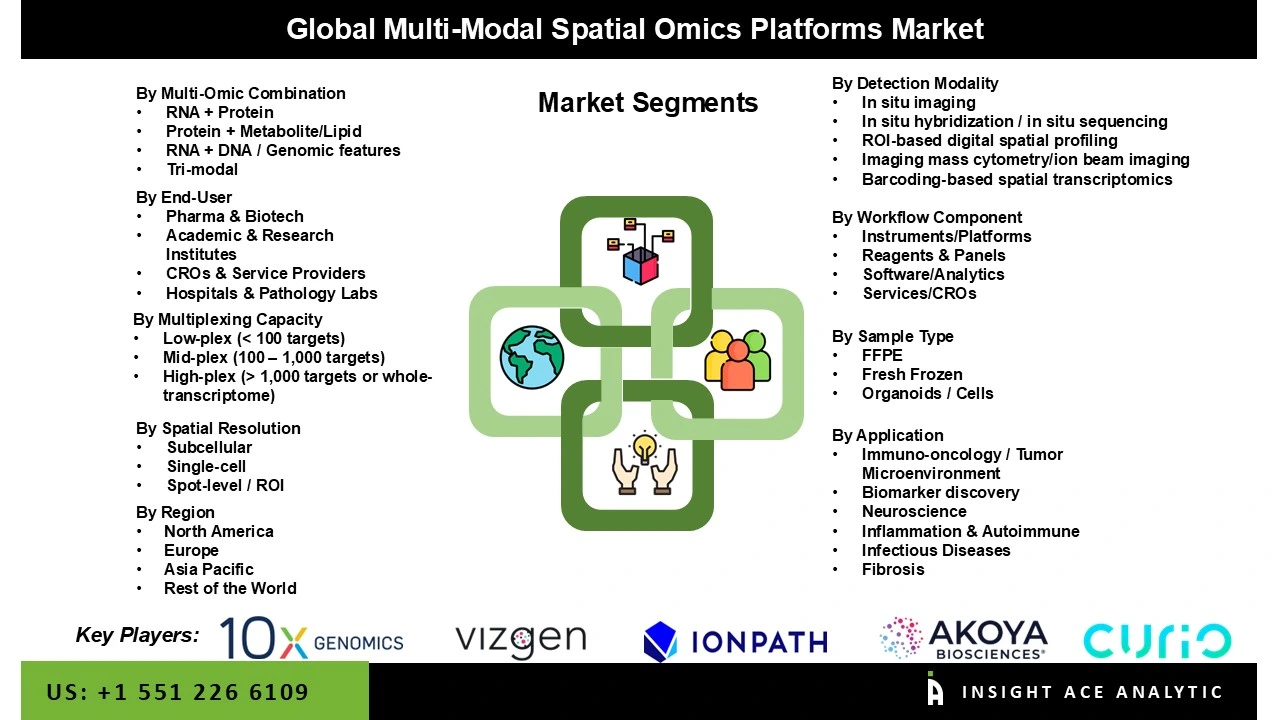

Multi-Modal Spatial Omics Platforms Market, Share & Trends Analysis Report, By Multi-Omic Combination (RNA + Protein, Protein + Metabolite/Lipid, RNA + DNA / Genomic features, Tri-modal (RNA + Protein + Morphology/Metabolite)), By Detection Modality (In situ imaging (cyclic IF, fluorescence), In situ hybridization / in situ sequencing, ROI-based digital spatial profiling, Imaging mass cytometry/ion beam imaging, Barcoding-based spatial transcriptomics), By Workflow Component, By Sample Type, By Spatial Resolution, By Multiplexing Capacity, By Application, By End-User, By Region, and Segment Forecasts, 2025 to 2034

Multi-modal spatial omics platforms integrate multiple molecular layers—such as RNA, protein, and metabolites—within the same tissue section while preserving spatial context. By combining techniques like spatial transcriptomics, multiplex immunofluorescence, and imaging mass spectrometry, these platforms reveal how different biomolecules interact within intact cellular environments. This holistic approach enables researchers to study cell-to-cell communication, tissue organization, and disease mechanisms in unprecedented detail, bridging molecular biology, imaging, and data analytics into a single, unified workflow.

Multi-modal spatial omics platforms allow researchers to analyze genes, proteins, and other molecules within their native tissue context, transforming tissue analysis from bulk sampling to in situ cellular mapping. The market is entering a phase of rapid expansion as spatial proteomics, high-plex imaging, and whole-transcriptome mapping emerge as key growth areas. Driven by rising R&D in immuno-oncology, neuroscience, and precision pathology, these platforms are becoming central to biomarker discovery, drug target validation, and the evolution of quantitative, spatially informed diagnostics.

Some of the Major Key Players in the Multi-Modal Spatial Omics Platforms Market are

The multi-modal spatial omics platforms market is segmented into multi-omic combination, detection modality, workflow component, sample type, spatial resolution, multiplexing level, application, and end-user. Based on the multi-omic combination, the market is segmented into RNA + protein, protein + metabolite/lipid, RNA + DNA / genomic features, and tri-modal (RNA + protein + morphology/metabolite). Based on the detection modality, the market is divided into in situ imaging (cyclic if, fluorescence), in situ hybridization / in situ sequencing, ROI-based digital spatial profiling, imaging mass cytometry/ion beam imaging, and barcoding-based spatial transcriptomics.

Based on the workflow component, the market is divided into instruments/platforms, reagents & panels, software/analytics, and services/CROs. Based on the sample type, the market is divided into subcellular, single-cell, and spot-level / ROI. Based on the multiplexing capacity, the market is divided into Low-plex (< 100 targets), Mid-plex (100 – 1,000 targets), High-plex (> 1,000 targets or whole-transcriptome. Based on the application, the market is divided into immuno-oncology / tumor microenvironment, biomarker discovery, neuroscience, inflammation & autoimmune, infectious diseases, and fibrosis. Based on the End-User, the market is divided into pharma & biotech, academic & research institutes, cros & service providers, hospitals & pathology labs.

The integration of RNA and protein analysis within multi-modal spatial omics platforms is a key growth driver, offering a holistic view of cellular function, tissue organization, and disease mechanisms at unparalleled resolution. Spatial transcriptomics maps gene expression within its native tissue context, revealing how genes behave in specific cell types or locations. Combining RNA and protein profiling enables the discovery of novel biomarkers and therapeutic targets, supporting precision medicine and advancing targeted drug development, particularly in complex areas such as tumor microenvironment research.

FFPE samples remain the cornerstone of clinical diagnostics and biobanking due to their global availability and stability. Their widespread use allows researchers to conduct retrospective spatial omics studies without the need for new tissue collection, reducing costs and logistical hurdles. FFPE’s dominance in pathology and oncology stems from its compatibility with RNA and protein mapping, enabling biomarker discovery and tumor microenvironment analysis. Ongoing improvements in RNA retrieval and antibody-based detection continue to enhance its value in multi-modal spatial omics.

North America is home to prestigious colleges and renowned research organisations like the National Institutes of Health, which create an atmosphere that is favourable for advances in spatial omics. By consistently creating and improving cutting-edge spatial omics platforms, well-known American businesses like 10x Genomics and NanoString Technologies have made a substantial contribution to the market. Research and the commercialization of these technologies have been further pushed by government financing programs and initiatives, such as those from the National Cancer Institute. North America is now a centre for precision medicine and advanced diagnostics due to the combination of strong regulatory frameworks and advantageous trade policies, which have also boosted market expansion.

· In October 2025, SPT Labtech, a pioneer in the design and development of laboratory automation and liquid handling solutions, and 10x Genomics, Inc. announced a strategic partnership to provide automated workflows for single cell research. The collaboration will allow scientists to scale experiments on 10x’s Chromium Single Cell platform, with planned future expansion to the Visium Spatial platform, by providing plug-and-play protocols on SPT Labtech’s firefly® liquid handling platform.

· In October 2025, Bruker announced FDA clearance of claims 7 and 8 for the MALDI Biotyper® CA System, expanding diagnostic capabilities. The MALDI Biotyper CA System is a mass spectrometry-based platform that uses MALDI-TOF technology for rapid identification of microorganisms following culture from human specimens, either from isolated colonies or positively flagged blood cultures.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 174.23 Mn |

| Revenue Forecast In 2034 | USD 504.55 Mn |

| Growth Rate CAGR | CAGR of 11.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Multi-Omic Combination, Detection Modality, Workflow Component, Sample Type, Spatial Resolution, Multiplexing Complex, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | 10x Genomics, Bruker (NanoString assets), Vizgen, Miltenyi Biotec, Standard BioTools (Fluidigm), Ionpath, Lunaphore (now part of Bio-Techne), Bio-Techne / ACD, Curio Bioscience, Akoya Biosciences, Molecular Instruments (HCR), Ultivue, Other prominent players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Multi-Modal Spatial Omics Platforms Market- By Multi-Omic Combination

· RNA + Protein

· Protein + Metabolite/Lipid

· RNA + DNA / Genomic features

· Tri-modal (RNA + Protein + Morphology/Metabolite)

· In situ imaging (cyclic IF, fluorescence)

· In situ hybridization / in situ sequencing

· ROI-based digital spatial profiling

· Imaging mass cytometry/ion beam imaging

· Barcoding-based spatial transcriptomics

Global Multi-Modal Spatial Omics Platforms Market – By Workflow Component

· Instruments/Platforms

· Reagents & Panels

· Software/Analytics

· Services/CROs

Global Multi-Modal Spatial Omics Platforms Market- By Sample Type

· FFPE

· Fresh Frozen

· Organoids / Cells

Global Multi-Modal Spatial Omics Platforms Market – By Spatial Resolution

· Subcellular

· Single-cell

· Spot-level / ROI

Global Multi-Modal Spatial Omics Platforms Market – By Multiplexing Capacity

· Low-plex (< 100 targets)

· Mid-plex (100 – 1,000 targets)

· High-plex (> 1,000 targets or whole-transcriptome)

Global Multi-Modal Spatial Omics Platforms Market – By Application

· Immuno-oncology / Tumor Microenvironment

· Biomarker discovery

· Neuroscience

· Inflammation & Autoimmune

· Infectious Diseases

· Fibrosis

Global Multi-Modal Spatial Omics Platforms Market – By End-User

· Pharma & Biotech

· Academic & Research Institutes

· CROs & Service Providers

· Hospitals & Pathology Labs

Global Multi-Modal Spatial Omics Platforms Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.